- Locations

- Middle East & Africa

- Unraveling the impact of the lockdown on the South African commercial landscape

The COVID-19 pandemic and subsequent lockdowns had a far-reaching effect on interactions with all of the pharmaceutical industry’s key stakeholders – healthcare professionals (HCPs), regulators, funders and patients. The restrictions on movement and personal contacts had a major impact on salesforce activities and the ability of reps to engage directly with HCPs.

IQVIA obtained feedback through a structured survey to better understand the pharmaceutical industry’s commercial activities in response to the pandemic and lockdowns. The survey had three focus areas:

- To understand changes in salesforce efforts (measured by days in field) by comparing changes prior to, during and post the hard lockdown

- To determine the impact on HCP interactions that sales representatives were able to conduct by comparing changes prior to, during and post the hard lockdown

- And thirdly, to evaluate the response of pharmaceutical companies through adjustments in salesforce team size during and after the lockdown.

This survey compared four different commercial team structures:

- Primary Care Segment where commercial teams are focusing exclusively on General Practitioners.

- Specialty Care Segment, where commercial teams are detailing to Specialists only.

- Retail Segment, where commercial effort is focused solely on Pharmacies.

- The Hybrid Segment, where teams are detailing to a combination of General Practitioners and Specialists or General Practitioners and Pharmacies.

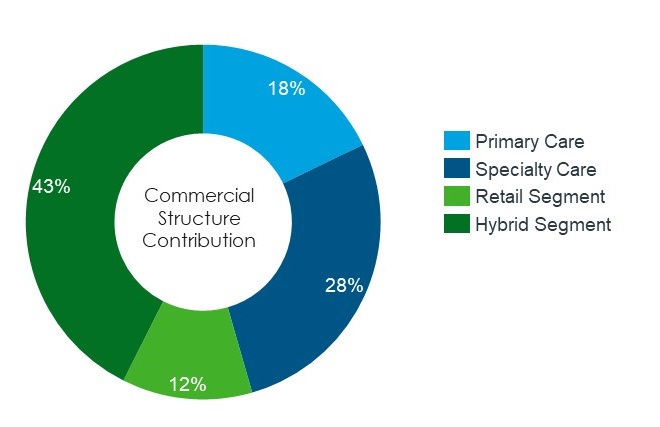

IQVIA received 23 completed surveys. This included information for 101 commercial teams within the pharmaceutical industry. On average, each organisation had four commercial teams in place with an average of nine FTEs per team. The contribution of the commercial structures analysed was leaning towards the Hybrid commercial model; this segment represents 43% of the teams analysed and demonstrates that companies have adapted to a more agile way of working.

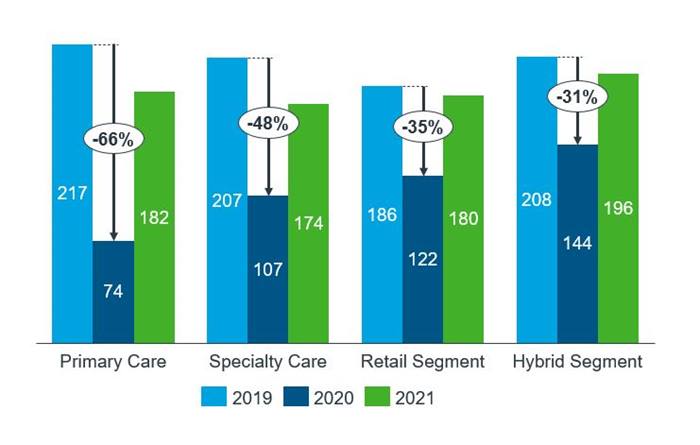

AVERAGE DAYS SPEND IN FIELD

The commercial teams in the Primary Care Segment experienced a 66% reduction in average days in the field during the 2020 lockdown period. This trend can be seen across all the commercial segments.

As lockdown restriction eased and the influx of patients reduced, doctors and pharmacies started to allow sales representatives into their respective practices, resulting in an increase in the number of days in the field in 2021.

The commercial teams within the Hybrid segment were impacted the least during the lockdown period when compared to all other segments. The Hybrid representative model bridges multiple healthcare disciplines and, therefore, could adapt to achieve access within the healthcare industry. The Hybrid segment also demonstrated the best recovery post-lockdown. The impact that the pandemic and lockdown regulations expressed on access of HCPs within the Hybrid segment was overall marginal.

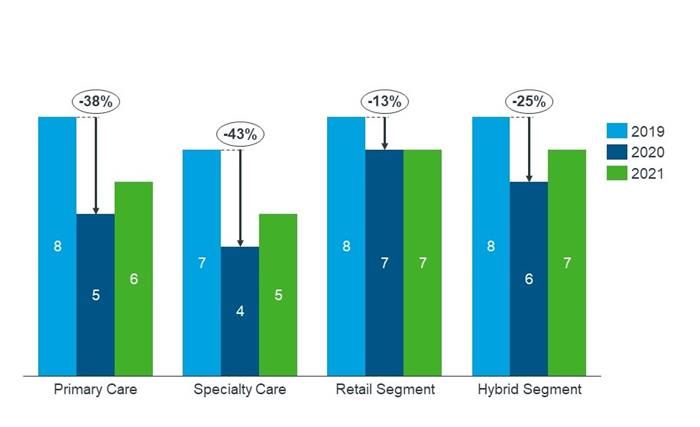

AVERAGE DAILY INTERACTION WITH HEALTHCARE PROFESSIONALS

The average call rate pre-lockdown for the Primary Care Segment was recorded at eight interactions per day. During the lockdown period, the average interaction a representative could achieve was reduced to only five interactions per day.

The average HCP interaction within the Retail Segment only decreased by one call a day (from eight to seven) when compared to the same period.

While many doctor practices were closed or were not welcoming sales representatives, pharmacies remained open and access was relatively easier, resulting in a higher call rate throughout the pandemic.

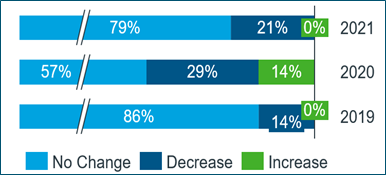

COMMERCIAL SALES FORCE SIZE ADJUSTMENTS

The commercial segment that was affected the most with regards to salesforce size adjustments were the Specialty Care Segment. 29% of the corporations that are represented in the Specialty Care Segment reduced their salesforce team size during the lockdown period. The average reduction in FTE headcount per team was approximately 20%. The reduction in elective surgeries and the reduced access for pharmaceutical corporations to the hospital environments were the key driving factors determining the size of their dedicated detail teams within the Specialty Care Segment. Organisations that had diverse portfolios were able to retain sales teams but had to alter the roles of these representatives. As an example: one organisation that had a focus on surgery specialists also had a presence in the consumer health environment but did not utilise any salesforce activity to drive business in the retail environment pre-COVID. This organisation had to rethink their commercial model, and they required their Specialist Representatives to become retail orientated with a Pharmacy commercial focus.

CONCLUSION

In a time when commercial teams are faced with a rapidly changing environment, being flexible and agile is key to ensuring that companies maintain a seamless connection with their customers. Our research showed that those organisations that were able to alter their commercial approach the quickest in the initial phases of the lockdown reaped the rewards during the volatile period. The best commercial strategy for pharmaceutical companies in South Africa is not yet known nor is the future profile of the sales representative. Nevertheless the organisation that does not take risks will not be successful.