Shape the future of consumer health.

- Blogs

- Consumer Health industry poised for further acceleration in the post-COVID environment

In this blog, we try to share a view of the positive effects these changes will have on the overall self-care industry and what are some of the challenges the industry will face in the coming 2-3 years!

The consumer health industry has been extremely resilient through the last three years of COVID-19. Growth never slowed even during the peak of the pandemic as categories like Vitamins, minerals and supplements (VMS) stepped in to cover for the shortfall across Cold/flu and Pain categories, during times of lockdown and social distancing.

As countries and retail begin to return to normal in mid-2021, growth across the overall consumer health market accelerated beyond pre-pandemic levels. For the current MAT Q2 2022, the industry is tracking at +11.3% value growth (Exhibit 1) and remains poised to continue at +6% growth during the next 5 years. In 2022, we are also seeing the positive impact of above-average inflation and some pent-up demand from previous years. These effects will taper off starting Q4 2022.

Exhibit 1 - Global OTC Market Size and Growth MAT Q2 2022 – IQVIA Consumer Health Global OTC Insights

Key drivers behind the separation of Consumer health business units are well known and the growing importance of self-care and over the counter (OTC) medications has never been greater. Strategically, firms have been focusing on investing in the pharma pipeline and thus leaving little space to invest adequately in consumer health business opportunities. We have also noticed that several consumer health firms were unable to secure deals for potential growth opportunities or smaller firms due to price-tags been deemed too high, leaving the way open for non-pharma players to swoop in and take the opportunity.

Benefits from these separations for the overall Consumer health industry are rich and plenty…

-

A chance to chart their own destiny as profitable stand-alone firms. Typical top 10 Consumer health firms generate over US$3 billion in sales every year and have been consistently growing over last 5 years(Exhibit 2). Also, they have remained profitable – despite the pandemic challenges - with net margins in the 15-25% range. This level of sales, profit and growth trajectory provides them with a healthy base to separate from their pharma parent firms and thrive with their own focus and priorities.

Haleon, as an example, is tracking to reach US$12 billion+ in sales, with a healthy 20%+ net margin, built from a substantial presence across 80+ countries globally. Compare this with new start-ups in fintech and data analytics that have little to show in terms of profitable sales, yet continue to have stratospheric valuation multiples!

Value Share and Growth of Top 10 OTC corporations – MAT Q2 2022 – IQVIA Consumer Health Global OTC Insights (Exhibit 2)

- Align business priorities with the needs of their own consumers and shoppers. We have experienced that pharma firms usually have slightly different targeting priorities from a consumer health firm when it comes to demand generation. Most consumer health firms sell formulations as brands and the messaging is targeted at shoppers, consumers and retailers. Some of the focus is on healthcare practitioners as well. Whereas pharma business units focus predominantly on doctors, payers and insurers with minimal consumer/patient targeting. Thus, CH firms not embedded within a pharma parent (P&G, Reckitt, etc.), tend to have more flexibility in terms of where to focus and how to win. Separation from their former pharma parents will provide the same of level of flexibility and independence to firms like Haleon, Opella and Kenvue. They will likely invest more aggressively in digital, e-commerce and analytics over the coming years.

- Flexibility with investments and across investment choices including R&D, M&A and digital. Besides strategic flexibility as discussed earlier, the new independent CH firms will potentially see increased flexibility across R&D and M&A priorities. Several large CH firms have been unable to engage and exploit the CBD opportunity as an example, as it would be a conflict with their parent company’s values and principles. Similarly, when engaging in a potential M&A discussion, the decision usually goes above the consumer health BU management and final decision rests with the parent pharma company board. This results in several potential partnerships being compared with other ongoing discussions at the parent level, thus impacting chances of final approval. Now the final decision will likely rest with the new consumer health-focused board.

- Accelerate brand building for long term success. For a consumer health firm, a key priority is building brands with distinct brand positioning and equity that sustains and grows for years and decades. On the other hand, the pharma firms are seeking to molecule/franchise level innovation, faster to market focus and maximizing sales/value during the patent life. Pharma companies usually sell every innovative drug under a specific brand name but there is little to no longevity focus. Once the molecule is generic post patent expiration, most patients don’t even remember the brand name! The reason for this stark difference is very simple – Consumer health brands such as Panadol, Nurofen, etc. are bought directly by consumers and shoppers whereas most pharma brands are prescribed by the doctor and cannot be purchased without a prescription. Today Keytruda is a US$20 billion+ brand but how many people know of it? Five years ago, Advair (for Asthma) was a US$5 billion+ brand but very few of us knew of it and today it is less than US$1 billion in sales. In comparison, Panadol globally one of the largest OTC pain brands was launched in 1960 and is available today in over 60 countries!

-

Attract appropriate talent profile for sustained success. People are the most important element that differentiates a successful firm from other competitors. The new CH firms will no longer be perceived as having a pharma mind-set (they do not have it today, but the perception persists) and will be able to attract talent from new and varied industries. Several of them are talking of being more like FMCG players, with agile decision making, test and learn approaches, fail fast mind-set, etc. However, we do understand that all CH firms have to build new capabilities and strengthen current ones across data analytics, tech solutions, AI/ML and e-commerce.

Challenges lie ahead for the Consumer health industry…. and the new entities will have to manage them well…

- Sustain the R&D innovation pipeline by investing adequately. As consumer health gets even more competitive post-pandemic, the larger players and the new CH firms will have to maintain a product innovation edge to keep their brands relevant in the minds of the consumers and shoppers. With the expanding share of e-commerce as a channel, consumers will be more open to new innovative offerings from smaller and newer firms across the same categories. Adequate investment in R&D will also have to be balanced with the profit commitments to the street and so operational efficiency across the entire value chain will be crucial for success. Expect more outsourcing of the R&D value chain, increased use of CROs, Real-world-evidence (RWE) for claims generation, virtual trials, etc. as some key levers for maintaining agility and edge.

- Fend off competition from big tech firms and digital devices start-ups. Tech firms are seeking opportunities to break into healthcare and see an opening with data and tech-enabled devices and solutions. Consumers and patients are also becoming more open to sharing personal data for mining insights and the RWE, hybrid trials, AI/ML driven commercial models, etc. is developing fast. Amazon has tried with mixed results to break into the pharmacy channel. Google Verily is experimenting and investing in several tech enabled consumer health solutions. We believe that it is only a matter of time before a large tech firm acquires a mid-sized healthcare or med-tech firm to further go beyond data into actual products and formulations.

- Ability to transcend across both traditional retail and e-commerce channels. Consumer health firms have been well entrenched in the traditional pharmacy channel and physical retail for decades. No new firm can match their distribution and supply chain in the traditional space. But the pandemic has disrupted the status-quo and e-commerce/e-pharmacies are here to stay. We forecast that the current 12% share of the OTC market held by e-commerce channels will grow to 16-18% by 2025 (Exhibit 3). This is a new space for large and mature consumer health firms, and they will need to invest heavily in technology, people and capabilities to prevent erosion of their market share by smaller players through the e-commerce route. Also, as the share held by physical pharmacies in the total CH sales reduces, margin pressures will come into play for both manufacturer and retailer.

Exhibit 3 -OTC Market Sales 2021-2025 split by online (e-Commerce) and offline channels – IQVIA Consumer Health e-Pharmacy Insights

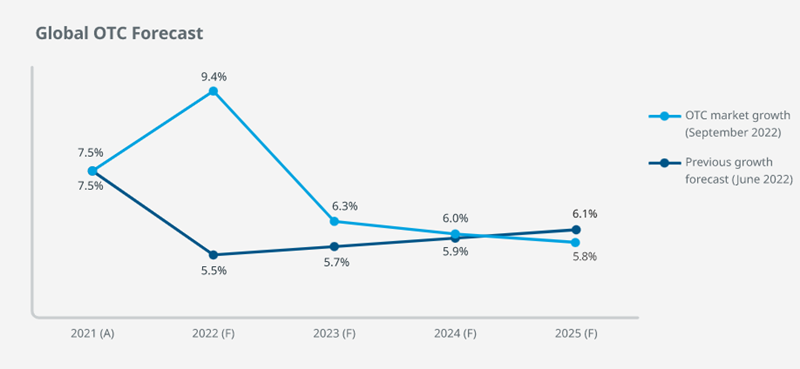

In closing, we are positive and excited about the recent announcements from both GSK Consumer (Haleon) and J&J consumer (Kenvue). For an industry that is healthy and continues to project a strong performance for the next 5 years(Exhibit 4), the announcements and formation of these new entities cannot come at a better time!

As Prasanna Pitale, Senior Vice President of IQVIA Consumer Health recently said: ‘The future for Consumer health industry has never been brighter and the new stand-alone consumer health firms will further strengthen the industry’s commitment to self-care.’

Exhibit 4 - Global OTC Market Sales forecast 2021-2025 – IQVIA Consumer Health OTC Review Forecasts

Our latest thinking on Consumer Health

Related solutions

Illuminate a path to consumer health success

Adapt fast, maintain momentum and stay relevant

See how we partner with organizations across the healthcare ecosystem, from emerging biotechnology and large pharmaceutical, to medical technology, consumer health, and more, to drive human health forward.