Effectively engage with patients to help improve adherence, drive better disease understanding, and deliver treatment value.

- Blogs

- Things are going to be different

Addressing the global impact of COVID-19 is the most significant challenge the pharmaceutical industry has faced in recent history. In the rush to make sense of the current uncertainty, there is a natural tendency to move quickly to predictions about what this ‘new normal’ will be. Unfortunately, the risk is finding more speculation than informed evaluation; hypotheses are often based on early insights and incomplete data from markets across the world.

At IQVIA, our data assets and analytic capabilities, combined with our everyday experience of how our customers are responding, come together in a body of market research and analysis to inform, enable and empower customers around the world as they consider their post-COVID-19 commercial planning.

An informed perspective

Our Contract Sales and Medical Solutions (CSMS) team is involved in delivering more than 500 commercial or patient support services globally, and evidence from these projects gives good insight into how life sciences companies across the spectrum of size and therapy areas are responding. Combining this with first-hand feedback from healthcare professionals, payers, providers and patients across countries and therapy areas delivers unique global insights that, in turn, will help identify the critical success factors for pharma to emerge successfully from the pandemic.

Digital and remote engagement

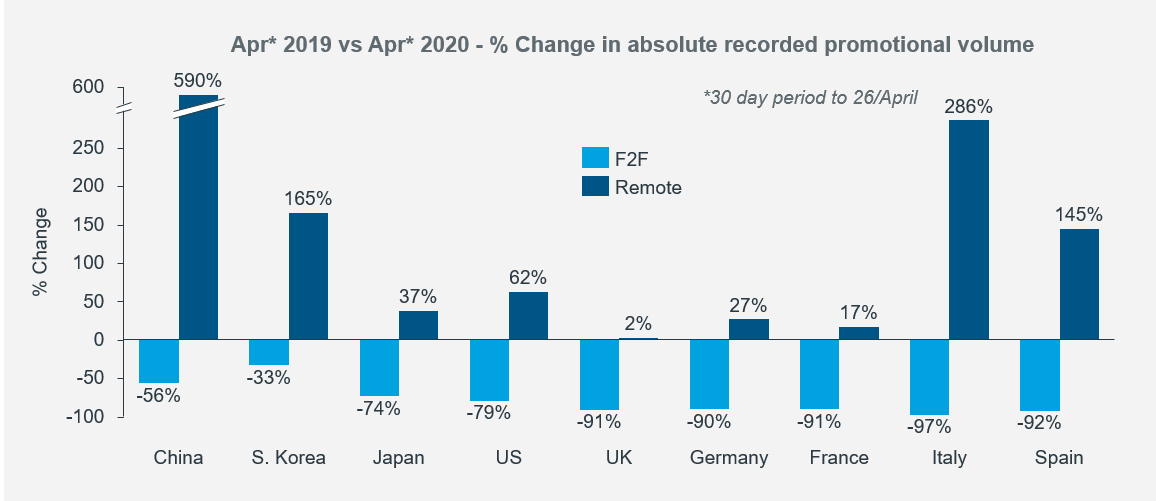

The biggest change during this pandemic has come in how companies are reaching out to customers using different channels while movement restrictions remain. With face-to-face promotional activity falling by more than 90 percent in April 2020 compared to the same period last year across each of the EU Big Five (see Figure 1), many companies have moved quickly to fill the void with email engagement or telephone contacts. However, we are also seeing an increasing number moving to more sophisticated models of remote detailing (ReD), using specialist resources designed specifically for this task. For example, we have seen a 500 percent increase in users and interactions using IQVIA’s Remote Engagement Platform between December 2019 and April 2020.

Indeed, the need for an effective response to COVID-19 has forced healthcare systems to drive significant changes in behavior that support the use of remote approaches. In the U.S., we have seen the use of telehealth grow rapidly, with IQVIA claims data showing a 1500 percent growth in claims in March 2020 compared to March 2019 and a noticeably large increase in its use by physicians over the age of 50. It should therefore come as no surprise that 73 percent of healthcare professionals (HCPs) say they have increased their use of digital resources as a result of the pandemic (source KLICK Health). In parallel, there has been a 62 percent increase in the use of remote detailing compared to the pre-COVID baseline, with that rate increasing week by week, but with some levelling off at the end of April.

Taken together, this demonstrates how the pandemic is driving greater acceptance of the use of remote interactions and digital resources in healthcare, even among those who have been more skeptical in the past.

It is interesting that countries hit earliest by an explosion in COVID-19 infections have seen the highest accelerations in the use of remote detailing. China has a near 600 percent increase, Korea 165 percent, Italy 286 percent, and Spain 145 percent. But the significantly lower rates in France, Germany and the UK show that this is not universally true and remind us that country-by-country variations will be significant.

Patient services

Similar efforts have been made to shift most pharma-sponsored patient services to digital, virtual and online support. Most interesting is the noticeable increase in the volume of pharma companies looking to extend homecare support as health systems have come under pressure. Data here is hard to come by, but assessing the picture based on inquiries IQVIA has received suggests more companies are trying to find constructive ways of shifting support into patients’ homes.

Indeed, in the UK it is government that has approached the industry about helping to release hospital capacity by investigating alternative options for some therapies already in use. In the U.S., rules have been relaxed to allow more at-home infusions. In Australia, IQVIA research suggests up to 60 percent of hospital specialists now want to refer more patients for home treatment.

Implications

It is important to put these developments into context. The pharma industry has been slow in its uptake of virtual and remote engagement models over recent years, partly because of caution related to the highly-regulated nature of the industry and partly because of a lack of experience of ReD. Estimating the size of residual effects of COVID-19-related changes will depend somewhat upon their scale and duration, but it is certain we will see some, if for no other reason than the greater use of remote engagement and telehealth as part of everyday healthcare practice during the pandemic.

The bigger impact may come from the support industry gives to enabling a shift to more home-based care. It will take considerable time for healthcare systems to recover from the strain of managing the impacts of COVID-19 and pharma can certainly play its part in helping to shoulder the burden while systems catch up. Patients are also likely to be much more accepting of home-based care and the role of industry in providing this, creating the ideal circumstances for industry to demonstrate its wider value.

In the next blog, I will share further insights as they emerge and will begin to explore their implications for promotional and medical services as we move into 2021.

If you would like to know more about IQVIA Contract Sales & Medical Solutions, please contact us.

Note: Unless otherwise noted, data cited in this article is drawn from IQVIA’s proprietary data assets accessed in May 2020, including IQVIA ChannelDynamics, IQVIA Medical Claims Data, IQVIA National Prescription Audit, IQVIA Formulary Impact Analyzer and IQVIA BrandImpact Network.

Our services pages

You may also be interested in

The Power of Remote Personal Interactions

Could life sciences companies be doing better?

Abiogen Pharma selects IQVIA’s Remote Engagement solution to maintain interactions with customers

Implements in just one week to maintain business continuity amidst COVID-19

IQVIA Remote Detailing

Optimize remote client interactions and improve sales force productivity