- Blogs

- RNA Therapeutics

Introduction

In our second blog, we looked at how one transformational technology – CRISPR – has been shaping the advanced therapies landscape. Since that publication, the UK’s MHRA has authorised the use of Casgevy, the world’s first CRISPR-based therapy. In this final blog, we look at another technology class that has recently undergone a significant transformation.

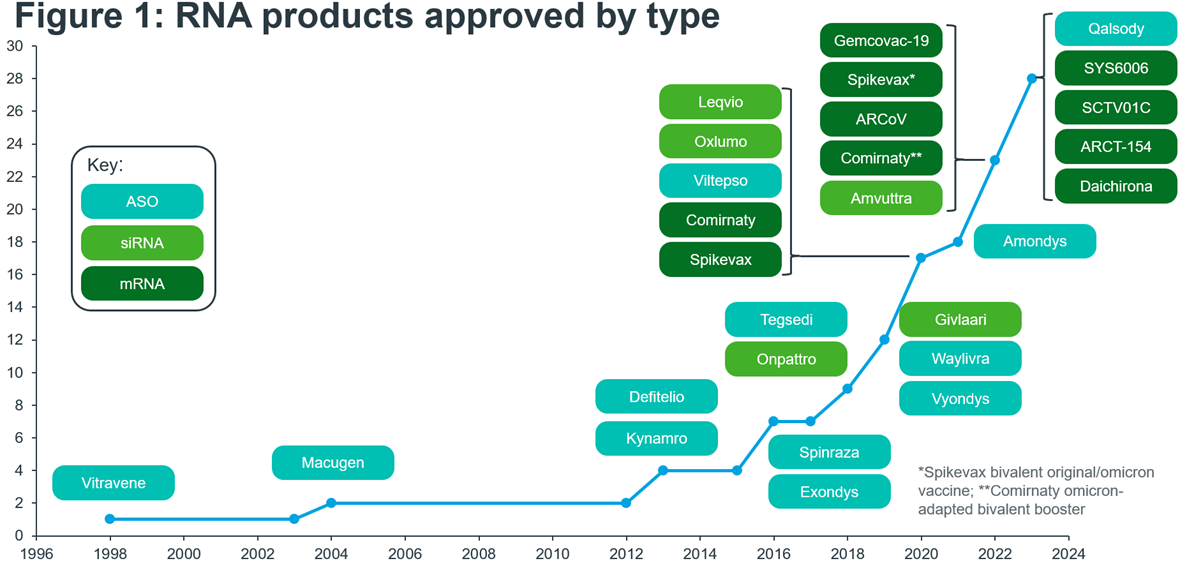

RNA therapeutics, a ground-breaking field in medicine, hold the promise of revolutionising the way we treat a wide array of diseases. At the heart of this innovation is the utilisation of ribonucleic acid (RNA) molecules, the genetic messengers responsible for carrying out vital cellular functions within our bodies. Whilst RNA therapies have existed since the launch of the antisense oligonucleotide (ASO) Vitravene in 1998, the path to clinical and commercial success has not been straightforward. That first product was withdrawn only a handful of years after its approval, citing a lack of demand and sales. For nearly 20 years following Vitravene’s approval the RNA market remained small, with few new product approvals. It has only been since 2016 that we have seen a flurry of activity, with new high-grossing products being marketed and new technologies being approved, and with many more products and technologies in development (Figure 1). In 2016 we saw the approval of Spinraza for spinal muscular atrophy, which in 2022 generated nearly $1.8 Bn in sales. Two years after Spinraza’s approval, the first small-interfering RNA (siRNA) product entered the market in the form of Onpattro.

The COVID-19 pandemic played a significant role in promoting the development and use of another new RNA technology – messenger RNA (mRNA). The unprecedently fast development of the COVID-19 vaccines showed that mRNA was safe, efficacious and could work at scale. They also catalysed a renewed interest in RNA technologies, with an 11-fold increase in M&A activity between 2020 and 20211.

Source: EMA, FDA, NMPA, PMDA, ASGCT Gene, Cell + RNA Therapy Landscape Q3 2023 data report. Notes: When approved my multiple regulatory agencies, the approval year for the first regulator to approve is taken. Includes products that have been withdrawn, discontinued, and are under Emergency Use Authorisation or Conditional Market Authorisation

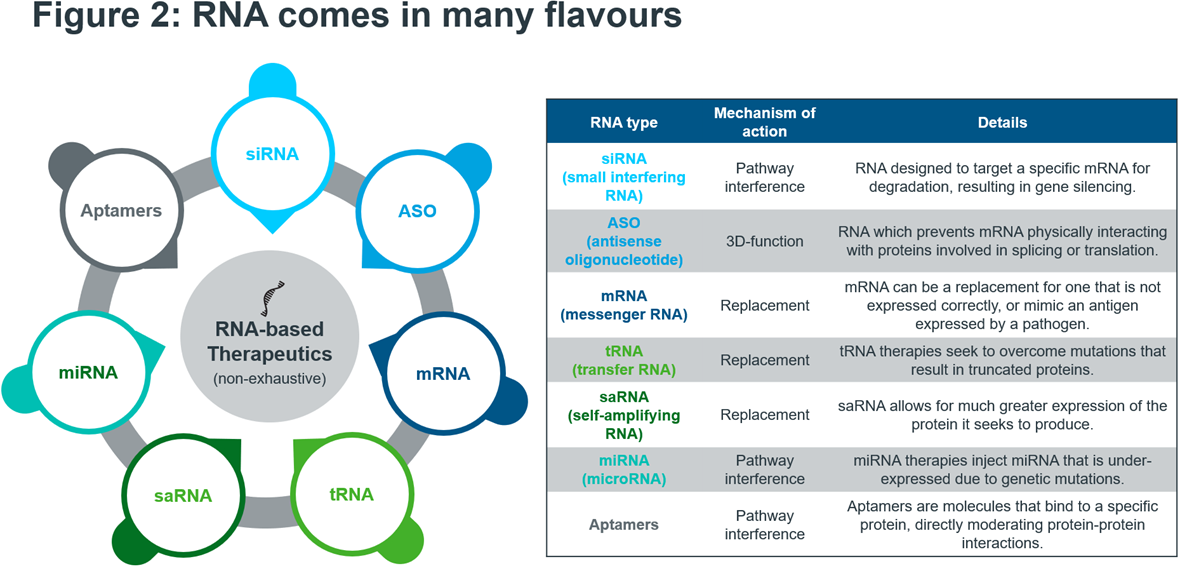

RNA therapies can be chemically synthesised, as opposed to biologic products which can require complex setups and bioreactors, meaning that if a promising RNA candidate is identified it can quickly be produced and tested. RNA technology is incredibly versatile. Figure 2 shows a selection of RNA platforms currently used in the clinics. Moreover, most disease-relevant drug targets are still “undruggable”. Small molecules and antibody drugs only target around 0.05% of the human genome – whereas the horizon for RNA treatments is essentially unlimited2. AI can also play a role in the development of RNA therapies in e.g., helping to automate the selection of the most promising candidates.

The current interest in RNA therapeutics is high, with players of all shapes and sizes developing and trialling candidates. The remainder of this article will cover the latest developments in RNA medicine; this will include therapeutic vaccines, but prophylactic vaccines will not be in scope. However, they are covered thoroughly in a separate deep-dive section in our white paper, “Race for Immunity: Exploring the Evolving Landscape of the Vaccines Market”. Additionally, whilst CRISPR-based therapies can be included within the broader scope of RNA therapies, we have not included them in this article as they were already covered in part II of this blog series.

Source: IQVIA EMEA Thought Leadership; Secondary Research

Innovation landscape

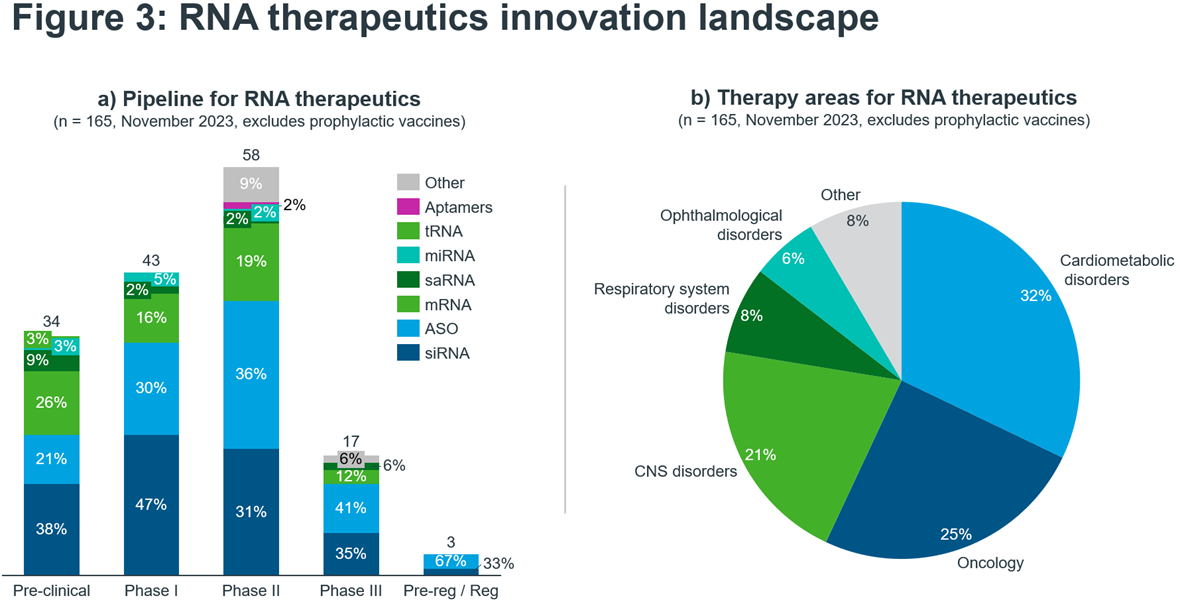

The most common types of RNA seen in development are siRNAs, ASOs and mRNAs that collectively account for 80% of the RNA therapeutics pipeline (Figure 3a). This is not too surprising, given that these three RNA platforms are most mature with approved products and demonstrated commercial success. Excitingly, only 19% of the pipeline are designated as orphan medicines – showing that in contrast to most currently marketed RNA-based drugs – the future of RNA will benefit larger patient populations.

Indeed, the largest therapy area under investigation is cardiometabolic disorders accounting for nearly one-third of the entire pipeline. Small-interfering RNA (siRNA) are the leading class of RNA. A notable example is Rivfloza, developed by Novo Nordisk. It was approved for use by the FDA in October 2023 for primary hyperoxaluria in adults and is in the process of being marketed. Eli Lilly’s candidate lepodisiran, also a siRNA therapy, recently received positive news following the outcome of its first in-human trial. The results were announced at the AHA conference and impressively showed that a single dose of the drug, reduced lipoprotein(a) (LP(a)) levels by up to 94% for nearly a year3. LP(a) is a well-recognised risk-factor for cardiovascular disease.

Following siRNAs, the next largest category is ASOs at 28% of the cardiometabolic RNA pipeline. Whilst ASOs may be the oldest type of RNA to be marketed, there is certainly no slowing down of innovation. Ligand-conjugated antisense (LICA) oligonucleotides combine an ASO with a ligand, resulting in a higher specificity product and a more precise delivery to the target area of the body. Eplontersen, which is in the pre-registration phase with the FDA after being accepted for a New Drug Application, is a LICA oligonucleotide. It is being developed by Ionis for a sub-type of amyloidosis called ATTRv-PN.

Source: IQVIA Thought Leadership, IQVIA Pipeline Intelligence November 2023, search criteria: Descriptor: RNA aptamer; RNA vaccine; RNAi ; microRNA mimic; RNA therapy; mRNA therapy; saRNA; oligonucleotide; antisense; oligonucleotide decoy; microRNA inhibitor

It is also worth noting that almost one-quarter of candidates in the cardiometabolic space are for liver-related diseases. The liver is an appealing organ to target with RNA therapies as medicine delivery is much easier than for other organs due to its function within the body and its high metabolism.

Oncology is the second largest area for RNA innovation. Here, the largest RNA technology type is mRNA with 32% of the pipeline followed by ASOs on 29%. Within oncology, some of the most exciting products are the therapeutic mRNA vaccines, which involve identifying either patient-specific or tumour-related antigens, followed by manufacturing and administration. These products are often being trialled alongside a checkpoint inhibitor, such as Moderna’s mRNA-4157/V940, which when combined with pembrolizumab showed a 44% improvement in melanoma patient’s reoccurrence-free survival4. For a more in-depth discussion of mRNA cancer vaccines, look to the respective deep dive in our recent vaccines white paper.

The third-largest therapy area for RNA therapies is CNS disorders. Here, ASOs are dominant, representing 67% of the pipeline. The indications within CNS that are represented are varied, ranging from Alzheimer’s and dementia to muscular dystrophy, to ultra-rare conditions such as Angelman syndrome and Dravet syndrome. The pipeline for CNS disorders is heavily centred around Phase II trials, with 64% of candidates in Phase II. The latest-phase product in the pipeline is Qalsody, an ASO granted accelerated approval by the FDA in April 2023. It is the first product approved to treat ALS in adults with a mutation in the SOD1 gene and is being developed by Ionis and Biogen.

The way forward

The growing number of RNA therapeutics targeting both rare and prevalent diseases that have entered the clinics today is a testimony to our improved understanding of basic biology and – importantly – our capability to translate these findings into human medicines. However, compelling science alone will not be sufficient in an increasingly unforgiving pharmaceutical market environment. To successfully transition from the clinics into a commercial product, RNA innovators must take some lessons to heart:

- Primary care innovation: Marketed and late-stage RNA assets often target disease areas with large patient populations – in contrast to the currently approved mostly orphan drugs. In primary care, RNA must win an uphill battle not just against an often-generic cost-effective standard of care (SoC) but also a “good enough” mindset by payers and prescriber that does not reward innovation. Innovators must therefore clearly articulate the differentiation of RNA therapies vs. SoC and quantify the value to patients and health systems. Moreover, we have previously identified early advocacy, evidence on outcomes, reassured payers, health system readiness and engaged patients as five key priorities in our “A Renaissance for Cardiometabolic Innovation” white paper.

- Rare disease rethink: Incentivising innovation for orphan drugs are a policy success story whilst the high price tag for some medicines led to payer concerns. Policy reforms on both sides of the Atlantic could put revenues in the most important markets at risk. Under the IRA, orphans lose exclusivity with additional indications and in the EU, the proposed pharma legislation could also reduce exclusivity by one year. Moreover, individual countries want to contain orphan drug spending. Germany lowered the sales threshold from €50 to €30 million before orphan drugs must go through a full HTA assessment. RNA innovators must rethink their strategy that encompasses a deep understanding of the patient journey, an integrated evidence strategy and a commercial model that addresses payer concerns and can ensure funding via e.g., innovative payment models.

- Innovative momentum: Health systems struggle to keep pace with the amount of more and more specialty and orphan launches. At the same time, the sophistication of innovation increases with sometimes multiple advanced therapeutics competing in the same area – some of them even offering curative approaches. Supporting health system readiness as part of a target launch strategy will be paramount for RNA innovators to ensure a strong uptake in a potentially short window of commercial opportunity.

Many companies developing RNA therapeutics are emerging biopharma (EBP) and have never launched a product before. Furthermore, EBPs are facing a tough funding environment and will have to operate with even tighter budgets when it comes to commercialising their assets. For EBPs that choose to go it alone, five critical success factors that are distinctive to EBPs are outlined in our Realising the Commercial Promise of Europe for Emerging Biopharma white paper.

RNA therapies without a doubt offer many advantages over small molecule or biologic drugs and innovation momentum is high as the science is evolving rapidly. Combined with a series of commercial success stories, the outlook for the entire field is bright. IQVIA Thought Leadership will continue to monitor this exciting space to see whether RNA will indeed fulfil its promise as a part of the next generation of healthcare.

1IQVIA White Paper “Promise fulfilled: the next decade of cell, gene and RNA therapies”; IQVIA Pharmadeals

2https://www.nature.com/articles/s41419-022-05075-2

3https://pharmaphorum.com/news/aha-one-dose-lillys-sirna-drug-cuts-lpa-year