- Blogs

- What Impact Is COVID-19 Having on Social Media Conversations?

As the COVID-19 pandemic has evolved, people have relied on social media to connect with one another and to share and consume healthcare information in new ways. Analyzing social conversations on COVID-19 can therefore be a powerful tool for life sciences companies to monitor the current pulse of the market and to ensure that their development and commercial strategies address the concerns of customers. Insights from social listening can help companies – among other things – identify intervention opportunities; inform trial recruitment; inform segmentation, targeting, and messaging; and track the treatment journey, brand perceptions, sentiment drivers, unmet needs, disease management challenges, and the humanistic burden of the disease.

So, how is the pandemic permeating social media conversations? What can life sciences companies learn from “listening in?”

A Vital Resource

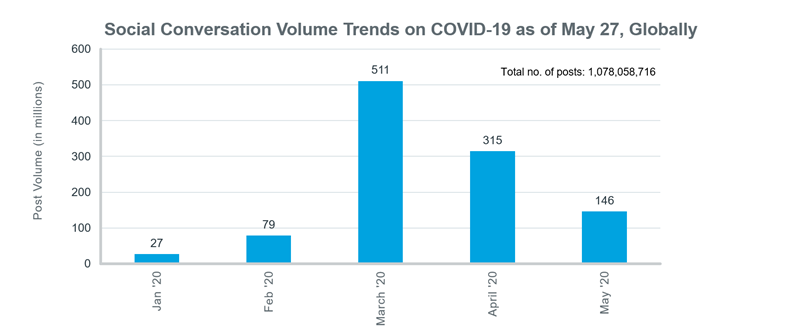

Since the crisis began late last year, COVID-19 related social conversations have increased exponentially around the globe. As of May 27, the social conversations around COVID-19 stand at a staggering 1 billion+, averaging approximately 50 million per week. To put things into perspective, diabetes conversations average about 200,000 per week. Outside of China, the top five nations by conversation volume are the US, Japan, India, UK, and Brazil. Twitter contributes to about 87 percent of the conversations followed by discussions driven by news articles at 7 percent.1

Brand Mentions Are Just the Beginning

The top five pharma companies by social media mentions in the US are Abbott (750,000+), Gilead, Roche, Bayer, and Sanofi. The most frequently mentioned medical device company is the 3M Company, which garnered 450,000 posts. Other top companies include Medtronic, Siemens, Biomerieux, Fresenius, Johnson & Johnson, Becton Dickinson, and Cardinal Health. Clearly, these companies are trending for a reason, and for each the burning question is: what precisely is being said? Further exploration of the data can reveal this.

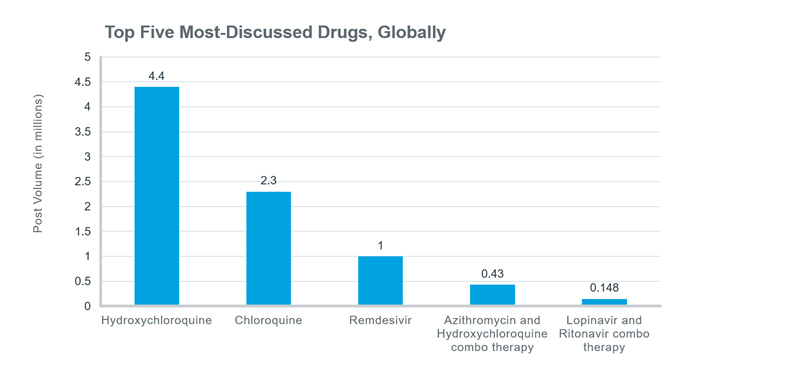

Social media conversations include mentions of specific products, and the tenor of these discussions should be a point of curiosity for brand teams. Including those in the pipeline, more than 35 drugs/brands are being discussed globally online and in social media.

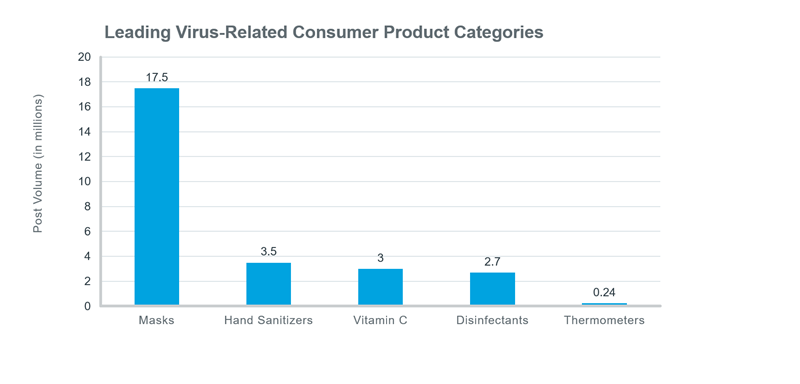

Globally, a significant portion of social conversations are focused on consumer health brands, health supplies, and cleaning products. For instance, the most often-mentioned cough and cold medications include paracetamol/acetaminophen and ibuprofen, with over 500,000 posts each. A variety of supplements are mentioned in over 394,000 posts.

Social media users are also discussing vaccine and treatment trials underway worldwide, of which there are nearly 1,6002 . Those related to anti-malarial and anti-viral drugs are mentioned most often. As these trials progress and vaccines are introduced for approval in the coming months, social media intelligence can uncover anecdotal feedback “on the ground” from investigators and trial participants alike, eventually providing pharma companies with critical insight about vaccine availability, insurance coverage, experiences and side effects. Brand managers can further use this insight to track the sentiment, patient experiences, and access issues reported by patients on social media to mitigate risks in a timely manner.

Spill Over into other Disease States

Unfortunately, at the rate in which COVID-19 has consumed our society’s healthcare resources, patients of other diseases have been adversely impacted. Other conditions mentioned in the context of COVID-19 are cancer, diabetes, pregnancy, asthma, bronchitis, cystic fibrosis, heart diseases, auto-immune diseases, and hypertension.

Patients often mention concerns over seeking treatment for other conditions. For instance, pregnant women and new mothers express difficulties in getting information/advice that they would expect under normal conditions. Patients who are required to travel across states for in-person HCP consultations/treatment sessions are risking gaps in receiving treatment. Cancer patients are experiencing appointment cancellations, given they are immuno-compromised. This has caused disruptions in current treatment or delays in initiating new treatments. A report by the IQVIA Institute for Human Data Science substantiates this with specifics on changes in the volume of physician visits for cancer patients.

Similarly, physicians are being spread thin as they care for infected patients. They report fear of infection, fear and guilt of putting other patients at risk, and deteriorating quality of life due to extended work hours, exhaustion, stress, insomnia, anxiety, and emotional burnout. Manufacturers should pursue further research to understand how the demands on physicians are impacting their ability to treat patients in other disease areas.

In select therapy areas, such as RA/Lupus, patients expressed concerns about the shortage of certain biologics (e.g. Actemra), given they are being used to treat COVID-19 patients as well. This suggests the need for manufacturers to examine possible shortages by geographic region and address any real supply chain issues.

Mental health patients express a number of concerns, including loneliness, anxiety, insomnia, depression, loss of freedom, dislike of social distancing, weight gain and limited exercise opportunities. Similarly, caregivers are concerned for those left in isolation. Follow-up research might investigate any changes in the symptoms of the mentally ill and any changes in substance abuse.

Analyzing social conversations on COVID-19 can be a powerful tool in furthering COVID-19 research, mobilizing healthcare resources to support patients, and informing healthcare initiatives in all disease areas. The findings presented here are just the beginning of what can be gleaned from Social Media Intelligence.

Visit our website for more information and click the Contact Us button to get more details on how to gain crucial market insight from social media intelligence.

1 Source for all social media mentions is IQVIA’s Social Media Intelligence, powered by Brandwatch.

2 ClinicalTrials.gov database