Gain high value access and increase the profitability of your brands

- Locations

- United States

- US Blogs

- How the Inflation Reduction Act is Changing the Rules in Life Sciences – Pt. 4

In continuation of IQVIA’s Inflation Reduction Act thought leadership series, the following is the fourth in a five-part blog series analyzing the first 10 products selected for Maximum Fair Price (MFP) negotiations. These 10 products represent the first of up to 100 products scheduled to be negotiated between 2023 and the end of the decade. The overall economic impact of the first 10 products belies the long-term impact on the life sciences industry, which will only grow as more products are added to negotiation.

Shifting economics in the Medicare channel creates many downstream secondary and tertiary effects on how products are brought to market. Brands, generics, and biosimilars will all be affected as competitive reference prices are impacted by market dynamics and directly from MFP capitation.

For branded products, multiple manufacturers have already announced that pipeline assets are being culled as the Net Present Value of drugs is reduced due to compression of the economic lifespan. Products that are most impacted are ones that would be on the margins of economic viability. This can be because of high development costs, riskiness of gaining approval, small patient populations, or because they would be launching into an already competitive market. Because of the 9-year eligibility rule for small molecules, traditional retail drugs will be the most challenged.

It is not unusual to have multiple manufacturers vying to enter similar markets with compounds within the same class. Consider the SGLT2 inhibitors, of which two were selected for MFP negotiation (Jardiance and Farxiga). Other products in the class, like Invokana, will need to watch negotiations closely as the potential for competitive spillover manifesting in new market dynamics is likely. The same can be said for immunology, which has over a dozen products, with the selection of Enbrel and Stelara for 2026 negotiation.

For these competitive classes, later line entrants are often referred to as “me-too drugs”. Such products deepen a market basket and increase competitive discounting as more are launched. Established markets with more than two products will be impacted by decisions to potentially not launch an asset. The direct impact of fewer branded drugs coming to market is that future classes may not have the same level of competition that exists in today’s market. As third-, fourth-, and fifth-line agents get removed from pipelines, that means that payers have reduced ability to extract the deep discounts that are present in six of the 10 drugs selected for MFP negotiations.

Additionally, as has been written elsewhere, the inflationary impact of the IRA is anticipated to accelerate launch prices. Products that are pulled from clinical development represent sunk costs that a manufacturer has expended and will seek to recuperate. Combined with other aspects of the Inflation Reduction Act, including expanded Medicare discounts and inflation penalties, manufacturers anticipate higher costs of access and flat pricing from launch across a product’s lifespan.

Generic and biosimilar manufacturers should also take notice of how Maximum Fair Price negotiations impact the economics of coming to market. Patent application and litigation are often a combination of public and private information, creating an environment where understanding end-of-life timing is difficult. One of the challenges of the current system that the IRA is seeking to address is that manufacturers are delaying generic and biosimilar entry through negotiation or changing of formulation to extend patent life. Understanding how MFP negotiations are addressed for late in the lifecycle products will be one of the many dynamics the industry needs to follow.

Of the 10 selected MFP products, six are facing generic or biosimilar competition (Xarelto, Januvia, Jardiance, Farxiga, Entresto, and Stelara) in similar timeframes as to the implementation of negotiated prices in 2026. Imbruvica, Enbrel, and Eliquis have patent dates that extend to the end of the decade and into the next. For those products with extended protected life, the economic impact of MFP negotiations will be higher as it will impact the products for longer, leading to an increase in lost economic years

Lowering the net price in Medicare directly reduces the branded reference price that insurers, and the system, should most care about – net price. Consider Januvia, whose patent expires in early 2027. If there is a lower net price in Medicare, that will alter generic pricing strategy, potentially reducing economic incentive to come to market. A reduction in economic incentive to launch, like with branded innovation, means fewer generic products move to market. As fewer products move to market, there is less competition, and system costs stay higher.

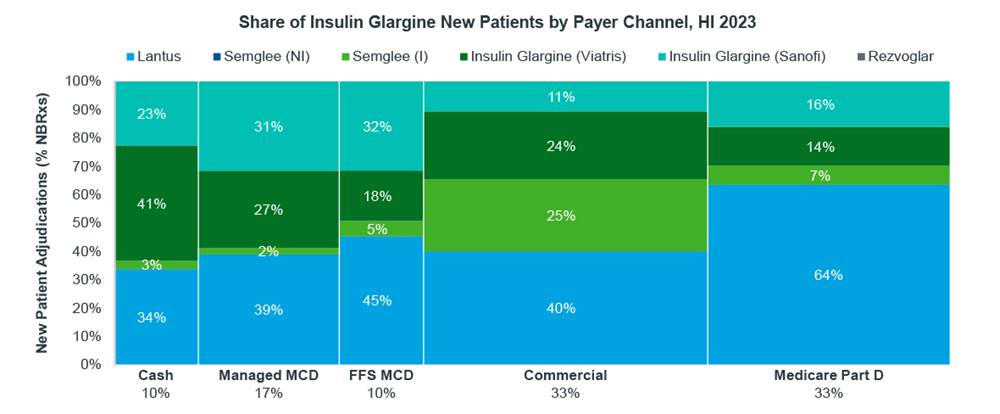

Examples of brand reference price, discounts, and net price impact on generic utilization already exist in the market today. The insulin market, which includes brands with high discounts, low-cost brands, and both non-interchangeable and interchangeable biosimilars, demonstrates how preference varies by payer channel. In Medicare Part D, branded Lantus with high discounts maintained 64% of utilization in the first half of 2023.

Source: IQVIA Market Access Center of Excellence; LAAD 2023

For biosimilar manufacturers, the market is even more complex than typical generics, as many biosimilars do not have therapeutic interchangeability. That means the tipping point between the economic incentive to switch to a biosimilar is also moving, making market inertia, or the resistance to switch to a lower list price alternative, even more powerful. Payers are already on the record stating that they will pursue the lowest net cost of a drug for their formularies, which may remain the branded reference product due to what is known in the industry as rebate walls. As biosimilar viability is broadly challenged, manufacturers who may have considered investing in launching a product will now need to re-evaluate the value of doing so. The rebate wall just got a little bit higher.

Just a few of the downstream impacts of the Inflation Reduction Act include a reduction to innovation, fewer branded products and indications launching, pressure to price higher at launch, and shifting net prices at the end of patent life. While intended to reduce drugs prices, it is very possible that the opposite may prove true.

At the time of publication, multiple lawsuits from the industry are pending in attempts to block all or pieces of the legislation from going into effect. For this blog, we will assume that the law is implemented as passed.

Special thanks to Marcella Vokey, Ingrid Hirt, Jeanna Haw, James Brown, Rob Glik, Jeff Thiesen, Michal Kleinrock, and Mason Tenaglia for their contributions.

The final chapter: The Inflation Reduction Act – Part 5

The final installment of this series explores how the rules have changed with the passage of the Inflation Reduction Act. It is still very early in the law’s implementation, and there is a complex road to realizing the true long-term economic impact. Prepare for the journey ahead.

You may also be interested in

Related solutions

Rely on market-leading strategists to help you achieve maximum access and profitability

Data, AI, and expertise empower Commercial Solutions to optimize strategy, accelerate market access, and maximize brand performance.