Gain high value access and increase the profitability of your brands

- Locations

- United States

- US Blogs

- How the Inflation Reduction Act is Changing the Rules in Life Sciences – Pt. 1

In continuation of IQVIA’s Inflation Reduction Act thought leadership series, the following is the first in a five-part blog series analyzing the first 10 products selected for Maximum Fair Price (MFP) negotiations. These 10 products represent the first of up to 100 products scheduled to be negotiated between 2023 and the end of the decade. The overall economic impact of the first 10 products belies the long-term impact on the life sciences industry, which will only grow as more products are added to negotiation.

Signed into law in August 2022, MFP negotiation is one of the IRA provisions that is intended to lower prescription costs for Medicare beneficiaries and reduce drug spending by the federal government. The provision calls for the U.S. Department of Health and Human Services to negotiate the price of Medicare Part D drugs (starting in 2026) and Part B (starting in 2028), targeting “top spend” medicines that have been on the market for at least nine years (for small molecules) or 13 years (for large molecules).

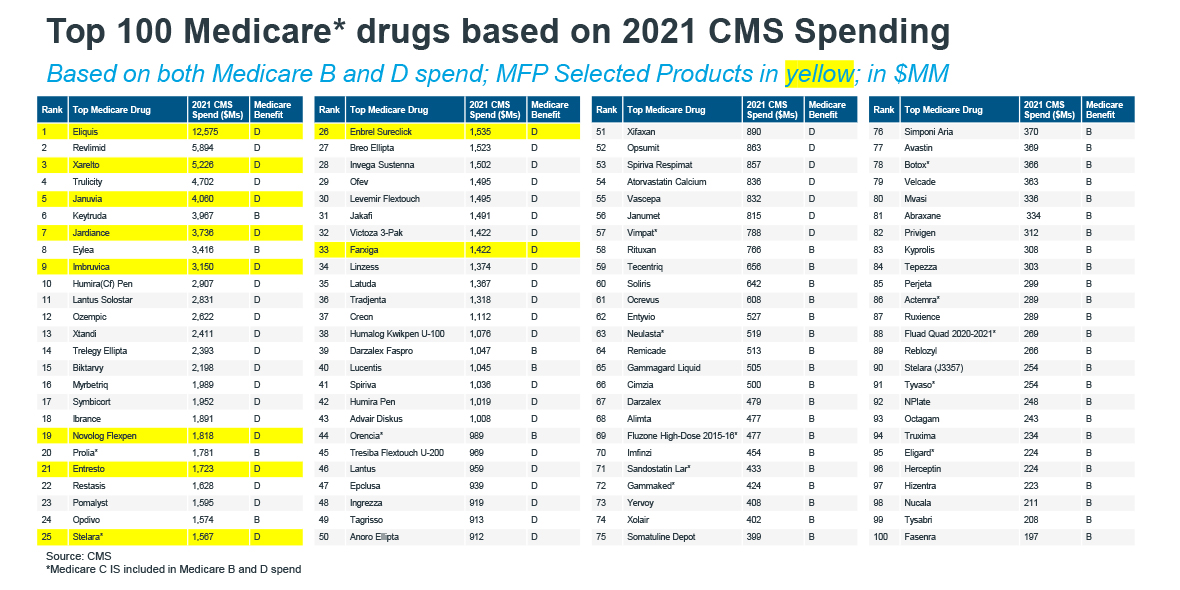

With a few surprise additions and exclusions to the initial list, the Centers for Medicare & Medicaid Services is targeting diabetes and cardiovascular therapeutic areas, as seven of the 10 selected drugs fall into these two categories. Based upon eligibility criteria, CMS could have targeted several other products, which would have increased year-one savings but would not have impacted as many seniors. For example, the inclusion of Entresto, Farxiga, and Stelara on the 2026 list instead of Ibrance and Xtandi, which were eligible, demonstrates the broader CMS focus and how year over year, shifts in utilization can impact selection. This makes it necessary for manufacturers not only to watch where their drugs fall on the CMS spend list, but also to be aware of where others fall and how products are growing or contracting from year to year.

Of the manufacturers with products selected, Janssen has three and competes with multiple products in other categories that were selected. For a product like Xarelto which is already heavily discounted, this will not have as much of a direct impact on net sales as will the selections of Imbruvica and Stelara, which are not as heavily rebated. BMS’ Eliquis, as the top spend product in Medicare Part D, is also impacted, but as with Xarelto, it is already heavily discounted in Medicare, so the net revenue impact is muted.

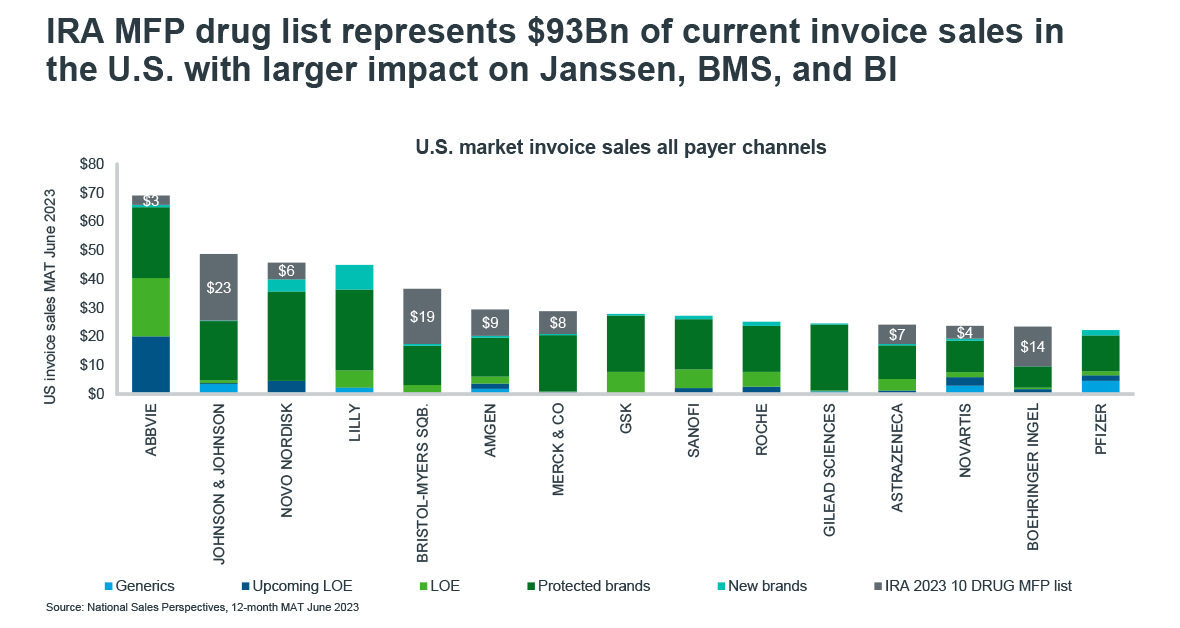

The 2026 MFP negotiation’s selected products, in total across all payer channels and not just Medicare, account for $23B in revenue from Janssen and $19B for BMS. Boehringer-Ingelheim, with only Jardiance selected yet already highly discounted, faces the largest potential effect proportional to its total portfolio.

The first 10 products represent a total of $93 billion in total U.S. gross revenue across all payer channels, with ~$39.2 billion being directly under Medicare Part D in 2021. The selected MFP products represent high-spend products in Medicare totaling to 23% of 2021 Medicare spend, with Eliquis spend being the highest at $12.5 billion or ~5% of total CMS drug spend. Of the initially selected products, six are likely heavily discounted already due to competitive contracting and time on market. Three are moderately discounted, and one is slightly discounted. Of the 10, only a few could see meaningful net price discounts to drive system savings.

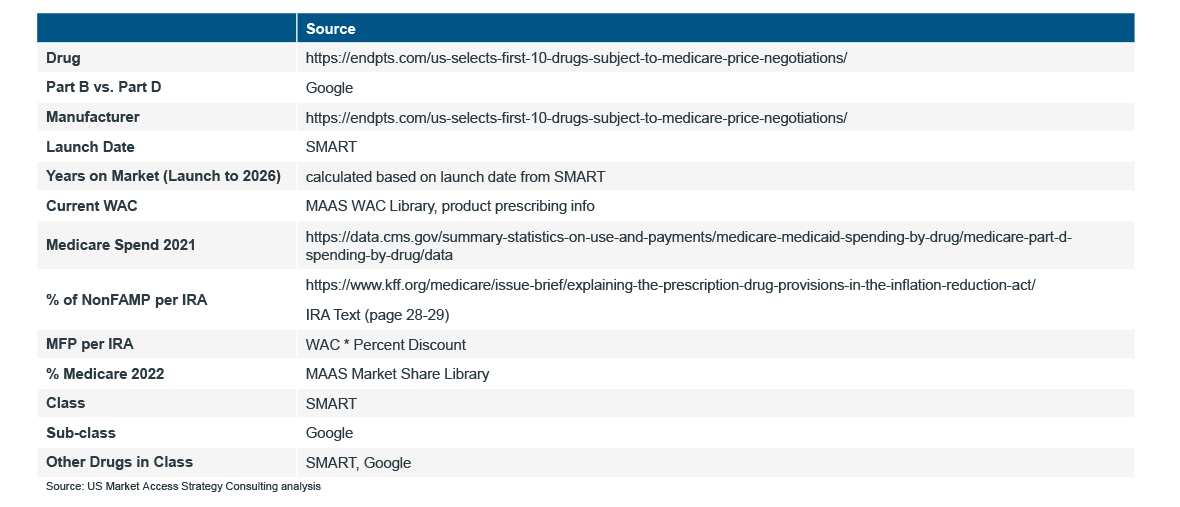

Source: IQVIA Market Access Center of Excellence; See Appendix for References

For the six heavily discounted products (Eliquis, Xarelto, Jardiance, Farxiga, Januvia, Novolog), MFP negotiations will have only marginal direct bearing on the actual brand economics, as the MFP price will be set at or near the current highest rebated level. Indirectly, products that fit this profile still face economic erosion as MFP prices become public and threaten to spill over into the Commercial channel.

Novolog represents an interesting case study for MFP selection. There are multiple strengths and moieties of the product, all of which will be impacted by MFP negotiations. For products with similar profiles, watching how Novolog is impacted will provide important insights for future selections. Additionally, Novo Nordisk enacted a price reduction in 2023, effectively reducing what was once a high-rebated product to a much lower list price with minimal rebates. Furthermore, Novolog has multiple dosage strengths, which impacts list prices. Direct CMS savings amongst drugs that are already highly discounted will be negligible.

For the four moderate-to-slightly rebated products that will have their new Maximum Fair Price at or below their current net price (Enbrel, Entresto, Stelara, Imbruvica), brand economics will erode both directly and indirectly. For 2026, selected products that have been on the market 9-16 years will be subject to a 25% discount, and a 60% discount will start negotiations for drugs that have been on market for more than 16 years. The Maximum Fair Price, however, should not be viewed as the new price but rather the new price ceiling. The floor can, and likely will, be lower than MFP for many selected brands.

Secondary gross-to-net market impacts of the first 10 selected products include the potential for Commercial channel spillover, the indirect impact for competitive products of a new lower price in the market, payer concessions required beyond the new MFP price, and changes in utilization. The industry can also expect greater payer controls driven by sponsors’ increased liabilities under the new Medicare Part D benefit design and the expectation that they cover negotiated drugs. Greater controls will, in turn, drive even higher rebates.

While the first 10 MFP products will send shockwaves across the industry, the aftershocks will be felt for years to come as the market adjusts to the new reality of the IRA.

At the time of publication, multiple lawsuits from the industry are pending in attempts to block all or pieces of the legislation from going into effect. For this blog, we will assume that the law is implemented as passed.

Special thanks to Ingrid Hirt, Jeanna Haw, James Brown, Rob Glik, Jeff Thiesen, Michael Kleinrock, and Mason Tenaglia for their contributions.

Continue the Inflation Reduction Act Series

Part 2 of this blog series explores the Inflation Reduction Act’s impact on the economic lifecycle. Maximum Fair Price negotiations reduce a product’s economic lifecycle by introducing a new Medicare event, effectively acting as a new Loss of Exclusivity date in the Medicare channel. As such, the impact of a shortened lifecycle’s value can be immense.

You may also be interested in

Related solutions

Rely on market-leading strategists to help you achieve maximum access and profitability

Data, AI, and expertise empower Commercial Solutions to optimize strategy, accelerate market access, and maximize brand performance.