- Locations

- United States

- US Blogs

- Now Trending: Biosimilars

Biosimilars are the subject of daily headlines across U.S. newspapers, drug reports, podcasts, and social media. After nearly a decade of growth, the now mature U.S. biosimilar market is of prominent interest across the nation as industry experts forecast how biosimilars will improve health outcomes, reduce spending, and most interestingly, influence market access trends. Today’s U.S. biosimilar market is comprised of:

- 40 FDA-approved biosimilars across 15 reference biologic products, also known as "originator” products.

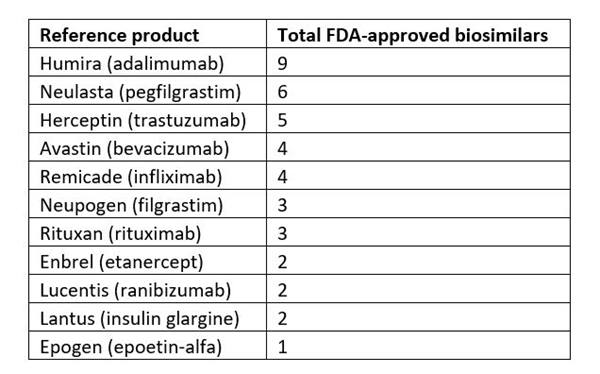

- Multiple biosimilars competing against one reference product (see Table 1 below).

- 30 launched biosimilars, with an additional 10 expected to launch by the end of 2023.1

Table 1: Total number of FDA-approved biosimilars per reference product. Current as of 5/25/2023.2

Biosimilars compete with just 14% of biologics as most of the market is protected by exclusivity, a timeframe during which biosimilar approval is restricted.3 Some biosimilars launch in the U.S. market within a year of approval, while others face lengthy launch delays due to a variety of factors such as patent litigation, legal settlements, and manufacturing delays. Current examples include:

- Celltrion’s Yuflygma received FDA approval in June 2023 as the 9th adalimumab biosimilar (i.e., Humira biosimilar) and is expected to launch in July 2023.4

- In contrast, Amgen’s buzzworthy Amjevita received FDA approval in 2016 with its historic launch taking place nearly 7 years later, in January 2023.5

- Erelzi, an Enbrel biosimilar manufactured by Sandoz, was also approved in 2016 though the product launch is not expected until 2029.5

- In June of 2023, Johnson & Johnson settled patent litigation with Amgen regarding their Stelara biosimilar. The lawsuit allows FDA approval of the biosimilar in the second or third quarter of 2023, and the settlement delayed expected launch from late 2023 to “no later than January 1st, 2025.”6

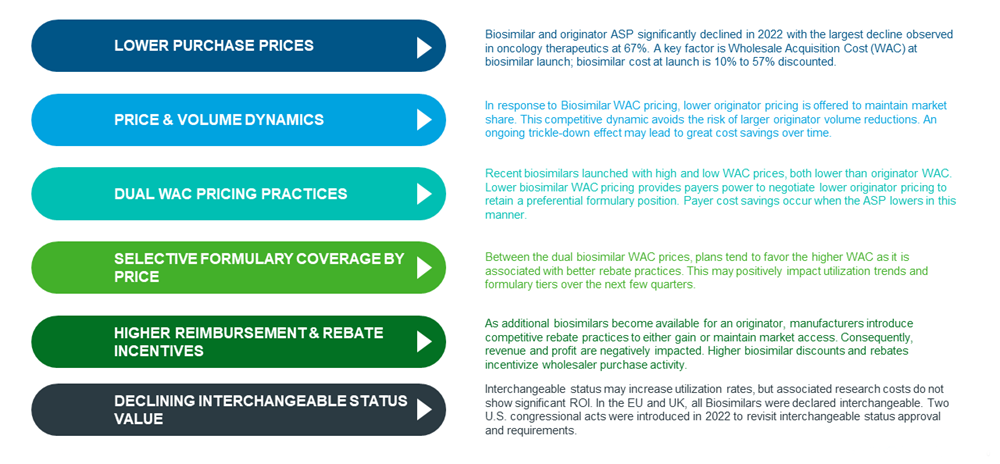

The timeframe when a biologic originator loses exclusivity, a biosimilar is approved, and the biosimilar is launched is highly anticipated, followed, and discussed. But insight to market access trends is observed post-launch, particularly when multiple biosimilars enter the picture. Current trends and observations are shown in Figure 1 below:

Figure 1: U.S. Biosimilar market trends roundup, July 2023.

It is impressive to look back on the growth of both biologics and biosimilars in the U.S. Both innovation and legislation have provided effective treatments to patients faced with complex, chronic diseases. Additional biosimilar launches and approvals in the coming years are anticipated to offer even more clinical success to U.S. patients and continue to be a major influence on U.S. drug spending.

References

- https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/biosimilars-in-the-united-states-2023-2027/iqvia-institute-biosimilars-in-the-united-states-2023-usl-orb3393.pdf

- https://www.fda.gov/drugs/biosimilars/biosimilar-product-information

- https://www.fda.gov/drugs/biosimilars/background-information-list-licensed-biological-products-reference-product-exclusivity-and

- https://www.centerforbiosimilars.com/view/fda-approves-celltrion-s-yuflyma-the-ninth-adalimumab-biosimilar

- https://www.amgenbiosimilars.com/commitment/2022-Biosimilar-Trends-Report

- https://www.reuters.com/business/healthcare-pharmaceuticals/amgen-settles-jj-patent-lawsuit-over-drug-similar-blockbuster-stelara-2023-05-23/

- https://www.iqvia.com/locations/united-states/library/white-papers/lessons-from-semglee-early-perspectives-on-pharmacy-biosimilars

- https://drugchannelsinstitute.com/products/industry_report/wholesale/

IQVIA Global Pricing & Contracting

Our GPC team is your “one-stop-shop” for business and technology solutions for your global business.

Related solutions

Data, AI, and expertise empower Commercial Solutions to optimize strategy, accelerate market access, and maximize brand performance.

Gain high value access and increase the profitability of your brands