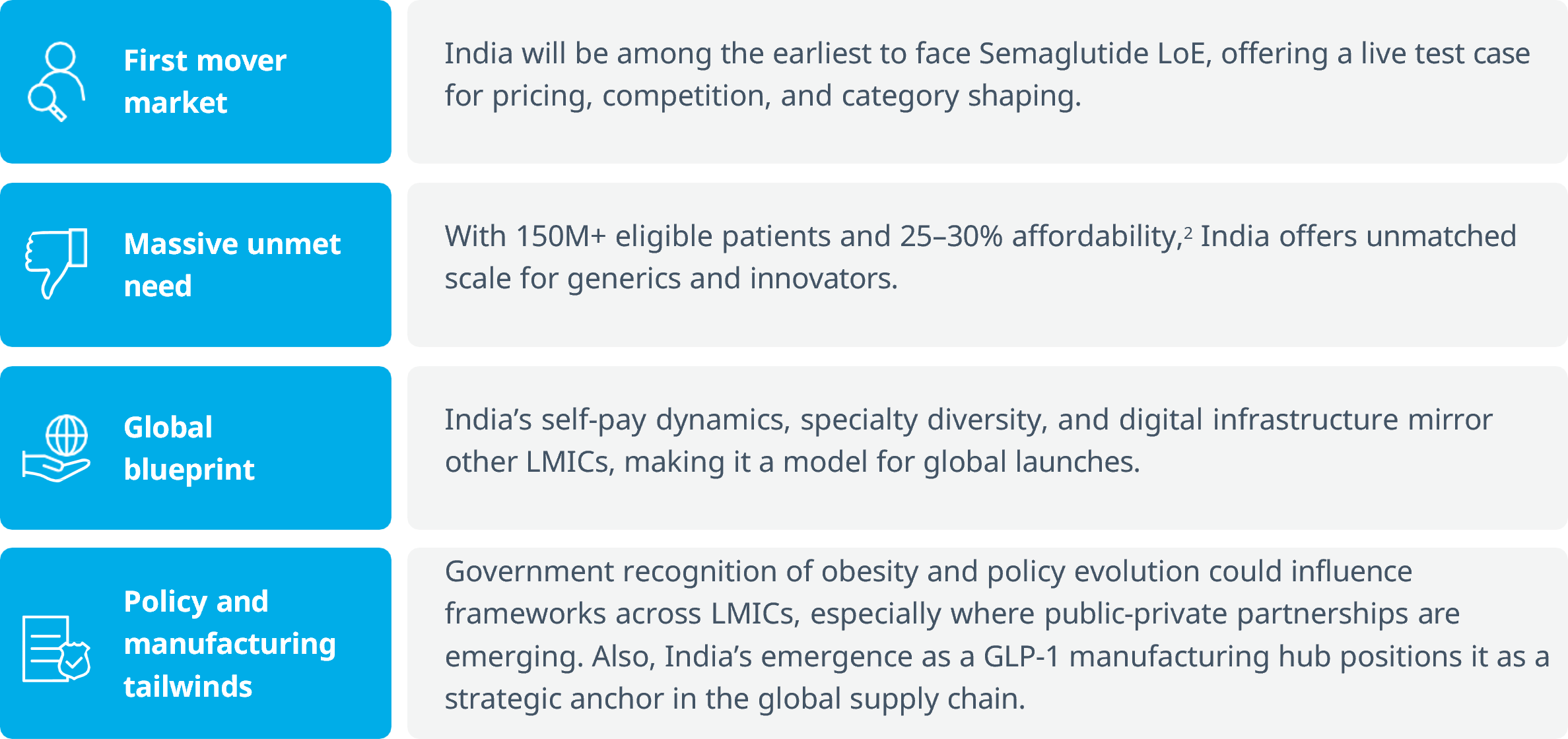

India’s Semaglutide Loss of Exclusivity (LoE) marks a strategic inflection point, combining scale, urgency, and ambiguity in a market still forming. With 150M+ addressable patients, early LoE timing, and a digitally connected self-pay ecosystem, India is not just a launch market, it’s a blueprint for global obesity care.

Semaglutide’s LoE in India is unlikely to follow the traditional generics playbook. The market is still being shaped, patient journeys are evolving, and therapy adoption is influenced as much by patient pull as by prescriber push. The compressed innovator launch window, coupled with rising patient awareness and evolving diagnostic frameworks, creates a strategic white space, one that demands reinvention, not replication.

India’s Semaglutide LoE: A catalyst for global market shapingIndia’s early LoE timing, vast self-pay population, and digitally connected ecosystem make it a strategic inflection point for Semaglutide’s post-patent journey. This is not just a domestic event, it’s a global signal.

India’s LoE moment will shape not only domestic outcomes but global norms for pricing, access, and category creation.

1IQVIA analysis from World Obesity Observatory; 2IQVIA’s internal affordability matrix

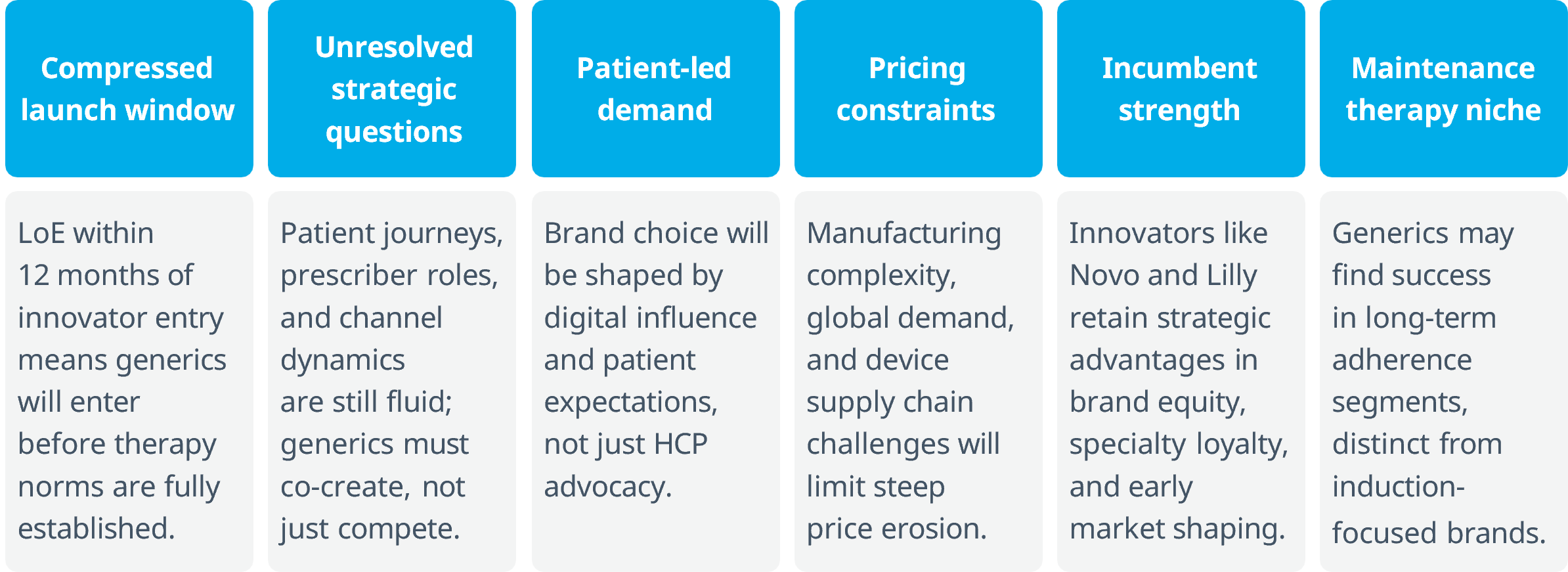

Semaglutide LoE in India: A playbook unlike any other

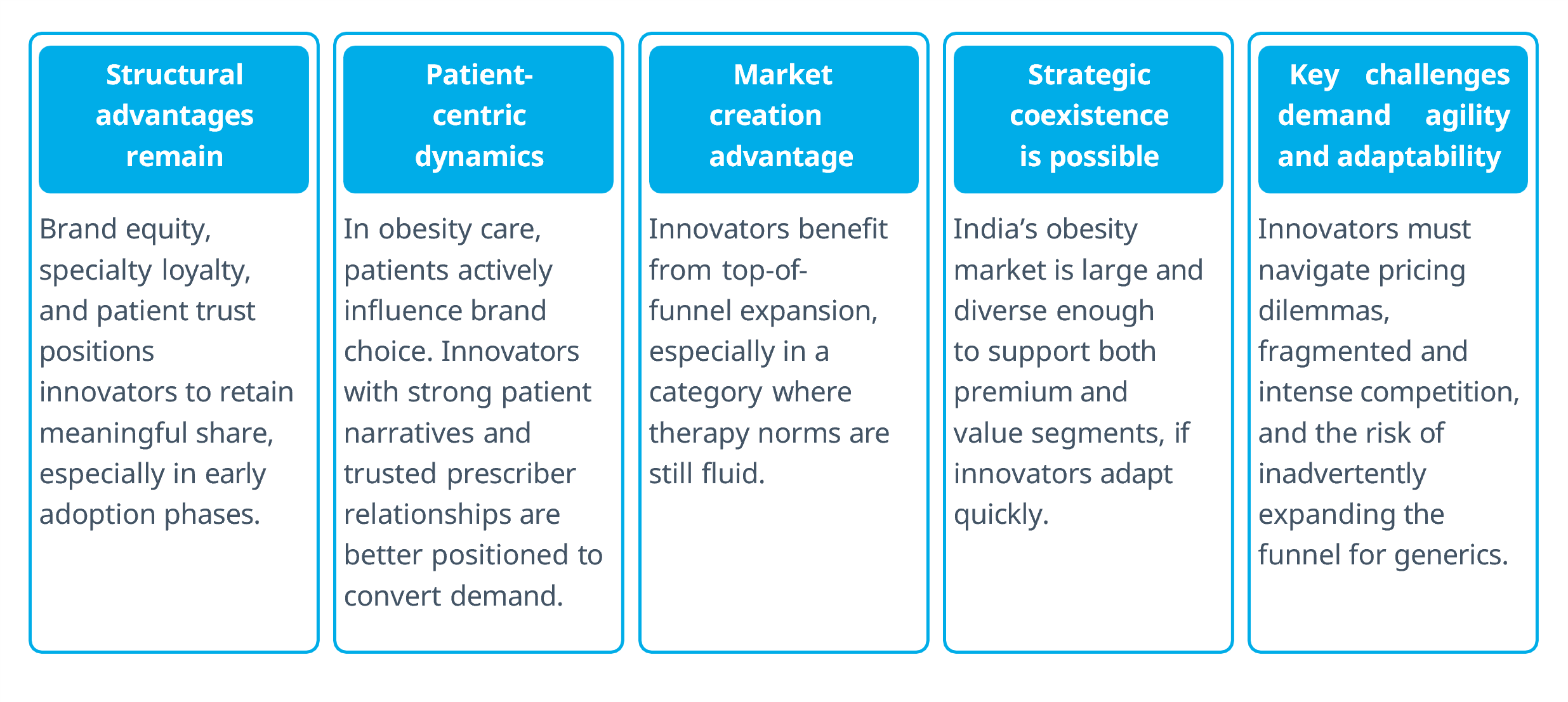

Semaglutide’s LoE in India is not likely to follow the traditional generics trajectory seen in previous cardio- metabolic categories. Unlike past LoEs, this one unfolds in a market still being shaped, with compressed innovator presence, evolving guidelines, and rising patient influence.

This is not a moment to replicate past LoE playbooks, it’s a moment to redefine them.

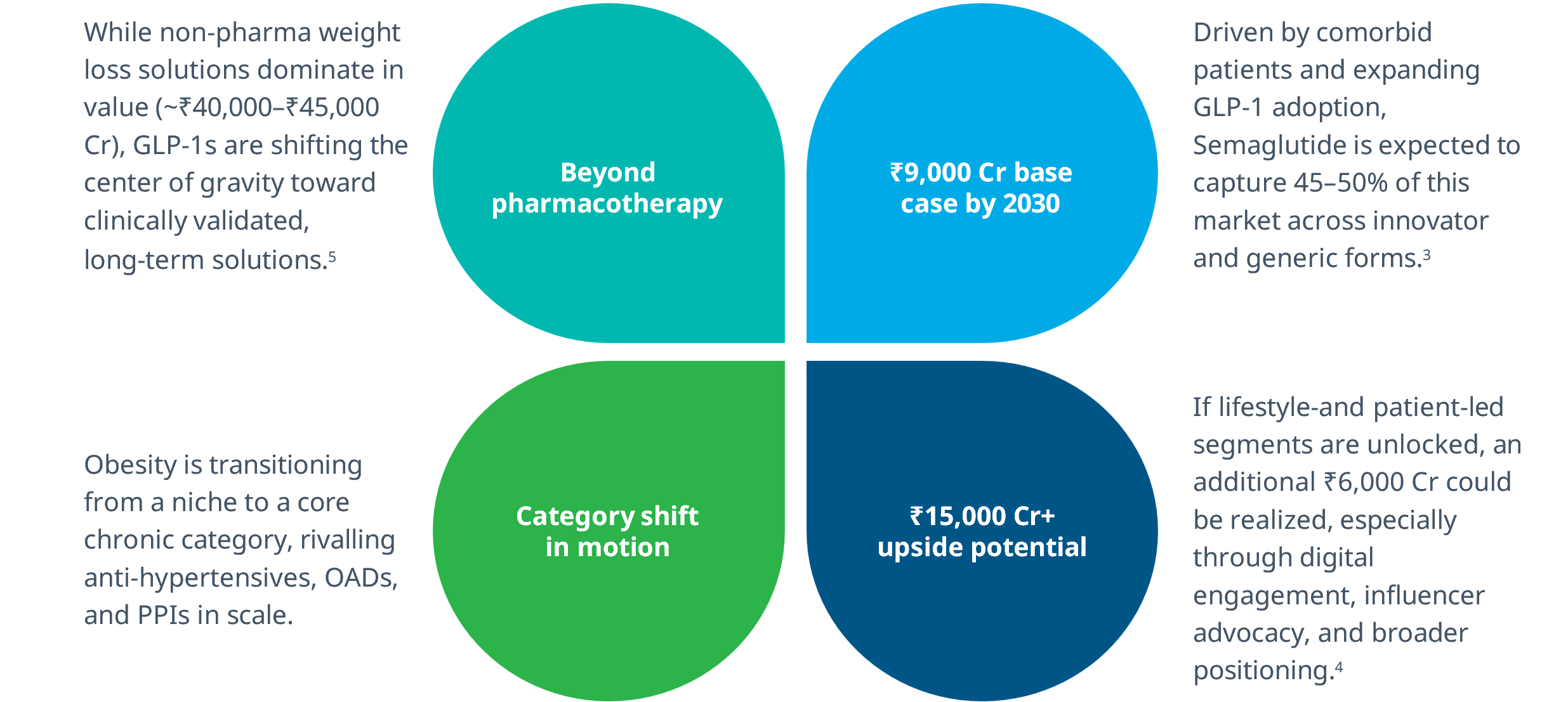

The Size of the prize: Obesity set to become a top 5 disease area in India

Semaglutide’s LoE is unlocking one of the most significant growth opportunities in the Indian pharmaceutical market, with obesity pharmacotherapy poised to become a top 5 disease area by 2030.

This is not just a growth opportunity, it’s a category-defining moment for chronic care in India.

3,4IQVIA analysis; 5IQVIA estimates from proprietary datasets and secondary research

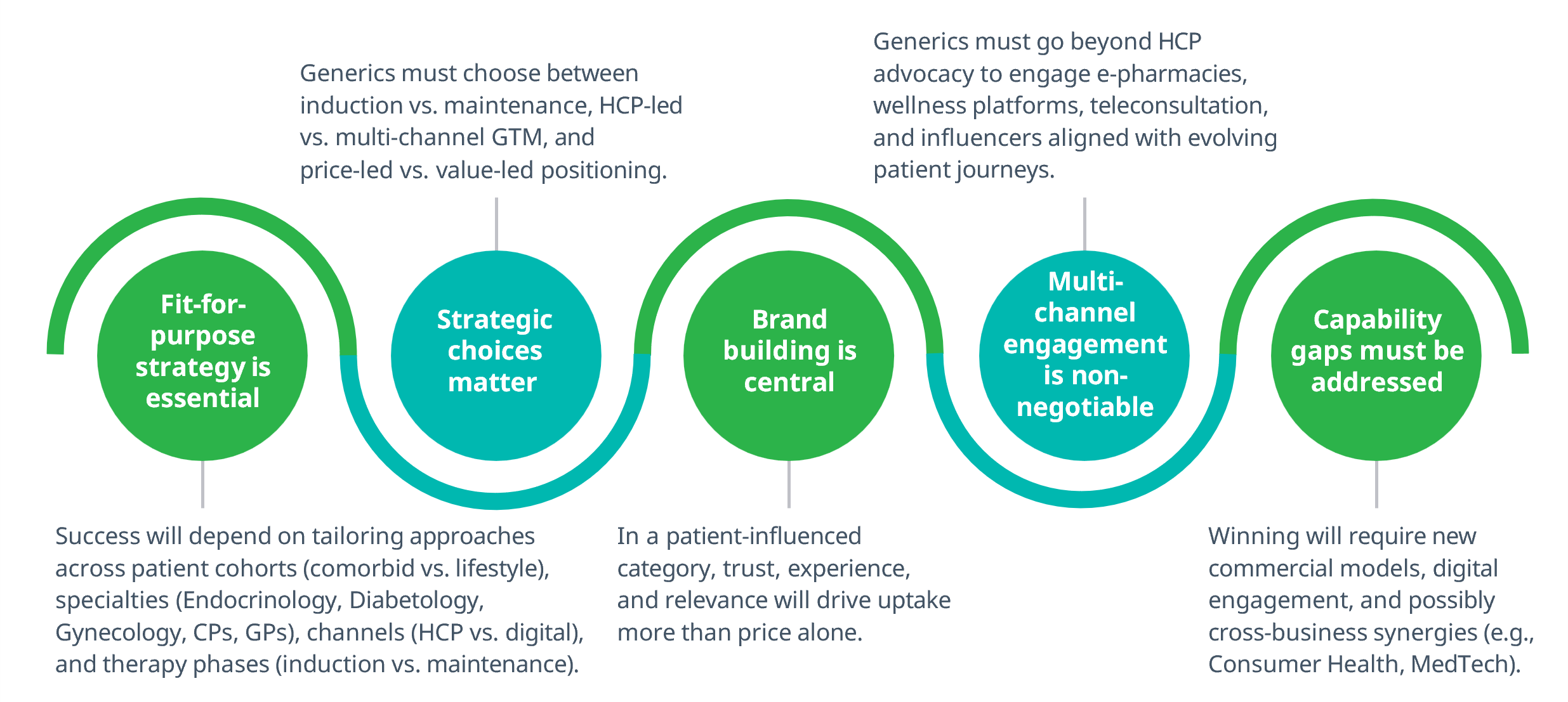

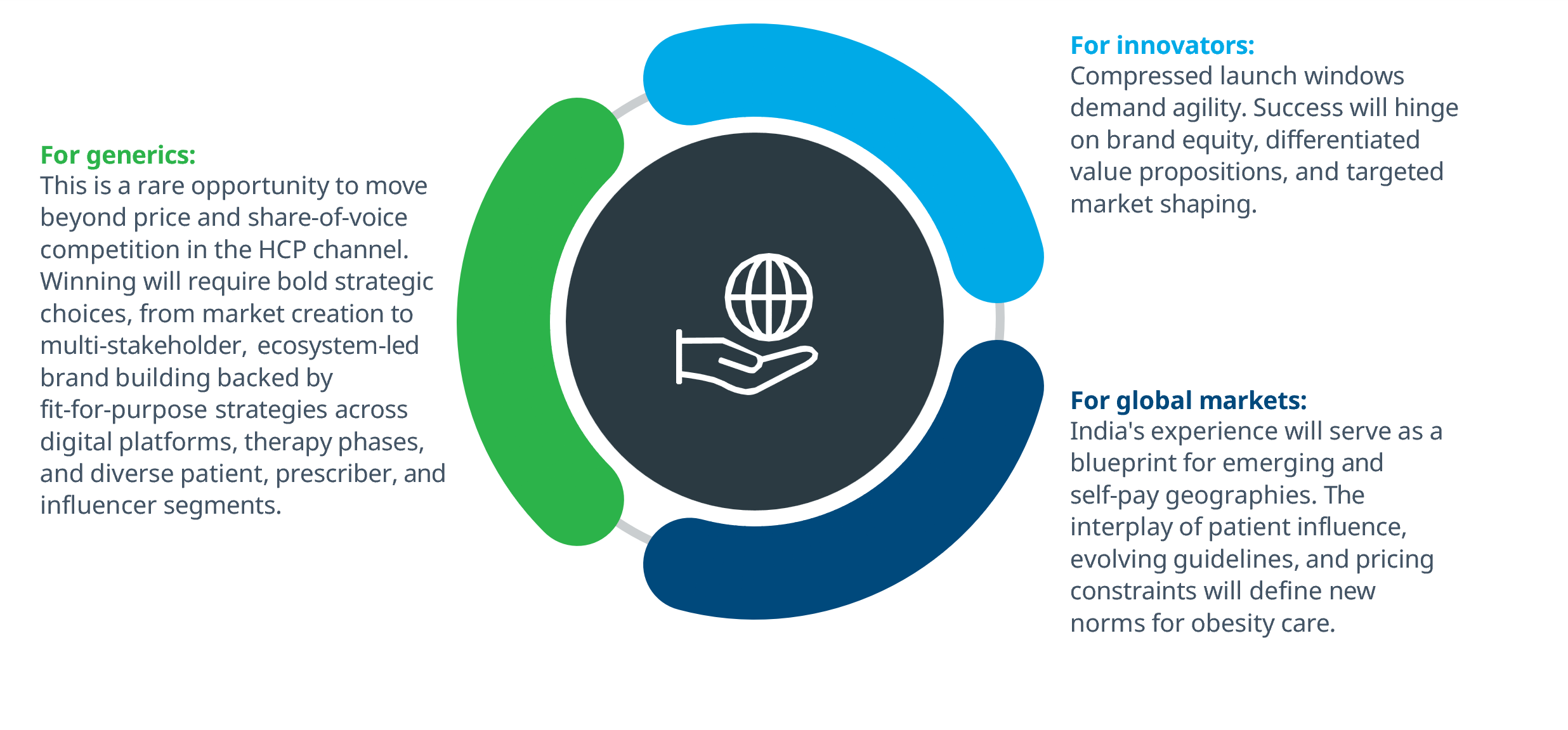

Generics in Semaglutide LoE: From tactical launches to strategic market shaping

Semaglutide’s LoE presents a rare opportunity for generics, but winning will require reinvention, not replication. The traditional share-of-voice model won’t suffice in a market defined by fragmentation, patient influence, and therapy complexity.

Generics won’t just compete; they’ll co-create the category. Strategic clarity and execution agility will define the winners.

Innovators in Semaglutide LoE: Defending leadership in a market still forming

Semaglutide’s LoE in India presents a compressed launch window for innovators, but also a strategic opening.

With the market still taking shape, innovators must pivot from tactical defense to agile, differentiated market shaping.

Winning post-LoE will require precision, agility, and a compelling value narrative — not legacy strength but adaptive leadership.

Conclusion: India’s Semaglutide LoE: A strategic blueprint for global obesity care

India’s Semaglutide LoE is not just a market event, it’s a strategic inflection point with global implications.

As India enters a precedent-setting phase in obesity pharmacotherapy, country leaders must ask:

This is not a moment to replicate past LoE playbooks, it’s a moment to redefine them.

Access the full white paper here.