Gain high value access and increase the profitability of your brands

- Locations

- United States

- US Blogs

- Mid-level Prescribers Telehealth and Digital Health Applications

In the post-COVID-19 healthcare ecosystem, the patient care landscape has changed considerably. Specifically, nurse practitioners (NP) and physician assistants (PA) now play a larger role in prescribing therapy for patients, while the use of telehealth has remained an option for patients seeking care since originally taking off during the COVID-19 pandemic. Manufacturers must consider the evolution of patient care and new technologies in their patient access strategies – either as tools to leverage or reasons to adapt.

A shift in prescribing patterns

Both nurse practitioners and physician assistants can diagnose, prescribe, and manage the care of many medical conditions. The Bureau of Labor Statistics reports that these mid-level practitioners have grown a lot in recent years and are expected to grow by 30% to 40% in the next decade. Indeed, pharmacy claims data shows that the proportion of prescriptions with NPs and PAs as the prescribers of record has grown from one-in-four claims to one-in-three since 2020. The volume of prescriptions written by physicians has remained relatively stable in the same time period. This increase is consistent across all payer channels (commercial, Medicare, and Medicaid), where the probability of receiving a prescription from a mid-level practitioner has increased over time. The growth in NP/PA prescribing reflects their ability to practice with increasing autonomy, as several states have relaxed physician supervision laws in recent years.

Written claim volume by prescriber type, all payer channels, all products

Note: Vaccines and COVID-19 treatments excluded.

Source: IQVIA PlanTrak Data; IQVIA LAAD 3.0 data; U.S. Market Access Strategy Consulting analysis

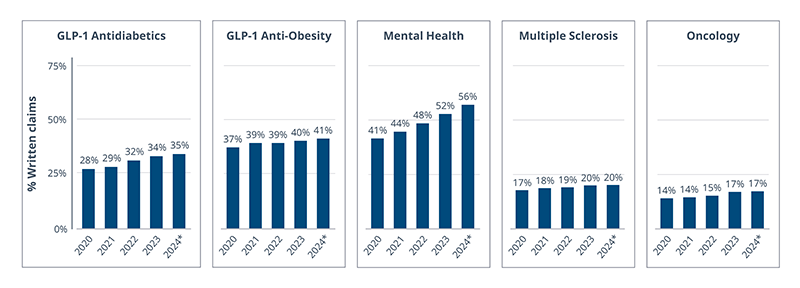

The rate of NPs and PAs associated with prescriptions has consistently grown across therapeutic areas, albeit with differences between them. In the case of mental health therapies, 56% of all pharmacy prescriptions had a mid-level practitioner named on the claim in 2024. Prescriptions for NP and PA claims in GLP-1s grew to 35% for antidiabetics and 41% for anti-obesity drugs. On the other hand, multiple sclerosis and oncology prescriptions had lower proportions of claims with NPs and PAs linked to them.

While NPs and PAs are empowered to prescribe, treatment decisions are often made with a physician consultation. Moreover, NPs and PAs might prescribe using physician letterhead or, in the case of specialty brands, on pre-filled out prior authorization forms. For these reasons, the prescriber on record can indicate directional trends but doesn’t necessarily reflect the entire journey. Further investigation of office-level prescribing patterns could inform access strategies even further.

Proportion of written claims by NP/PA, all payer channels, brands

* 2024 data is from January through September

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting analysis

The role of telehealth visits in managing care

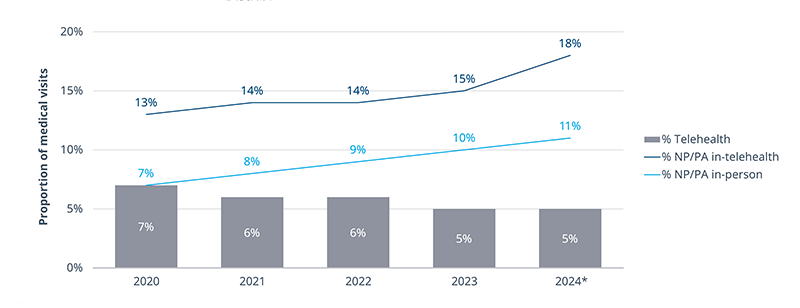

Prior to the COVID-19 pandemic, only 0.5% of non-hospital medical visits were through telehealth services. For Medicare patients, telehealth wasn't covered for most locations, providers, and services until new laws expanded coverage. In 2020, telehealth appointments made up 7% of all medical visits, and even four years later, telehealth has remained higher than pre-pandemic levels at 5%. The convenience of remote telehealth visits for both patients and providers, as well as the reduced risk of exposure to illness, makes telehealth an appealing option even after the pandemic. For providers, parity laws that require telehealth to be reimbursed equally to in-person visits have grown over time, as well.

The role of NPs and PAs has grown over time for medical visits, as well. This is particularly so in telehealth visits wherein NPs and PAs are the listed as the provider more frequently than in-person visits.

Proportion of medical visits via telehealth, all payer channels, all diagnoses

* 2024 data is from January through September

Note: Limited to professional visits, meaning out-patient, non-hospital

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting analysis

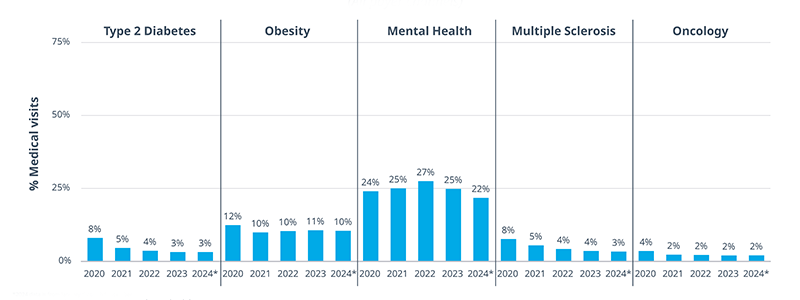

In 2024, non-emergency medical visits related to mental health or obesity diagnoses were conducted over telehealth 22% and 10% of the time, respectively. Patients with visits related to cancer, metabolic, or autoimmune conditions used telehealth only 2%-3% of the time. In some therapeutic areas, manufacturers have leveraged the growing use of telehealth by linking to online providers through their websites, allowing patients easy and quick access to diagnosis or even treatment.

Proportion of medical visits via telehealth and patient diagnosis, all payer channels

* 2024 data is from January through September

Note: Limited to professional visits, meaning out-patient, non-hospital

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting analysis

The rise of digital health

As patient care evolves, innovations outside the system develop, as well. From 2013 to 2024, the number of digital health applications grew from 66.7 thousand to 337.5 thousand. Recently, apps have shifted from tracking fitness, lifestyle, diet, and stress to managing health conditions. Management applications focus on particular disease or condition states. Recently, many of these applications are addressing mental health, obesity, and GLP-1s and allow patients to connect with providers remotely. Through subscription-based platforms, patients can also receive drug prescriptions via these applications and may be able to receive products at a lower cash price and with fewer access challenges than were they to go through their insurance. For patients searching for personalized care, digital apps are an attractive alternative to traditional medical pathways.

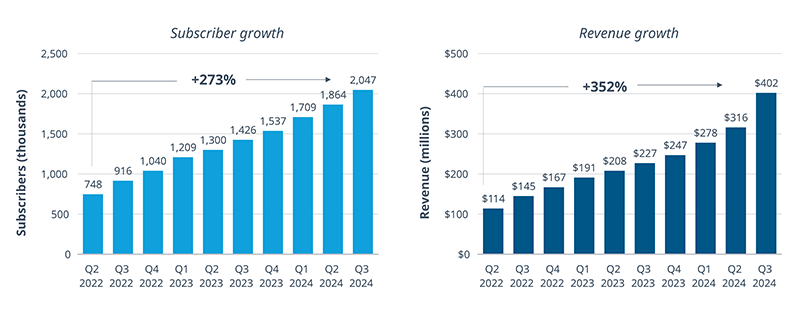

Hims™ and Hers™ are two digital apps owned by the same parent company, which have gained over 50% of new patient market share amongst their stated competitors. Focusing on four distinct markets (sexual health, dermatology, mental health, and weight loss), Hims™ and Hers™ combined have grown 273% in the number of subscribers and 352% in revenue over the past two years. In 2024, they had over two million subscribers and a gross margin of 82%. These apps represent a piece of the larger digital health app world, and with Hims™ and Hers™ stock having grown 200% over the past year, the market seems confident that these applications and the digital universe they are a part of, will continue to flourish.

Without more disclosure, the intersection between digital health platforms and mid-level prescribers remains unclear. However, applications could very well leverage NPs and PAs as virtual providers.

Hims™ and Hers™ reported subscriber and revenue growth trend

Source: Hims & Hers Health, Inc. Financial Quarterly Reports; U.S. Market Access Strategy Consulting analysis

Impacts of new prescribing patterns and access points

For patients and providers

The patient care landscape has evolved in ways that meaningfully increase availability, accessibility, and convenience. While some of these changes make patient care inside the traditional medical channel easier, the rise of digital health apps represents growing competition for care outside the system. From the patient perspective, continued innovation in patient care is a positive thing, and they will continue to catalyze changes to the industry that fit their evolving needs.

The growth of telehealth and NP/PA prescribing corresponds to wider trends in vertical integration and consolidation. Patients can now book appointments, receive care, and fill prescriptions all through the same entity - hospital, pharmacy, and drug manufacturer services all rolled into one. While these services may not be covered by insurance, the ease of streamlined care is often preferable to working through traditional channels.

Growth in telehealth is enabled by low-cost goods and services. On the provider side, PAs and NPs allow for expanded capacity for provider organizations. On the pharmaceutical side, proliferation of small-molecule generics and manufacturer-sponsored telehealth platforms allow for more affordable patient cost-sharing. Both of these factors allow patients to receive care through more convenient pathways that may lie outside of traditional insurance coverage.

For manufacturers

Markets with this proliferation of PAs and NPs are highly dynamic. Manufacturers must be aware that the high-value targets of the past may not be prescribing to the same extent as before 2020. Nurse practitioners and PAs have a larger role than ever in the treatment landscape and should not be ignored when designing salesforces and establishing a marketing strategy. Traditional targeting methodologies may be outdated, and manufacturers should consider how best to engage with this evolving prescriber base and medical offices holistically.

Manufacturers can use the changes within the patient care landscape to their advantage. Promoting telehealth via product websites may help keep patients within conventional channels while providing the accessibility and convenience of digital services. Additionally, targeting the right group of providers in the appropriate specialties can help get medications in the hands of patients. Digital innovations by manufacturers, such as LillyDirect™ and PfizerForAll™, allow patients to overcome accessibility hurdles and interface digitally while working within the existing healthcare system. By keeping the patient’s needs at the forefront of their strategies, manufacturers have and can continue to evolve alongside and in tandem with the patient care landscape.

Master Class: Advanced Market Access

This free monthly webinar series explores the latest insights into critical industry topics to progress your Market Access knowledge and help enhance your strategy and execution to drive growth for your business.

Taught by the world’s leading Market Access experts here at IQVIA, the Market Access Master Class will help unlock the full potential of your team and brands by facilitating the development of critical skills and by supporting your company’s Market Access goals.

Join our live classes or watch the videos on demand at your convenience. We hope to see you in class!

Related solutions

Rely on market-leading strategists to help you achieve maximum access and profitability