- Blogs

- Novel therapies will boost global depression market following recent losses due to generics

Based on IQVIA’s Forecast Link, this article considers how the depression market is expected to develop over the next 10 years, and how new product launches and generic entries are expected to shape market evolution.

Depression is the most common psychiatric disease affecting over 322 million individuals worldwide in 2017.1 The prevalence of the disease is thought to be relatively stable and therefore the number of people with the disease has been increasing steadily with the overall growth of the global population.2 Despite its high prevalence, the disease is under diagnosed and treated, and current treatments produce suboptimal outcomes in a significant percentage of patients.3 A lack of clinical tools for stratifying patient subgroups and predicting response also complicates treatment. Established treatments for depression act by increasing the availability of one or more neurotransmitters in the brain such as norepinephrine, serotonin and dopamine. Recently, other neurotransmitter chemicals have been implicated in the pathogenesis of depression leading to the development of glutamatergic-based drugs such as N-methyl D-aspartate (NMDA) receptor antagonists and gamma-aminobutyric acid (GABA) modulators.

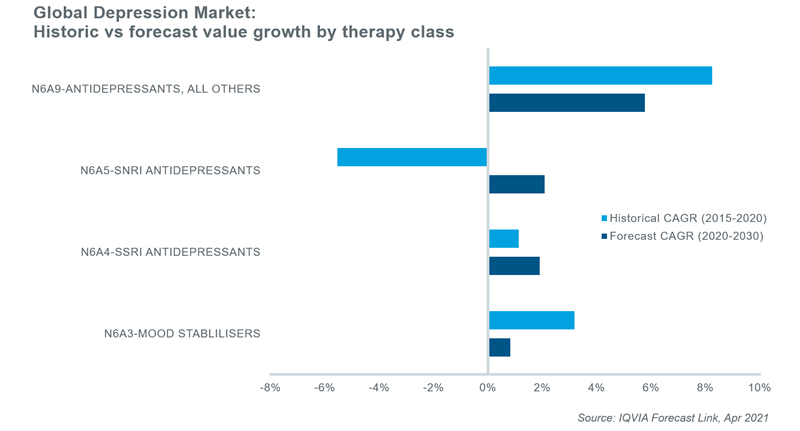

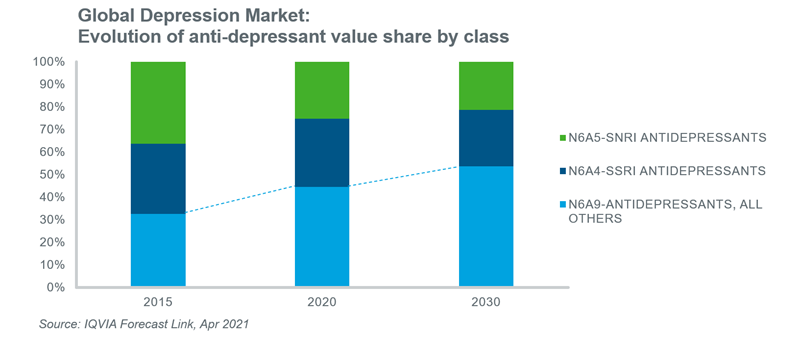

The global depression market grew at a CAGR of -0.8% in value terms between 2015 and 2020, but new product launches are expected to help drive growth at a CAGR of +3.0% between 2020 and 2030. This will increase market value from an estimated $9.9bn in 2020 to over $13.3bn by 2030. A raft of generic launches following loss of protection (LoP) events for leading brands, especially within the selective norepinephrine reuptake inhibitor (SNRI) class, drove this negative value growth in recent years. Products within the N6A9 (anti-depressants, all others) class helped to curb losses from the increased genericization of the SNRI and selective serotonin reuptake inhibitors (SSRI) classes and will drive most of the market growth over the coming decade.

Recent and expected new launches within the N6A9 class that will primarily be responsible for market growth include a small number of products that employ novel mechanisms of action in a field that is plagued by suboptimal outcomes with existing therapies. Some new therapies will be restricted to specific subpopulations such as esketamine, a non-competitive NMDA receptor antagonist nasal spray indicated for treatment-resistant depression (TRD), and the intravenously administered GABA-A receptor positive modulator brexanolone for the treatment of postpartum depression. Other new therapies have the potential for use in a broader group of patients including: ansofaxine, an orally administered triple reuptake inhibitor; zuranolone, an orally active GABA-A receptor modulator; the oral atypical antipsychotic cariprazine as an adjunct for major depression; and seltorexant, an orally administered orexin 2 (OX2) receptor antagonist for patients with insomnia associated with depression.

Since existing therapies are only effective in 40% to 60% of cases and resistance develops in 50% to 60% of successfully treated patients4, products showing even modest improvements in efficacy are expected to secure significant price premiums in many geographies. Non-generic products will account for 51% of total depression value sales by 2030, but within the N6A9 class, this figure is expected to be 78% owing to these new products. It is anticipated that the average implied cost per patient day ($/PATDAY) for products within the N6A9 class will be approximately 2.8 times that of the other anti-depressant classes. As a result of this premium and expected volume demand, the value share of the N6A9 class will continue to increase.

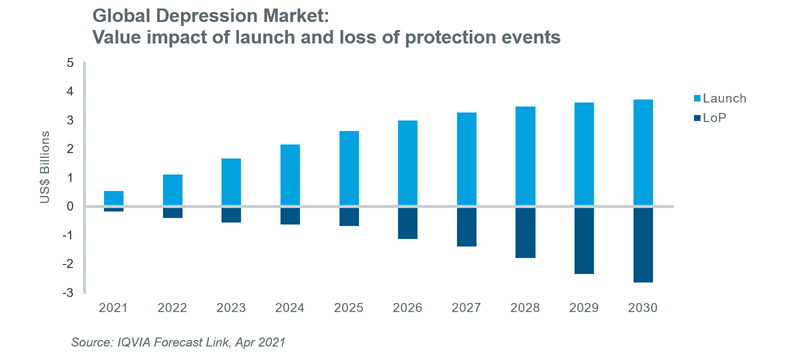

Additional LoP events will occur over the next decade, but their impact on global value sales will be offset by the new launches mentioned above. Most SSRI and SNRI molecules are already available generically in many markets and this trend will continue to expand across the globe. Furthermore, some well-established products in the N6A9 class will experience generic competition for the first time such as vortioxetine, vilazodone and agomelatine. Despite this, there will be a net positive impact from new launch and LoP events as higher cost new therapies capture share of existing products.

The loss of protection for brands within the SSRI and more recently the SNRI classes led to a contraction in depression market value between 2015 and 2020. However, new therapies affecting different neurotransmitters and pathways will usher in a new era in the treatment of depression. New approaches are desperately needed and as such, the market is expected to react favourably to these new products. Demand for new and more effective antidepressants coupled with higher expected prices will drive value growth in the depression market over the next decade.

1Depression and Other Common Mental Disorders: Global Health Estimates, World Health Organisation, 2017.

2Bretschneider J, Janitza S, Jacobi F, et. al. Time trends in depression prevalence and health-related correlates: results from population-based surveys in Germany 1997–1999 vs. 2009–2012. BMC Psychiatry 18, 394 (2018).

3Kraus, C., Kadriu, B., Lanzenberger, R. et al. Prognosis and improved outcomes in major depression: a review. Transl Psychiatry 9, 127 (2019).

4Institute for Quality and Efficiency in Health Care (IQWiG), Cologne, Germany, 2020.

IQVIA Forecast Link provides regularly updated and fully segmentable sales and volume forecasts across 10,000 products, 600 diseases and 73 countries. Gain insights into current and future market landscapes and power your strategic decision making via this single easy-to-use platform providing unrivalled breadth of coverage. To learn more, please view the Forecast Link Video.