- Blogs

- Price growth forecast to slow as patent expiries impact the Diabetes market

Diabetes Market

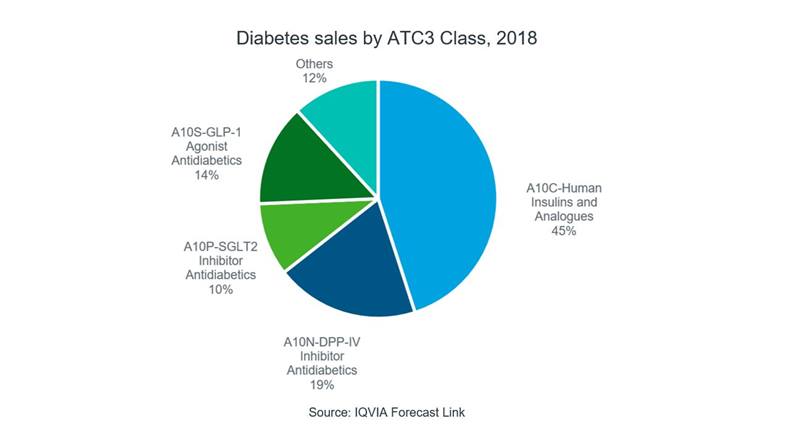

The 2018 diabetes market is estimated to be $87 billion globally. Insulin products create 45% of sales, while newer Glucagon-like peptide-1 (GLP-1) inhibitors and sodium-glucose cotransporter type 2 (SGLT2) inhibitors contribute to a smaller but growing proportion. Total sales are forecast by IQVIA’s Forecast Link to grow minimally with a 2% growth rate (CAGR) over the 10-year forecast period (2018-2028).

Regional Diabetes Sales and Volume

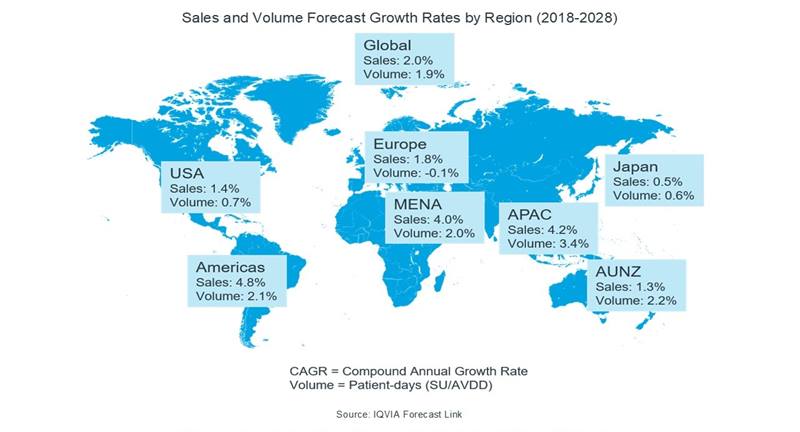

The USA is the biggest market for diabetes and will continue to dominate to 2028, accounting to $65.2 billion due to high cost of treatment. Diabetes sales in the USA is expected to grow at a CAGR of 1.4% from 2018 to 2028, but will remain flat in terms of volume growth, indicating that price growth drives the market in this region. In fact, apart from Japan and AUNZ, regional sales growth exceeds volume growth signifying a similar trend globally.

APAC regions show the highest growth in the volume of diabetes drugs used, most likely due to the increasing ‘westernization’ of diet in the region which has been linked to increased type 2 diabetes.

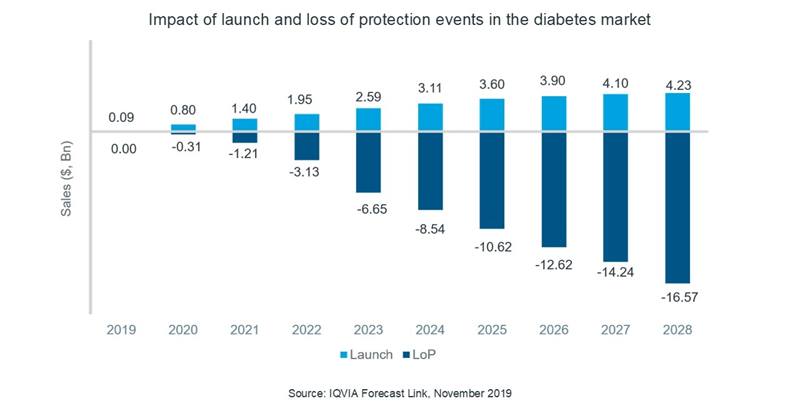

Growth due to new launches overshadowed by the loss of protection events

IQVIA forecast the launch of 10 new pipeline products in upcoming years but the effect of these launches on total market sales is outweighed by dramatic reductions in sales due to generic competition for key brands. Over the forecasted period, DPP-IV inhibitors will show most erosion by generics followed by SGLT-2 inhibitors.

Recent decisions by the US FDA have also reduced the impact of new launches. For example, the FDA declined to approve two SGLT2 treatments for additional use in type 1 diabetes, despite both these molecules (dapagliflozin and sotagliflozin) being approved this year in Europe for type 1. Most recently the FDA advisory committee has voted against approval of another SGLT2 treatment for type 1 diabetes, which looks likely to be the third drug in the class to be rejected by the agency.

Price growth continues, but increased resistance emerging

IQVIA forecasts that the diabetes market will see positive price growth between 2018 and 2028 in all regions except Japan and AUNZ on an average implied price basis ($/patient-day). The average growth will be greatest in South America at 6.6%, likely driven by high inflation rates here, while North America will experience the slowest positive growth at 0.7%. Average prices are expected to decrease in Japan and AUNZ at a CAGR of -2.0% and -0.3%, respectively. Globally, the average price for diabetes treatments will grow at a CAGR of +0.2%.

Recent criticism over high insulin prices from media and public sources have led to increased pressure on insulin manufacturers, particularly in the USA. Biosimilar launches are beginning to combat this. For example, one company is launching an authorized biosimilar of their own insulin aspart product in January 2020, before loss of patent protection and at 50% of the originator brand price, to allow access to lower priced insulin to those that need it. This is accounted for in the IQVIA Forecast Link tool and contributes to the lower sales growth in the USA.

Diabetes is a significant area of innovation in new drug treatment, and the launch of novel and improved GLP-1 inhibitors drives some of the growth seen in the market. For example, there is particular interest in a new mechanism just entering clinical trials which involves encapsulating a human cell line that has been genetically engineered to produce and release insulin in response to the levels of blood sugar in the human body. The encapsulated cells are implanted in a diabetic patient where the aim is that they will function as a “bio-artificial pancreas” and will produce insulin when needed. This and other innovative options have the potential to transform the diabetes market and offer exciting opportunities for patients.

The Forecast Link online tool provides 10 year forecasts for an unrivalled breadth of disease and country coverage, and is updated quarterly. To find out more, please view the Forecast Link video

For individual disease data extracts please see Forecast Link: Disease.

Other blogs from IQVIA Forecast Link: Heart Disease Market Forecasts