Analyze industry leading sales and medical data in a standardized and comparable way, including cross-country analysis of performance and additional insights into global and regional markets.

The first article of this series took advantage of IQVIA’s new MIDAS Disease data to uncover global dynamics within the oncology market which were previously inaccessible, with a particular focus on analysing trends at the disease level. This article explores some of the indications and products which dominate and drive growth within the immunology and respiratory diseases areas.

Psoriasis is a key driver of the immunology market due to its many successful new therapies

Immunology is another high-value, fast-growing therapy area, with a global 2021-22 year-on-year (YOY) growth rate of 13%. However, growth of the immunology market is expected to slow down significantly in the next five years; this is examined in the IQVIA blog Changing of the guard: Immunology at an inflection point.

For the purposes of this article, the definition of immunology includes autoimmune indications and allergic inflammation, and the key drivers within immunology as a whole are assessed. Inflammatory respiratory indications are excluded from immunology here; they will be analysed along with other respiratory indications below.

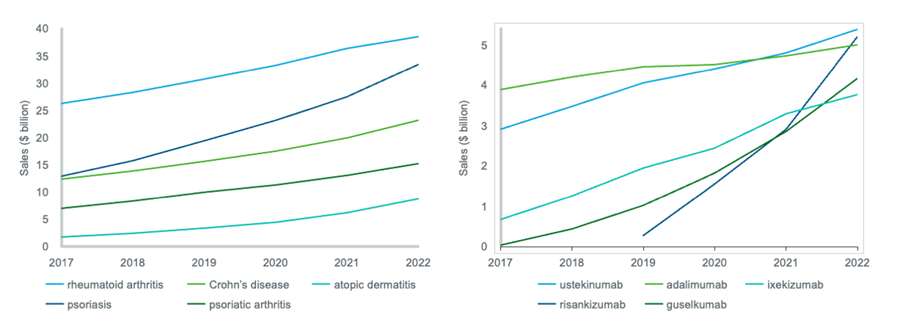

Figure 1: trends in the total value of selected immunology indications; trends in the value of the top 5 molecules for psoriasis

Source: IQVIA MIDAS Disease. Sales are global and ex-manufacturer, calculated using a constant exchange rate. In the first line chart, the value of each indication is the total value of all its respective products. In the second line chart, the value of each molecule is its value within the psoriasis market only.

Within the rheumatoid arthritis market, adalimumab remains the leader, and its growth is accelerating. While its 2017-22 CAGR was 11%, its 2021-22 YOY growth rate was 13%. The overall value growth of adalimumab has been driven by Humira in the US, where it only lost patent protection in early 2023, while in Europe adalimumab biosimilars entered the market in 2018. Another notable driver of growth in the rheumatoid arthritis market is Rinvoq (upadacitinib) which first received FDA approval in mid-2019 for moderate to severe rheumatoid arthritis, and has since been approved for many other immunology indications. Rinvoq sales are growing rapidly in the rheumatoid arthritis market, at 43% YOY, and Rinvoq is already the second largest driver of absolute growth, behind adalimumab.

Psoriasis is driving absolute growth in immunology more strongly than any other indication, and the top five psoriasis drugs have been steadily increasing in value year-on-year, demonstrating the competition within this indication. Of these, Skyrizi (risankizumab) and Tremfya (guselkumab) were the biggest drivers from 2021-22, both in terms of absolute and percentage growth, with YOY growth rates of 79% and 46% respectively.

Despite its relatively small market size, atopic dermatitis was the third largest driver of absolute growth from 2021 to 2022 within immunology, due to its large YOY growth rate of 40%. Atopic dermatitis is an indication whose value has grown steadily over recent years, with a 2017-22 CAGR of 38%. One product dominates the atopic dermatitis market – Dupixent (dupilumab). There has however been innovation in this indication; Adtralza/Adbry (tralokinumab) has been launched recently, and Rinvoq has gained a licence expansion for atopic dermatitis.

Meanwhile, for Crohn’s disease, Stelara (ustekinumab) has been by far the biggest driver of absolute growth, and also has a greater 2021-22 YOY growth rate in this indication than any other major molecule, at 35%. In 2022 ustekinumab overtook adalimumab to become the Crohn’s disease market leader.

Asthma is a growing area of the respiratory market, whilst COPD sales have plateaued

The global respiratory market grew substantially from 2021 to 2022 at a rate of 13%, dwarfing its 2017-22 CAGR of 5%. However, a more detailed look at the dynamics reveals that sales for many of the relatively-high-value respiratory illnesses dipped during the pandemic but are now making a strong recovery; examples include acute upper respiratory infections, allergic rhinitis, the common cold, cough, influenza, and acute tonsillitis. Therefore, the high growth rate from 2021 to 2022 is at least in part due to bounce back after the pandemic.

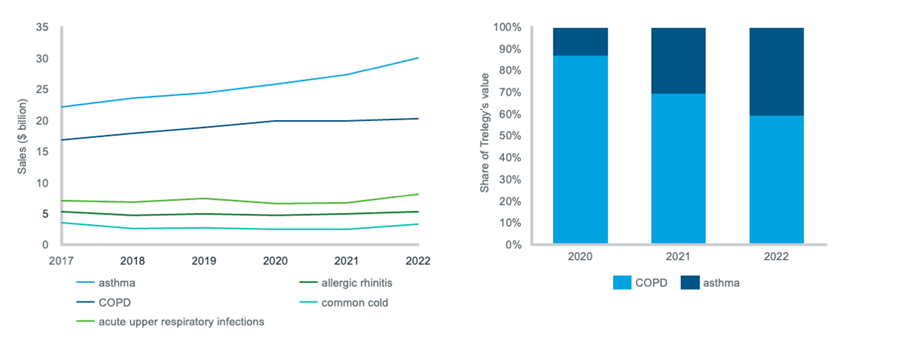

Figure 2: trends in the value of the top 5 respiratory indications; asthma and COPD shares of Trelegy by value

Source: IQVIA MIDAS Disease. Sales are global and ex-manufacturer, calculated using a constant exchange rate. In the line chart, the value of each indication is the total value of all its respective products.

Within the respiratory therapy area, asthma and COPD have together consistently constituted over 50% of the market for the last five years, and triple-therapy inhalers such as Trelegy (fluticasone furoate, umeclidinium and vilanterol) are driving growth in both of these indications. Trelegy was approved by the FDA for COPD in mid-2017, and for asthma in mid-2020. As illustrated in Figure 2, asthma is responsible for an increasing percentage of Trelegy’s sales, exceeding 40% in 2022.

The value of asthma has grown steadily and recently accelerated, whereas the value of COPD plateaued in 2020. Innovative treatments for severe asthma have recently entered the market in the form of biologics, which are at the intersection of respiratory and immunology: these include Nucala (mepolizumab) and Fasenra (benralizumab) which had 2021-22 YOY growth rates of 19% and 17% respectively for asthma. Within the COPD market, the lack of growth is partly due to the entry of generic versions of tiotropium bromide – causing the former market leader to fall in value during the last five years.

Nasal polyps are also driving growth in the respiratory market; despite being relatively low-value, this indication’s 2017-22 CAGR and YOY growth rate are striking, at 59% and 50% respectively. These are driven largely by Dupixent – the first FDA-approved treatment for inadequately controlled chronic rhinosinusitis with nasal polyps. However, other novel biologics such as Nucala and Xolair are also gaining traction as next-generation therapies. Within the nasal polyps market, these three products have the greatest YOY growth rates of the highest-value (over $1 billion in 2022) therapies.

The next article in the series will explore similar trends and insights, but in the endocrine & metabolic, cardiovascular and central nervous system (CNS) markets. The final article will investigate the generics sector.

To access additional resources about MIDAS Disease, such as fact sheets, on-demand webinar, blog articles and to inquire about a demo, please click here.

Related solutions

Get an up to date view of key performance indicators globally, regionally, or locally.

Be proactive about growing your brand using the latest in data, analytics, and domain expertise.