Leapfrog the competition by proving the value of your products

- Locations

- United States

- US Blogs

- Expanding Business into Ambulatory Surgery Centers

It’s no secret that the Ambulatory Surgery Center (ASC) space has grown exponentially1 over the last six years as there has been a significant amount of procedures that were historically being performed in a traditional hospital setting now shifting to ASCs. When given the choice, more and more patients are choosing smaller outpatient care facilities like ASCs, rather than hospitals, for outpatient surgeries due to the lower costs, flexibility in scheduling, and more personalized care from physicians and staff.

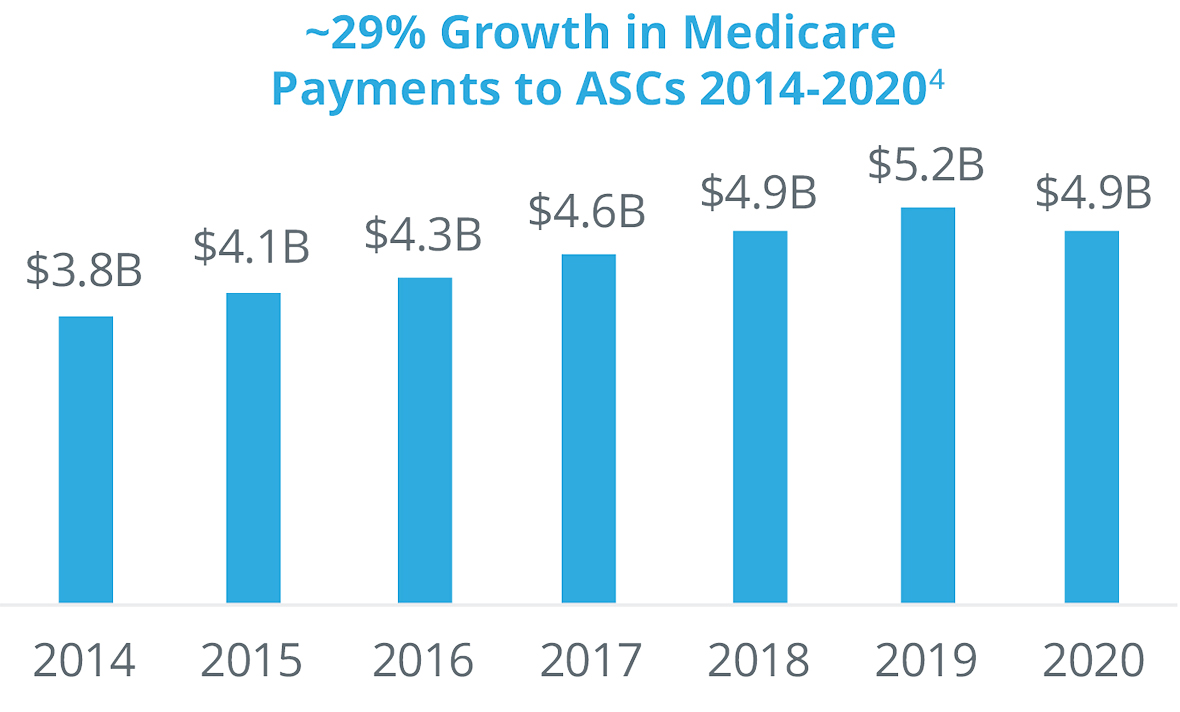

Between 2014 and 2020, the number of Medicare-certified ASCs increased by 11% and the volume of Medicare payments for ASC procedures increased by 29%. This segment is expected to see 25% growth2 in procedural volume over the next four years, and with more than 93% of ASCs having some measure of physician ownership, we can see how they too are opting for ASCs as their site of choice for performing surgery. Often, being a part owner in the center affords them more freedom of choice and management over equipment, staff, and scheduling. Moreover, procedures performed in an ASC where a physician has ownership could represent higher earning potential.

The Centers for Medicare and Medicaid Services are also migrating many procedures that have been traditionally performed only in the hospital setting to ASCs. Private payers are following the same trend and enacting policies to drive procedures to ASCs. These changes are positively impacting the healthcare system landscape, thus fueling growth and demand.

Three Trends Affecting MedTech Go-to-Market Strategies

Nonetheless, this $36 billion industry3 can remain difficult to understand as many companies try to enter the space by pushing for failing solutions and strategies that are tailored predominantly to traditional hospitals. To be successful in ASCs, it is crucial for MedTech companies to listen and understand the needs of the business. It is equally important to understand the differences in the way an ASC operates versus a traditional hospital and use this as a competitive advantage to create a partnership and implement comprehensive, tailored solutions.

IQVIA MedTech experts detail three key strategies companies should keep in mind when entering the ASC space:

|

ASC migration The transition from hospitals to outpatient care facilities has started and it’s here to stay. The ASC space is expected to grow from $36.69 billion (in 2021) to $58.85 billion by 2028, at a 7% compound annual growth rate (CAGR).4 One of the key contributing factors to this migration is that ASCs can largely perform the same procedures as hospitals for about half the cost with equal, if not better, clinical outcomes. This is something that health plans continue to recognize and incentivize. MedTech companies should not fight this migration, but rather, embrace it by creating meaningful partnerships that further alleviate growing pains and aid overall business growth in this area. |

|

ASCs ≠ HOPDs ASCs are different than hospital-based outpatient departments (HOPDs), and one of the biggest mistakes that MedTech companies can make when entering the ASC space is to approach them with the same strategy as hospitals. ASCs, by design, are different than hospitals; they have smaller infrastructures, fewer and smaller operating rooms, inventory constraints due to geographical and space challenges, faster patient flow, and different scheduling capabilities. ASCs also have more financial constraints and, often, limitations within their internal business operating systems. Therefore, solutions that have historically worked in the HOPD cannot be forced into the ASC. In return, this is an opportunity for MedTech companies to craft customized solutions that will foster growth in all the right areas. |

|

ASCs have specific needs We’ve all been guilty of jumping into solution mode without first thoroughly understanding the problem. Before jumping in, first listen and understand the needs, concerns, and challenges of the individual ASC with which you are working. As MedTech companies tap into the ASC opportunity, they need to keep three things at the front and center: Listen first, understand specific challenges, and know that often, one size does not fit all. |

MedTech companies can leverage these insights to create customized solutions that will address the challenges and concerns of their specific ASC customer. Here are some solutions that can successfully equip you to become a true ASC partner:

- Understanding changes in industry dynamics.

- Analyzing procedural volume data and shifts in site-of-care where procedures are being performed.

- Identifying and understanding shifts in demand.

- Understanding physician ownership.

- Obtaining insight into healthcare professionals and the facilities at which they perform procedures.

- Determining physician and market-level share.

- Utilizing reliable data quality and stakeholder insights.

- Targeting the right facilities.

- Understanding the needs of the underserved opportunities.

- Leveraging industry-leading data to optimize sales territory planning and initiatives.

Learn how IQVIA’s MedTech Market Activator and Claims Data Solutions can help.

References:

- Three Trends Affecting MedTech Go-to-Market Strategies.

- MedTech Strategies to Win in the Ambulatory Surgery Center Market.

- Munnich EL, Richards MR. Long-run growth of ambulatory surgery centers 1990–2015 and Medicare payment policy. Health Serv Res. 2022; 57(1): 66-71. https://doi.org/10.1111/1475-6773.13707.

- Fortune Business Insights, US Ambulatory Surgery Center Market Report 2022. https://www.fortunebusinessinsights.com/u-s-ambulatory-surgical-centers-market-106323

Related solutions

IQVIA Market Activator Platform gives timely insights, maximizing MedTech effectiveness with precise targeting for swift decisions.

IQVIA's Hospital Procedures & Diagnosis delivers real-time, claims intelligence to pinpoint hospitals, surgeons, and key insights.