Leapfrog the competition by proving the value of your products

- Locations

- United States

- US Blogs

- Three Trends Affecting MedTech Go-to-Market Strategies

There are several trends affecting how MedTech companies will go to market in 2023, but three of the most interesting and impactful are the expansion of Ambulatory Surgery Centers (ASCs), the increasing power of Value Analysis Committees (VACs), and the growing acceptance of digital communications among MedTech stakeholders.

ASCs are reimbursed, operated, and owned differently than hospitals, which affects how MedTech manufacturers work with them. VACs are reaching their peak as disciplined, experienced, and coordinated gatekeepers of institutional purchasing. In addition, MedTech marketing and sales channels are quickly turning digital. This blog examines each of these three trends in depth.

Expansion of ASCs

Both payers and physicians are driving the significant growth of ASCs.

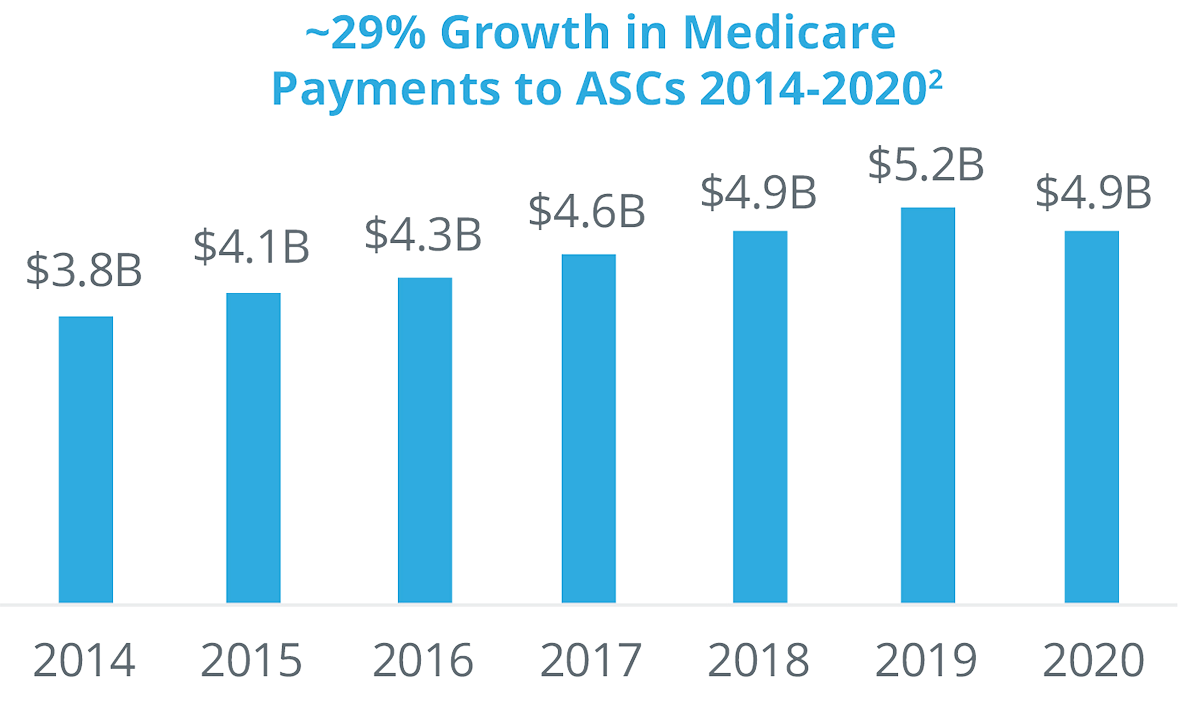

Payers are encouraging the shift of procedures to ASCs because it costs them, on average, approximately half the amount for a procedure in an ASC versus a hospital outpatient department. The Centers for Medicare and Medicaid Services are migrating many procedures from their inpatient-only or hospital-only lists and moving them to ASCs. Private payers are following suit, enacting policies to drive procedures to ASCs. In addition, private payers have been acquiring ASC networks (for example, United Health acquired Surgical Care Affiliates).

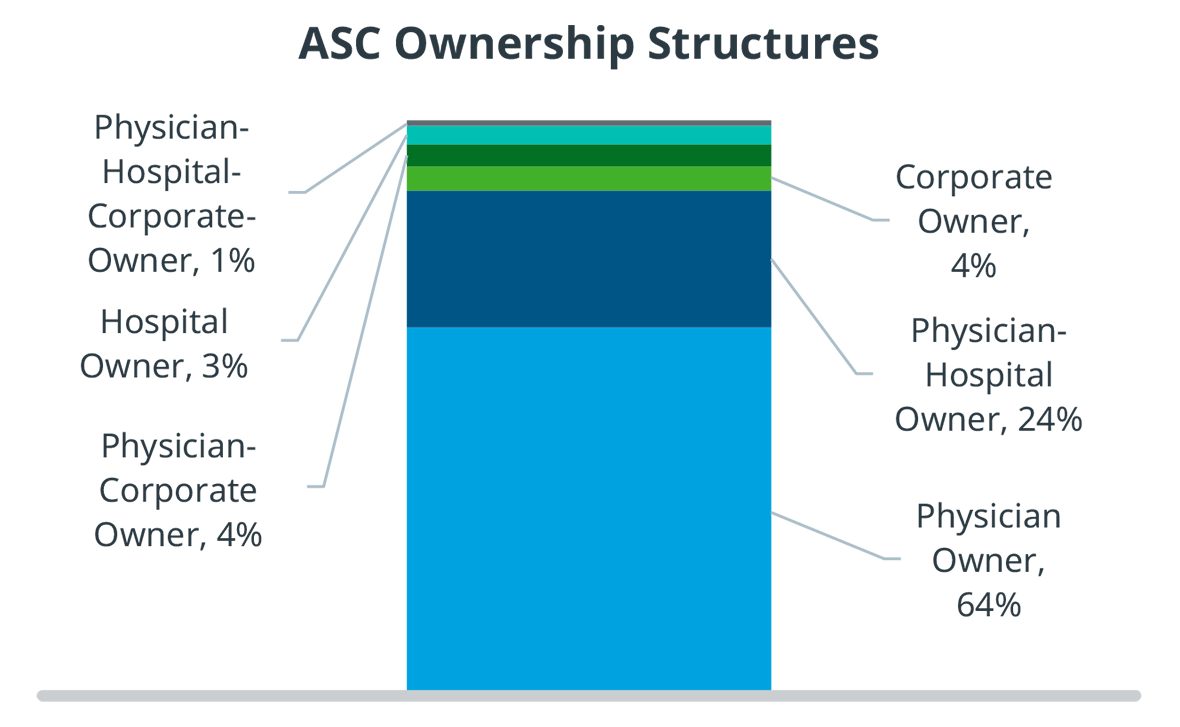

Physicians also have financial incentives to shift procedures from inpatient to ASCs. They often have an ownership stake in the ASC they operate in, they have more control regarding staffing, equipment, and scheduling, and the enjoy fewer protocols and regulations than in a hospital outpatient surgery department. Even though there has been more consolidation and corporate acquisitions of ASCs, more than 60% are still physician owned.

Physician owners do not have the backing of a large institution, and therefore have limited access to capital. As a result, ASCs are much more financially sensitive and risk-averse than hospitals, and they run much leaner. Merged ASCs have slightly more access to capital, but it is still limited.

Additionally, ASCs also have limited staff. This makes it a challenge for claims processing, inventory and referral management, and maintaining efficient operating rooms and perioperative procedures. These financial and operating challenges represent opportunities for MedTech manufacturers to assist ASC customers and gain competitive advantage.

Increasing Power of VACs

IQVIA conducted a survey of VAC members that revealed several insights for go-to-market strategies.

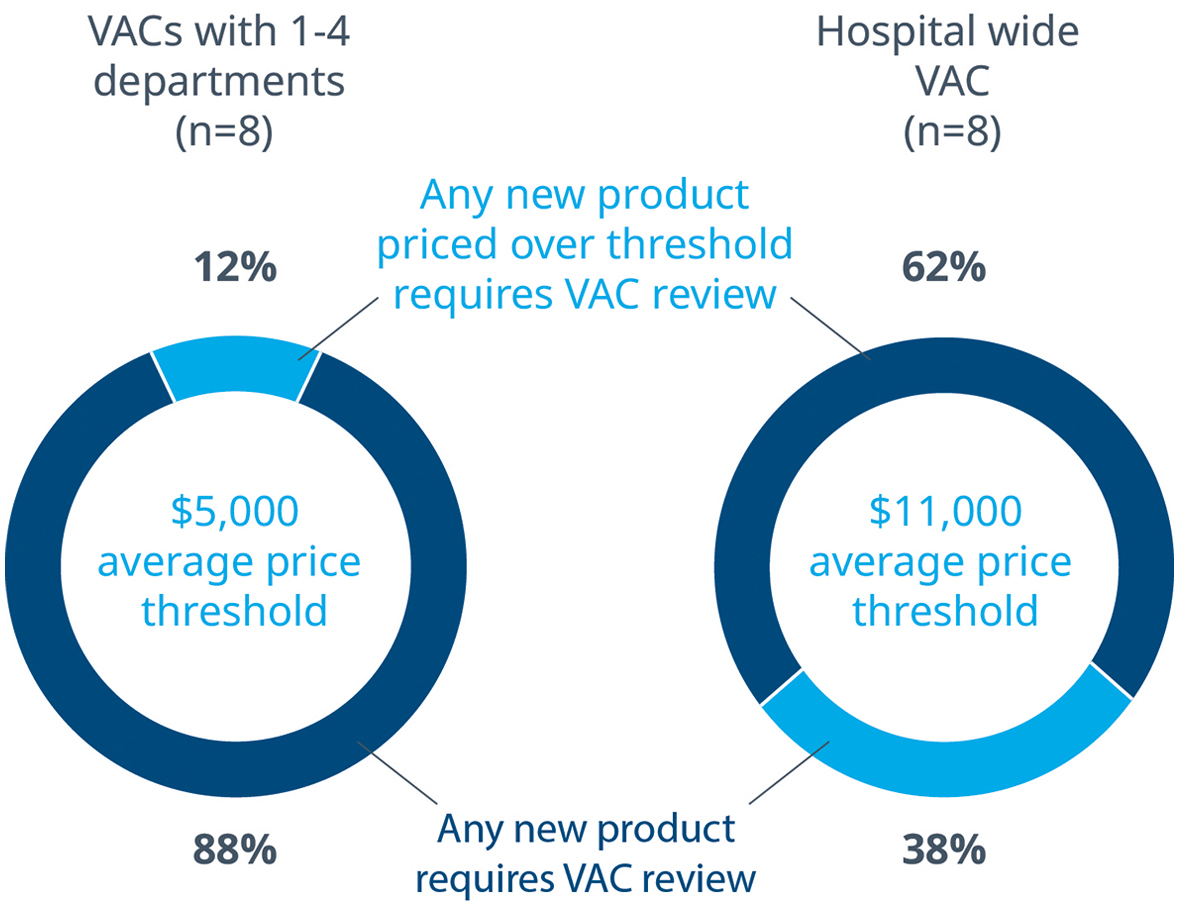

The survey confirmed that it is common for any new MedTech product, regardless of price, to go through a VAC review at some level. Only 12% of department level VACs allow products to bypass the VAC review process, and those products on average cost $5,000. On the other hand, most VACs with hospital wide purview limit themselves to reviewing products that cost on average $11,000.

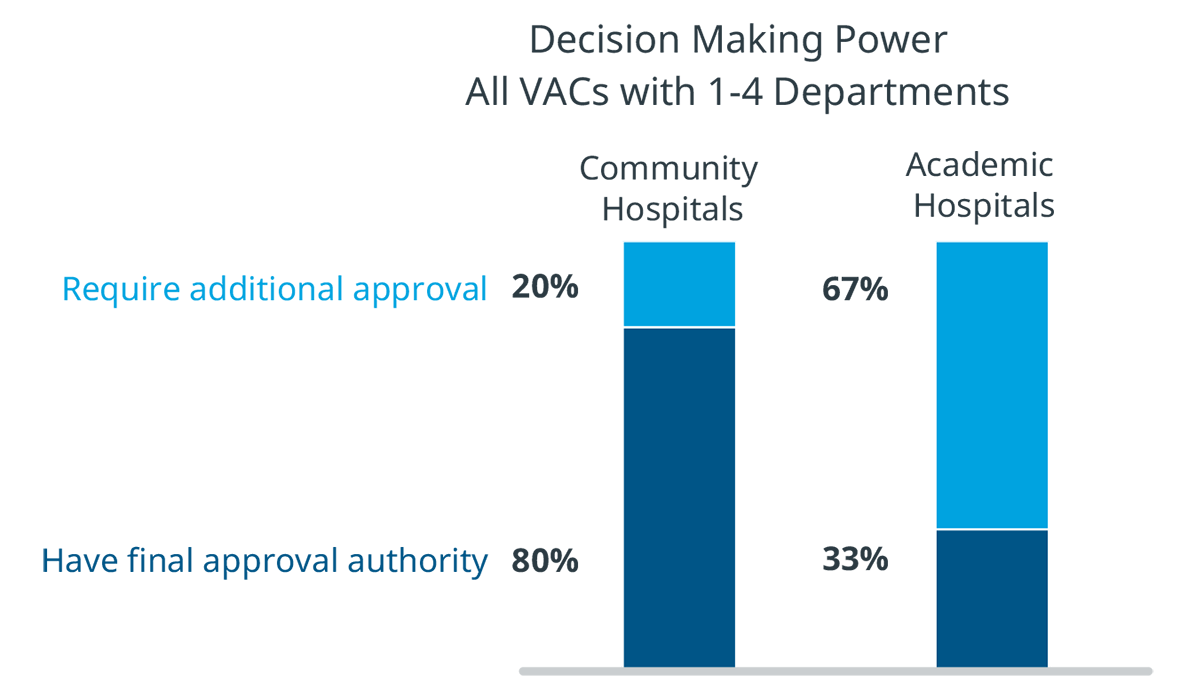

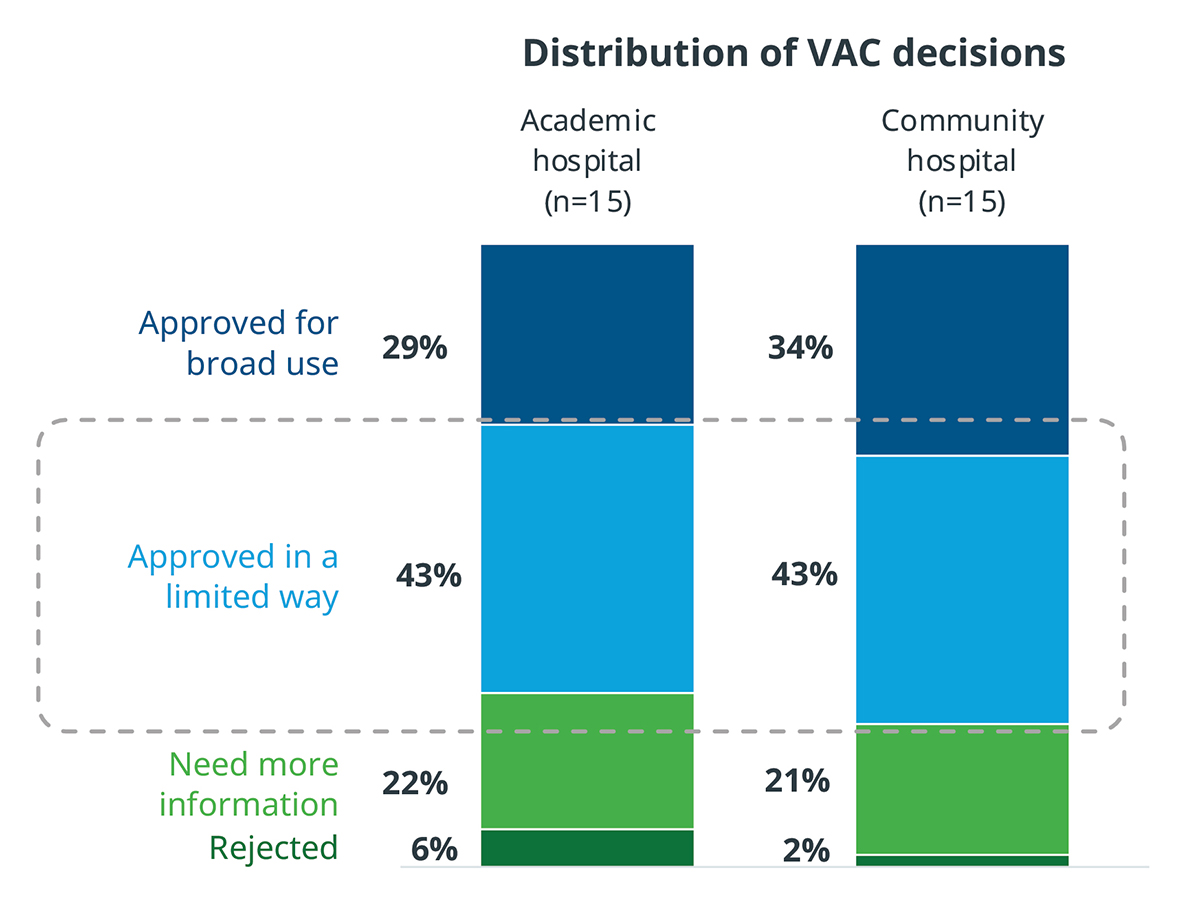

There are also differences in VAC authority between academic and community hospitals. In community hospitals, VACs that oversee departments have final authority on many decisions. However, in academic hospitals, 67% of products reviewed by a department level VAC are required to go through another VAC with broader purview. MedTech manufacturers should take these layers of scrutiny and approval into account in their hospital interactions.

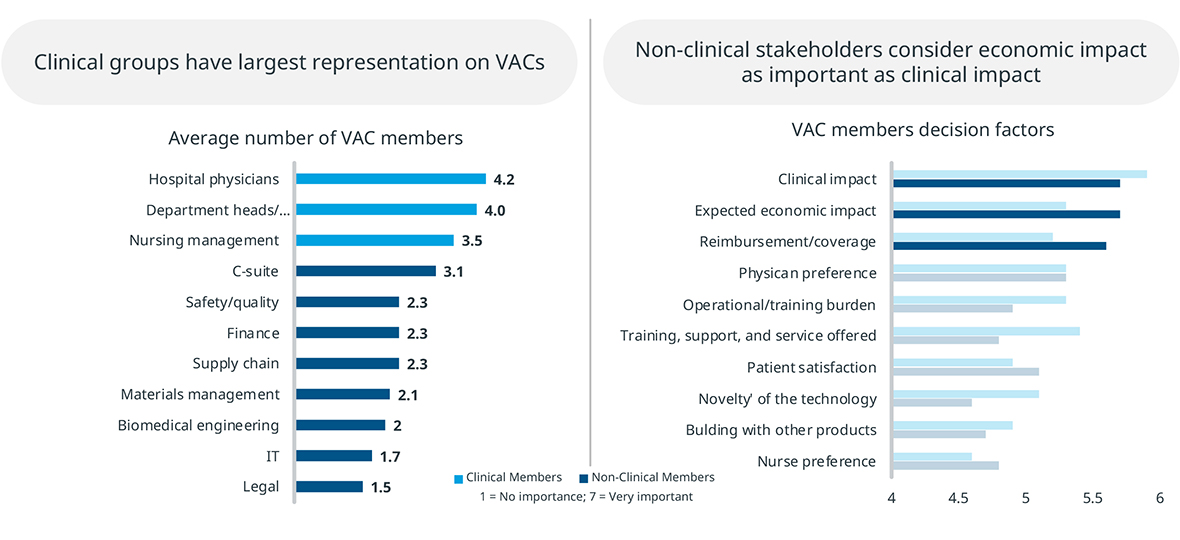

VACs also represent both clinical and non-clinical stakeholders. While clinical stakeholders are most represented in VACS, non-clinical members are also significant, and they place greater emphasis on economic factors. MedTech manufacturers should keep in mind that they are presenting their product to a group with a mixed set of evaluation criteria.

Even after VAC approval, only about one third of products are approved for broad use throughout the hospital. A large percentage must go through a trial period to prove their value and utility. During that trial period, it is critical that the product performs as promised, because otherwise it will not be adopted for broader use.

Therefore, during the trial period, MedTech manufacturers should:

- Train the relevant clinicians to use the product in the right way

- Manage inventory to ensure the ideal supply of disposables

- Immediately repair or service the device if anything goes wrong

- Generate patients for the device through referrals

- Provide patient support as appropriate

Greater Acceptance of Digital Tools and Engagement

The rise of virtual tools in telemedicine during the COVID-19 pandemic has accelerated the acceptance of virtual engagement among all healthcare providers.

Physicians who used to avoid digital meeting tools and online seminars are now much more accepting. And partially thanks to regulatory and reimbursement changes, telemedicine has increased. While telemedicine has declined from its high of 30% of office visits during COVID-19, it still represents ~7% of office visits, a greater than 3x increase from prior to COVID-19.

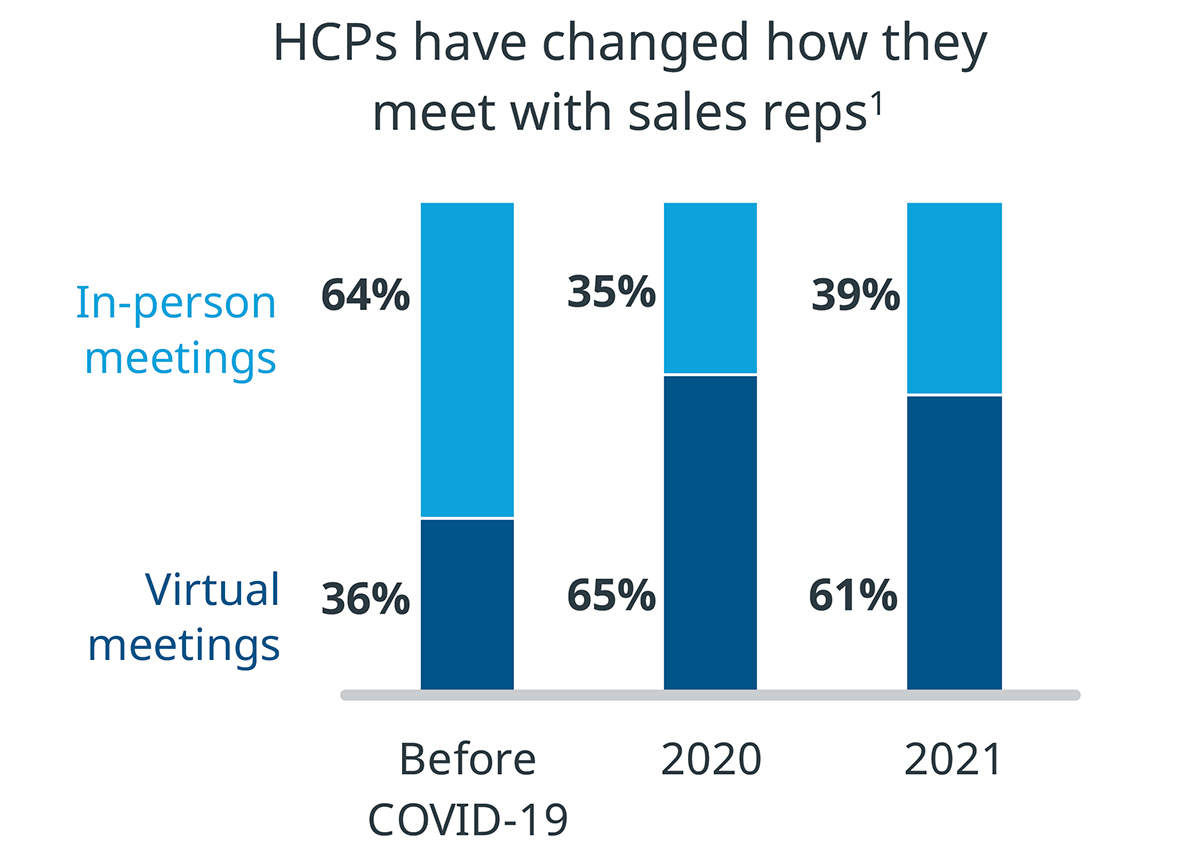

Meetings with sales reps follow a similar trend. Before COVID-19, 64% of meetings between physicians and sales reps took place in person. In-person meetings dropped to 35% in 2020, and only returned to 39% in 2021.

Healthcare providers enjoy virtual engagement. MedTech manufacturers should consider that this shift to virtual affects everyone in the life sciences industry, so virtual training or virtual support could be part of their go-to-market strategy.

Learn More

Ten MedTech Trends to Watch in 2023

Dynamics that the MedTech industry should monitor in the coming year

Considerations for Successful MedTech Product Adoption through Value Analysis Committees

What medical device manufacturers need to know about the processes and priorities of hospital stakeholders and decision makers

Related solutions

Turn insight into action by surfacing behavior-changing intelligence within daily workflows to deliver the right message at the best time for greater HCP satisfaction.