- Locations

- United States

- US Blogs

- Trends in Price Protection

In today’s world of increasing price pressure on pharmaceutical manufacturers, payers, and pharmacy benefit managers (PBMs), it is important for every stakeholder to stay competitive. To encourage sales, pharmaceutical manufacturers execute contracts with PBMs to provide rebates on their branded drugs.

From the manufacturer’s perspective, these contracts contain negotiated discount strategies designed to avoid barriers to patient access and improve market share via formulary placement requirements. For PBMs, these contracts contain rebate strategies and additional fees to keep the drug prices down and provide incentives for formulary management services. One of these strategies is Price Protection.

This blog will focus on Price Protection and how it has evolved over the past decade. First, it is important to understand that “Price Protection” is the term used for the negotiated limits to Wholesale Acquisition Cost (WAC) price increases of the formulary brand drugs. In the Managed Care segment, Price Protection discounts pay the PBM as a rebate.

For context, rebates are grouped into categories, such as:

- Flat, Access, or Base Rebates

- Rebates for formulary status, position relative to competitors and/or levels of restrictions (i.e., prior authorization, step-edits)

- Value-Based or Outcomes-Based Rebates

- Rebates that offer strategic longer-term incentives in areas such as efficacy, adherence, consistent formulary compliance, covered lives, or cost-sharing

- Performance Rebates

- Rebates that offer incentives to grow sales, most typically measured on market share

- Admin Fees

- Payments to PBMs for their administrative services negotiating with health plans

- Data, Service, Portal, Enterprise Fees

- Rebates negotiated by PBMs for providing data, access to the data portals, providing different reports, etc.

- Price Protection Rebates

- Rebates negotiated to cover the manufacturer increases the WAC over an agreed-upon increase for the time period

- Price Protection rebates disincentivize manufacturer price increases by dictating a limit on the allowed increase relative to a baseline price (WAC on a specific date) over a defined timeframe. Rebates are paid only when the price increase percentage or dollar value exceeds the allowed price for that specific period. These rebates largely benefit PBMs and their member plans -- not the manufacturer -- and can effectively discourage large or multiple price increases in a year.

… and:

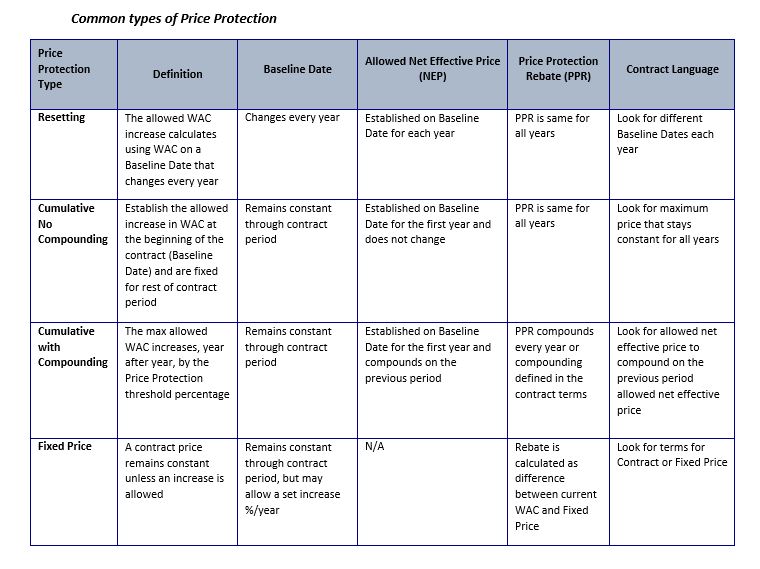

Price Protection strategies are generally grouped into types that identify shared characteristics and define the math (formulas) to determine rebate amounts. Before jumping into the trends, here is a review of the most common Price Protection types and how they work and differ.

Larger manufacturers will use revenue management applications to calculate rebates according to contract terms. Most systems have functionality to handle complex Price Protection rebates, however, there may be a need to tweak values annually or supplement the standard setup with an additional rebate to account for variations.

Despite the availability of automated calculations, some manufacturers are still reluctant to use the functionality in the revenue management systems. This continued manual approach seems to stem from a lack of training and confidence in the system’s ability to perform these complicated Price Protection calculations. Another justification may be their need for separate documentation and formulas. However, regardless of the rationale, manual calculations do have a much higher chance of error and do require time-consuming maintenance.

Trends in Price Protection Strategies

Price Protection strategies have become one of the important and inevitable parts of contracting negotiations and have evolved in complexity over the past decade. Historically being available to only a few of the large PBMs, Price Protection is now part of almost every PBM/Manufacturer Rebate Agreement. When Managed Care/Commercial contracts introduced Price Protection more than a decade ago, only a few PBMs and products were negotiated. The initial Price Protection terms were nominal and allowed the manufacturer to increase the drug prices annually. The strategies were simple, limited, and operationally easier, but handled manually.

Recently, most PBMs have Price Protection terms across all (or the majority) of their contracted products. Price Protection has become more complex and can be difficult to manage operationally. Current contract terms may include multiple Price Protection strategies varying by business segment and influenced by the negotiating power of the PBM.

Here is a look at some of the newer strategies being introduced:

- Net WAC/Allowed WAC shift to Actual WAC/Allowed WAC

- Fixed Contract Prices with Price Increase Allowance

- Cumulative Price Protection with Compounding

- Combination of Cumulative and Reset

- Tiered Price Protection

- Continued Price Protection Rebates

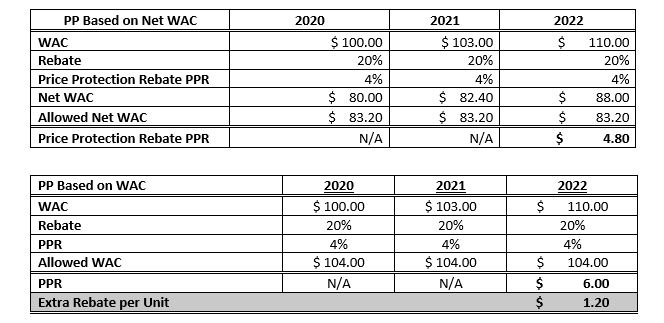

1. Net WAC Price Protection shift to Actual WAC and Allowed WAC

A recent trend in Price Protection strategy is that the PBMs are moving away from Net WAC for Price Protection calculations. This may seem easier operationally for the manufacturers, however they end up paying a higher rebate using the WAC and Allowed WAC as shown in the example below:

2. Fixed Contract Price with Price Increase Allowance:

These contracts are negotiated to set a certain value (price) of WAC which is the Fixed Contract Price. The Fixed contract price freezes the WAC price of the product. Manufacturers may be allowed to take an increase on that Fixed Contract Price. In this type of strategy, the manufacturers can increase the WAC, if negotiated, only up to the ‘Maximum Allowable Fixed Net Price’ for the term of the agreement. If an increase in Fixed Contract Price is allowed, the user must manually update the contract. Another consideration for this type of strategy is that it is often difficult to track the difference between WAC and contract price as a Price Protection rebate.

3. Cumulative Price Protection with Compounding:

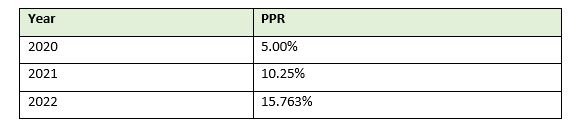

In cases where the system contract does not span all the price protection periods, then a manual calculation is required outside the system to determine the relevant starting Price Protection rate for the first year. For example, a product is contracted for 2022-2023, but the baseline date for price protection is the product intro date which is 2020.

If the PPR is 5%, then the compounded Price Protection rate will be following:

The user must do manual calculations to determine the price protection rate for the contract start year in the system, which is 15.763% in the example above.

4. Combination of Cumulative and Reset:

As in the cumulative type of Price Protection year-over-year, the maximum allowable price increases by the Price Protection threshold percentage. In the resetting iteration, the maximum allowable price is calculated on a yearly basis and reset every year based on the price changes. In this new type of Price Protection, the Maximum Allowable Price is reset every year based on the price change. The lower of last year’s Max Allowable Price and the current WAC is used to calculate next year’s Max Allowable Price.

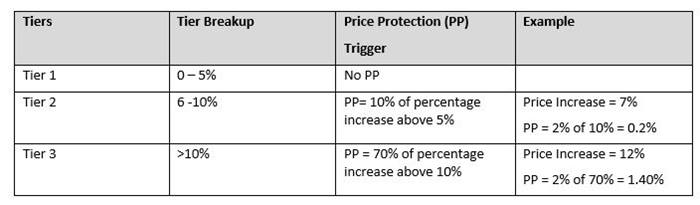

5. Tiered Price Protection:

Adding to the complication of Price Protection calculations, some of the PBMs are using this new Tiered Price Protection. In this type, manufacturers can increase the WAC to a certain level and then pay Price Protection based on the percent increase in the tiers. The example below illustrates how Tiered Price Protection is calculated.

6. Continued Price Protection Rebates – Amount Carried Forward or Maximum:

In some instances, the contract language may state to reset the baseline data at the end or beginning of each year, but the manufacturer must continue to pay (carry forward) that Price Protection amount for the remainder of the term. In other cases, the manufacturer must continue to pay the highest Price Protection percentage ever triggered throughout the term. Such situations require a review of system setup each year to evaluate and adjust the Price Protection rebates/setup. These strategies become time-consuming when there are numerous products on contract, with various Formulary options all eligible for current rebates and several periods of back-bills.

Price Protection in 2023: The Norm

Price Protection is very likely here to stay. These rebates are a powerful negotiation tool that protects the PBMs from being surprised by price increases. As a result, Price Protection rebates are now part of most Managed Care (Commercial and Medicare Part D) agreements – National PBMs as well as Regional. Manufacturers have needed to adapt and develop ongoing processes to pay these rebates --- both inside and outside of revenue management systems. However, even those manufacturers that rely on automated functionality will still find scenarios that require a work-around to handle one-off exceptions or other unique calculations. Software vendors have started to respond to these requirements by adding functionality to their revenue management systems.

The key takeaway is that the complexity of Price Protection hits each of the contracted parties to execute the terms. There is significant value in the proactive assessment of contract terms and implementation of system functionality whenever possible. Manual calculations have a much higher risk of error and could result in hours or days of rework to adjust the payment. Additional efforts to transition Excel Price Protection calculations to automated solutions via contract setup will pay off quickly.

If assistance or more information is needed, IQVIA’s consultants have extensive experience in the area of Price Protection. We have proven success implementing the full range of Price Protection strategies in various systems and for numerous customers. We have a great team of subject matter experts in the Managed Care space who have partnered with manufacturers and helped them overcome these challenges. Contact us at lauren.campbell@iqvia.com for more information on how we can support your organization. To learn more about the capabilities of the IQVIA Global Pricing & Contracting team, visit our website here.

IQVIA Global Pricing & Contracting

Our GPC team is you “one-stop-shop” for business and technology solutions for your global business.