Data, AI, and expertise empower Commercial Solutions to optimize strategy, accelerate market access, and maximize brand performance.

- Locations

- United States

- US Blogs

- Impact of Reduction in Insulin Prices by Major Drug Manufacturers

The price of insulin has been rapidly increasing for the past decade, weighing heavy on the consumer and limiting patient access and affordability. While lowering list prices may not have a direct impact on all consumers due to a complex supply chain and presence of intermediaries, it is a step in the right direction by the market leaders. The overarching goal is to help provide inexpensive access to life-saving medication for all socio-economic segments. This article will examine the role of insulin in treating diabetic patients, its cost, and the size of the insulin market. We also will explore the effects of insulin pricing strategies employed by 340B-covered entities, pharmacy benefit managers (PBMs), drug manufacturers, and Medicaid.

Diabetes and the role of insulin

Diabetes is a chronic condition involving the human body’s production and use of the hormone insulin. It affects 37.3 million people or 11.3% of the United States’ population, per the Centers for Disease Control and Prevention (CDC)1. Insulin is a naturally occurring hormone secreted by the pancreas to regulate the use of glucose or blood sugar. In patients suffering from diabetes, the human body does not naturally produce enough insulin to control blood sugar or glucose levels. In such instances, insulin that is either derived from animals, or synthetically using bacteria and yeast, must be externally injected into the human body.

There are two types of diabetes – Type 1 and Type 2. The key difference among them is the human body’s ability to produce and effectively use insulin. Individuals diagnosed as Type 1 diabetic create little-to-no insulin. Type 2 diabetic patients create insulin in limited quantities that the human body is not able to effectively use to regulate blood sugar2.

Fast diabetes facts

- 96 million adults in the U.S. are estimated to be pre-diabetic, and more than 80% of them don’t know it 3

- Diabetes is the eighth leading cause of death in the United States3

- Type 2 diabetes accounts for 90-95% of all diagnosed cases of diabetes, and Type 1 diabetes accounts for approximately 5-10%3

- In the last decade, the number of individuals diagnosed as diabetic in the U.S. has more than doubled as the population has aged3

- Individuals enrolled in Medicare or private insurance plans spent an average of $452 out-of-pocket for a year’s supply of insulin, and $9964 out-of-pocket, on average, among uninsured individuals

Insulin pricing

The list price, also known as Wholesaler Acquisition Cost (WAC), is set by the drug manufacturers. It forms the starting point from which further discounted pricing and negotiated prices are derived. The role of the PBM is to negotiate with medication makers to establish the pricing and rebates granted based on various insurance policies selected by consumers. A PBM plays a crucial role in determining the average price that a consumer ultimately spends for purchasing insulin. Involvement of multiple stakeholders, such as pharmacies, healthcare plans, and a complex supply chain, further complicates the aspect of drug pricing. This additionally coincides with an incentive to gain lucrative drug positioning on private insurance plan drug formularies to help achieve sales. It is also at this stage of negotiations that additional layers of complexity emerge in the process, making it more difficult for consumers to gain access to the lowest-cost insulin on the market.

Insulin market

Manufacturers have been under scrutiny about insulin pricing for a long time. A provision of the Inflation Reduction Act (IRA), passed by Congress in 202212, reduced insulin costs for patients, capped the cost of insulin copays and targeted price reductions in the insulin market.

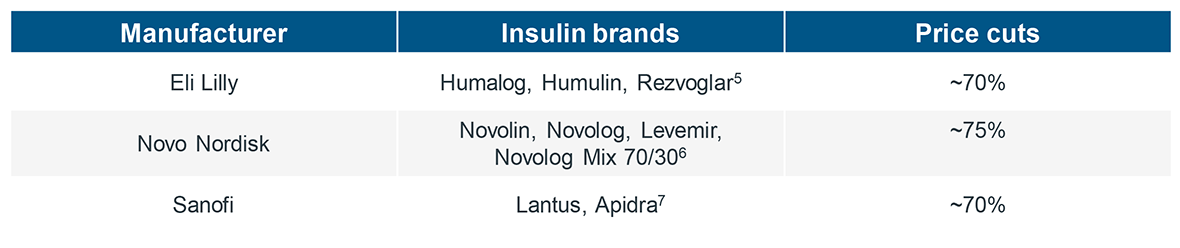

Recently, three manufacturers that collectively supply 96% of insulin in the U.S. announced significant reductions in the WAC of their products. This effort to address the pricing issues should increase market access for their insulin products.

Impact on pricing and contracting

Manufacturers of brand-name insulin products provide deep rebates to PBMs. This forms part of a larger gross-to-net problem wherein the rebates and discounts offered exceed the net cost of insulin to the patient8. In the past, cost of insulin expenditure flowing to drug manufacturers has steadily decreased and the profit share flowing through intermediaries has increased, especially among pharmacies, PBMs and 340B-covered entities9. This mode of revenue sharing, with the intermediaries receiving a larger share than the producer, could be impacted in the future by list price changes.

Another direct consequence of reduced list prices for drug manufacturers would be savings in rebates that are paid to PBMs, which would in turn, lead to an increase in their earnings13. Additionally, health insurance plans will also not be able to bring down the cost of premiums charged to consumers. Reduction in premiums is typically achieved using high-rebate dollars to help insurance plans gain more market share through lower premiums10. High rebates that were once offered before insulin price cuts could erode the pricing power leveraged by insurance plans to offset premium costs for all beneficiaries10.

Impact on 340B

From a 340B discounted pricing perspective, covered entities and associated contract pharmacies will be impacted in terms of profits earned by these organizations. An arbitrage strategy involving the discounted 340B acquisition cost versus the reimbursement offered was a key pricing strategy used by these entities11.

Impact on PBMs

PBMs would be directly impacted by the price cuts because they no longer would earn fees, as previously, from high insulin prices. PBMs have increased the rate of their administrative fees to as high as ~5% of WAC, creating a bigger bucket of revenue which will shrink now with lower prices. PBMs have complete discretion on which branded insulin products to include and to provide preferred formulary placement for high-rebate drugs, thus circumventing the actual use of low-cost insulin products. Changes are made to those formularies that are majorly opted for by health insurance plans.

At the consumer level, such exclusions would result in patients being pushed to use the high-cost/high-rebate versions of insulin (subject to their insurance plans)10. As a result, it does not help patients to realize the actual benefits of the price cuts in the form of reduced pricing and out-of-pocket costs.

The larger PBMs, such as CVS Caremark, Express Scripts, and OptumRx, drive significant market power when the time comes to negotiating rebates. These PBMs can negotiate better rebates in comparison to smaller rivals. PBMs also have price protection strategies within their contracts which benefit the PBM whenever drug manufacturers increase their list prices. Over the past few years, the cap of price protection has been reduced to a low of ~4% , which restricts drug manufacturers to increase price over the cap; and, if the price has been increased, then it generates additional revenue for PBMs. By lowering price, this revenue also will shrink. CVS Caremark and Express Scripts have both added biosimilars for insulin to their formularies and are incentivizing patients to switch over to the new treatment through value programs (Express Scripts), or exclusion of Lantus from the formulary (CVS Health).

Impact on Medicaid

Since drug manufacturers have spent the last decade increasing the price of insulin products, and the rebates offered to Medicaid are linked to the WAC, companies with high list price and high rebates might have to, in-turn, pay Medicaid to use their products11. This problem is further compounded by the removal of the 100% cap on Medicaid rebates as per the American Rescue Plan Act of 202111. While the most tangible benefit is the lowering of the list price, other stakeholders and intermediaries in the system may yet find ways to avoid lowering prices, as described above, by either side-stepping or altogether avoiding the path to actual realized lower costs for the diabetic consumer.

Conclusion

All parties within the drug supply chain, ranging from wholesalers, PBMs, and pharmacies, to insurance plans and consumers, will witness the impact when drugmakers lower prices. This will also reduce the significant effort spent on contract negotiation and monitoring the profitability for all parties. The assumption is that patients will only benefit if all parties work together keeping the diabetic consumer, along with their economic strata, in mind. Otherwise, lowering the price will not have a marked impact on affordability of drugs at lower cost.

References

- https://www.cdc.gov/diabetes/data/statistics-report/index.html

- https://www.endocrineweb.com/conditions/diabetes/diabetes-type-1-vs-type-2

- https://www.cdc.gov/diabetes/basics/quick-facts.html

- https://usafacts.org/articles/a-cap-on-insulin-costs-benefits-millions-of-americans-with-diabetes/#:~:text=Those%20without%20health%20insurance%20are,supply%20of%20insulin%20in%202019

- https://investor.lilly.com/news-releases/news-release-details/lilly-cuts-insulin-prices-70-and-caps-patient-insulin-out-pocket

- https://www.novonordisk.com/news-and-media/latest-news/lowering-us-list-prices-of-several-products-.html

- https://www.sanofi.com/en/media-room/press-releases/2023/2023-03-16-20-06-43-2629188

- https://www.drugchannels.net/2022/01/drug-channels-news-roundup-january-2022.html

- https://jamanetwork.com/journals/jama-health-forum/fullarticle/2785932

- https://www.drugchannels.net/2021/11/why-pbms-and-payers-are-embracing.html

- https://www.drugchannels.net/2023/03/drug-channels-news-roundup-march-2023.html

- https://time.com/6206569/insulin-prices-inflation-reduction-act

- https://www.nejm.org/doi/full/10.1056/NEJMp2303279

IQVIA Global Pricing & Contracting

Related solutions

Gain high value access and increase the profitability of your brands