- Locations

- United States

- US Blogs

- Trends to Watch through 2023: Policy changes after pricing and reimbursement

As we launch into 2022, it’s time for our stakeholders to look ahead and begin making and adjusting their yearly goals. It will be important to explore what trends in pharma are developing and how they may impact those working in the industry. In this blog series, we will explore the top seven trends we see emerging in 2022 and 2023, and how our customers should respond.

In this first blog, we will explore how policy changes around pricing and reimbursement will affect the healthcare ecosystem.

Policy changes after pricing and reimbursement

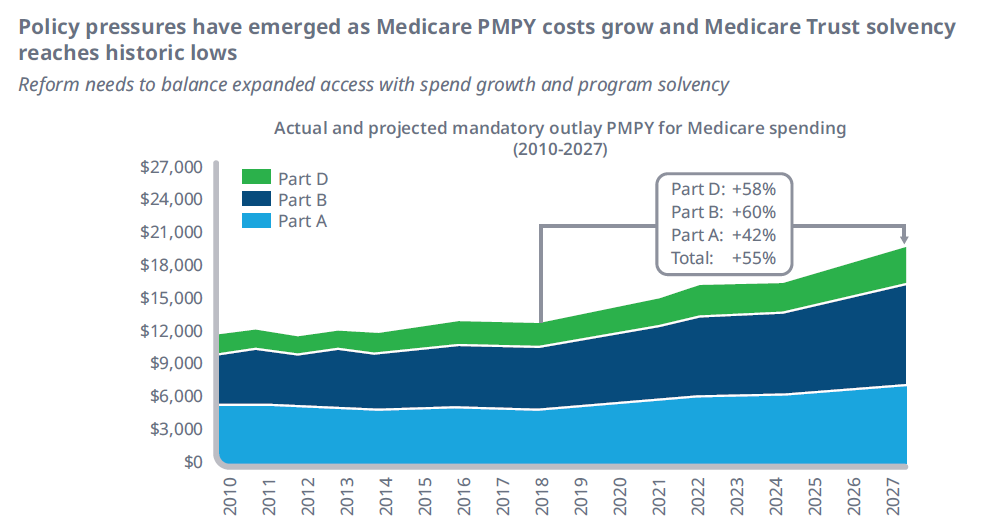

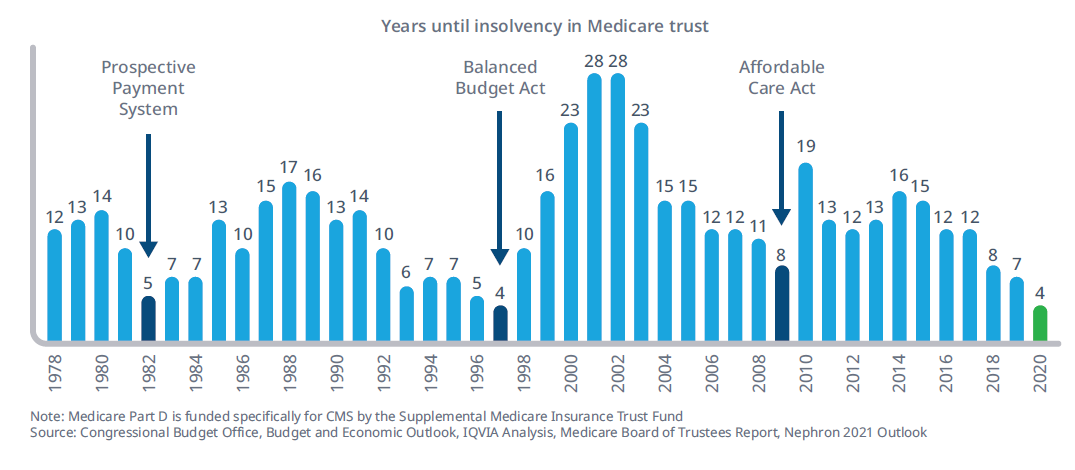

While constant rumblings by Congress and shifting administrations to address drug pricing issues have failed to materialize in concrete legislation, changes in drug pricing policies continue to be an industry wild card. Current Centers for Medicare and Medicaid Services (CMS) forecasts for Medicare solvency sit at historic lows as budget pressures the existing framework (Figure 1).

Figure 1

Recent precedents with the legal challenges to CMS rules indicate that the path forward for true, substantive, reform lies with the legislative pathway. As reforms like rebate safe harbor removal, international reference pricing, and drug reimportation get debated, new bipartisan ideas have begun to emerge. One such area where there is both Democrat and Republican support lies in Medicare benefit redesign.

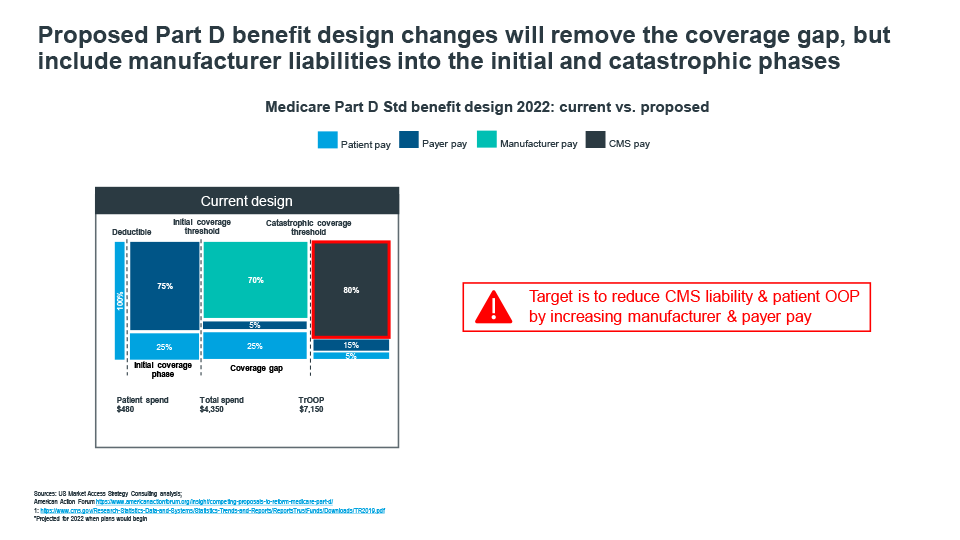

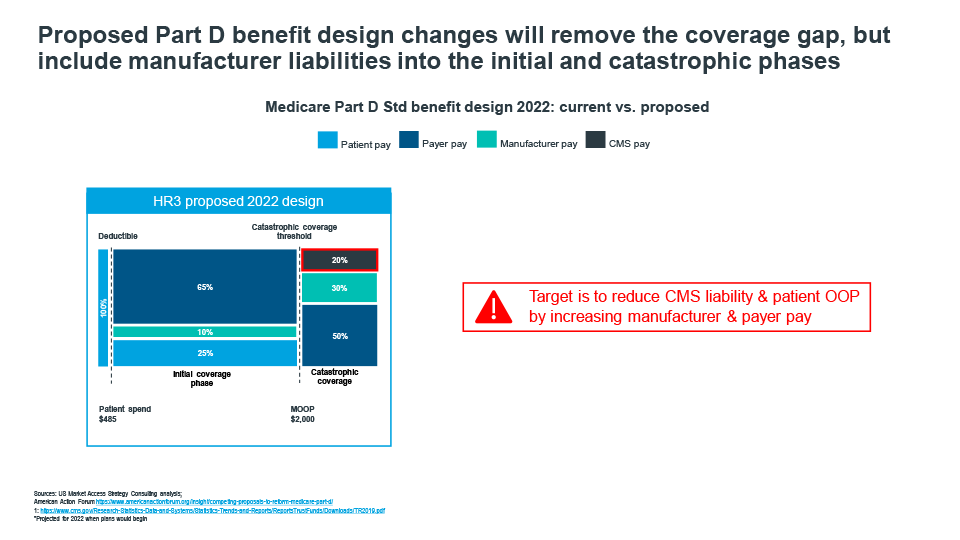

Cracks in the current Medicare Part D benefit design have been exposed as the market has evolved over the past decade. Patients on specialty drugs quickly move through the Coverage Gap phase and into catastrophic coverage, where CMS picks up 80% of the cost, patients are faced with high cost sharing requirements causing many to forgo treatment, payer pay is minimal for many drugs pushing liability to CMS, and Coverage Gap liabilities disproportionately impact retail brands (Figure 2).

Figure 2

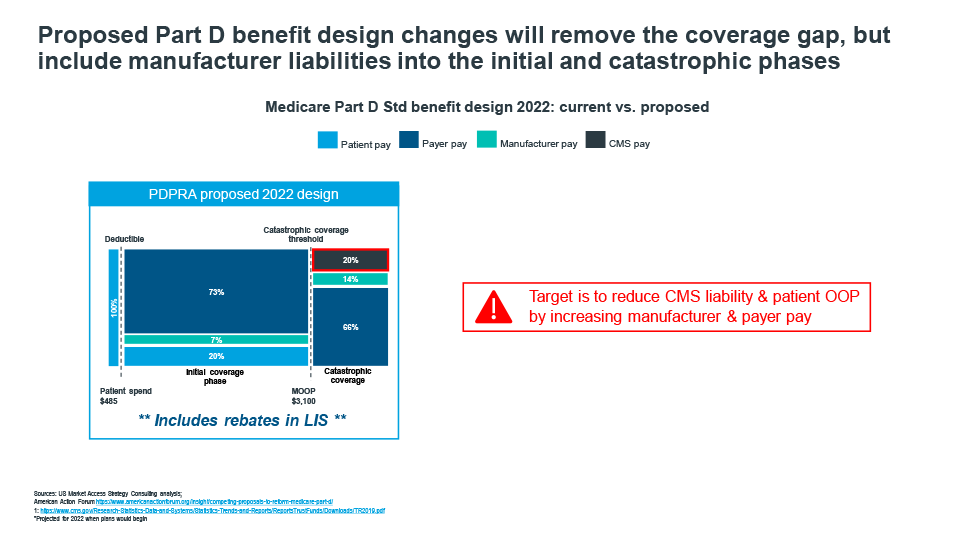

Recent policy frameworks introduced by house democrats and senate republicans demonstrate that there is general overlap in proposed redesigns. While the actual percentages of liabilities vary across patient, payer, manufacturer, and CMS, there is room for negotiating a path forward. That path will likely see a shifting of responsibility from patients and CMS to manufacturers and payers. New liabilities and incentives will create the need for market adjustments to address the changing dynamics. Payers will likely seek to tighten formularies even more, and manufacturers must prepare for an upward shift in specialty product liabilities and potentially extend liabilities to include prescriptions filled by low income subsidy patients. Patients will benefit as new out-of-pocket spending caps are introduced, which will make it easier to stay on higher cost therapies throughout the year versus enduring the copay fluctuations many experience under today’s design.

The effects of policy change will be long-lasting and will have many intended, and unintended, outcomes. The shifting of responsibility from CMS back to manufacturers and payers will help improve Medicare solvency but will come at a cost of billions of dollars annually for which CMS currently holds responsibility.

In our next blog, we will explore Copay Accumulator Adjuster Programs.