- Locations

- United States

- US Blogs

- Trends Affordability economics

As we launch into 2022, it’s time for our stakeholders to look ahead and begin making and adjusting their yearly goals. It will be important to explore what trends in pharma are developing and how they may impact those working in the industry. In this blog series, we will explore the top seven trends we see emerging in 2022 and 2023, and how our customers should respond.

The entire industry is facing compressing economics. Patients, payers, pharmacies, policymakers, providers, health institutions, employers, and more are being challenged to address shifting healthcare economics and growing liabilities. For manufacturers, this has resulted in margin pressure and growing uncertainty on the future. One of the drivers of public discourse is the perception of drug costs in the U.S. as compared to the rest of the world.

Affordability economics — perceptions and reality

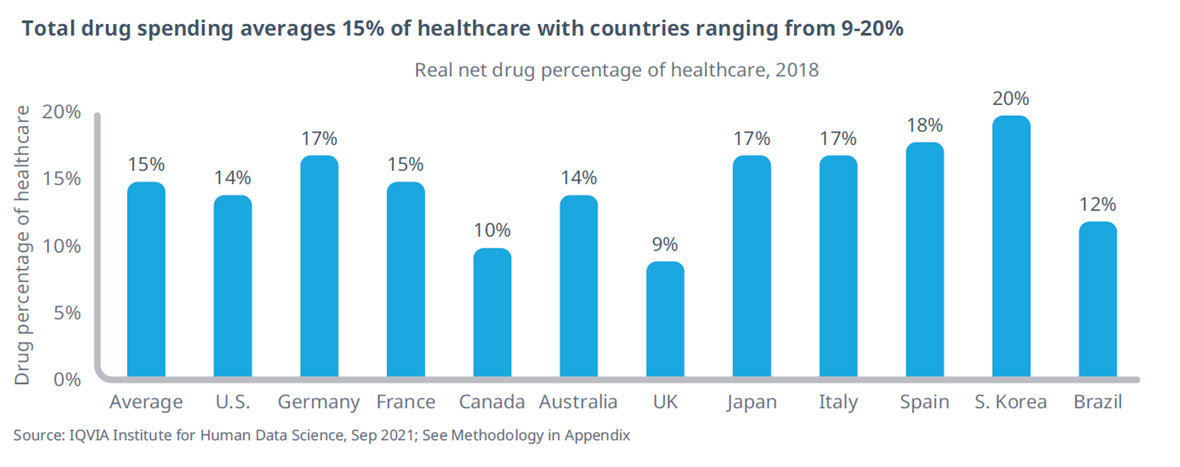

Drug costs contribute 14% to the overall cost of healthcare in the U.S. When this is examined against ten other developed countries, the cost of drugs in the U.S. system is comparable as a percentage of overall costs. The vast majority of the total healthcare spending relates to costs in other parts of the healthcare system, including hospital services, medical technology, infrastructure, supply chains, and provider reimbursement and salaries (figure 1).

This is not to say that pricing and healthcare reform is not needed. Rather, the facts of what the U.S. spends on drug costs is perceived to be more than other developed countries. While that may be true for raw dollars, it is important to contextualize what that spend represents as a part of the whole.

Additionally, many quickly turn to list prices because they are more readily observed while ignoring that net drug pricing has been at or below the rate of inflation for over five years. Making these facts transparent to key stakeholders will be an important effort in closing the significant gap between perceptions and reality.

Navigating the evolving market access ecosystem

All the efforts by policymakers, payers, PBMs, pharmacy chains, and healthcare systems – whether that be copay accumulators, 340B, value-based care arrangements, etc., – are part of a rapidly evolving market access ecosystem that generates growing margin pressures and complexity for manufacturers. For the patient, they are faced with an increasingly complex journey as they continue to get caught in the middle of trying to navigate an opaque system.

Understanding the drivers and implications of this evolving ecosystem is critical for pharma companies as they navigate these challenges.

An array of strategies and tactics are required for manufacturers:

- Enhance capabilities to address operational pressures, such as identifying duplicate discounts, distribution concentrations, copay program design, and preventable revenue leakage.

- Enrich insights through data and advanced analytics that improve net pricing transparency.

- Ensure compliance with and become codified. Model how shifting liabilities impact demand and margin.

- Help more patients gain access to treatments through manufacturer assistance and focus on improving health equity so that more patients can gain the full value of treatment.

- Improve forecasting and strategic planning to be proactive in assessing the impact of changes in the ecosystem and determine responses.

References

1 IQVIA Institute for Human Data Science, Drug Expenditure Dynamics. 1995-2020: Understanding Medicine Spending in Context, October 2021