- Locations

- United States

- US Blogs

- Trends to Watch through 2023: Pharmaceutical benefit managers' rising purchasing power

As we launch into 2022, it’s time for our stakeholders to look ahead and begin making and adjusting their yearly goals. It will be important to explore what trends in pharma are developing and how they may impact those working in the industry. In this blog series, we will explore the top seven trends we see emerging in 2022 and 2023, and how our customers should respond.

We at IQVIA expect to see an increased importance in the role that pharmaceutical benefit managers (PBMs) play in 2022 and beyond. This blog explores their rising power and the influence they carry.

Pharmaceutical benefit managers’ rising purchasing power

Programs such as Copay Accumulator Adjusters and 340B do not exist in a vacuum; they are dynamics in a larger market access ecosystem that should be considered alongside rebates, copay cards, and other forms of patient assistance programs.

Simultaneously with these market events, payers are increasingly encompassing the prescription value chain to gain control and reduce transaction costs while finding new ways to generate margin. PBMs are now influencing the value chain by going beyond traditional access rebates. As more prescriptions are pushed into vertically integrated specialty pharmacies, the large integrated entities are able to exert more control on utilization. The vertical integration further inflates brand exposure to Accumulator Adjuster and Copay Maximizer programs while increasing the PBMs’ ability to further lower their costs by taking full value of manufacturer-sponsored programs.

As control and strength increase, so too, does leverage which manifests itself in higher rebates and pharmacy fees. Most recently, the large PBMs have been seen to move even further into the value chain by creating their own group purchasing organizations (GPOs). These GPOs now allow for the PBM to shift discounts into complex fee structures that are less transparent. The larger and more complex the organization, the easier it is to exert pressure and value through consolidation strategies.

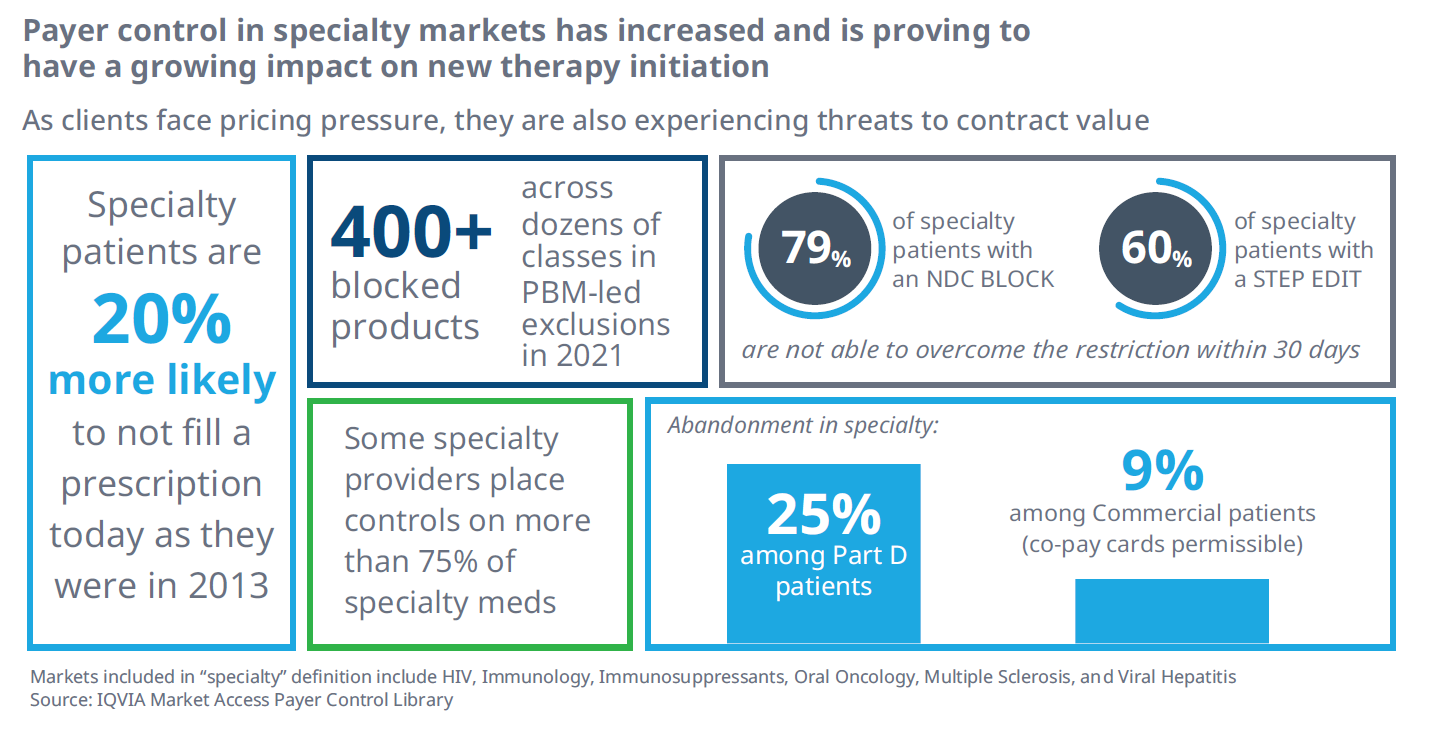

The growing purchasing power and control by payers is a challenge not only for manufacturers, but also challenges patient access. Over the past decade, as payer consolidation and control has increased, patients treated with specialty medications are feeling the pain. Patients treated with specialty therapy are 20% less likely to fill a specialty medication prescription than they were in 2013 (figure 1).

At the same time, the number of prescription products facing an NDC block has grown to include over 450 at the large PBMs, directly impacting the number of products available to patients. These NDC blocks, also known as formulary exclusions, are powerful controls and drive manufacturer access rebates higher as more classes become exposed.

Figure 1

In our next blog, we will explore a new era for value-based pricing agreements.