- Locations

- United States

- US Blogs

- Trends 340B Drug Discount Program

As we launch into 2022, it’s time for our stakeholders to look ahead and begin making and adjusting their yearly goals. It will be important to explore what trends in pharma are developing and how they may impact those working in the industry. In this blog series, we will explore the top seven trends we see emerging in 2022 and 2023, and how our customers should respond.

The next trend we see becoming more prevalent for pharma in 2022 and 2023 is the 340B Drug Discount Program. This blog details how its emergence has changed the current marketplace and tactics stakeholders should consider to help mitigate compliance and financial risks.

The 340B Drug Discount Program

The 340B Drug Discount Program (340B) has grown into a considerable market force, amplifying market pressures manufacturers already face in the U.S. marketplace. By the end of 2020, 340B program sales accounted for 13% ($80B) of total U.S. pharmaceutical sales and, year over year, grew four times faster than the overall pharmaceutical market.1

Initiated by the Health and Human Services (HHS), 340B is a mandatory discount program for manufacturers if they choose to participate in Medicare. Through the program, manufacturers provide discounts to hospital systems that serve needy patients in rural areas and underserved urban communities. At the surface, the program is well-intended, aiming to make scarce healthcare resources go further in those communities that most need them. However, the threshold to qualify for 340B is a relatively low bar, driving growth in the number of covered entities that qualify for participation. With no oversight into how economic gains are used by participating systems, the profit incentive to qualify for the program is high. As such, the number of participating covered entities and covered sites has grown precipitously over the past decade.

Another key driver in the growth of the 340B discount program has been the rapid expansion in the number of contract pharmacies, which has increased nearly 15 times since 2010. There are now more than 28,000 contract pharmacies participating in the 340B program and over 181,000 covered entity/contract pharmacy relationships as of Q3 2021. Combined with the increase in participating health systems, the growth in contract pharmacies has created a compounding effect of the number of transactions moving through the program (figure 1 below).

For a manufacturer, part of the challenge of the well-intended 340B program is that discounts are provided up front as a price reduction. Like pricing in the Medicaid channel, that discount can be as much as 100% of the drug’s value. The complexity arises because the 340B discount is provided up front, and manufacturers frequently find themselves having to pay an access rebate on top of the already discounted price. The effect of stacking discounts can be extremely complex to unravel and can quickly lead to negative margins and revenue leakage over large segments of prescription volume. IQVIA estimates that in 2021, manufacturers will be responsible for $20-25 billion in duplicate discounts that may not have been owed.

Consequently, in 2020, a handful of pharmaceutical companies decided to change their participation in the 340B pricing program and began taking steps to limit contract pharmacies’ ability to dispense drugs purchased at 340B prices. In response, HHS' Health Resources and Services Administration called out six pharmaceutical companies for violating rules under the 340B drug discount program, ordering them to repay affected providers for previous overcharges and warning of more penalties if they don't comply. The final outcomes are still being litigated.

There are steps that manufacturers can take to mitigate the explosive growth, financial consequences, and compliance risks of the 340B program.

One strategy is mitigating the impact by getting better with disputes of duplicate discounts. If a payer rebate contract language allows it, a manufacturer can dispute paying a rebate where a 340B discount has already been applied. Unfortunately, there is a very short window to identify and dispute these duplicate discounts, and data is often incomplete.

Another strategy is data enrichment. Some manufacturers are using multiple data sources to get better at rebate transparency. Aside from using these integrated data to drive better financial operations, generating insights about patients on specialty therapies through data aggregation and integration can improve patient outcomes.2 Data aggregation and integration can help pharmaceutical companies obtain an expanded view of the patient journey.

The best data aggregation solutions provide pharmaceutical companies with broad sources of data, as well as integration services that deliver high-level perspectives across patient populations or geographies. The data can even be linked back to an individual prescriber, healthcare organization, insurer’s practice, or de-identified patient and be used to build detailed strategies – financial and otherwise.

A third strategy is to prepare for the margin pressures by understanding the demand-side drivers of 340B volume. Incorporating these insights into forecasting and strategic planning decision-making processes can give more predictability to future events, lessening the likelihood of an unwanted surprise.

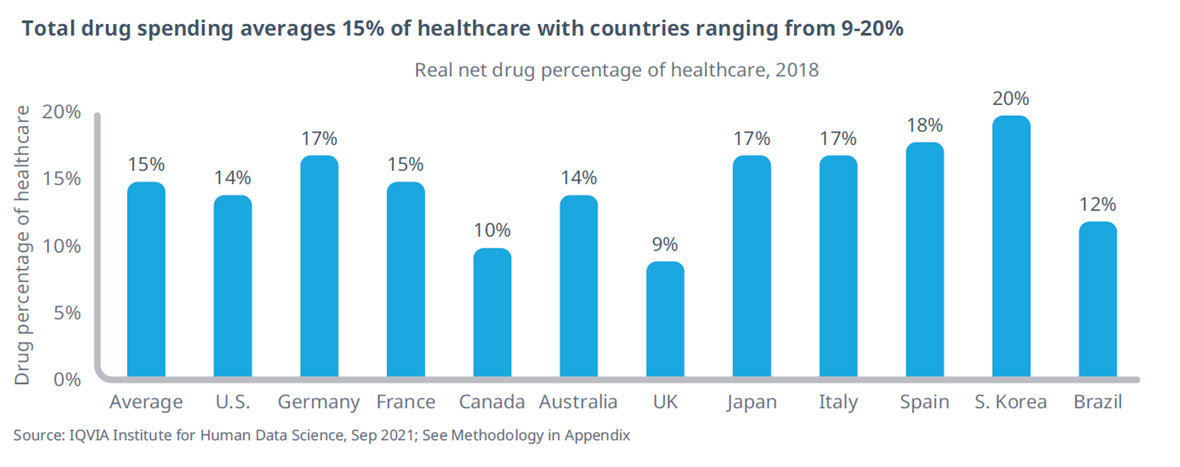

The pharmaceutical industry is undergoing unprecedented change, challenging manufacturers with shrinking margins and demand efficiency like never before. In the meantime, the payer is continuing to exert more controls, encompass more of the value chain through consolidation, and gain more influence in lowering their costs. The patient, as a result, is facing a more complex and opaque journey and is forced to navigate an ever more intricate system. What are some of the current industry themes that are generating these multifaceted dynamics?

In our next blog, we will explore the evolving role pharmaceutical benefit managers play.

References

1 IQVIA, 340B Drug Discount Program Growth Drivers, April 16, 2021.

2 World Pharma Today, Giannouris J and Scannapieco H., Bridging the Gaps in Complex Patient Journeys by Enriching Data.