Analyze industry leading sales and medical data in a standardized and comparable way, including cross-country analysis of performance and additional insights into global and regional markets.

- Blogs

- IQVIA Early Bird: Pharma Defining Trends in 2024 and What Lies Ahead

LISTEN TO, OR READ THIS BLOG BELOW

2024 has been a year of significant policy shifts, innovative breakthroughs, and strategic investments. These developments are shaping the future of the pharmaceutical industry.

2024 was marked by the biggest election year ever, resulting in a rightward, protectionist shift. Additionally, the United Nations has committed to reducing deaths associated with antimicrobial resistance (AMR) by 10% compared to 2019 levels by the end of the decade. This is a crucial step towards global health improvement. The European Union also made headlines by passing the EU AI Act into law, establishing a new regulatory framework for artificial intelligence. In the United States, we saw the first negotiated prices under the IRA Medicare Drug Price Negotiation program, a significant move towards making medications more affordable.

In terms of innovation, 2024 witnessed groundbreaking approvals. The FDA in the U.S. approved a drug for schizophrenia, the first in decades with a novel mechanism of action called Cobenfy by BMS, and another amyloid-targeting treatment for Alzheimer’s Disease, Kisunla by Lilly. Another milestone was the approval of the first-ever treatment for MASH, Rezdiffra by Madrigal. Moderna's mRESVIA became the first mRNA vaccine outside of COVID to receive regulatory approval. It provides protection against lower respiratory tract disease caused by the respiratory syncytial virus (RSV). Additionally, the bispecific antibody ivonescimab by Akeso/Summit beat Keytruda in a non-small cell lung cancer (NSCLC) trial1. Following this, several significant deals were made in the bispecific space, including Sanofi and Novartis' partnership with Dren Bio2 3. This showcases the potential of next-generation therapies, fuelled by investors showing increased interest in companies developing bispecific antibodies and pharmaceutical companies exploring acquisitions and licensing agreements to expand their portfolios.

Factors such as the looming patent cliff, high cash burn rates for biotech companies, and the need for portfolio renewal remain critical. Despite strong fundamentals, major mergers and acquisitions (M&A) deals failed to materialise this year save for the increasing demand for anti-obesity medicines leading to some high value deals for manufacturing capacity, notably Novo Nordisk's acquisition of Catalent for $16.5bn.

Despite the challenges, the global prescription medicines market grew in value by 9% at list prices last year (excluding COVID-19 vaccines and treatments). The market is now valued at $1.5tn, with the U.S. constituting more than half of the market. Innovative biologics have been the market drivers for the latest years and now for the first time, accounted for a larger share of the market compared to innovative small molecules (Figure 1). Innovative biologics grew by 12% last year, equating to $60bn and are expected to continue driving growth.

The top 3 global therapy areas by value: Oncology, Immunology and Anti-diabetics accounted for over 70% of the innovative biologic market in 2024. Oncology, valued at $250bn remained the top therapy area.Immunology & antidiabetics are ranked second and third, valued at $198bn and $138bn respectively. Historically, these therapy areas have been growth engines for the biopharmaceutical industry and will continue to do so in the coming years, alongside the increasing demand for anti-obesity treatments. The new treatments offer significant weight loss option for the first time and despite not being broadly reimbursed. The promise has propelled the therapy area movement by 18 places in the last year to rank 13 as per the latest 2024 sales. IQVIA predicts it is on course to be among the top 5 therapy areas by 2030.

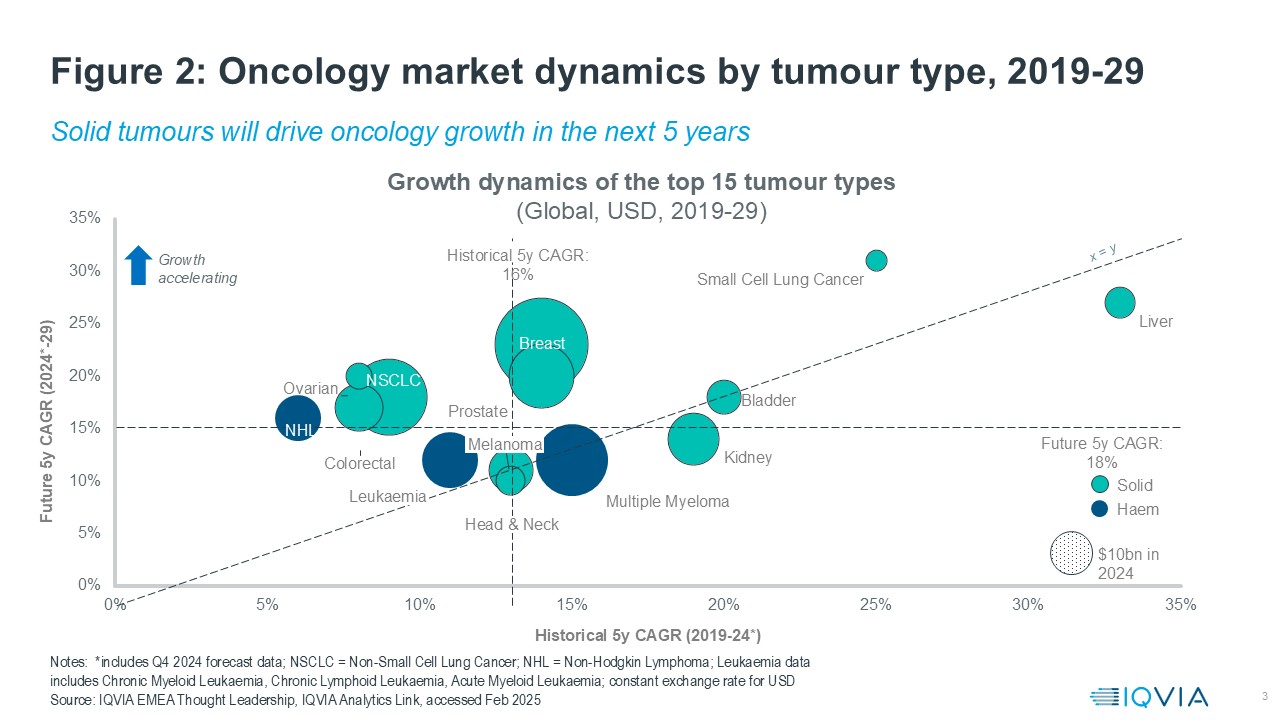

Oncology has always been a powerhouse of innovation, with 25 new oncology drugs launched globally in 2023, bringing the average annual new launches from 2019–2023 to 25 compared to an average of 13 annually in the five years prior4. Despite significant progress, there remains a substantial unmet need, driving continued interest from pharmaceutical companies. The R&D pipeline is robust, with numerous launches expected by 2030.

Recent launches and indication expansions have brought innovative new treatments to several cancer types. For instance Pfizer’s Elrexfio5 for multiple myeloma has significantly improved patient outcomes. These advancements explain the rapid growth in these areas, highlighting the dynamic nature of the oncology market.

Immunology is the second biggest therapy area by value. Due to factors, such as the high prevalence of autoimmune disorders, higher drug prices and the willingness to pay for innovation in the U.S.- it constitutes three-quarters of the global market share. Immunology indications can be classified into autoimmune and allergic inflammation, and the autoimmune indications dominate immunology sales, with a market share of 84% in 2024. Of these, rheumatoid arthritis and psoriasis are the most valuable indications, each making up around 25% of autoimmune sales.

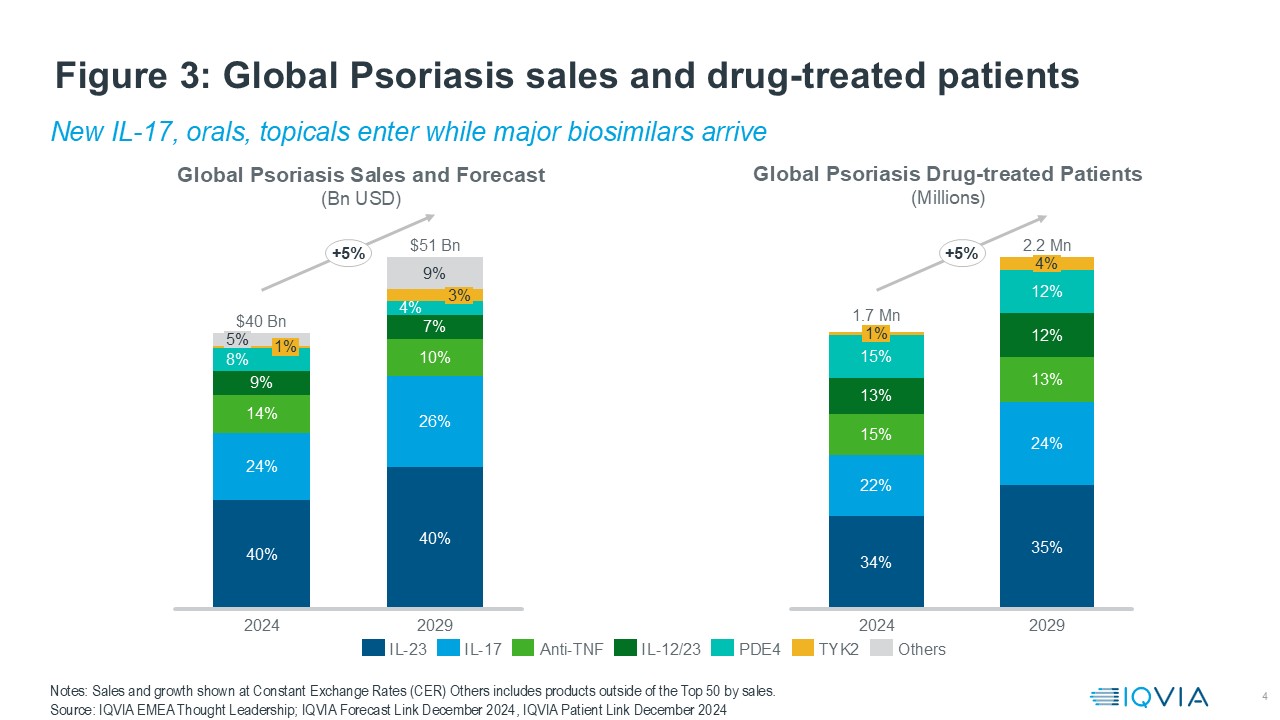

Psoriasis is a prime example of a large disease within Immunology, the psoriasis market is valued at $40bn in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 5% to $51bnin 2029. This is in-line to the drug treated patient numbers, which would reach 2.2Mn by 2029 as per IQVIA Patient Link. Based on the mechanism of action, IL-23 dominates the market, followed by IL-17 and Anti-TNF. These three together constitute nearly three-quarters of the market both by value and drug-treated patients.

Psoriasis, rheumatoid arthritis (RA), and other large indications are fiercely competitive, with biosimilars for Stelara, Humira, and many approved mechanisms of action. Hence, we expect future growth will be driven by smaller, underserved indications.

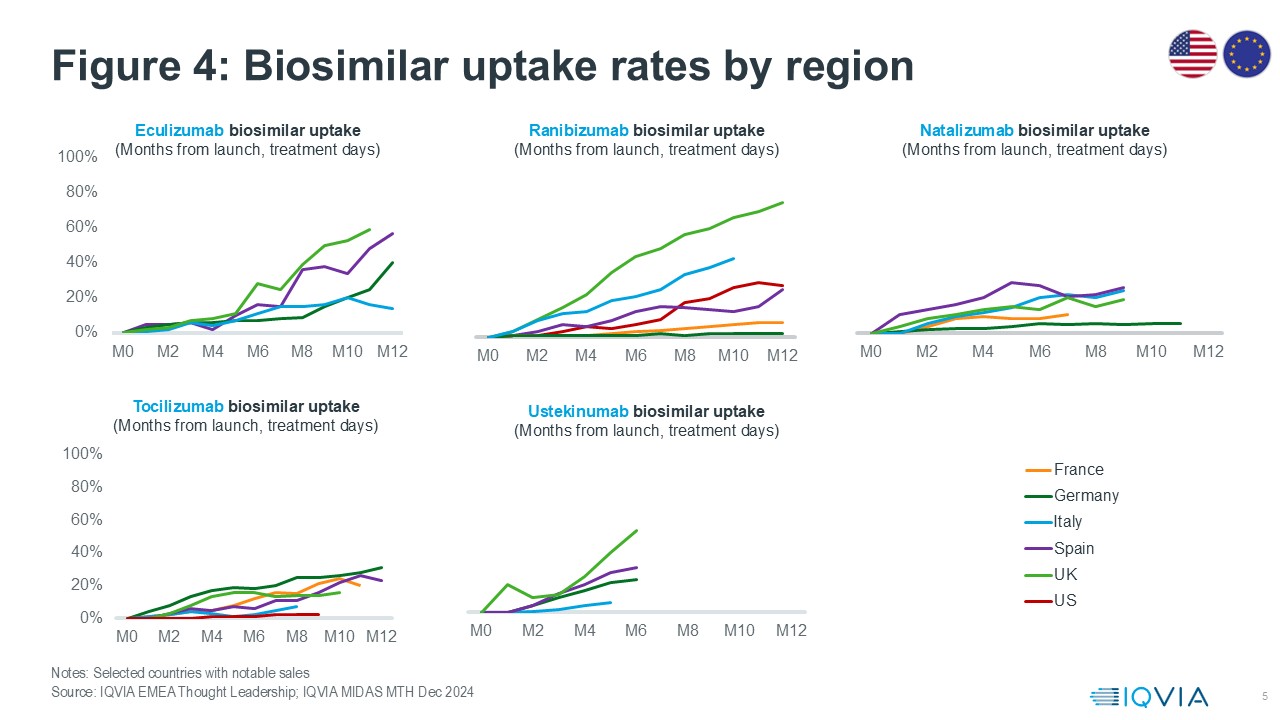

Biosimilars form an increasingly important consideration in healthcare provision, particularly within high-value therapeutic areas. There has been an increase in acceptance, largely due to rigorous regulatory standards and stakeholder outreach, and this has driven rapid biosimilar adoption across broad types of physicians. In turn, this has led to substantial reductions in treatment costs and enhanced accessibility to critical medicines.

Figure 4 explores some of the latest biosimilar entrants in EU4,UK and the US The UK demonstrates rapid uptake across new biosimilars due to a concentrated effort by NHS England to introduce and disseminate biosimilars rapidly through national procurement and policy measures. An example is the ranibizumab biosimilar capturing ~75% of the market by treatment days in less than a year since launch. This is particularly interesting in the context of ophthalmology, a new therapy area for biosimilars, where there was a lot of uncertainty about how practitioners would react. The rapid adoption of ranibizumab biosimilars highlights the potential for biosimilars to gain significant market share outside of Oncology and Immunology.

The uptake of biosimilars also varies by molecule. Tocilizumab biosimilars haven’t had the uptake seen for ranibizumab and eculizumab, averaging only 20% after 8 months since launch across countries. This lower uptake can be attributed to several factors, including brand loyalty and the lack of additional formulations, which limits flexibility for prescribers and patients.

The innovation, policy and investment issues are considerable roadblocks, however looking ahead, there are various hidden opportunities to drive value in an increasingly risky environment. With challenges in the healthcare system capacity change, AI and digital tech along with better public/private collaboration would be key to innovation. There is also an increasing risk of chronic, high prevalence disease of aging which would need refocusing on preventative care in primary care settings and with the new obesity medications showing promise, optimizing outcomes on spend would be critical. There is a lot of uncertainty in the market after the election results and policy changes, increasing the likelihood of supply chain disruptions in the short term. In the medium to long term, supply chains may need to be reconfigured to meet the demands of supply security within major trading blocs. This would involve localization of manufacturing and capacity, along with stockpiling, to boost resilience.

Sources:

1 Akeso, Summit PD-1 bispecific crushes Merck's Keytruda in lung cancer

2 Press Release: Sanofi to acquire Dren Bio’s bispecific myeloid cell engager for deep B-cell depletion, broadening immunology pipeline

3 Novartis pens $150M upfront bispecifics deal with Dren Bio

4 Global Oncology Trends 2024: Outlook to 2028 - IQVIA

5 Pfizer’s ELREXFIO™ Receives U.S. FDA Accelerated Approval for Relapsed or Refractory Multiple Myeloma | Pfizer

For a deeper dive into these topics, watch our on-demand webinar. Explore global market dynamics, successful product launch environments, and pivotal developments in Oncology, Immunology, and Obesity markets, along with the latest data on biosimilar trends. Don't miss out—watch the webinar now to stay ahead in the industry!

ON DEMAND WEBINAR

Explore 2024 industry trends and pharma outlooks for 2025

Join this webinar to review key pharma metrics for 2024, understand driving forces behind current healthcare market challenges and discover strategies to overcome them.

- Get an overview of global Market Trends for 2024 including:

- Sales value and volume, therapy area split, promotion mix

- Launch environment performance

- Deep dive into the Oncology, Immunology and Obesity markets looking at key trends, innovations and developments, including an overview of patient dynamics.

- Review the current Biosimilar uptake

Related solutions

IQVIA Analytics Link Ecosystem establishes deep connections across our key data assets.

Strengthen your portfolio by making more informed decisions and prepare for the impact of new research discoveries.