Much has been written about how the pandemic impacted the way pharmaceutical companies engaged with healthcare professionals (HCPs), for example physical access restrictions accelerating the rise of remote and digital channels. During the pandemic, this trend was observed across all interactions a company has with HCPs, including both commercial teams and medical affairs.

IQVIA’s latest proprietary primary research, conducted with HCPs in EU4/UK and the U.S. in October and November 2023, explores the extent to which pandemic-induced changes have a lasting impact on medical engagement and HCP preferences.

In this blog we present highlights from our research and discuss the implications for pharmaceutical companies.

I. MSL-HCP interaction volume has yet to fully recover

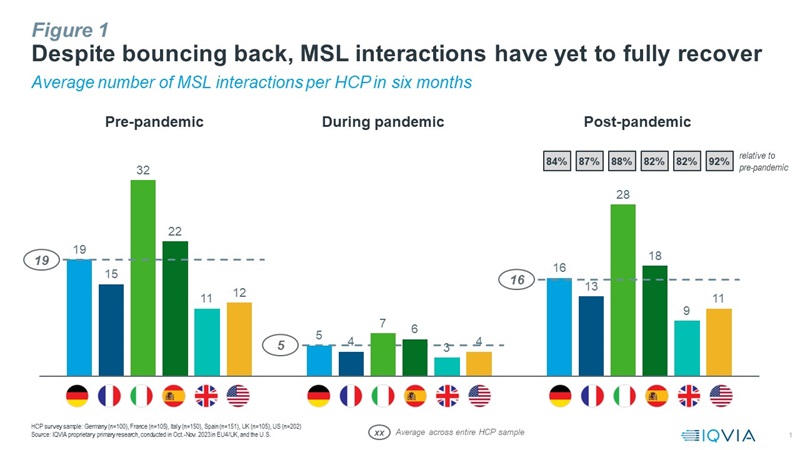

As expected, contact volumes declined dramatically as the pandemic hit, from an average of 19 MSL interactions per HCP for a six-month period to just 5 across the six countries in scope of our survey.

While post-pandemic contact volumes for MSL engagement have bounced back to an average of 16 per HCP for a six-month period, these are still below pre-pandemic levels in each of the six countries, including EU4/UK and the U.S., ranging from 82% to 92%, with the U.S. having seen the highest rate of recovery (see Figure 1).

For context, interactive contacts between sales reps and HCPs, based on IQVIA Channel Dynamics data as at Q3/2023, are also still below pre-pandemic levels in EU4/UK, ranging from 64% in Germany to 94% in the UK. As an outlier, in the U.S. interactive contacts by sales reps now exceed pre-pandemic levels, reaching 121%, according to IQVIA Channel Dynamics.

Important caveat: We are comparing two different data sources here, a one-off survey of just over 800 HCPs focused on MSL trends vs. IQVIA Channel Dynamics, a regular survey instrument with a much larger sample size measuring pharma-HCP engagements.

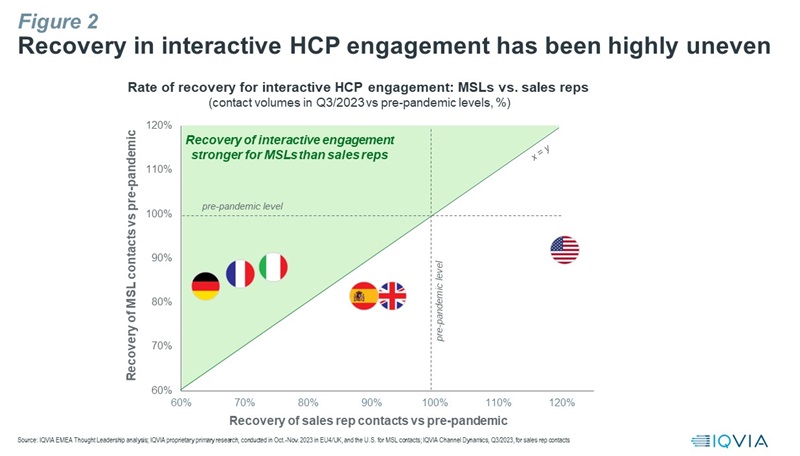

The overall recovery in interactive HCP engagement, including both commercial and medical contacts, has played out very unevenly across the six countries in focus. Relative to interactions by sales reps, the rebound in MSL engagement has been considerably stronger in Germany, France and Italy, whereas in Spain, the UK and the U.S. the opposite is true (see Figure 2).

The latter three countries saw the most significant pivot to remote, interactive channels for sales detailing during the pandemic, which they continued at higher levels than other countries even after access restrictions eased. This explains their stronger, post-pandemic recovery for interactive sales rep contacts compared to Germany, France and Italy.

In most countries, healthcare systems still grapple with the hangover from the pandemic. As another IQVIA study found, across EU4/UK and the U.S., the majority of healthcare professionals (53-74%) were still reporting that understaffing due to resignation and burnout remains a significant problem in 2023 [1], while patient backlogs continue to exacerbate pressures.

In such an environment, with HCPs’ available time to engage at a premium, it is critical for pharmaceutical companies to make every contact count. This means delivering relevant, tailored and compelling content but also looking beyond in-person engagement and embracing an orchestrated, HCP preference-led omnichannel approach [2]. Companies also needs to recognise that HCPs ultimately value information that helps them optimise patient care.

Our survey results reflect this sentiment, with 7 in 10 HCPs saying they would like more personalised medical interactions based on their individual needs, which applies to both content and the format and channel of its delivery.

On a positive note, HCPs in all six countries indicated that they are likely to increase interactions with MSLs in the future.

II. A hybrid model for medical engagement is here to stay

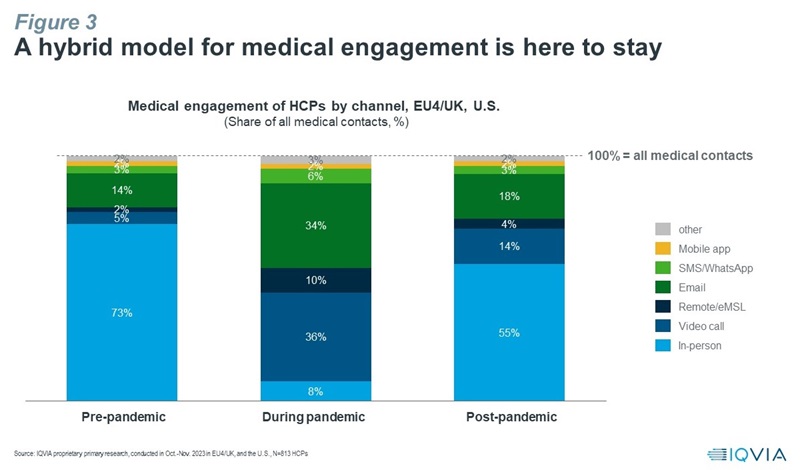

During the pandemic we saw a steep increase in the use of remote and digital channels in medical engagement, especially video calls and email, which significantly grew their share of all HCP medical contacts from 5% and 14% pre-pandemic to 36% and 34%, respectively.

After we emerged from the pandemic, video calls and email have retained a significant share of medical contacts, at 14% and 18%, respectively, with both above their pre-pandemic levels, even as the share of in-person MSL interactions bounced back from a pandemic low of 8% to 55% today (see Figure 3).

Respondents identified more frequent virtual and/or remote engagement and utilising real-time virtual educational events as the top changes they adopted permanently since the pandemic, with a majority of HCPs across the six countries confirming they are comfortable with virtual MSL interactions. At the same time, a majority of HCPs acknowledged that building relationships with MSLs virtually is challenging.

When asked about the future, HCPs indicated they expect a hybrid model for medical engagement to continue, with a similar channel mix as observed today.

III. HCPs’ medical and scientific information needs are evolving

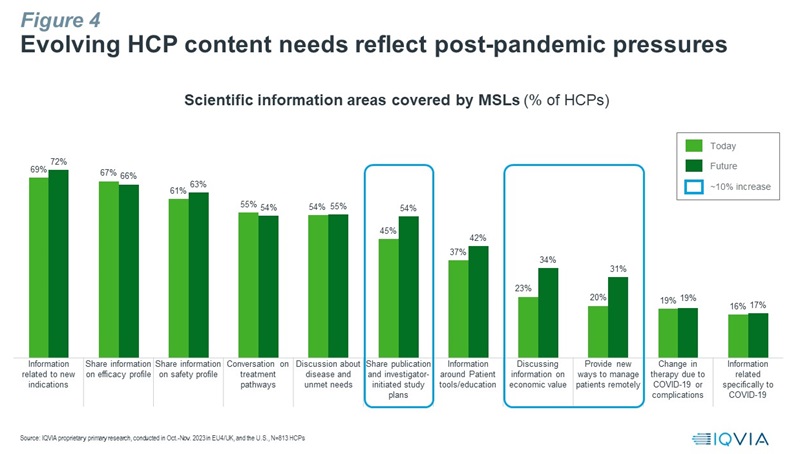

Information related to new indications and about a product’s efficacy and safety will continue to be top priorities, as identified by over 60% of HCPs. However, three information areas saw significant increases of around 10% between current and future importance as attributed by survey respondents (see Figure 4):

- A product’s economic value

- Managing patients remotely

- Opportunities for publications and investigator-initiated studies (IIS)

The reported elevation in importance of the first two topics clearly reflects the post-pandemic pressures many HCPs are facing, in particular a budget- and resource/capacity constrained environment in which they have to operate. Therefore, it is not surprising that they see an increasing need to seek relevant information, including from pharmaceutical companies, to help them (better) manage those challenges, e.g., by exploring home care or remote treatment to overcome capacity bottlenecks and alleviate persistent patient backlogs.

HCPs also expressed a clear preference for engagement with MSL vs. sales reps on specific information needs, including:

- Balanced, unbiased information on a disease area

- In-depth discussions on disease, treatment landscape, patient unmet needs and latest data/evidence

These findings highlight how medical affairs is uniquely placed to engage with HCPs in ways that deliver differentiated value. As a non-promotional function, with a deep understanding of disease, the underlying science behind innovation, clinical practice and patient needs, medical affairs can build trust-based relationships that are free of potential commercial conflicts of interest or perceived bias. Furthermore, only medical affairs is allowed to respond to off-label questions, upon unsolicited request.

This positions medical affairs at the heart of efforts to rebuild HCP interactive engagement post-pandemic which, as we discussed earlier, is still below pre-pandemic contact levels across both commercial and medical in most countries (see Figure 2).

Our research also shows that rebuilding post-pandemic medical engagement requires a different approach, as there will be no return to the pre-pandemic model. Successful medical engagement now requires much more than simply providing relevant scientific or medical information to HCPs. How, when and where such information is provided is as important, with expectations of greater personalisation of content, its contextualisation and delivery to reflect HCP preferences.

To successfully navigate post-pandemic realities, it is therefore paramount for pharmaceutical companies to truly understand healthcare professionals’ needs and preferences to enable highly personalised, impactful medical engagement. Naturally, the same holds true for commercial.

References:

- Firestorm to Burnout: The Impact of the Pandemic on Healthcare Professionals; IQVIA white paper, 2023; https://www.iqvia.com/library/white-papers/firestorm-to-burnout-the-impact-of-the-pandemic-on-healthcare-professionals

- Medical Affairs’ Next Frontier: Unlocking Omnichannel Engagement; IQVIA white paper, 2022; https://www.iqvia.com/library/white-papers/medical-affairs-next-frontier-unlocking-omnichannel-engagement

Learn More

Driving Growth with Omnichannel HCP Activation: New Models. New Value.

As the dust settles, one thing is clear — multi-channel engagement remains challenging but crucial to ensuring consumer health brand success.