Maximize your healthcare investments, with evidence.

- Blogs

- Biopharma M&A outlook for 2024

In our first blog of 2024 on biopharma M&A trends, we will provide an outlook for the year ahead, following a brief recap of how 2023 played out.

Recap: Biopharma M&A in 2023

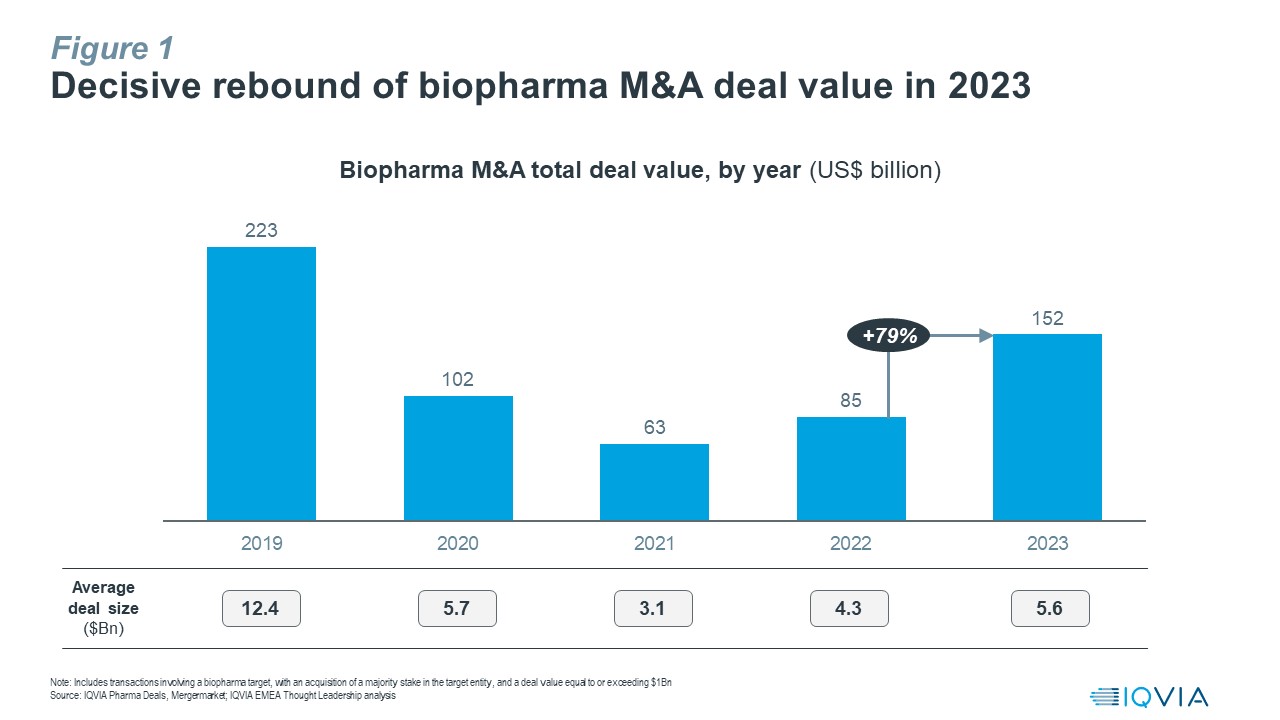

Biopharma M&A activity has witnessed a decisive rebound in 2023, with aggregate deal value up by 79% vs. 2022 to reach ~$152Bn for the full year, the highest since 2019. Average deal size also continued its upward trend towards levels last seen in 2020 (see Figure 1).

This outcome is in line with our prediction that we made early last year of M&A value in 2023 hitting a total of $140-160Bn for transactions involving a biopharma target, with an acquisition of a majority stake in the target entity, and a deal value equal to or exceeding $1Bn.

In 2023, bolt-on deals dominated, with the exception of the $43Bn Pfizer-Seagen acquisition as the only mega-deal announced last year. Noteworthy, sizeable transactions announced in 2023 include BMS-Karuna ($14Bn), Merck-Prometheus ($10.2Bn), AbbVie-Immunogen ($10.1Bn), AbbVie-Cerevel ($8.7Bn), Biogen-Reata ($7.3Bn) and Roche-Telavant ($7.1Bn).

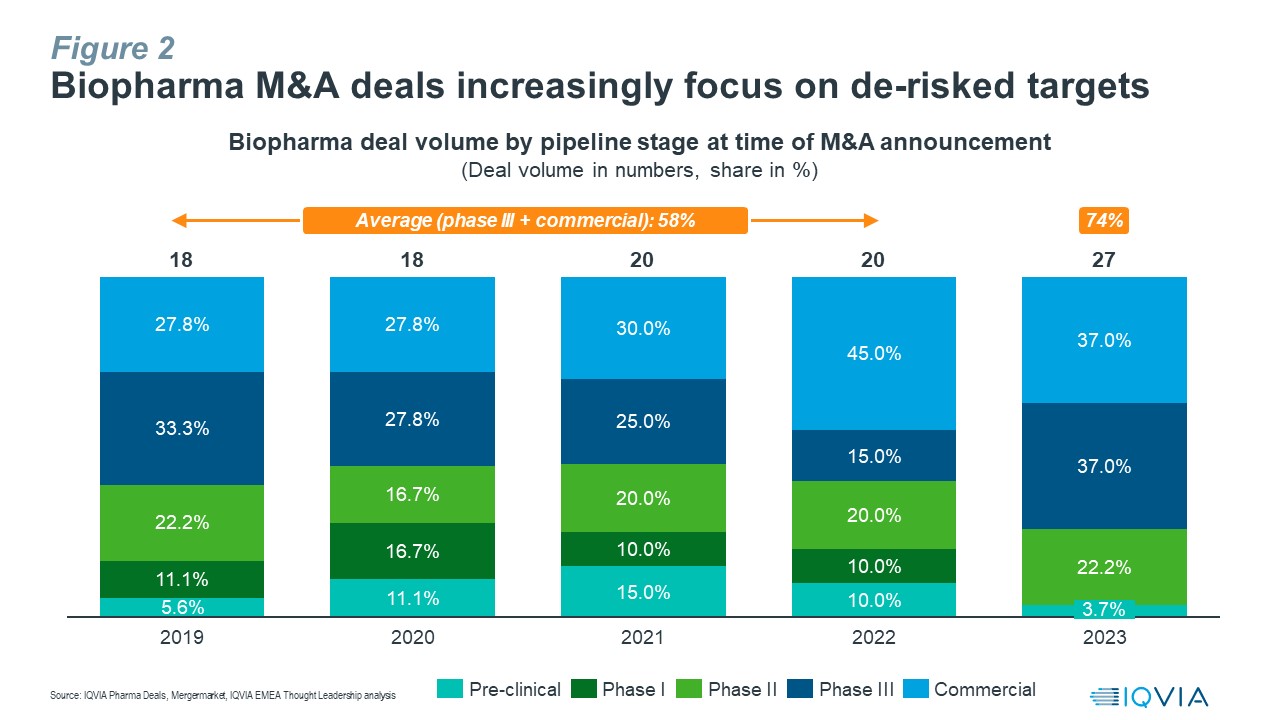

M&A deal activity in 2023 also highlighted a significant decline in acquirers’ risk appetite compared to previous years, with 74% of transactions focused on de-risked targets with assets which were at least in phase 3 or already on the market, an increase of 16% compared to the average share of 58% for such deals during the four-year period from 2019 to 2022 (see Figure 2).

Unsurprisingly, oncology as hotbed of biopharma innovation was the leading therapy area (TA) for M&A deals in 2023, representing 48% of deal value.

Interestingly, CNS, long shunned by big pharma, was the focus of several high-profile deals in 2023: BMS-Karuna ($14Bn); AbbVie-Cerevel ($8.7Bn) and Biogen-Reata ($7.3Bn), with the former two deals centred on leading schizophrenia assets with a novel MoA, muscarinic receptor agonists, for treating psychosis. Overall, CNS became the #2 TA in focus of M&A deals last year, with 21% value share.

Immunology dropped from its #1 spot in 2022 to third rank by deal value, with a share of 14%.

Cardiometabolic assets, especially those focussed on obesity, saw a surge in interest in 2023 as acquirers were eager to participate in the industry’s latest, innovation-fuelled growth bonanza. Such strong demand elevated this TA to fourth place, with a deal value share of 9%, while it was only second to oncology by deal volume, with a share of 22% (see Table 1).

Table 1: Cardiometabolic-focussed M&A deals in 2023

| Acquirer | Target | Indication | Total deal value (M) |

| Roche | Carmot Therapeutics | Obesity, T1D, T2D | $3,100 |

| Sanofi | Provention Bio | T1D | $2,815 |

| Lilly | Versanis | Obesity, heart failure | $1,925 |

| AstraZeneca | CinCor | Hypertension, CKD | $1,635 |

| Chiesi | Amryt | Lipid disorders, HoFH | $1,429 |

| Novo Nordisk | Inversago | Obesity, metabolic disorders | $1,075 |

Overall, 2023 turned out as a very reasonable year for biopharma M&A, however, we did not see deal activity roaring back to the frantic levels of 2019.

Outlook: Biopharma M&A in 2024

As 2024 gets underway, the fundamentals in support of dealmaking continue to be strong:

- Deal capacity: Already by 2023, big pharma amassed a formidable war chest, equating to $0.8Tn deal capacity among the top 15 companies, which we expect to grow to $1.2Tn through 2025. The stellar success of Novo’s and Lilly’s GLP-1 franchises in both diabetes and obesity, possibly to be followed to some extent by other market entrants, will further add to the available M&A firepower. Much of this dry powder has yet to be deployed.

- Growth gap: Between 2023 and 2030, $210-$250Bn of biopharma industry revenue is facing LoE exposure in the critical US market alone, thus creating an urgency to replenish pipelines and portfolios to drive future growth.

- Supply side: Innovation continues to be dominated by Emerging Biopharma Companies (EBPs), accounting for over 280 unpartnered assets currently in phase 3 which are owned by pre-commercial biotech companies without any revenues. While the funding environment for EBPs is showing early signs of improvement, it will take time to fully recover and feed through to the market. At the same time, we do not expect a return to the frothy days of easy money seen in 2020/21, leaving many EBPs to still pursue exits via the M&A route.

In addition to these strong fundamentals, there are incremental positive catalysts to provide further support for deal momentum in 2024:

- New threats to growth: Challenges from new policies and cost-containment measures are a common theme across major pharmaceutical markets and increase the need to replenish revenue via deals. For example, the IRA in the U.S., including the prospect of direct price negotiations by Medicare; the GKV-FinStG, Germany’s Statutory Health Insurance System Financial Stabilization Act, freezing drug prices until 2026, while increasing mandatory rebates from 7% to 12% and reducing the free-pricing period from 12 to 6 months, alongside other measures; or the new EU Pharmaceutical Legislation, e.g., proposing to shorten Regulatory Data Protection and orphan drug exclusivity, adding potential medium-term risk for which companies may want to start preparing in 2024.

- Fear of missing out: The emergence of new growth platforms meets growth-seeking big pharma companies eager to secure a stake in those opportunities, for example, novel modalities such as ADCs or radiopharmaceuticals; or the revival of stalled TAs as a result of breakthrough innovation, e.g., GLP-1s in obesity or novel MoAs for treating a range of CNS indications, e.g., Alzheimer’s, schizophrenia or depression. M&A provides an attractive route for quickly establishing a presence and closing any portfolio gaps.

- Renaissance of high prevalence conditions: Commercialisation of the new wave of transformative therapies for conditions with sizeable patient populations, such as obesity, NASH or Alzheimer’s, compounded by the absence of an effective standard of care, requires extensive market shaping and the engagement of a large customer universe. The commercial infrastructure and investment levels needed put self-commercialisation beyond the reach of most EBPs, even if well-funded, and thus force such companies to seek commercialisation partners for their assets, including via the M&A route.

Despite such a positive sentiment, some uncertainties remain which may result in potential headwinds for M&A momentum in 2024.

A more benign interest rate outlook for 2024, especially as signalled by the U.S. Federal Reserve, will improve the funding environment for EBPs. However, its overall impact on biopharma M&A is more nuanced, as opposing forces play out:

-

Asset prices will likely increase, as EBPs have alternatives to the M&A route, triggering a potential snowball effect: Higher valuations for public biotechs, leading to bigger follow-on rounds which may unblock the IPO route, as more private companies are keen to tap into revived public markets. For context, by the end of December 2023, the XBI biotech index was up by nearly 42% vs. its bottom in late October 2023, while 3 biotech IPOs were announced in the first week of 2024 alone vs. a total of 20 in 2023 – a harbinger of the IPO window re-opening at last?

- As returns on cash holdings start to look less attractive, generalist investors may also be encouraged to return to public biotech investment, with the extra demand further contributing to higher asset prices.

- Private funding could also be buoyed, as institutional investors may fear they will miss out if they don’t secure a stake in private biotechs before they go public.

- Recently announced closures of new, oversubscribed life science funds by Goldman Sachs and TCG Crossover suggest that limited partners are becoming more interested again in both private and public biotech investments.

- At the same time, big pharma deal capacity will largely be unaffected by lower interest rates, especially for bolt-on acquisitions, as they typically do not rely on debt financing. Given the continuing, pressing need for big pharma to close a sizeable growth gap, demand for M&A deals will likely be inelastic. At higher valuations of potential targets, this combination would drive up overall M&A momentum in value terms.

As in 2023, the Federal Trade Commission’s (FTC) more activist stance continues to be a source of uncertainty for dealmakers in 2024. Once focused on direct competition, especially scrutinising the impact of large transactions, the FTC now applies a wider lens to how it assesses the impact of deals on pharma companies’ negotiating power.

- In late 2023, the FTC made an unprecedented move: It threatened to block Sanofi's deal to license a phase 1 asset for Pompe disease from Maze Therapeutics, leading Sanofi to terminate the agreement. This was the first time an FTC challenge has targeted a phase 1 clinical programme that is years from the market, on the basis that such deal would have eliminated a nascent competitive threat to Sanofi’s own Pompe disease efforts.

- On the other hand, two mega-deals, initially challenged by the FTC on anti-competitive grounds, were completed last year after all: (i) Amgen’s $28Bn acquisition of Horizon, in October 2023; (ii) Pfizer’s $43Bn acquisition of Seagen, in December 2023.

Ultimately, we expect greater FTC scrutiny will impact specific deals, or deal types, rather than discouraging M&A activity across the board, while dealmakers will proactively navigate potential regulatory risks.

The broader geopolitical outlook for 2024 remains challenging, e.g., ongoing conflicts, the U.S.-China strategic rivalry or the wider deglobalisation creating new barriers to cross-border sourcing of bio-medical innovation and its commercialisation. The outcome of the U.S. presidential election in November 2024, and its impact on the direction of both foreign and domestic policies, represents another, major unknown for public markets. Collectively, these incremental uncertainties will weigh on dealmaking sentiment.

Considering the dynamic interplay of all these factors that we elaborated on, including strong fundamentals, incremental catalysts, remaining uncertainties and potential headwinds, on balance our outlook for 2024 is more bullish compared to 2023.

Therefore, at this point in time, we forecast aggregate M&A deal value to reach $180-200Bn in 2024.

As for deal focus in 2024, we expect a preference for bolt-on acquisitions and de-risked assets to continue, while cardio-metabolism/obesity is likely to cement its new-found popularity alongside acquirers’ perennial favourites oncology and immunology.

Finally, while we have focused on M&A transactions in this blog, it is important to note that other deal types – beyond taking outright ownership of target companies or assets – will also play a vital role, such as licensing agreements, joint ventures, collaborations and (R&D) partnerships, as dealmakers navigate the entire risk spectrum in pursuit of future growth.

Acknowledgements

The authors would like to thank Aaron Wright and Helena Bayley for their analytical support to developing this blog.

Key data and information sources

IQVIA Pharma Deals; IQVIA Forecast Link; IQVIA Pipeline Link; Mergermarket; Refinitiv Workspace; company financial reports; company press releases and deal announcements; IQVIA EMEA Thought Leadership desk research and analysis

You may also be interested in

Related solutions

See how we partner with organizations across the healthcare ecosystem, from emerging biotechnology and large pharmaceutical, to medical technology, consumer health, and more, to drive human health forward.