- Blogs

- Find the signal: navigating an increasingly complex oncology M&A space

Oncology remains the world’s largest therapeutic area and a hotbed for innovation. In 2020, In 2020, over 30% of new medicines were in cancer including many targeting specific genetic mutations i. The surge in innovation, accompanied by a strong focus across health systems to increase early cancer diagnosis and expand access to treatments, has caused global spending on oncology drugs to soar. The total number of new (oncology) drugs in the R&D pipeline reached almost 3,500 in 2020, up 75% since 2015. i

The pay-off for developers of these drugs can be considerable. The success of these products drove $164 billion in revenues 2020, including Keytruda, which generated more than $14B in salesii . The category is expected to exceed $269 billion by 2025 as more innovative products come to market.

Oncology innovation: potential for growth

The huge potential revenue from these drugs is making oncology the most dynamic M&A category in the pharmaceutical marketplace. Most oncology innovation is coming from emerging biopharma companies. Many of them are shifting their early-stage pipelines to more sophisticated mechanisms of action (MoA) and developing second generations of current technologies to deliver improved versions of already successful treatments.

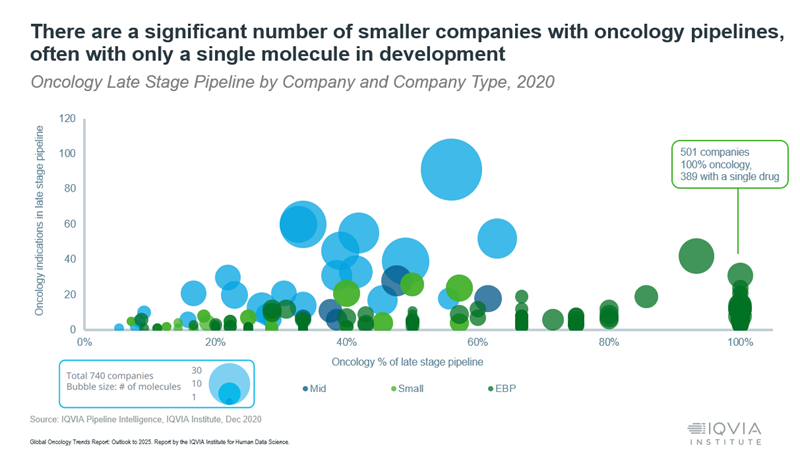

These small companies hold big promise, yet most of them (80%) have only one asset in development and often lack the ability to successfully bring these products to market (see Figure). This limitation is drawing the attention of big pharma companies seeking partnerships, licensing deals, and acquisition opportunities. They see the acquisition of promising novel therapeutic agents as a key to winning in the space, and accelerating delivery of the next new blockbuster oncology treatment.

However, competition for these deals is fierce and they include a lot of potential risk.

Oncology trials often take longer to complete than other diseases and are more complex due to eligibility criteria and endpointsiii, and the cost to develop these drugs is rising. Yet the success rate of these trials is at a decade-low of less than eight percent. Clinical trial complexity has also increased, driven by the growing number of endpoints and eligibility criteria.

How to find the hidden gems

The combination of competition and complexity is making it difficult for investors and pharma corporations to find promising products to in-license or companies to acquire, and to vet the benefits and risks of these deals when they find them.

Currently, many biopharma companies developing promising oncology drugs have either 1) entered collaboration agreements, 2) have already been acquired, or 3) are very expensive. Extensive clinical and commercial due diligence is required before M&A decisions can be made.

This is pushing investors to focus on companies that are still in pre-proof-of-concept and early phase 1 trials. The early-stage pipeline includes a significant number of promising new approaches to precision medicine, along with next-gen research focused on gene editing, adoptive cell therapies, and RNA therapeutics.

Often, these companies and early-stage therapies can be acquired at a lower cost than those in later phase trials – if the buyer has an appetite for risk. However, the lack of proven success, limited data, and years-long research still to be conducted make it harder for investors to properly evaluate these early phase opportunities.

Risky proposition

Understanding the potential benefits of a treatment in development is only part of the M&A evaluation process. Investors also need a deep understanding of the technology being leveraged to drive development, and the key talent and long-term vision of the team.

These decisions require knowledge of the global oncology development landscape, and access to the right data to accelerate these investment decisions. The data on these early phase trials is generally slimmer and more obscure, but a comprehensive market analysis that evaluates published articles, conference sessions, capital flows, MoA interest, and online discussions can help investors determine which early stage companies have the potential to deliver exciting new oncology treatments to market.

Once investors have a short list of candidates, they can assess the scientific rationale behind the research, future demand for a treatment, and quality of the team, the technology, patents, and other indicators of success.

While there will always be risk in the early-stage oncology space, a data-driven approach to vetting emerging biopharma developers can help companies make the most informed decisions about their own risk tolerance and find the right balance of risk and reward when investing in these companies.

Check back here for future articles on how to use data to inform M&A decision making in the oncology space.For more information about IQVIA’s Asset and Portfolio Strategy services, contact Dr. Pedro Andreu Perez at pedro.andreu@iqvia.com, or Frank Herrmann, frank.herrmann@iqvia.com or visit IQVIA.com.

ihttps://www.iqvia.com/insights/the-iqvia-institute/reports/global-oncology-trends-2021

iihttps://www.fiercepharma.com/special-report/top-20-drugs-by-2020-sales-keytruda

iiihttps://www.iqvia.com/insights/the-iqvia-institute/reports/global-trends-in-r-and-d