- Blogs

- Enhancing Biosimilar Analysis

Introduction

Biosimilars or ‘follow-on-biologics’ are biologic products similar to a reference biologic and for which there are no clinically meaningful differences with respect to purity, safety and potency. Once patents expire for biologic medicines, opportunity opens for cheaper biosimilars to enter the market, as seen for small molecule generics. Since their inception, biosimilars have garnered popularity and acceptance in the medical armamentarium. This is attributed to reduced healthcare costs – both for the patients and the payers.

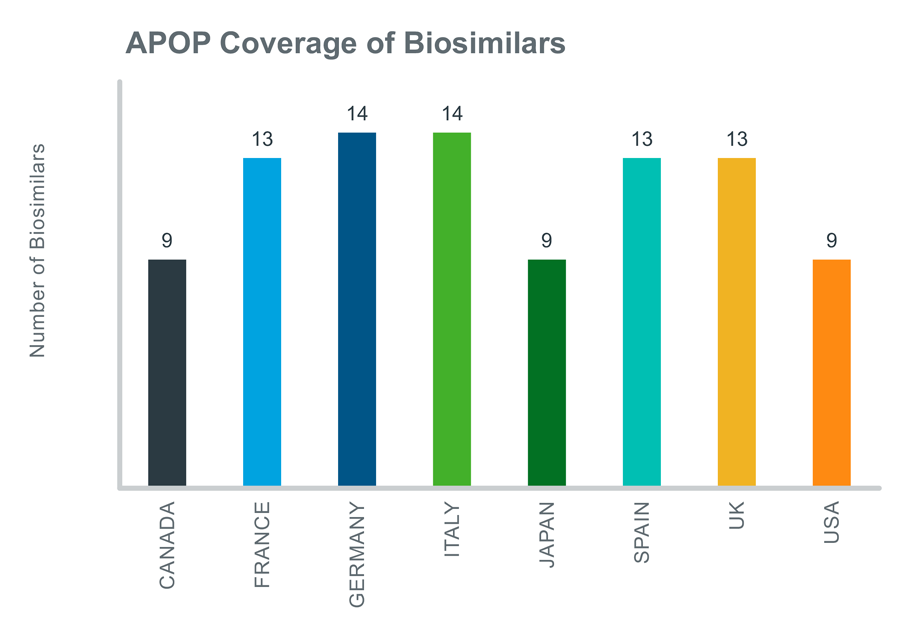

Biologic Loss of Exclusivity events (LOEs) have grown in importance in the last 10 years due to the loss of protection of some of the world’s highest value products: Humira, Enbrel and Remicade. It is speculated that this trend will continue throughout the next 10 years due to the high number of biologic launches. Keeping this in view, the IQVIA Analogue Planner Off Patent (APOP) tool 2021 launch has incorporated biosimilars for the first time to its extensive pool of generics across 8 countries to support the generation of justifiable forecasts for branded products (small molecule and biologic) and their generic competitors following patent expiry. The below exhibit shows the coverage of 94 Biosimilars across 8 major markets in APOP.

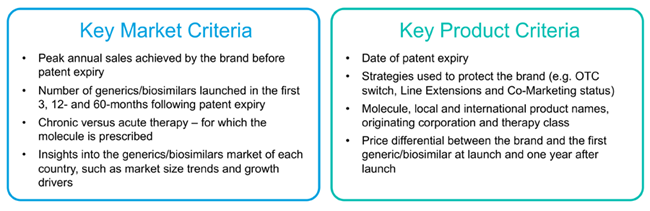

The tool provides a database of historical LOE events which are categorized against 27 key criteria that may affect generic/biosimilar impact. These criteria include basic information such as therapeutic class, originating corporation or formulation, to more detailed analysis around sales and volume erosion, price differential or promotional spend – the tool encompasses all. These criteria can be used to identify analogues for future LOE events and consequently forecast the likely impact on original brand and generic/biosimilar competitors.

The APOP interface thus enables the user to enrich their analysis and forecast future LOE events by selecting any combination of the key criteria to identify suitable historical analogues. For example, using the APOP database it was observed that on average, historical biosimilars had been launched at a price differential of 20-24% in France.

Biosimilars’ Market Overview

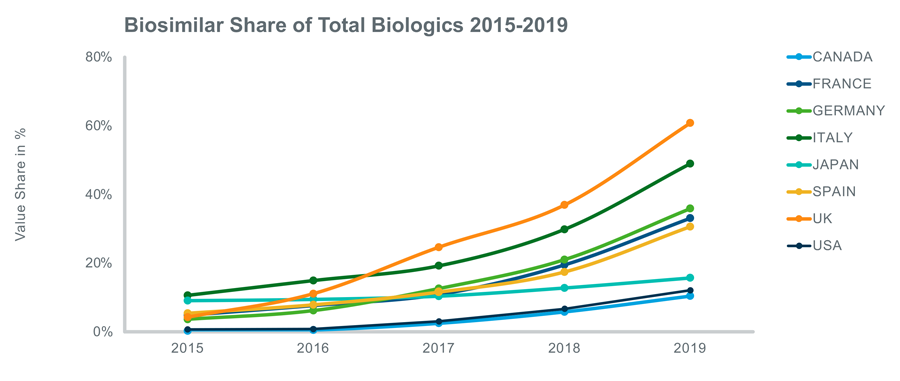

The global biosimilars market currently shows double-digit growth and is expected to maintain a similar level of uptake in the coming years. This will be driven by the rising incidence of chronic diseases and the cost-effectiveness of biosimilars, especially as more stringent cost-containment measures are likely post the COVID-19 pandemic.

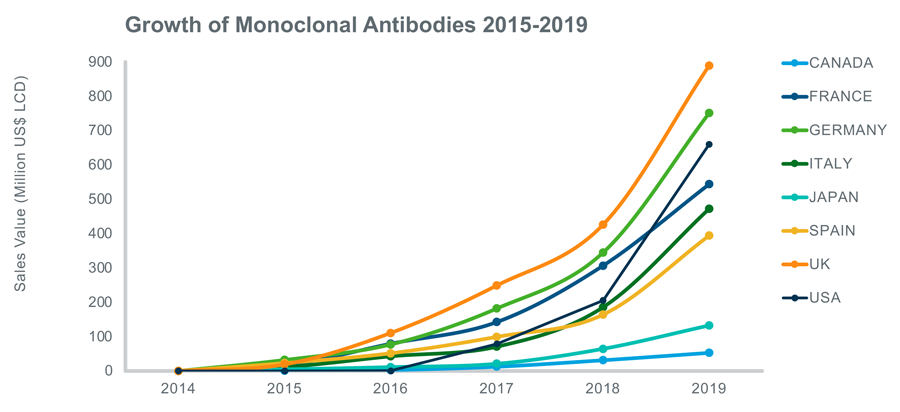

This trend is clearly seen across the 8 countries covered by APOP - the below figures portray the rising trend of biosimilars since 2015.

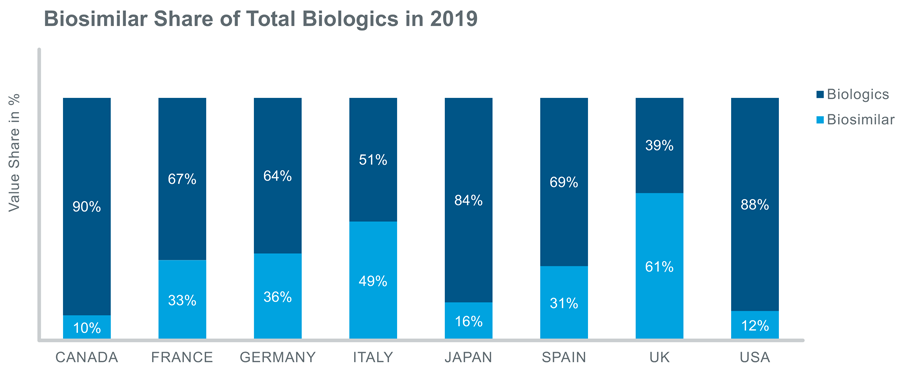

If we look at the share of biosimilars in each country in 2019, it is clear that the uptake of biosimilars is more advanced in the EU5 markets:

At the therapeutic level - the biosimilar industry is segmented into insulin, monoclonal antibodies, recombinant human growth hormone, granulocyte colony-stimulating factor, interferon, erythropoietin, etanercept, follitropin, glucagon, calcitonin, teriparatide and enoxaparin sodium. Of these segments, the monoclonal antibodies tend to capture the bigger market share owing to rising incidence of cancer and increase in the number of product launches or approvals. The chart below shows sales growth of monoclonal antibodies in the eight APOP countries since 2015.

The Analogue tool can support a wide range of such analyses. The data covered in APOP is at brand, molecule and generic level and includes several measures such as: Sales in dollars (LCD), Standard Units (SU), Kilograms (KG), Market share at molecule and ATC4 level and Price per standard unit (SHP). By combining these measures with the selection criteria, the user can perform a range of different analyses and build a deeper understanding of the generic and biosimilar markets.

Conclusion

Biosimilars are expected to continue to grow their market share, aided by patent expiries and regulatory improvements which will permit easier and more rapid market access. Pharmaceutical companies witnessing this trend have now started to leverage the biosimilar opportunity.

With a rich pool of 3769 historical LOE events including biosimilars, Analogue Planner Off-Patent thus provides potential benchmarks for forecasting brand erosion, generic/biosimilar uptake and enables the user to leverage these trends to their advantage.