- Blogs

- Interleukin Inhibitors to Continue Driving Psoriasis Market Growth

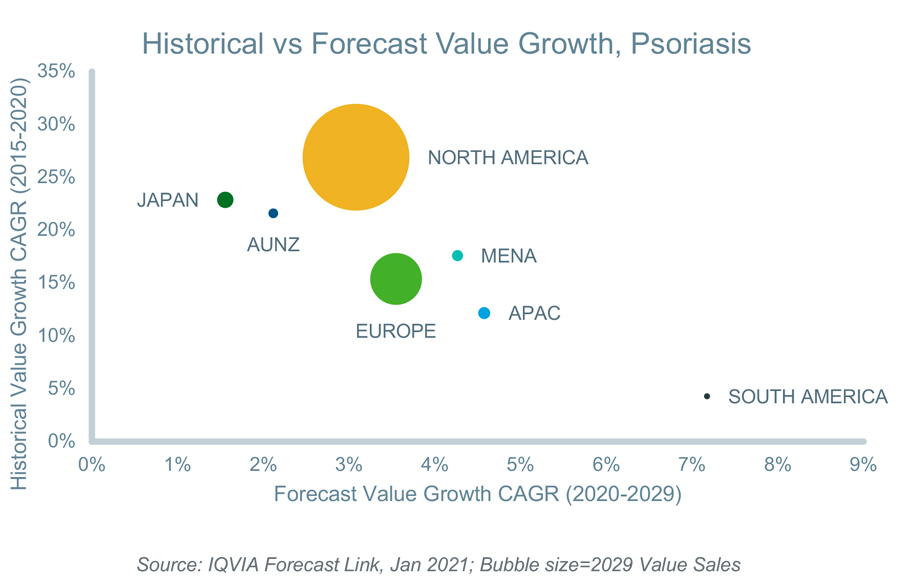

Psoriasis was the leading dermatology condition globally in 2020 with an estimated market value of $25.3bn and it looks set to maintain this top position over the next decade. The condition is a chronic, immune-mediated disease characterized by red, scaly, raised patches or plaques on the skin and affects approximately 125 million people worldwide.1 Estimates of psoriasis prevalence vary considerably since standard diagnostic criteria and study designs are lacking, but it is generally agreed that prevalence is increasing.2 Importantly, prevalence varies considerably across regions; it is higher in countries further away from the equator and virtually nonexistent in Asia; and this partially accounts for the large difference in market size across regions. Until 2003, pharmacological treatment consisted of non-biological products such as topical corticosteroids, vitamin D analogues, keratolytics and calcineurin inhibitors, and for more serious disease, drugs such as methotrexate or ciclosporin.3 However, the availability of biologics targeting specific immunologic pathways implicated in the pathogenesis of the disease, such as the tissue necrosis factor (TNF) inhibitors and the interleukin (IL) inhibitors resulted in significantly improved treatment outcomes and a boom for the psoriasis market. According to IQVIA’s Forecast Link, global value sales increased 192% between 2015 and 2020. Growth is beginning to slow due to the availability of lower cost biosimilars, but positive value growth will continue globally and across all regions due to rising prevalence and continued prescription demand.

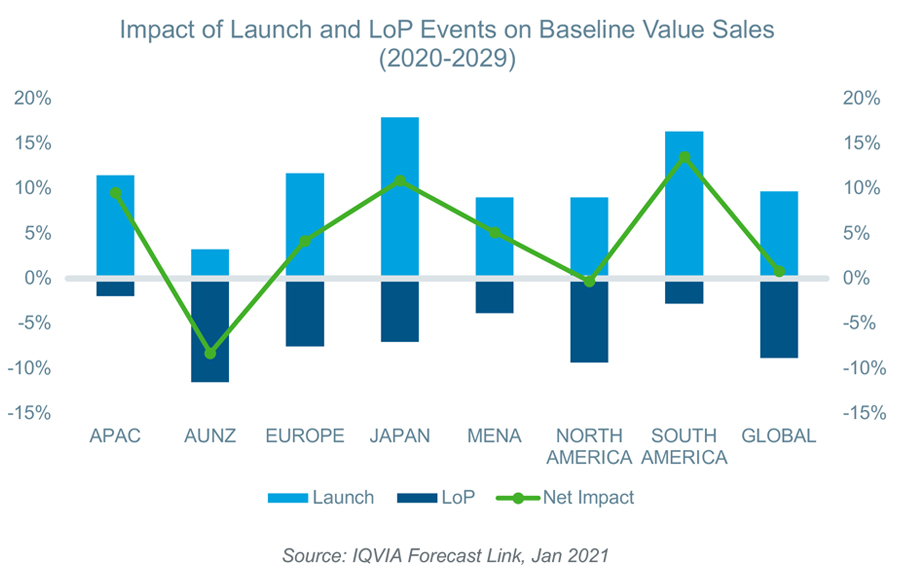

In addition to baseline prescription demand, new product launches and loss of protection (LoP) events will have an impact on the psoriasis market. New product launches consist of currently marketed IL inhibitors and TNF inhibitor biosimilars becoming available in more geographies as well as new molecules coming to the market for the first time. New biologic molecules expected to launch include IL-17 and IL-23 inhibitors, and the first IL-36 inhibitor, although the impact of these products is expected to be minimal as the former are late entrants and the latter is not expected to launch until late in the coming decade. Novel non-biologic molecule launches are anticipated to include an orally administered tyrosine kinase 2 (TYK2) inhibitor, a topical phosphodiesterase type 4 (PDE4) inhibitor and a topical therapeutic aryl hydrocarbon receptor (AhR) modulating agent (TAMA). Among these, the TYK2 inhibitor is considered the most promising because it is an orally administered product which blocks the same immune cytokines as the highly effective interleukins which must be administered parenterally.4 Meanwhile, sixteen molecules are expected to experience LoP events over the next decade and the most significant of these include IL-17 and IL-23 inhibitor products opening the interleukin class of products to biosimilar competition. The net impact of these events will be positive in all regions apart from AUNZ. Value growth in AUNZ is expected to remain positive, however, due to stronger baseline prescription growth in that region.

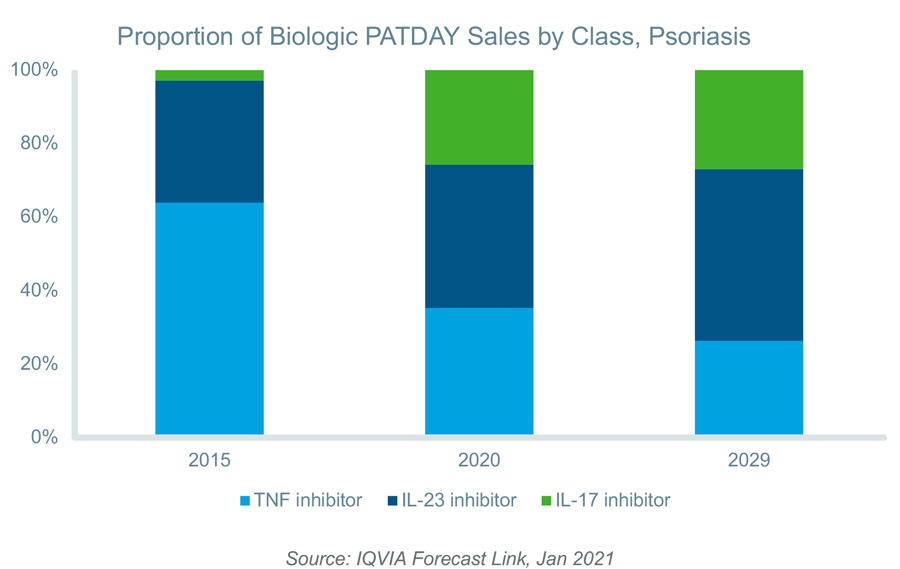

Another factor contributing to positive value growth is greater use of higher cost IL inhibitors and this trend is expected to continue over the next decade. The preference for IL inhibitors stems from several factors including more targeted mechanism of actions, fewer warnings and side effects, faster onset of effect and more durable responses than TNF inhibitors.5 In 2015, TNF inhibitors accounted for 64% of all biologic patient days (PATDAY) and by 2029, IL inhibitors are collectively expected to account for approximately 74% of biologic PATDAYs. Given that IL inhibitors are priced approximately 30% more than TNF inhibitors on an average implied cost per patient day basis, the shift in volume to IL inhibitors has and will continue to result in positive value growth.

Between 2020 and 2029, the global value of the psoriasis market will increase by a CAGR of 3% reaching $33.5bn by 2029. Although biosimilars will decrease the average implied cost per patient day of biologics, rising prevalence and a shift to the more effective and costly interleukin inhibitors will continue to drive positive value growth albeit at a slower rate than that seen in recent times. TYK2 inhibitors hold the potential to provide an equally safe and effective means of combating the disease as the interleukins in an orally administered form and are therefore also expected to drive positive value growth. As a result, psoriasis will hold onto its position as the leading dermatology market globally.

1 Armstrong AW, Read C. Pathophysiology, Clinical Presentation, and Treatment of Psoriasis: A Review. JAMA. 2020;323(19):1945–1960. doi:10.1001/jama.2020.4006

2 Global Psoriasis Atlas Annual Report. Year 2: April 2018 – March 2019.

3 Rønholt K, Iversen L. Old and New Biological Therapies for Psoriasis. Int J Mol Sci. 2017 Nov 1;18(11):2297. doi: 10.3390/ijms18112297. PMID: 29104241; PMCID: PMC5713267.

4 Nogueira M, Puig L, Torres T. JAK Inhibitors for Treatment of Psoriasis: Focus on Selective TYK2 Inhibitors. Drugs. 2020 Mar;80(4):341-352. doi: 10.1007/s40265-020-01261-8. PMID: 32020553.

5 Green LJ, Yamauchi PS, Kircik LH. Comparison of the Safety and Efficacy of Tumor Necrosis Factor Inhibitors and Interleukin-17 Inhibitors in Patients With Psoriasis. J Drugs Dermatol. 2019 Aug 1;18(8):776-788. PMID: 31424708.

IQVIA Forecast Link provides regularly updated and fully segmentable sales and volume forecasts across 10,000 products, 600 diseases and 73 countries. Gain insights into current and future market landscapes and power your strategic decision making via this single easy-to-use platform providing unrivalled breadth of coverage. To learn more, please view the Forecast Link Video.