- Blogs

- Novel therapies drive growth in the atopic dermatitis market

Based on IQVIA’s Forecast Link, this article considers how the atopic dermatitis market is expected to develop over the next 10 years, and how new product launches and generic entries are expected to shape market evolution.

Atopic dermatitis (AD) is a chronic inflammatory skin disease characterized by dry skin and intense itching which often leads to skin trauma and considerable sleep disturbances. Sufferers can experience a significantly diminished quality of life, not only due to their symptoms, but the stigma of a visible skin disorder and the need for frequent applications of topical medications. Treatment consists of a stepwise approach based on the severity of symptoms including the liberal use of emollients and moisturizers for milder symptoms and topical steroids such as hydrocortisone, or topical calcineurin inhibitors such as tacrolimus, for moderate symptoms. Historically, options for severe or recalcitrant atopic dermatitis involved systemic agents such as oral steroids, cyclosporine, azathioprine and methotrexate. These therapies, however, possess potentially serious side effects and require careful monitoring, and as such, are only recommended for short-term use. Fortunately, recent advances in understanding about the pathogenesis of the disease has led to the development of novel therapies which offer significantly improved treatments for patients with moderate-to-severe disease.

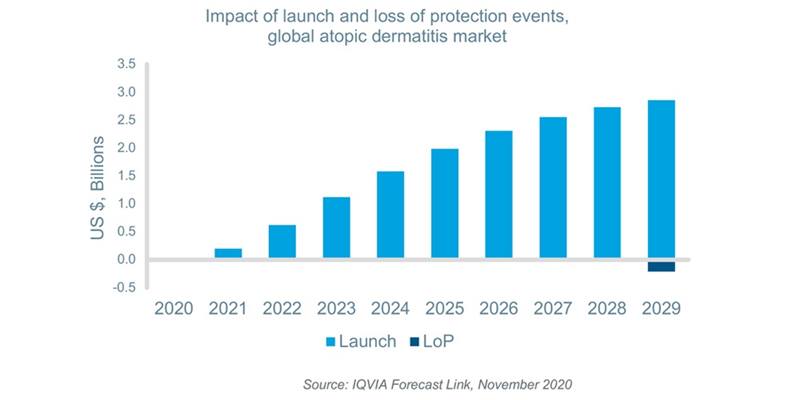

According to IQVIA Forecast Link, there will be eleven new product launches for AD including products coming from the interleukin-4 and -13 (IL-4/13), phosphodiesterase-4 (PDE-4) and Janus Kinase (JAK) inhibitor classes globally between 2020 and 2029. These new launches will provide additional options for patients with moderate-to-severe disease; improve quality of life; and drive value growth in the AD market. Seven molecules, including topical steroids, second-generation oral antihistamines, an IL-4/13 and JAK inhibitor will lose patent protection during the same time period. Although the first loss of protection events for IL-4/13 and JAK inhibitors have the potential to have a greater impact, the events will occur too late in the forecast horizon to have a significant effect. Furthermore, topical steroids and oral antihistamines account for a very small percentage of market value share. As a result, loss of protection events are expected to have a negligible impact on value sales. As the newer therapies are expected to be launched at much higher implied prices on a cost per day basis and compete with existing therapies, the net impact of these events will be positive.

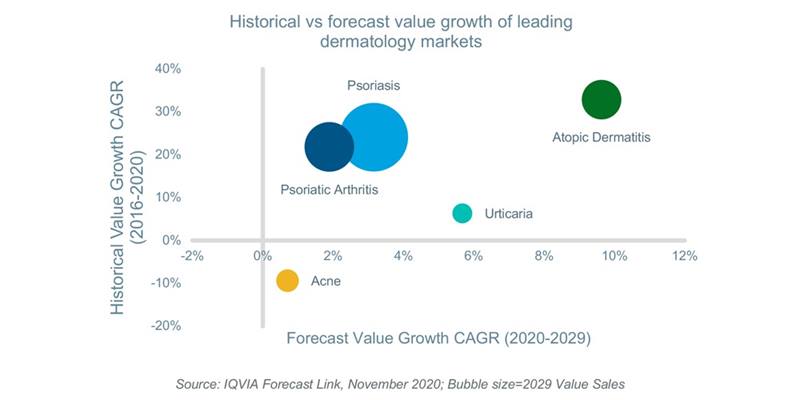

The availability of these new products and ongoing prescription demand will grow the global AD market by a CAGR of 10% in terms of value over the next decade reaching approximately $11.3bn by 2029. This represents a 130% increase over projected 2020 value sales. Moreover, during the same time period, the AD market will grow faster than other leading dermatological conditions such as psoriasis and psoriatic arthritis which are estimated to grow at a CAGR of 3% and 2%, respectively.

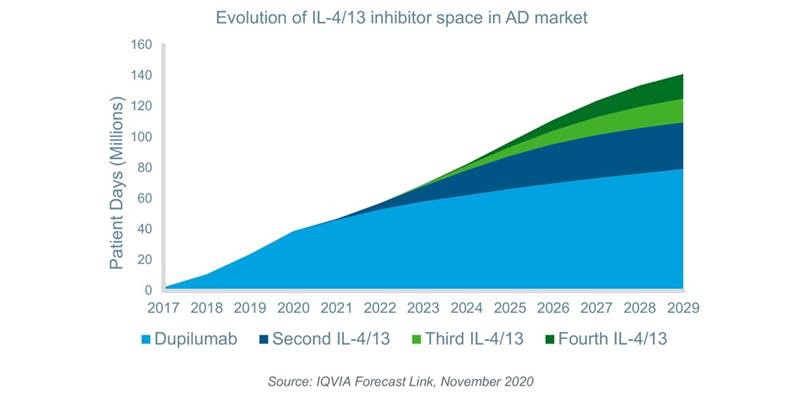

The most successful recent launch in the AD market has been dupilumab, a monoclonal antibody which inhibits IL-4/13 and is administered once every two weeks by subcutaneous injection. The drug was launched in Q2 2017 and is the first of its kind to be approved for the treatment of AD. Unlike traditional therapies, IL-4/13 inhibitors specifically target the Type II inflammation pathway which is strongly implicated in the pathogenesis of the disease. Initially approved for adults, dupilumab has expanded its indications to include adolescents, and children aged 6 to 11 years in Q1 2019 and Q1 2020, respectively. The average implied price per patient day for biologics is approximately 209 times that of non-biologics, and consequently, the drug already accounted for approximately 60% of AD value sales globally in the year to Q2 2020. Three additional IL-4/13 inhibitors are expected to launch within the next decade and while dupilumab possesses a first-to-market advantage, two of the expected new entrants are administered less frequently, i.e. once per month, providing a potential point of differentiation. By 2029, dupilumab’s share of the IL-4/13 space in the AD market is expected to decrease due to the entry of these competitors.

Crisaborole, a topical PDE-4 inhibitor and delgocitinib, an oral JAK inhibitor are other recent additions to the AD market that have driven recent historical value growth, although they have reached fewer geographies than dupilumab as of Q2 2020. JAK inhibitors exert their effect in AD by suppressing inflammation and inhibiting immune-cell activation and offer the advantage of oral administration. The exact mechanism by which topical PDE-4 inhibitors produce their effect in AD is unknown, but they improve symptoms without the need for steroids. Four additional JAK inhibitors, some of which are already approved for other indications, and one additional topical PDE-4 inhibitor are expected to gain approval for AD in the coming decade. These products are expected to be launched at a price premium compared with existing non-biologics and will increase the average implied cost per patient day of this group by 71% thereby driving value sales.

Recent launches of the subcutaneous IL-4/13 inhibitor dupilumab and topical PDE-4 inhibitor crisaborole resulted in a paradigm shift in the treatment of AD. These products offer advantages over topical steroids or systemic therapies because they are not only effective for moderate-to-severe AD, but they avoid important drawbacks of existing therapies. For example, long-term use of topical steroids can cause striae (stretch marks), petechiae (small red/purple spots), telangiectasia (small, dilated blood vessels on the surface of the skin), skin thinning, atrophy and acne. In addition, systemic therapies have a less favourable risk-benefit profile which requires careful monitoring and short-term use. While these new products are more costly, demand has already driven their collective value share to 60% of the global AD market. Several launches of new targeted therapies will occur between 2020 and 2029 that will improve quality of life for AD sufferers while driving value growth higher than is anticipated for several leading dermatology conditions.

IQVIA Forecast Link provides regularly updated and fully segmentable sales and volume forecasts across 10,000 products, 600 diseases and 73 countries. Gain insights into current and future market landscapes and power your strategic decision making via this single easy-to-use platform providing unrivalled breadth of coverage. To learn more, please view the Forecast Link Video.

1 Yang EJ, Sekhon S, Sanchez IM, et al. Recent Developments in Atopic Dermatitis. Pediatrics 2018;142(4):e20181102

2 Siedilkowski S, Sandhu V and Lynde C. Treatment of Atopic Dermatitis Using JAK Inhibitors: A Systematic Review. EMJ Dermatol. 2019;7(1):89-100.

3 Kapur S, Watson W and Carr, S. Atopic Dermatitis. Allergy Asthma Clin Immunol 14, 52 (2018).