- Blogs

- Progression of COVID 19 in Italy and the systems reaction

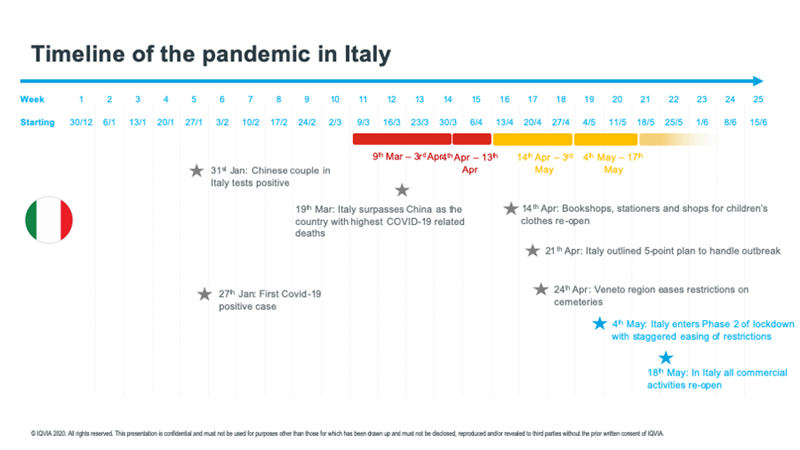

Italy was hit early and hard by COVID-19. The first case was in January, and by March, Italy had passed China in terms of the number of cases and was positioned among the top 10 countries most affected by the pandemic. In mid-March, Italy was one of the first countries to follow lockdown and other restrictive measures. Only recently, on 18 May, did commercial activities reopen, with many precautions giving way to what is called Phase 2.

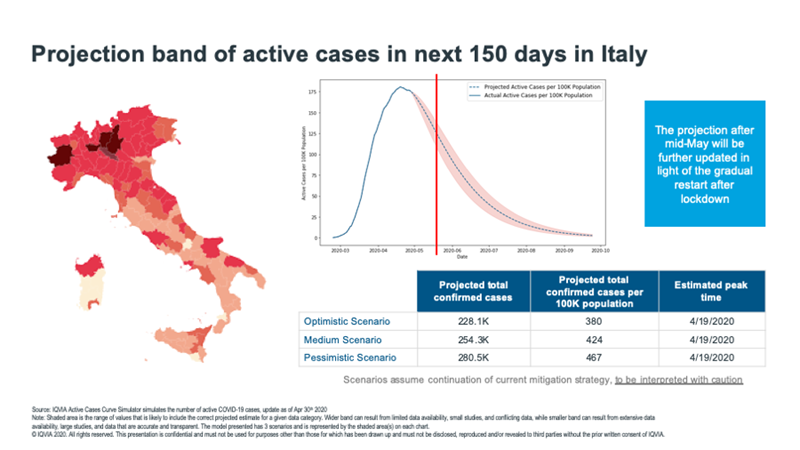

As the image above shows, the center of the pandemic has been in the northern area of Italy, especially in the Lombardy region and in the Milan area.

IQVIA has monitored the evolution of the situation in different countries and our team has developed a forecast model to predict the number of cases. We are proud to have supported the Italian Ministry of Health with our data to forecast the evolution nationwide.

We have identified three different scenarios – medium, pessimistic and optimistic – to forecast the number of cases, with an evolution spanning from 380 to 467 cases per 100k population.

Like most other countries in Europe, we saw a rapid uptake of new daily cases followed by a flattening of the curve as social distancing measures were introduced.

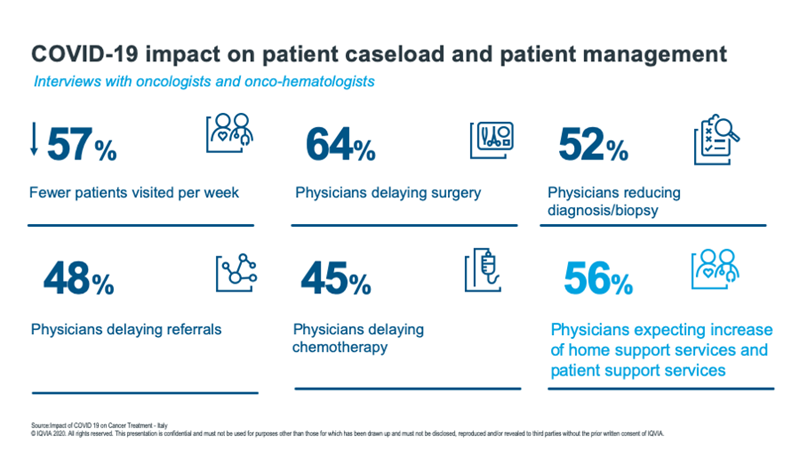

We have considered, as outlined in the image above, the COVID-19 impact on patient caseload and patient management.

We introduced the survey “Impact of COVID-19 on Cancer Treatment - Italy” among oncologists and hematologists, which claimed a significant reduction of activities in these two medical branches: 57 percent decrease of patients visited per week, 64 percent physicians delaying surgery and 52 percent reduction of diagnoses and biopsies. A decrease was recorded in referrals (48 percent) and chemotherapy (45 percent) as well.

In this survey, oncologists, when asked what they wished to see from pharmaceutical companies in the future, stated that they wanted more support in terms of oncology-specific services, including nurse support and patient support, more relevant information provision, both for oncology in general and specifically in relation to oncology and COVID-19, and fewer face-to-face interactions with reps.

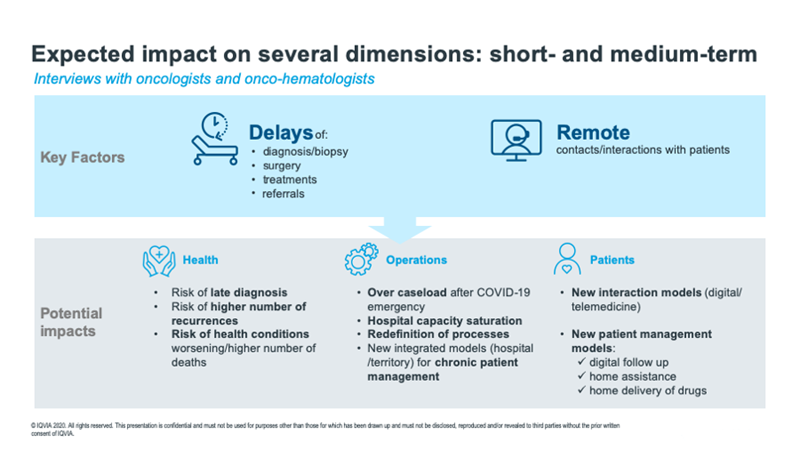

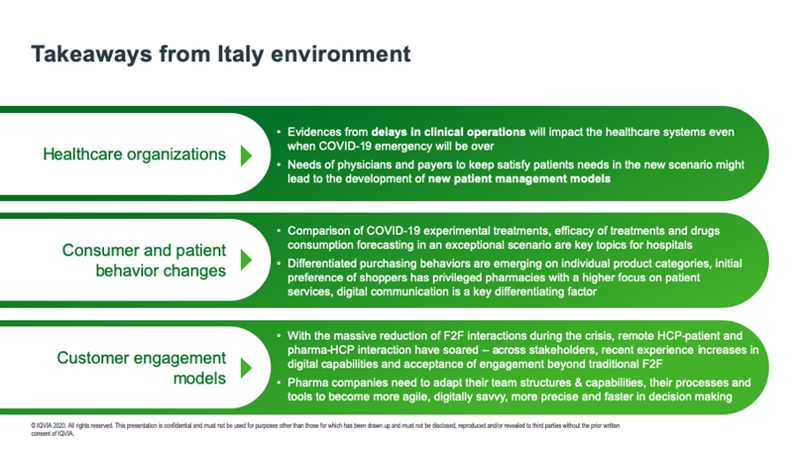

In the second half of 2020, the delays will likely decrease while the needs of new patient management models, telemedicine and digital follow-up services will remain.

In terms of consumer and patient behavior changes, we collected information from a sample of key Italian hospitals about developments on three different aspects.

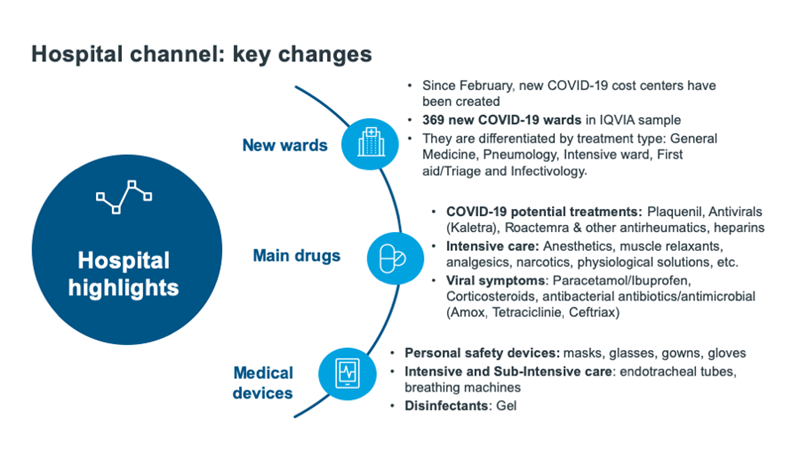

Since February, new COVID-19 cost centers have been created. The IQVIA samples counts 369 new COVID-19 wards, differentiated by treatments (general, pneumology, intensive ward, first aid/triage and infectiology).

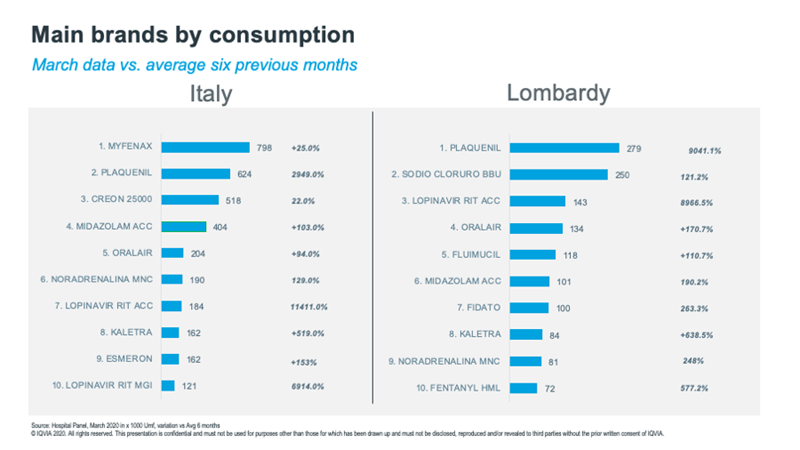

Collecting data from different hospitals, we are now able to provide a clearer representation on the evolution of prescription medicine consumption in relation to COVID-19. Based on raw data, we have seen a rise of drugs related to COVID-19 potential treatments (Plaquenil, antivirals, Roactemra and other antirheumatics, heparins), intensive care (anesthetics, muscle relaxants, analgesics, narcotics, physiological solutions, etc.) and then treatments for viral symptoms (paracetamol/Ibuprofen, corticosteroids, antibacterial antibiotics/antimicrobial).

In terms of medical devices, there has been an increase in personal safety devices (mask, glasses, gowns, gloves), intensive and sub-intensive care (endotracheal tubes, breathing machines) and disinfectants (gel).

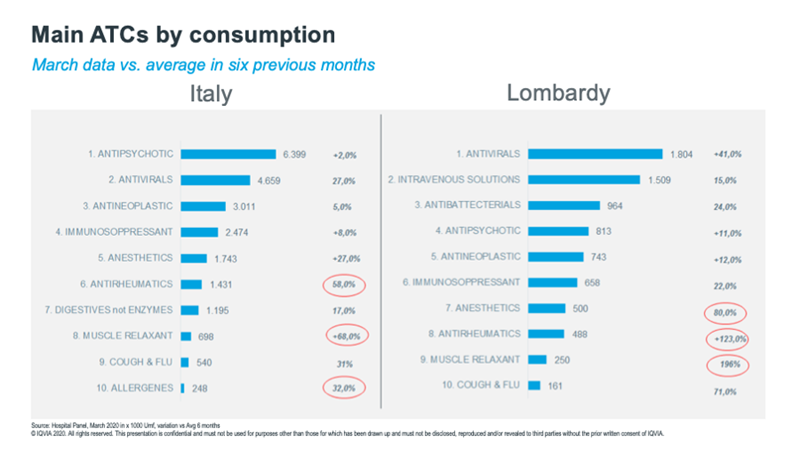

Since 22 March, the impact of the pandemic has recorded a dramatic increase in consumption of some categories of drugs in Italy, and especially in the Lombardy region. Among these, the ones increasing most are antirheumatics, muscle relaxants, and allergens.

Despite being preliminary projections, the data gives us a clear message about what happened in these months in Italy.

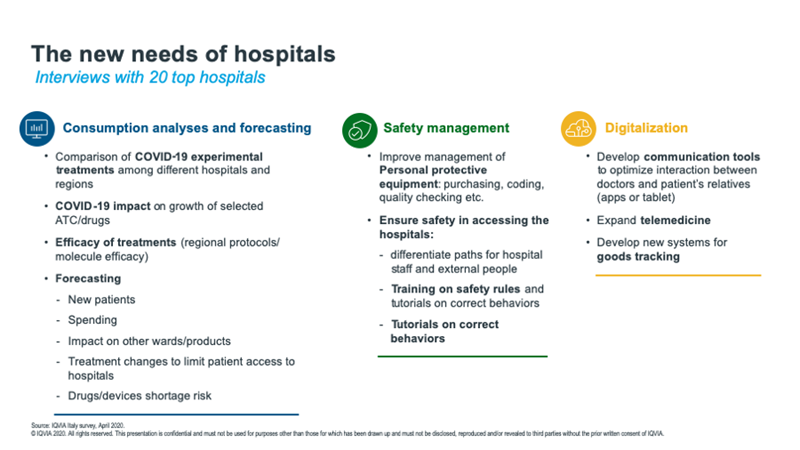

We interviewed 20 of the top Italian hospitals to understand their needs. We have had many responses whose key highlights can be split in three areas:

1. Hospitals are looking to have more information about:

- COVID-19 impact on growth of selected ATC/drugs

- Efficacy of treatments (regional protocols/molecule efficacy)

- Forecasting on patients, drugs consumption and spending

2. Safety management in order to minimize the risks:

- Improve management of personal protective equipment (PPE)

- Ensure safety in accessing the hospitals

3. Digitalization, such as developing communication tools and telemedicine practices.

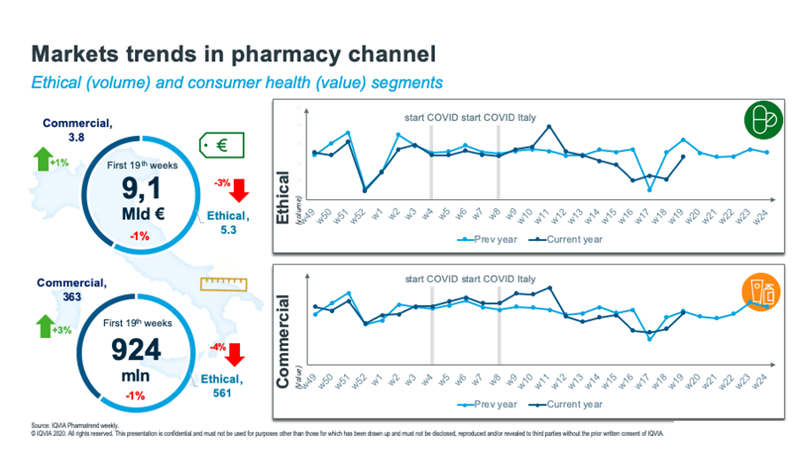

In the first 19 weeks, we are providing a weekly update about market trends in the Pharmacy channel. We captured an increase in the commercial segment and a decrease of ethical with several oscillations, if we consider the period between the beginning of March and the end of April as the lockdown phase in Italy.

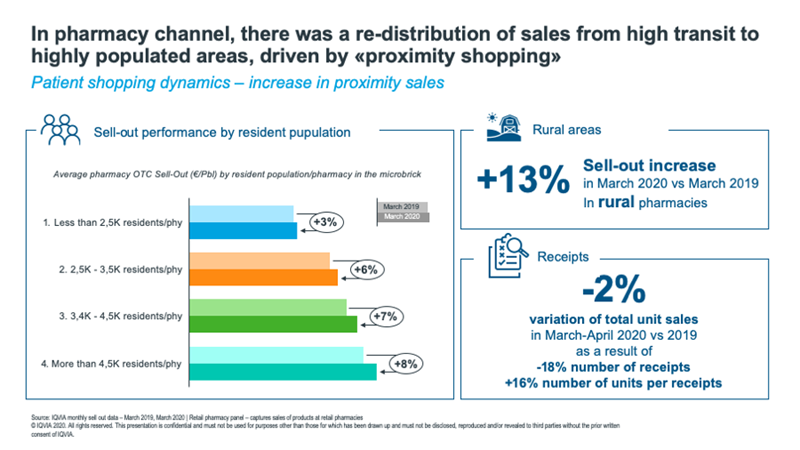

In the pharmacy channel, we have noticed that there has been a redistribution, mainly due to the use of pharmacies near the homes where people were forced to stay for the lockdown. Some changes also occurred in terms of receipts: we have experienced an 18 percent reduction in numbers of receipts and an 18 percent increase in the numbers of units per receipt.

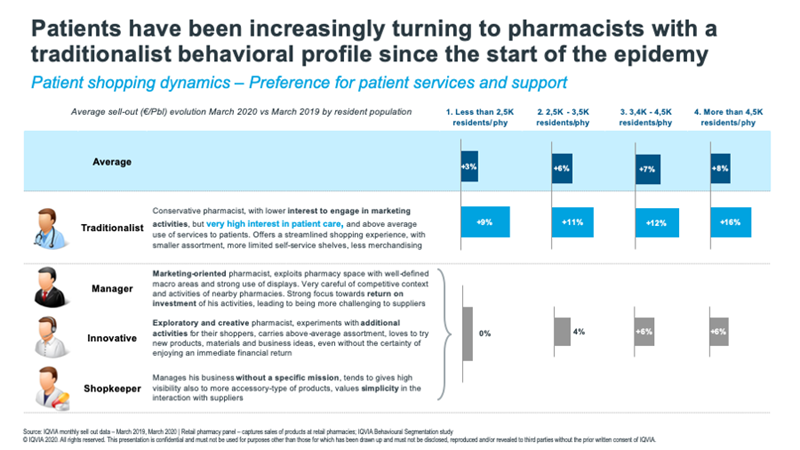

We are also considering clusters of pharmacists and we have seen that those who can be identified as traditionalists (potentially closer and more attentive to their customers) have had a good return compared to those who have adopted a more innovative approach with their customers.

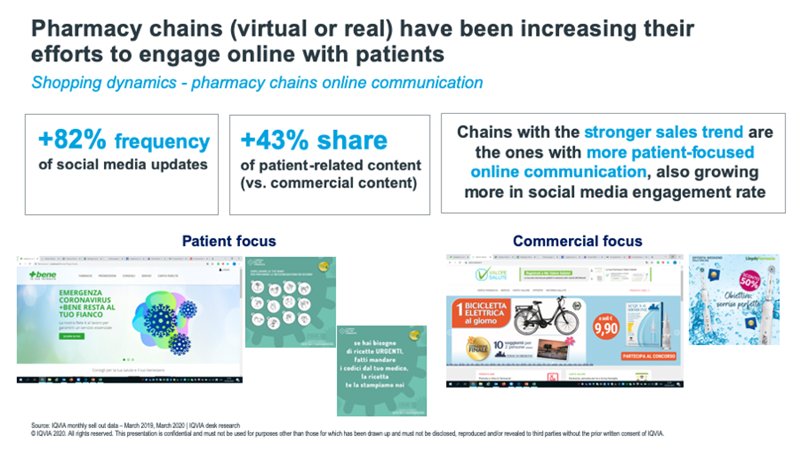

Moreover, during these months of lockdown, we recorded how the pharmacies that pushed e-commerce with e-shops were better performing. Discount policies, greater attention to communication, and making Q&A reports available to customers also proved to be successful.

Pharmacy chains are still limited in Italy. During the emergency, they invested in online communications to patients with a strong commercial focus. They were able to quickly adapt, accelerating the shift to online services in the new situation.

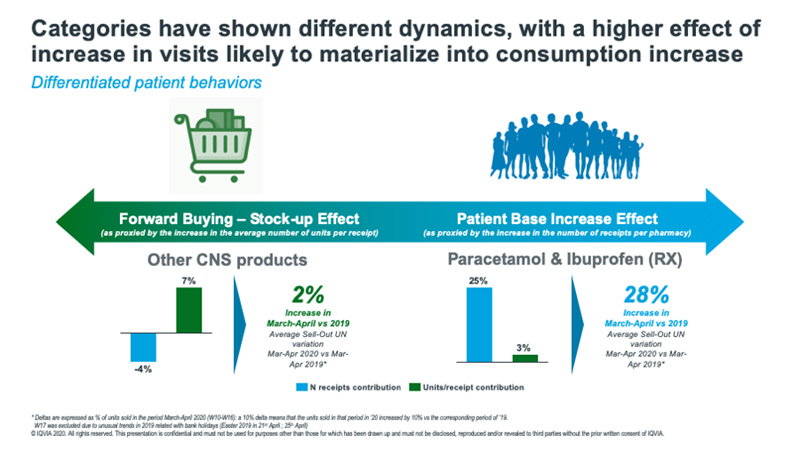

We also tracked different consumer behaviors between categories and recorded different dynamics. Some categories, like CNS products, had a stronger impact from the number of units per receipts due to forward buying and stockpiling.

On the other hand, categories like paracetamol and ibuprofen had a strong increase due to patient choice.

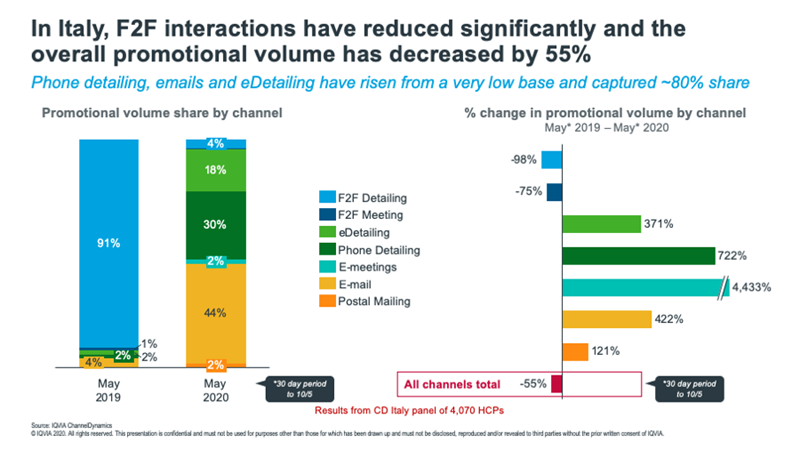

Customer engagement models show a face-to-face approach has declined compared to the same period last year, as expected, while other communication channels such as e-mail, phone detailing and e-detailing have grown exponentially.

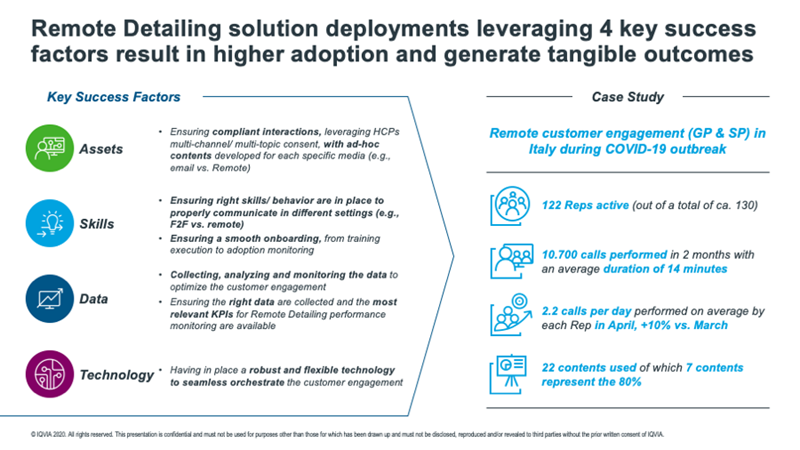

Setting up a remote detailing solution and technology is a key enabler for success. Our case, shown in the above graphic, of technology solution deployment and support during the launch phase has shown how rapidly a company can leverage a renewed approach and react to the “new normal”.

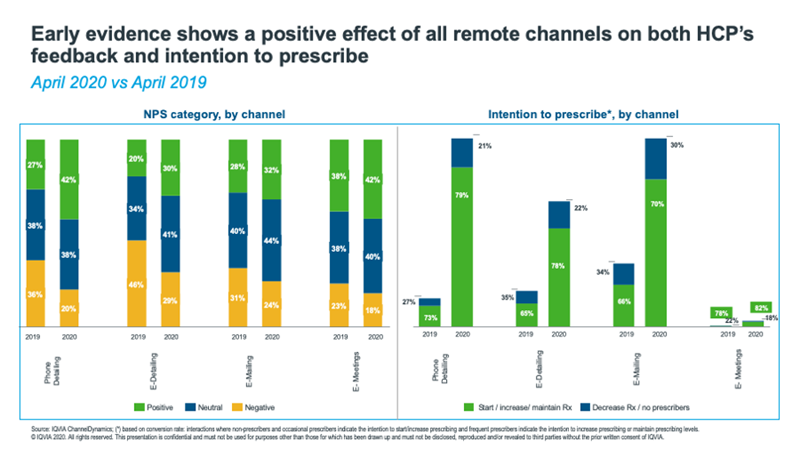

Our data shows in the graphic above, an increase of effectiveness in the usage of remote channels. Shifting to remote year-over-year has resulted in an increasingly positive outcome.

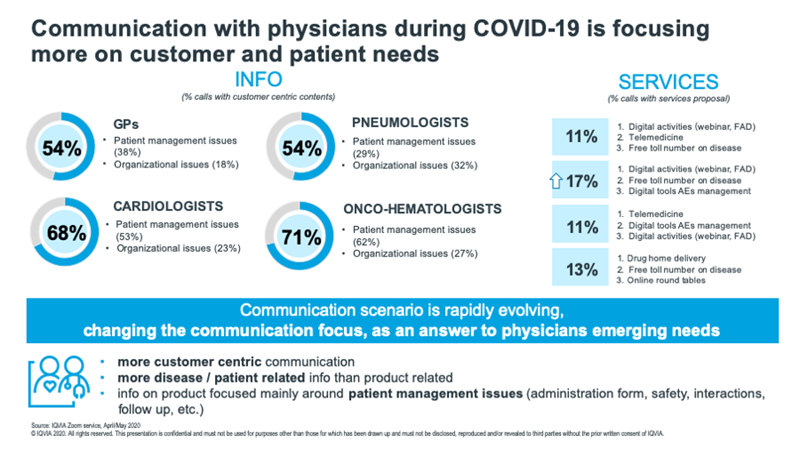

As the image above shows, communication with physicians during COVID-19 focuses more on customers and their needs. Information of the promotional activities now focuses on how to help physicians to re-organize their approach to managing patients.

In conclusion, in Italy the pandemic is leading to a general rethinking of the healthcare sector. IQVIA Italy will be able to play an important role, helping all stakeholders reimagine the patient approach, digitalize business models and use data intelligently.

For a more in-depth discussion, please contact us.