- Blogs

- Germany and the progression of COVID 19 and the systems reaction

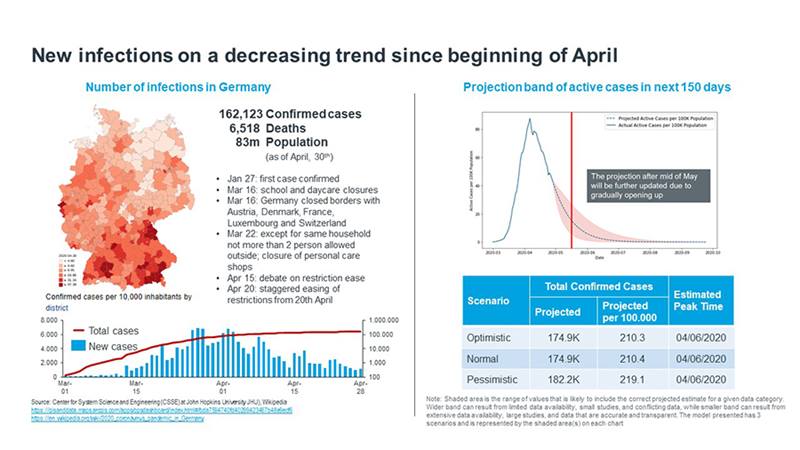

Similar to most other countries in Europe, Germany has seen a fast uptake of new daily cases followed by a flattening of the curve as social distancing measures have been introduced, as shown in the graphic above.

The map shows that the regional distribution is still influenced by the original hotspots, Bavaria and south of Germany, because of their relation to skiing — and North Rhine Westfalia, close to the Belgium Border (where the carnival took place). Both regions stayed the most affected by the number of cases while, for example the Northeast of Germany has only a few cases.

Our IQVIA data science and advanced analytics team has developed a simulation model (the IQVIA COVID-19 Active Cases Curve Simulator) to simulate the number of active cases in the next 150 days, given certain non-pharmaceutical intervention or mitigation efforts. This model, which pulls from public data sources, is a valuable, objective resource for decision making during this somewhat chaotic time. It also serves as a useful comparative tool, as we look at the progression of COVID-19 in different parts of the world.

A swift public response

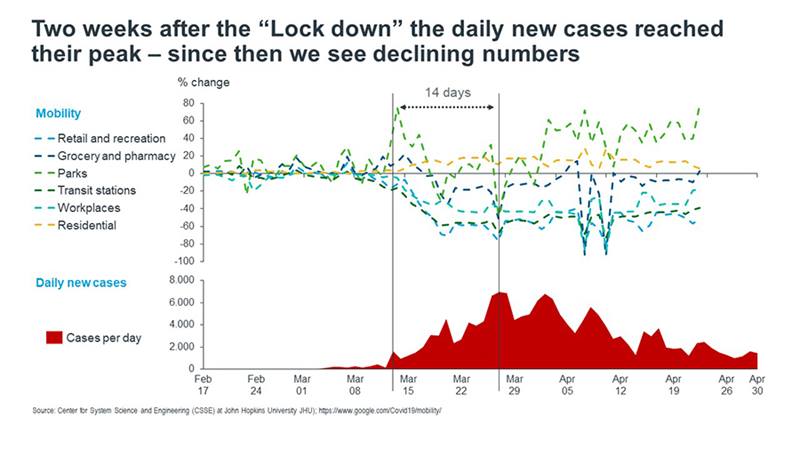

The formal lock down in Germany commenced on March 22nd, when Angela Merkel announced the rules of social distancing. However, as we can observe from the Google mobility numbers, shown in the graphic above, the German public started to lock down voluntarily a week earlier, when the borders were closed. We can also observe that this voluntary reduction of activities and the lockdown came earlier than in other countries and not related to the number of deaths. This allowed Germany to manage the number of severe cases and thus a complete curfew could be prevented. Parks, residential areas, grocery stores, and pharmacies are staying close to the normal or even increased level, ie. at or above the zero line. Retail and recreation and Transit stations declined by almost 80%. Germany is now (beginning of May) preparing to open up again — like other countries — in a staged manner. Hopefully, the positive situation remains.

A winning testing strategy

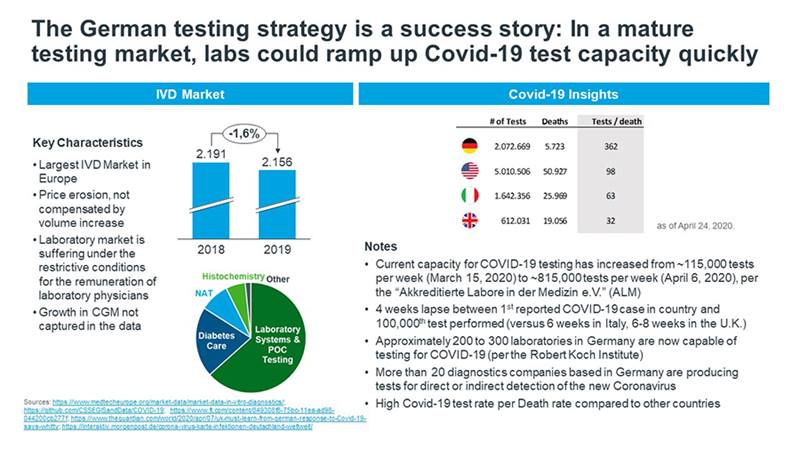

The development of the new laboratory assay to detect the novel SARS-Cov2-Virus at the German Center for Infection Research (DZIF) at Charité already in January (Team of the Prof. Christian Drosten) laid the foundation for an early testing and buildup of the testing capacity in Germany, the leading In-vitro testing market in Europe. While there was a small market decline in 2019, driven by the restrictions of the reimbursement of laboratory physicians, this could not be compensated by the volume increase, we are now experiencing an increase in Nucleoid Acid Tests as COVID-19 is becoming a part of this group.

Specifically, for the COVID-19 tests, capacity has been ramped up quickly and substantially in a way unparalleled in Western Europe, as shown in the graphic above. This was fueled by a strong private labs and testing sector and a significant number of companies producing tests.

COVID-19 poses a unique challenge in the history of epidemics; its replication rate is fast, and R0 high, as the infection is passed on before symptoms appear, if any. But testing helps to assess the extent of the pandemic and to take corrective action as quickly as possible. As of early May, Germany has a ratio of 360 tests per death. To give a sense of the current situation, last week Prof. Hendrik Streeck, from Bonn University Hospital, the virologist who has researched in detail the Heinsberg situation, stated in a Telephone conference that Monday, 27th and Tuesday 28th they tested 700 and 800 samples respectively. On both days only one positive case was detected.

A young, and anxious, patient population

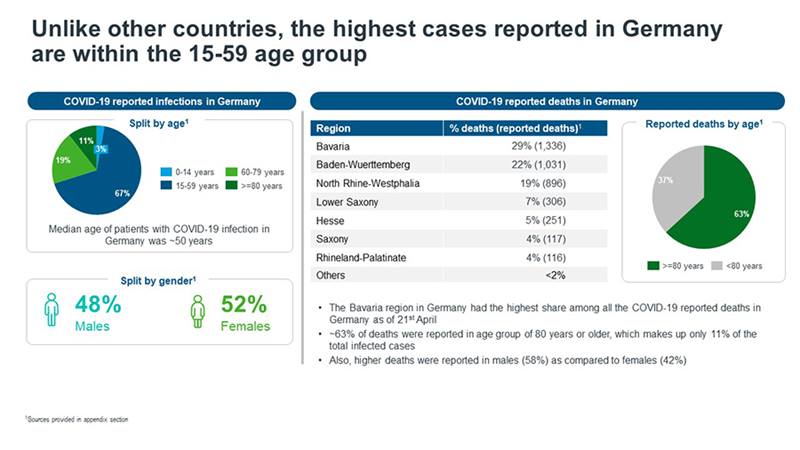

COVID-19 had two points of entry into Germany: skiers who had been in Austria; and a super spreader event during the carnival in Heinsberg. As a result, the initial sufferers were younger than in other countries, as shown in the graphic above.

Views and behaviors of patients and its impact on pharmacies, physicians and hospitals

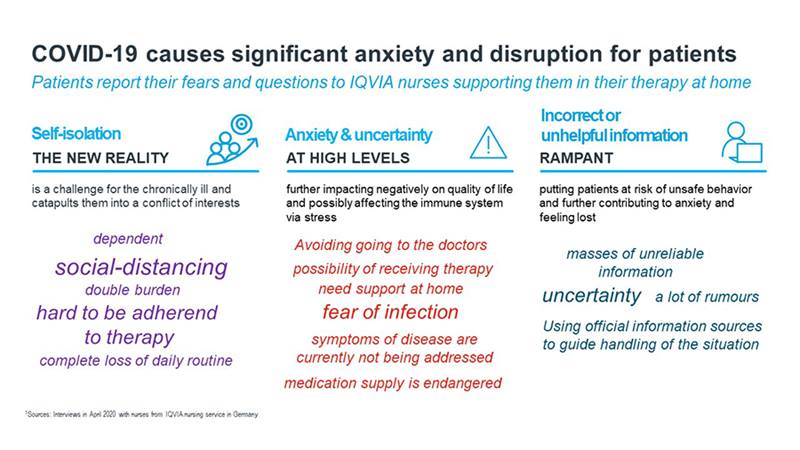

IQVIA’s team of nurses who visit patients on behalf of clients and instruct those patients for example in usage of medical devices. We have asked these nurses what they hear from their patients and how they deal with the situation. Basically, three areas can be distinguished, shown in the graphic above:

First — self-isolation is in conflict with the needs of the chronically ill. They lose their daily routine and are doubly burdened by social distancing and needing care to adhere to their therapy.

Secondly, fear plays an important role: Since these patients typically belong to the risk group, fear and uncertainty exist at a particularly high level. In the foreground, of course, is the fear of being infected. As a result, they do not go to the doctors.

Thirdly, false information and rumours cause further uncertainty and concern. Patients then try to gain security and stability through information from official sources.

Tracking the impact on treatment

In order to assess the effects of these uncertainties, we have therefore taken a close look at the situation in doctors' practices, hospitals and pharmacies.

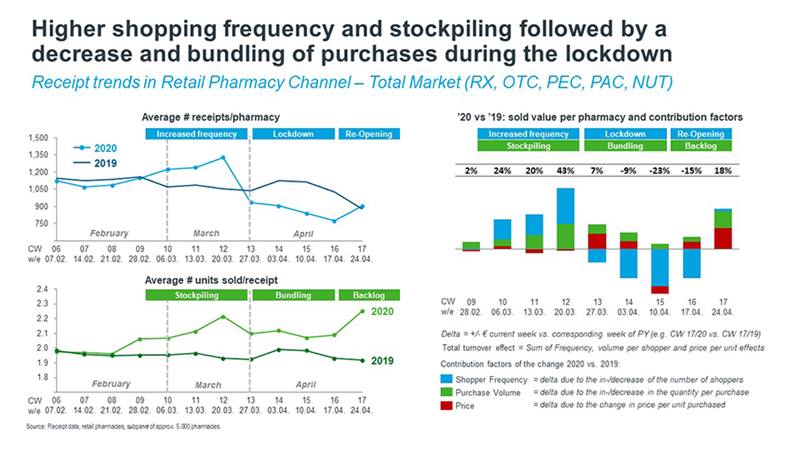

We use our pharmacy panel — the largest in Germany — with 6,500 pharmacies as the basis for these analyses. In the individual pharmacies, we record the receipts booked in the inventory management system to the day covering the total market, ie. including Rx, OTC, personal and patient care as well as nutrition.

If we look at the receipts per day, or here aggregated to per week, it becomes clear that before the official lockdown, the number of receipts first increases before there is a rapid fall to a level about 25% below the normal level.

At the same time, we see a roughly 10% increase in the number of products taken per purchase, from about 2 to 2.2, during this period. There is a significant increase in the week of April 24th, when a catch-up effect is obviously starting. Although there are always a number of inputs and levers that can impact the rise and fall of purchases, in general the three phases can be distinguished during this time: Stockpiling, Bundling, and Backlog compensation.

Also the graphic above includes a unique analysis in which we have quantified for an average pharmacy what the drivers are for the revenue differences compared to the previous year.

It becomes obvious that in the time before the lockdown the number of customers per day increased significantly. However, these customers also buy more products per purchase. Price differences do not play a major role. In the next phase from week 13, the number of customers decreases. The average price per purchased item increases noticeably. This indicates that more expensive prescription drugs are bought in the pharmacies. In week 17 we see that an increase in frequency, but also the volume, per purchase effect is strong. The price change hints that cheaper OTC drugs become also a larger part of the mix again.

New patient behavior emerges

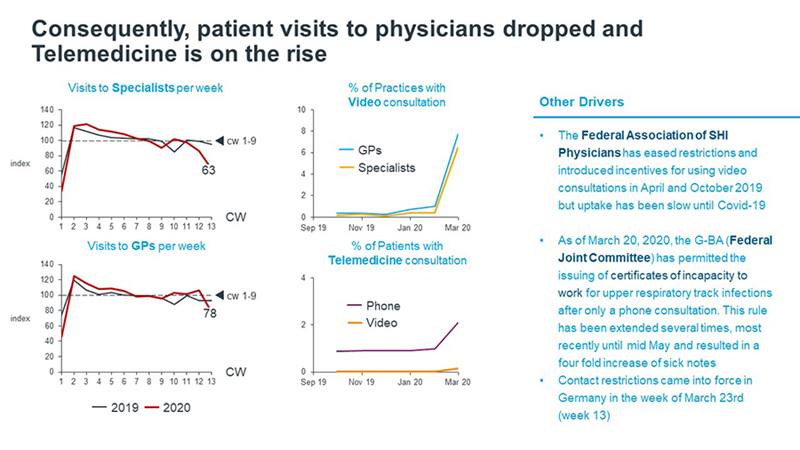

We have already addressed the emotional state of the patients. Consequently, we see patients' behavior with the effect on visits to general practitioners and specialists.

Here we use our unique physician panel, where we collect non-identified information through the electronic medical record system. The practices report monthly, so we only have data up to and including week 13. However, the drop in the number of patients is already becoming apparent, and this trend will continue, as we know from other of our sources. This is somewhat more pronounced with specialists than with general practitioners.

At the same time, we see a strong increase - albeit still at an absolutely low level of telemedicine and increased telephone contacts. COVID-19 thus accelerates the use of remote contacts in the patient-doctor relationship, which previously played almost no role.

Managing hospital capacity

In Germany, it is important to understand that specialists mainly practice in the retail sector in private practices, unlike in many European countries, where specialists usually work in polyclinics or hospitals. So with hospitals we are mainly looking at inpatient care.

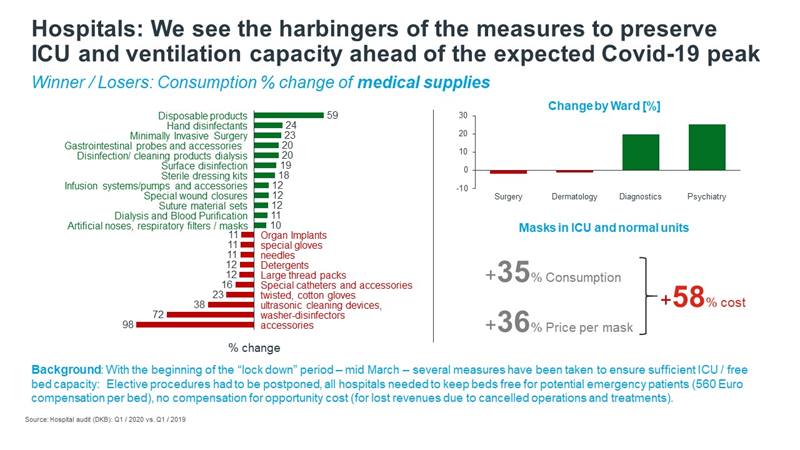

One of the major concerns of the government was to avoid overloading the intensive care units and ventilation stations in the hospitals. It was therefore specified that any non-emergency operations (including all elective surgeries) had to be delayed and that a certain number of beds should be kept free.

Data from our hospital panel of about 500 acute care hospitals (image above) for medical supplies are, at the publication date of this blog, only available for the 1st quarter. But already we see normal hospital business is declining, recognizable by the strong decrease of general accessory materials, or detergents for regular laundry in the graph on the left side, while disposable products and hand disinfectants are increasing strongly.

The chart above illustrates the high demand for masks and the already noticeable increase in the price of these items, as a result of the high global demand and adjusted prices of suppliers.

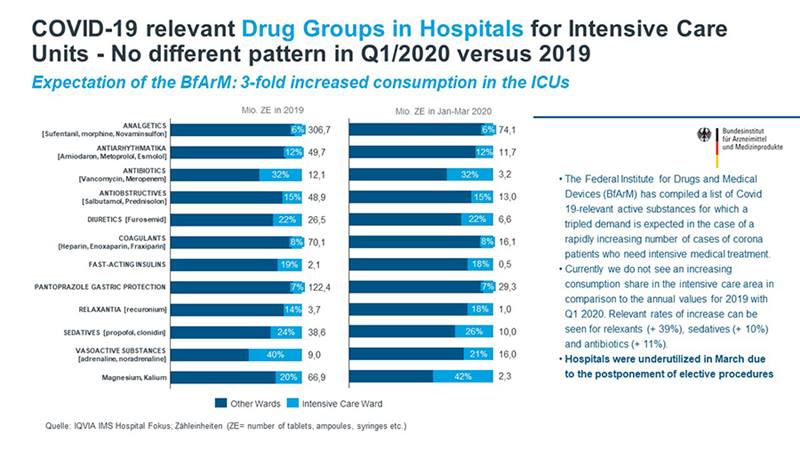

The Federal Institute for Drugs and Medical Devices warned that for certain groups of drugs, they expect considerable increased demand in intensive care units if there is a rise in especially severe cases. The list of drugs on this page represents the group of products that were expected to be most severely affected. However, comparison of the structure from 2019 and the 1st quarter of this year (graphic above) reveals that this concern has fortunately not materialized so far. At no time did the German hospital system come anywhere near overloading. On the contrary, many hospitals have not been working to full capacity because of the measures mentioned before. In the end, even patients from France and Italy were flown in — for example to Frankfurt — for treatment.

A view through product sales

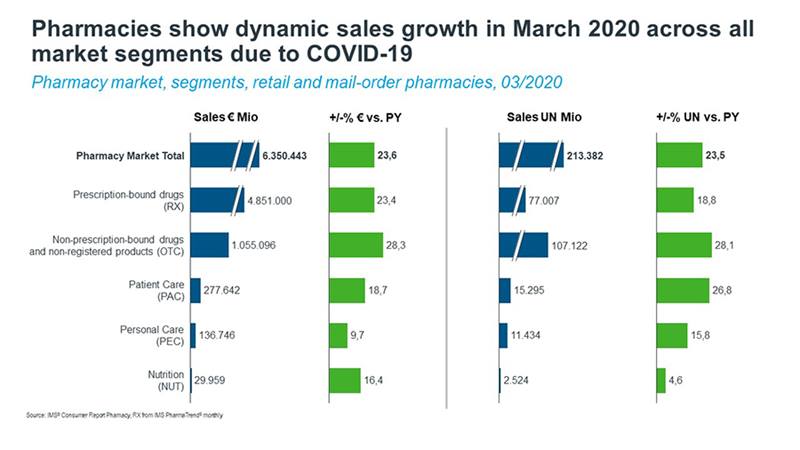

The pharmaceutical market (outside the hospital channel) supports the picture we discussed above, that the pharmacy market was rising strongly in March. This applies to all market segments in a more detailed breakdown, compared with the same period last year,we see a double-digit growth across the board.

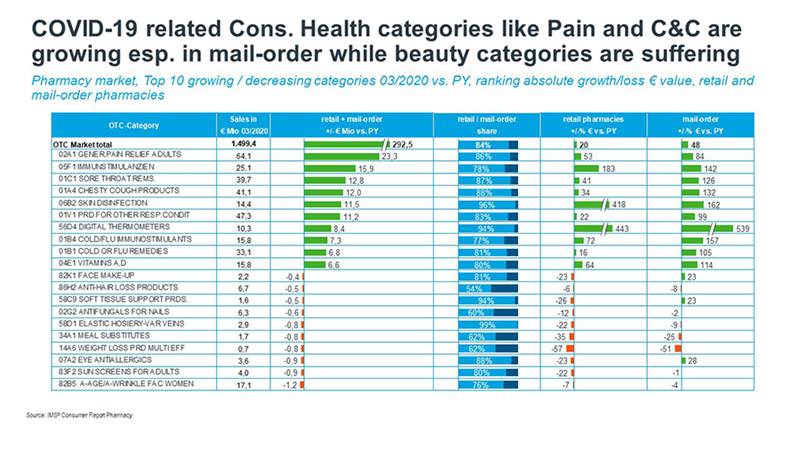

The top ten growing and declining categories in Consumer Health (image above) are maybe not surprising. Clear winners are - unsurprisingly - COVID-19 related therapeutic fields, painkillers, cough and cold products but also immune stimulants and skin disinfection.

Beauty products are less in the spotlight because locked down people have different priorities and are less outdoors, among friends and in public. This has a negative impact on the sales of sun protection or anti-aging products.

Mail-order pharmacies are growing much faster than office-based pharmacies, and are therefore becoming increasingly important - also in areas which have not been a particular strength of mail order in the past. This is clearly to be expected initially. The question is whether this will continue to be the case after the crisis and whether we will see a significant shift in the balance of the two channels, triggered by COVID-19. This needs to be monitored further, as it may have a significant impact on the number of pharmacies and likewise on future corporate strategies and resourcing.

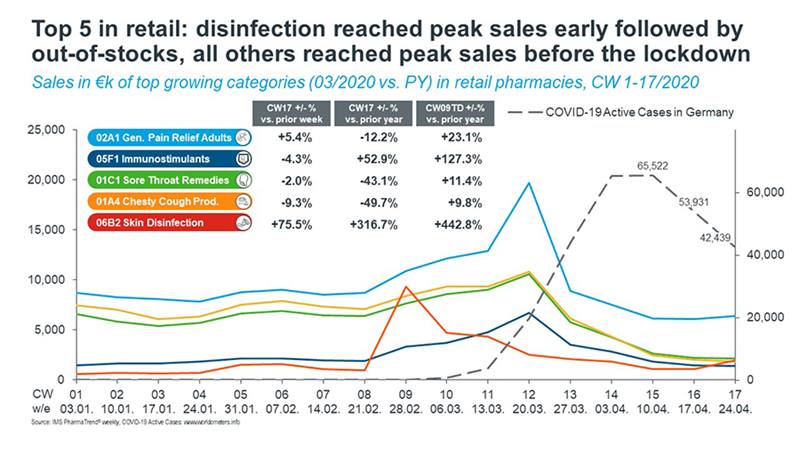

The weekly sales on the Top 5 categories also show the pattern of stockpiling before the initial restrictions began, as seen earlier.

In the area of skin disinfectants, increased demand had already set in before initial restrictions. From week 13 onwards, however, demand collapsed, because by then the demand was already met. Towards the end of the observation period, we are seeing a slight increase again, among other things in disinfectants, when the supply bottlenecks were removed.

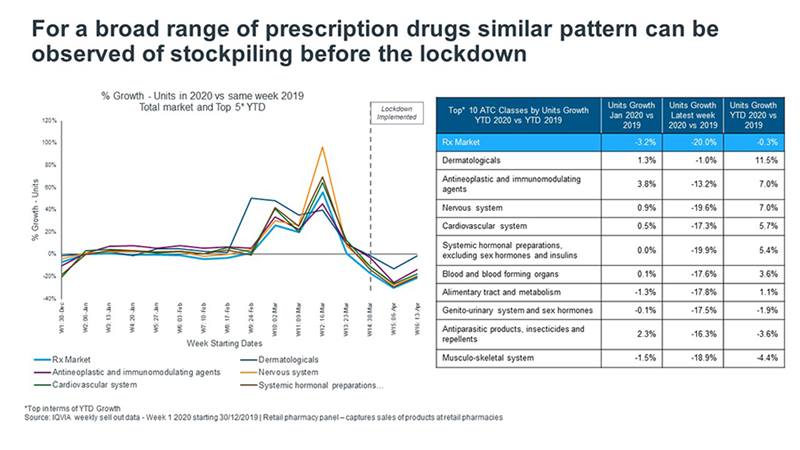

We also see the stockpiling pattern on the graphic above for unit sales of prescription products in certain therapeutic areas. While in January there was still a notable decline in the Rx market compared to 2019, also driven by a lower number of working days in individual German federal states, the market is now flat for the period up to and including March. Some categories are growing significantly, e.g. dermatologicals. All categories show a double-digit sales drop with the beginning of the initial restrictions, which will only recover in the most recent period. Nevertheless, the figure is still in double digits behind the previous year.

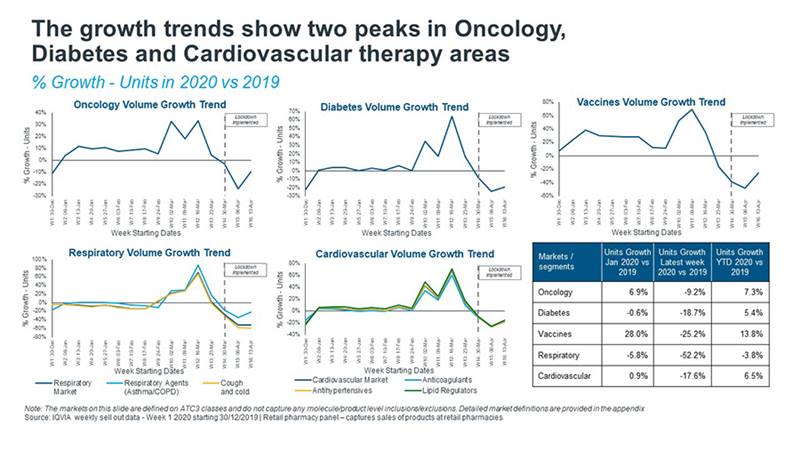

If we take a closer look at individual therapeutic areas in the graphic above, we see differences in the stockpiling pattern for particularly important therapies, namely cancer, diabetes and cardiovascular disease, versus eg. respiratory agents. It is worth noting that here we are looking only at the part of each of these markets which is passing through the retail channel. For respiratory, diabetes and cardiovascular, this is the majority of the market. For oncology, other channels may also be important.

From an analysis of our IQVIA longitudinal patient data, which are not presented here, we know that in some therapy areas about one third of the so-called repeat patients, i.e. well-adjusted patients on existing long-term therapy, went to the doctor earlier than normal in the first three weeks in March. Accordingly, their prescriptions are then missing in the following weeks.

After the initial restrictions have come into effect, the initiation of new therapies fell by 25%. This even applied to the postponement of cancer therapies. A survey conducted by IQVIA among oncologists across the five major European markets, including Germany, in early April 2020 found that oncologists reported patient load fell by 50%, also creating a significant burden on individual patients.

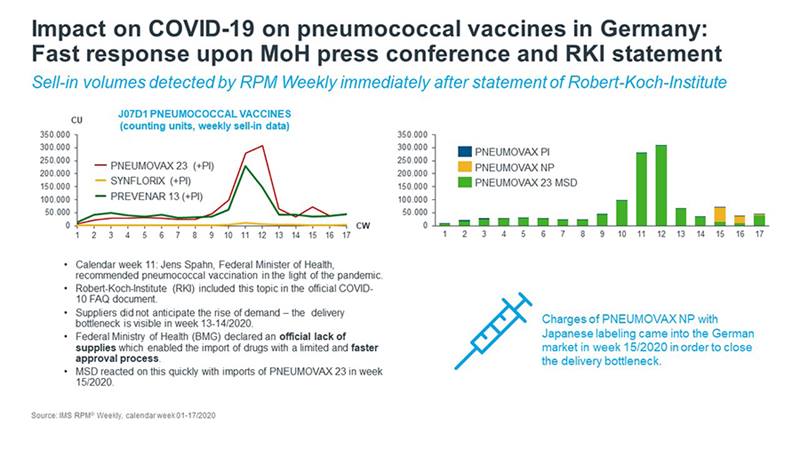

Finally, the image above shows a snapshot of pneumococcal vaccines to illustrate rapid response to market demand. The pneumococcal vaccination was in greater demand after positive comments from the Ministry of Health and the Robert-Koch-Institute. As the demand could not be met with existing supply so quickly, a special regulation was used to bring goods from Japan to the German market.

Impact and strategies for the go-to-market of pharma companies

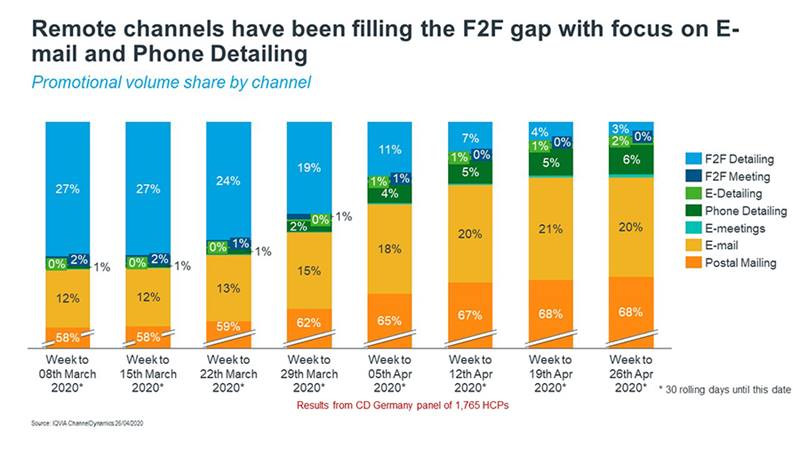

What does this mean for pharmaceutical companies, and especially for their commercial model? Most companies reacted quickly and restricted their field work or sought to switch towards remote detailing, which most frequently happened through the use of email and telephone. However, few companies were really prepared to implement true remote detailing, and this is driven by a lack of technology platform and preparedness, for example, in obtaining valid consent for digital communication.

Currently, most companies are making use of the short-time working scheme, which the federal government introduced as an immediate measure to preserve jobs across industries. Nevertheless, there are early signals that companies are preparing for a re-opening of their customer engagement activities.

Finally, we would like to encourage pharmaceutical company leaders to think about the post-COVID-19 crisis environment. Changes can be expected across all aspects of healthcare, and in three areas that require special attention:

- Portfolio Implications

- Go-to-Market

- Capabilities and Ways of working in the future

Leaders will have to think carefully and holistically about both the immediate and longer term consequences of COVID-19. For example, how to balance face-to-face contacts versus digital channels, investments in the field force, or proper support from marketing to build digital contents. Capabilities must be further developed to effectively communicate with all of a pharmaceutical company’s stakeholders in a new environment.