See how we partner with organizations across the healthcare ecosystem, from emerging biotechnology and large pharmaceutical, to medical technology, consumer health, and more, to drive human health forward.

In the second part of our M&A blog series, we will discuss trends in dealmaking focus as acquirers seek value in a dramatically changing market environment. We will further provide an outlook on deal momentum for the remainder of 2023.

Consistent with blog 1, deals included in our analysis meet specific criteria: they involve a biopharma target, the acquisition of a majority stake in the target entity, and an enterprise value equal to or exceeding $1Bn, while we excluded acquisitions of products and divisions as well as licensing deals.

Deal focus: where acquirers look to find value

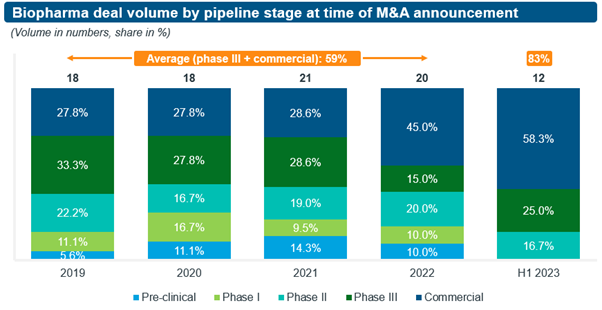

Recent trends in M&A deal activity indicate a significant decline in acquirers’ risk appetite compared to previous years, as they seek greater certainty to navigate a fast-approaching patent cliff and other post-COVID challenges (see Figure 1). Specifically,

- In H1/2023, 83% of transactions focused on de-risked targets with assets which were at least in phase 3 or already on the market, an increase of 24% compared to the average share of 59% for such deals during the four-year period from 2019 to 2022. This increase came at the expense of earlier stage targets, especially phase 1 and pre-clinical.

- The share of transactions focussed on revenue generating, commercial-stage targets increased from 28% in 2019 to 58% in H1/2023, with a major step-up from 29% to 45% occurring between 2021 and 2022.

- Furthermore, while contingent payments are the norm in M&A deals with clinical-stage private companies, such deal structures for biopharma targets with late-stage assets have become more common, with its share of all transactions rising from 15% in 2019 to 33% in H1/2023.

Instead of taking on undue risk through acquisitions, dealmakers appear to prefer hedging their early-stage bets via collaborations and partnerships. These may precede taking full ownership at a later stage once sufficient data is available to better appraise the residual risk profile, and thus a target’s fair value.

In addition to acquirers’ changing risk appetite, the observed M&A deal pattern is driven by a combination of a surge in deal capacity and a challenging biotech funding environment starting in mid- to late 2021, which we elaborated on in our first blog. The effective closure of the IPO market since 2022 has been especially important in elevating M&A as the preferred, strategic exit route for many cash-strapped biotech companies with late-stage assets, and this trend is likely to continue given the current outlook for IPOs.

Oncology and immunology continue to dominate as the leading therapy areas in focus of M&A activity, collectively accounting for an average share of 55% of deal value and 46% of deal volume over the time period from 2019 to H1/2023. Interestingly, cardiometabolic-focused acquisitions have seen a notable uptick in H1/2023, a reflection of the renaissance for cardiometabolic innovation and the excitement around recent therapeutic breakthroughs, e.g., in obesity or NASH.

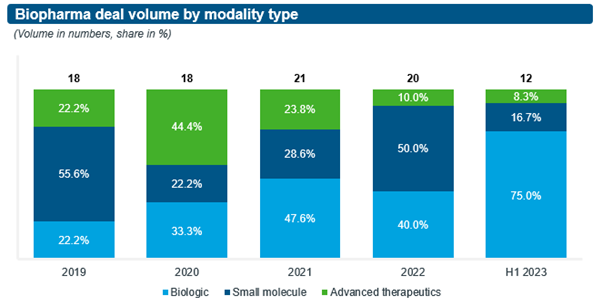

Driven by key external trends, the modalities in focus of M&A deals have changed significantly over the past five years (see Figure 2):

- In 2020, acquisitions focused on advanced therapeutics saw a pandemic-induced bounce, given the high visibility COVID afforded to mRNA technology. However, since then enthusiasm for acquiring advanced therapeutics targets has cooled as uncertainties remain, e.g., validation of mRNA technology beyond COVID, for example in flu vaccines or oncology. As discussed earlier, potential acquirers prefer other deal structures, such as partnerships and collaborations, to better mitigate such risks. This preference is also reflected in the dominance of an asset-centric M&A rationale, which underpinned over 90% of all M&A deals over the past five years, as opposed to M&A deals anchored on novel, complex technology platforms.

- The share of deals focused on biologics has increased steadily over the past five years, with a dramatic step-up from 40% in 2022 to 75% in H1/2023 at the expense of small molecules, which saw their share decline from 50% to 17% during the same time period. While it is premature to definitively attribute this pattern to the impact of the U.S. IRA, we should expect biologics to become more attractive targets relative to small molecules, given the difference in length of patent protection proposed under the IRA legislation.

Over the past five years, strategic bolt-on acquisitions with a deal value of less than $6.5Bn were much preferred over mega deals and accounted for 83% of all M&A transactions. This trend has recently been buoyed by the aforementioned risk aversion of potential acquirers, while greater scrutiny by the Federal Trade Commission (FTC) may potentially discourage larger deals.

Outlook for the remainder of 2023

On the supply side, our analysis has identified 283 unpartnered phase 3 assets alone which are owned by pre-commercial biotech companies without any revenues. Notably, oncology emerges as the prominent therapeutic focus, with additional significant presence in infectious disease, immunology, CNS and ophthalmology. Furthermore, several currently unpartnered mid- to late-stage assets will reach key milestones in H2/2023 which is likely to turn their respective companies into sought after acquisition targets, for example:

- Karuna Therapeutics is expected to file an NDA for its novel antipsychotic therapy KarXT in Q3/2023 and thus set the stage for its transition into a commercial-stage company.

- On 17 July 2023, Madrigal Pharmaceuticals announced the completion of the rolling submission for resmetirom, its potential treatment for NASH, a condition with high unmet need and without any approved therapies to date. This follows the FDA granting resmetirom Breakthrough Therapy designation in April 2023.

- In Q4/2023, Ventyx Biosciences is expected to present top-line data from the phase 2 SERENITY psoriasis trial of its TYK-2 inhibitor VTX958, an asset class which was at the centre of the $6Bn Takeda-Nimbus acquisition in December 2022.

- Meanwhile, recent news flow suggests several of the top 15 pharma have been studying argenx as a potential acquisition target. The company recently announced positive CIDP data and does not have any major collaborations or royalty pathways, which is attractive as an acquirer would own 100% of potential blockbuster, Vyvgart.

Such rich supply of potential targets meets with a formidable deal capacity, which in our first blog we estimated as $0.8Tn among the top 15 pharma companies. This is nicely supported by the recent Q2 earnings season where several companies mentioned that they are seeking large acquisitions and / or are size agnostic. Therefore, at the current run rate, we could expect M&A deal value to reach $140 -160Bn by the end of 2023.

While greater scrutiny by the FTC increases uncertainty for dealmakers, its impact is not yet clear at this time. On the one hand, the FTC challenged Amgen’s proposed $28Bn acquisition of Horizon Therapeutics and recently also demanded more data from Pfizer on their proposed $43Bn acquisition of Seagen. On the other hand, Microsoft just won a high-profile court case against the FTC which had challenged its planned acquisition of Activision.

This dynamic illustrates that subdued deal momentum across the board, as a result of a more activist regulator, is not a forgone conclusion. Instead, dealmakers may learn to proactively mitigate potential regulatory risks, while greater FTC scrutiny may end up impacting specific deals, or deal types, rather than discouraging all M&A indiscriminately.

The renewed deal momentum observed in H1/2023, combined with strong underlying fundamentals, bodes well for the full-year 2023 outlook. Reflecting on the industry's history, these developments raise the possibility of a return to levels of deal activity historically seen, despite remaining below the peak activity observed in 2019.

Key data and information sources

IQVIA Pharma Deals; IQVIA Forecast Link; Mergermarket; Refinitiv Workspace; IQVIA Institute report: Global Trends in R&D 2023; company financial reports; company press releases and deal announcements; IQVIA EMEA Thought Leadership desk research and analysis

Exploring strategic alternatives? Reach out to us!

Related solutions

Maximize your healthcare investments, with evidence.