- Locations

- United States

- Impact of COVID 19 on US Pharma Market

It’s been a question lingering on everyone’s mind for a year: How will we compare to 2020? How will we calibrate future activity when “last year” was a pandemic year? Is 2020 the exception, or the new rule?

Step 1: Calibration

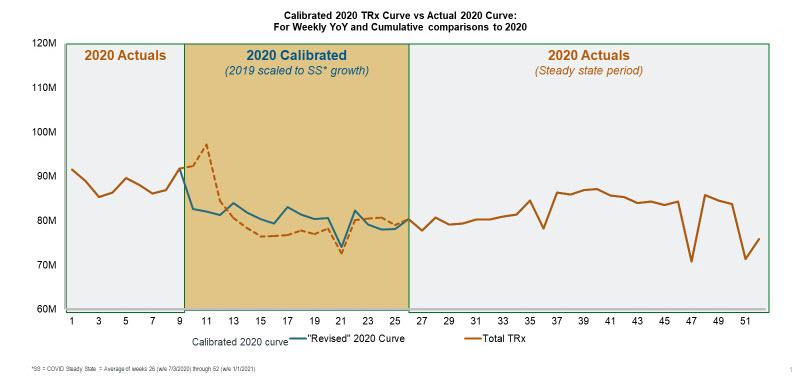

As we move further into 2021, that question is now a practical reality, and determining the degree to which current prescription (Rx) and medical claims activity can be reasonably benchmarked against same period last year is an important calibration.

Looking back on 2020, a fairly consistent story emerges: After a volatile period between week 10 and week 25, characterized by rapid stockpiling and then an almost complete retreat from Rx and claims activity during lockdowns, we reach somewhat of a “steady state” that continues to this day.

Figure 1: Calibrated 2020 TRx Curve vs. Actual 2020 Curve

Therefore, while the initial pandemic shock period is not a reasonable baseline for comparison, the steady state that followed is. Furthermore, this steady state is a closer comparator to 2021 than 2019. The result is as “calibrated” period between weeks 10 and 25 that uses the average growth rate from the steady state and applies it to the 2019 curve, or activity. What remains is a curve that retains appropriate seasonality, while also accounting for the pandemic.

Step 2: Short-term change or sustained innovation?

The next question we face is how much of the innovation or change sparked by COVID-19 will sustain into the future; what will remain after the public health emergency subsides? It seems clear that we will not return to the dynamics of 2019, but how much of 2020 can we consider as a single burst of change, versus sustainable innovation and transformation.

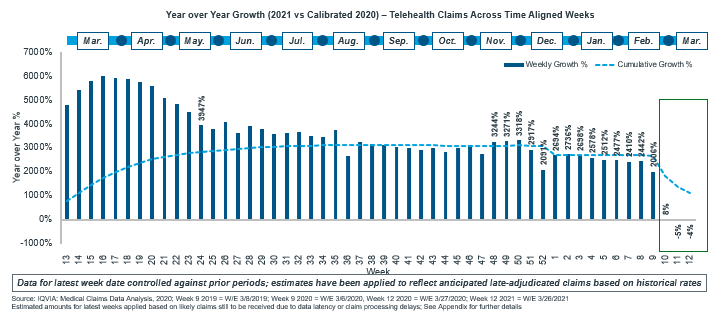

Telehealth is a natural focal point for this question, and so in our latest issue, we begin to look into the dynamics of growth and staying power – especially as we are entering a period when the tremendous growth rates will start to subside and telehealth begins to compete with its peak-pandemic self.

Figure 2: Year over Year Growth

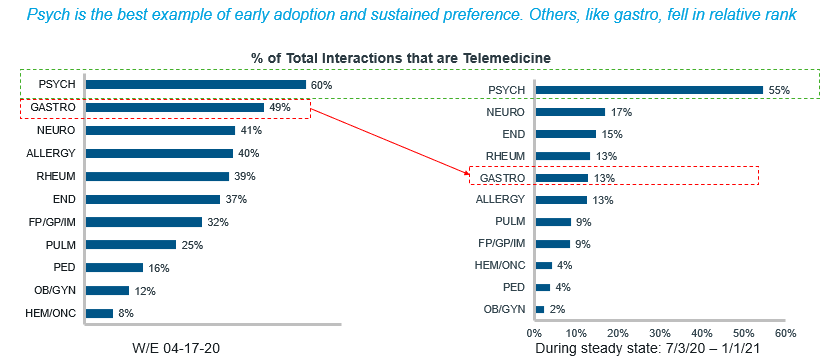

At the specialty level, a cursory look shows an overall (and unsurprising) decline since the days of lockdown, although some early adopters, such as psychiatry, have embraced the pandemic as a more permanent inflection point.

Figure 3: % of Total Telehealth Interactions

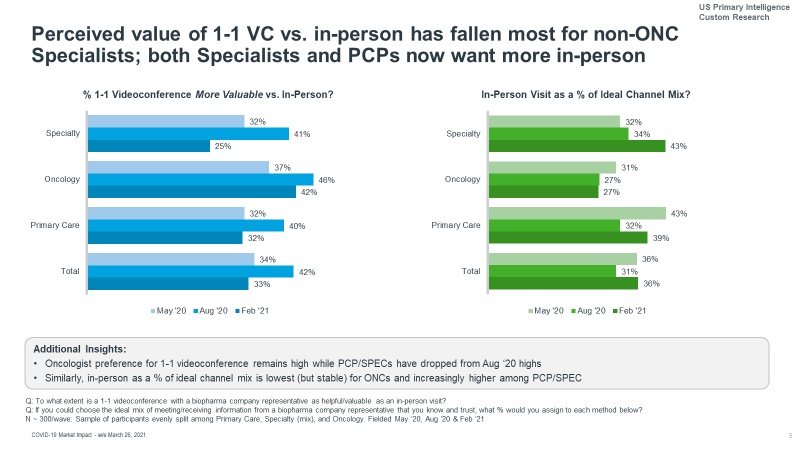

The dynamics of “Zoom fatigue” are well-discussed and documented in the business world, however it seems possible that the healthcare community is also approaching a bit of a trend break; when it comes to HCP engagement with pharmaceutical reps, a new survey indicates a slight decline in perceived value of 1:1 video conference for doctors outside oncology.

Figure 4: Video vs. in-person 1:1

Both sides of the telehealth story deserve more attention and more analysis, particularly as a proxy for the idea of pandemic-driven change vs. pandemic-led innovation. Whether the road ahead will stay the course defined by 2020, or ultimately veer back to 2019, remains to be seen.