- Locations

- United States

- US Blogs

- Top Trends to Watch in 2023

Already it is clear that 2023 is poised to be an important inflection point for much of healthcare in the United States. Against a challenging economic environment, there remains undeniable optimism and an appetite for innovation and progress in service of better patient care.

New strategies and technologies for educating and engaging healthcare providers are coming of age; rising expectations, but stagnating engagement from patients suggests that the reality of new delivery models is imminent; and the shifting legislative and regulatory landscape is forcing a fundamental rethink of portfolios and pipelines.

Below, we outline these and other trends and inflection points on the horizon in 2023. These are all areas of change that pharmaceutical companies, and in particular commercial organizations, should consider.

- The reality of the Inflation Reduction Act sets in

The passage of Inflation Reduction Act of 2022 fundamentally changed who will pay for the most expensive drugs affecting the largest patient population. The phased introduction of provisions is designed to drive a multi-decade impact, but in reality the law’s implications will be seen as early as this quarter. Starting almost immediately, we can expect to see penalties issued for any drug prices exceeding Consumer Price Index (CPI) - based benchmarks.

And although the ink is yet to dry, it is now clear that commercial leaders may already be behind in developing a cohesive strategy to mitigate risk and proactively manage their portfolio and pipelines. Everything will be on the table – from a reassessment of existing strategies and forecasts to reconfigured launch plans that account for margin-mitigating effects.

For more of IQVIA's perspective on the Inflation Reduction Act:

- Read our insight brief where industry experts establish the contours of the conversation and elucidate both short-term impact and long-term implications.

- Register for our on-demand webinar, The Impact of the Inflation Reduction Act of 2022, exploring second and third order effects of the legislation and how to navigate through these changes.

- Specialty pharmacy biosimilars debut

One of the largest brands in the history of biopharma – Humira (adalimumab) – will face biosimilar competition in 2023. In the U.S., biosimilars have already found success in the oncology space, in part due to buy-and-bill dynamics and the acute, episodic nature of the diseases they treat. The performance of adalimumab biosimilars, which face a fundamentally different provider and patient dynamic, will set the tone for the future of the biosimilar market – especially for chronic conditions.

An expanding biosimilars market is a turning point for pharma, and patients. There is real potential for net savings as innovators compete for payer coverage and market share – but of course this competition will also naturally drive margin pressure for innovators and biosimilars alike.

Biosimilars also present new challenges and opportunities for patient engagement and patient support programs. Proactive plans to educate both patients and physicians will be a top priority for pharma companies and will create a critical playbook for future launches.

What remains unknown are the strategies biosimilar and innovator manufacturers will employ, how payers will respond to biosimilars with interchangeability, and pricing impacts due to a competitive market with multiple biosimilar manufacturers launching come summer.

-

A new rubric for launch success emerges

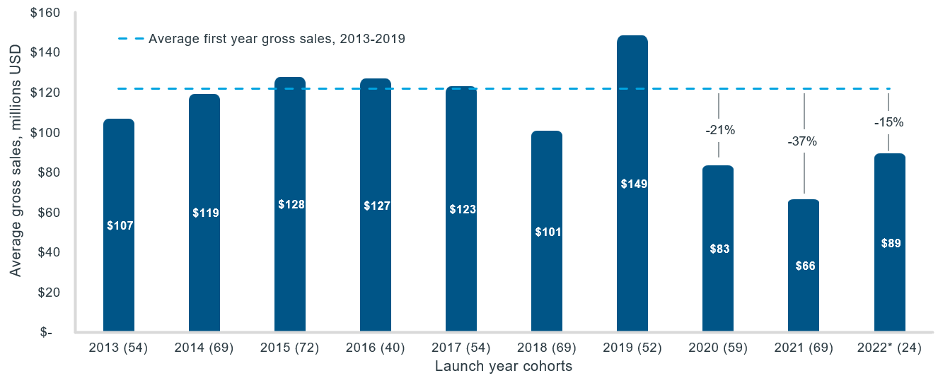

Without a doubt, the launch environment for new product launches is more complex and more challenging than ever before. In 2020 and 2021 there was an obvious disruption, as the fundamental dynamics of physician and patient engagements needed to change. But it is increasingly clear that this disruption was not a singular event, but the beginning of a sea change in launch axioms.

This is largely due to other, more systemic currents of change: stronger payer restrictions; a hesitant patient population that just weathered a pandemic; legislative and regulatory actions; and the rising noise of crowded marketplaces. While the main tenets of launch excellence — patient acquisition and prescriber activation — remain, it’s now clear that how brand teams define success must change.

The time has come for a modernized approach to planning, forecasting, and engaging stakeholders. The golden rule of years past was “generate return on investment.” Now, and for the foreseeable decade, the new rule is defined as “drive demand at all costs.” The time-to-profitability window is lengthening for small and large companies alike, meaning launch planning must be more exacting in defining and measuring goals from the outset. This requires more refined, and potentially more uncomfortable, approaches to planning, like forecasting on patient and prescriber numbers instead of dollars, having a strategy to shift patients from bridge programs to payer coverage, and clear benchmarks to allow for real-time course correction.

Average gross sales by launch cohort, 2013–2022*

Source: National Sales Perspective, IQVIA 2022

Notes: *2022 values projected for full year based on 6-month performance of 24 products. Analysis includes only new active substance (NAS) products. Analysis excludes Hepatitis C treatments, flu vaccines, COVID-19 treatments and vaccines, and Mounjaro. Sales have been CPI-adjusted to Dec 2021 USD.

-

Modern digital advertising in healthcare is here

Advertising was long the domain of “push” engagement; the mass push of one-message-for-all content to large audiences. And while other industries embraced more modern forms, life sciences lagged, unable to meaningfully deploy digital data and technology to improve the customer experience. What’s worse, this approach pushed life science companies further away from their core values and mission – to create a healthier world.

But now the modernization of the digital marketing ecosystem is in full swing, with publishing networks, identity solutions, and digital data and technology platforms creating a groundswell of innovation. This year, traditional advertising will give way to a more sophisticated, more dynamic, and more personalized engagement of physicians and consumers to improve the delivery of care. Such a transformation will be wholly dependent on three core pillars:

- A modern and nuanced commitment to privacy and customer confidence operationally via better collection and use of data, a commitment to industry standards, and adherence to privacy enhancing technologies (PETs) and methodologies

- A harmonized mindset – where digital outreach is just part of a larger, more agile, more intelligent brand experience

- A ruthless (and analytical) approach to eliminating the systemic waste in messaging and engagement that obstructs optimal medical care

-

Medical Affairs paves the way for better patient outcomes

Perhaps the most exciting developments in healthcare are the discoveries that improve our ability to treat and even cure complex diseases. But with new knowledge and new treatments comes new questions, and a growing urgency to better connect clinical expertise with commercial decision making in an efficient, trustworthy, and impartial feedback loop.

Medical Affairs has emerged as the center of this loop – the linchpin that helps brand leaders integrate science, patient voice, and trust into company strategy and provider engagement. This function is proving to be essential in unearthing innovation in evidence generation, lifecycle planning, and key opinion leader (KOL) digital engagement. At the same time, they continue to be at the forefront of evidence dissemination and education on diseases, safety and efficacy data, and the nuance of additional clinical findings. This central positioning – between clinical and commercial – allows them to provide real-time feedback to both commercial and clinical teams to ensure patients are receiving optimal treatments.

Looking at the pipeline of innovative medicines in development, and especially the shifts in launch strategy, this year will see an acceleration of Medical Affairs as a centralized function in pharma. Their role will not change, but rather expand and mature; increasingly they will participate earlier, moving upstream in clinical development programs with insights on patients, providers, the larger market, and relevant real-world endpoints.

-

Needs-based delivery of medicine becomes the standard

Many of the health disparities realized during the pandemic remain top of mind for the life sciences industry. As the industry continues to work to recruit diverse patient populations in clinical trials, it’s clear the view of the patient is evolving. Patients are individuals with unique human circumstances – their social determinants of health – and understanding their needs is essential to identifying the most effective treatment and care.

To rise to the intricate challenge of changing demographics (a majority minority population in the U.S. by 2045) and the ever-evolving human experience, pharma companies are likely to invest more in 2023 in a variety of tools and methods to understand, define, and meet the needs of individuals. These include:

- Geography - based assessments (i.e., resource deployment into medical and pharmacy “deserts”)

- Continual, strong, partnership with community organizations

- Application of behavioral psychology in patient programs

- Diverse analytics and strategy teams

- Careful interpretation of AI/ML models and insights

Companies need to set out clear goals, metrics, and partnerships to reach individuals, and how companies reach these goals may differ. But the outcome will remain the same: healthier, happier humans.

-

COVID-19 fatigue plagues the healthcare system

Our final trend is less something to watch, and more something to hope for. The COVID-19 pandemic shook the world with its arrival in late 2019, but fast action and resilience in the healthcare system led to a silver lining: A new era of engagement in personal and public health. The production and distribution of vaccines and boosters created additional touchpoints with the healthcare system, and a combination of technology and necessity brought digital health and telemedicine into the limelight.

However, coming upon the third anniversary of COVID-19’s initial surge in the U.S., we’ve reached an undeniable state of COVID-19 fatigue. Rising inflation, skepticism around boosters, and a respiratory trifecta (flu/RSV/COVID-19) that captured the ebb of once-ubiquitous safety measures (masks, distancing) has left a system flooded with exhausted providers and increasingly disengaged patients. Compared to 2021, overall prescription volume and productive patient-physician engagements (diagnosis visits) are flat – and stable – but still fall below pre-pandemic levels. Elective procedures began declining mid-2022 as inflation began to rise, and flu vaccinations initially lagged compared to previous seasons. But we saw telemedicine find its niche, comprising 8% of all claims throughout the year.

The hope is here: Patients and providers are finding their footing, and hungry for a healthcare environment that understands and works for them. The time is ripe for a transformation in the design and execution of patient and provider engagement – and they’re ready for it, too.

For a deeper dive and more insights into these and other topics, please subscribe to U.S. Progress Point.