Illuminate a path to consumer health success

- Locations

- Asia Pacific

- Creating agility, the shift to e-pharmacy in Australia

Across industries, 2020 has been a year like no other for eCommerce. In a recent report “Inside Australian Online Shopping 2020”, the latest statistics show that total online shopping year on year growth was over 80%1. Across general retail in a pre-COVID-19 world online shopping was responsible for 9% of Australia’s total retail sales2. COVID-19 has shifted the trend upwards, and it is estimated that online sales will account for 15% of total retail by the end of 20203.

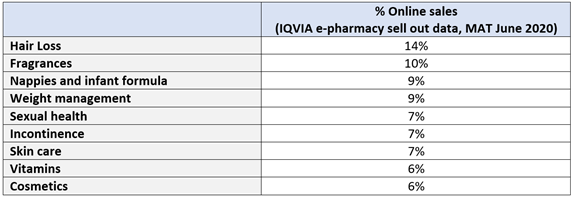

Since 2017, Australian pharmacy has seen an increase in the proportion of sales shift from brick and mortar stores to online pharmacy platforms. With most of the major pharmacy retailers also hosting an online store, e-pharmacy penetration is continuing to rise. In the MAT June 2020, 4.1% of pharmacy consumer health sales were purchased online. The proportion of online sales in June 2020 jumped to over 10% of sales for many categories4. The shift was most notable in potentially sensitive products, products with an export component, those with convenience factor as well as beauty categories.

The convenience of online shopping is a huge attraction for consumers, but online pharmacy retailers in Australia continue to face headwinds:

- Lengthy delivery times restricting online sales growth, particularly in rural and regional areas (delivery times greater than 3-4 days). However, in the past 12 months delivery times have reduced, with 1-2 days more common as penetration rates (now 80% Australians shop online) and logistics resourcing have improved5.

- Added shipping fees limiting single basket or low-cost item online purchases. Many pharmacy retailers offer free shipping for basket of goods over $50. Australian consumers expect free or low-cost shipping, almost 60% of shoppers will not checkout on a cart if shipping cost is too high6.

- Product class online purchasing restrictions means many consumers need to visit a physical pharmacy, therefore purchasing their consumer health products during this visit. Some pharmacy retailers have launched Click and Collect, depending on the shoppers goods and ability to wait for delivery —this saw an increased popularity as people wanted to avoid shopping centres and high streets.

Online sales experienced substantial growth with the onset of COVID-19, and higher online demand is expected moving forward. In June 2020 online pharmacy sales were up 71% on June 2019, compared to a -13% decline in pharmacy bricks and mortar sales. Many categories experiencing over 100% growth in online sales year on year. Consumer Health companies will have to build this shift to online pharmacy into future plans and strategies, remaining agile to meet consumer need and demand in an ever-changing environment.

For more information, please feel free to contact us.

References

1 Inside Australian Online Shopping 2020 eCommerce Industry Report, Australia Post.

2 National Australia Bank Retail Sales Index January 2019.

3 Inside Australian Online Shopping 2020 eCommerce Industry Report, Australia Post.

4IQVIA e-pharmacy sell out data, MAT June 2020.

5Source: eMarketer, SAP.

6Source: eMarketer, SAP.

Related solutions

Shape the future of consumer health.

See how we partner with organizations across the healthcare ecosystem, from emerging biotechnology and large pharmaceutical, to medical technology, consumer health, and more, to drive human health forward.