Ensure your stakeholders are getting the information they need, when and where they need it, to see where your product can improve outcomes.

As another year plays out, and countries across the world continue to deal with the aftermath of the pandemic, pharma and life sciences companies face an evolving landscape for interacting with healthcare systems. The first article in a two-part series will explore the trends in HCP channel preference, showcasing predominantly country-level insights and analysis from the 2023 ChannelDynamics™ Channel Preference Survey.

Each year for the past 7 years, IQVIA have been closely analysing the environment by asking over 20,000 HCPs from 38 countries about their preferred communication channels. Today, we have the results from the 2023 survey which asked the following question:

“Please enter - as a percentage - the mix of interactions you would generally prefer over the course of a year. For example, if you would prefer about half of your interactions to be Face-to-face, 1:1 in-person visits, please indicate 50%”

The question asked in 2023 provided another level of detail compared with previous years, as it required HCPs to enter their overall preferred channel mix rather than simply choosing their top channel.

As the data was collected at an individual HCP level, we have produced a series of charts that explore differences according to four key attributes: country, specialty, age and gender. The information was aggregated to cover major markets, predominantly the UK, Spain, Italy, France, Germany and the US.

Understanding these differences in preferences helps to answer the following questions:

How should promotional investment be prioritised for different HCP specialties across countries?

How much effort should be put into developing media for different channels?

What is the best way to structure field force teams?

How should digital and in-person headcount be balanced?

How can HCP information requirements be met effectively?

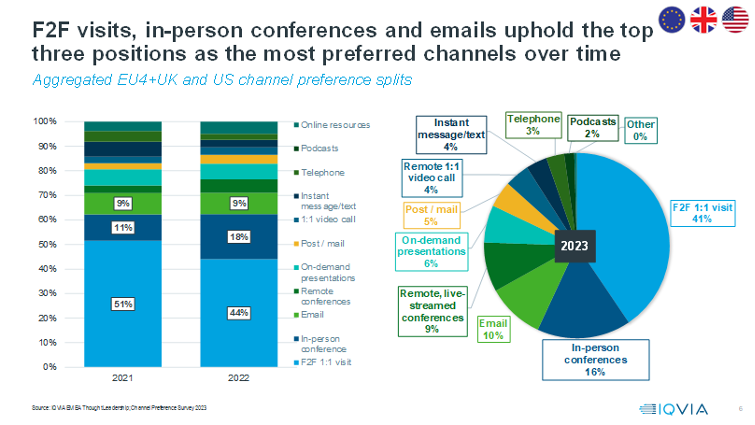

At a macro level across the six countries, individual F2F interactions maintain a high share of the overall channel preference in 2023 at 41%. However, this is following a downward trend from 51% and 44% in the two respective prior years. In-person conferences uphold second place in overall HCP preference with a 16% share in 2023, down from 18% in 2022 but still higher than 11% in 2021.

Emails have stayed consistently third, with 10% share in 2023, despite the marked increase in email traffic that many HCPs experienced through the pandemic period. Therefore, digital fatigue does not seem to have dramatically altered overall HCP preference for emails. In contrast, the preference for remote 1:1 video calls remains fairly low at 4%.

At a regional level, the obvious outlier in the 2023 survey is the Nordics. These show a 28% share of overall preference for individual F2F interactions, whereas all other regions sit within a small range between 39% and 42%. This difference in the Nordics is partly accounted for by the higher share of preference captured by in-person conferences, at 24%. Globally, the more developed markets prefer to have a greater share of communication via email, the US leading the way with a 14% share.

There is clear channel variation at a country level, with Greece, Spain and Italy showing the strongest affinity for individual 1:1 F2F visits from sales representatives. At the other end of the spectrum, the UK, Sweden and Denmark show the lowest preference for 1:1 F2F interactions. This trend can be explained by the strict ABPI code of conduct in the UK and the sparse population spread in Nordic countries making 1:1 F2F interactions less feasible.

Looking more closely into grouped channel preferences over time, significant differences remain compared to the pre-Covid benchmark of 2019 in France, Italy and Spain. The growth in individual interactions is partially due to the growth of remote video calls alongside the desire for F2F visits to return. The preference share for online resources has decreased in all countries since 2019 and has only followed an upward trend over the last 3 years in the UK. This shows there is a need for pharma and life sciences companies to produce relevant digital content that is optimised for websites.

Exploring trends in individual interaction preferences over time in more detail shows a year-on-year reduction in the UK and Germany since 2021. HCPs in Italy and Spain show the highest affinity for individual interactions, and in all countries, it remains higher than the 2019 pre-Covid benchmark.

*

It should be noted that two separate channel preference questions were posed in 2021 and 2022. HCPs were asked for their preferences given the social distancing restrictions of the time, and also asked what their preferences would be if no such restrictions were in place.

The most detailed view of channel preferences across the six countries shows the nuances beyond simply the top three channels. The desired proportion of remote interactions varies between 25% and 43% and, within this segment, the preferred share of different remote channels varies too. HCPs in Germany have a higher preference for post than any other country, while those in France are particularly keen on virtual conferences and Spanish HCPs appreciate on-demand presentations. The channel that often gets the most hype since the pandemic started is remote video calls, and these remain popular in the UK.

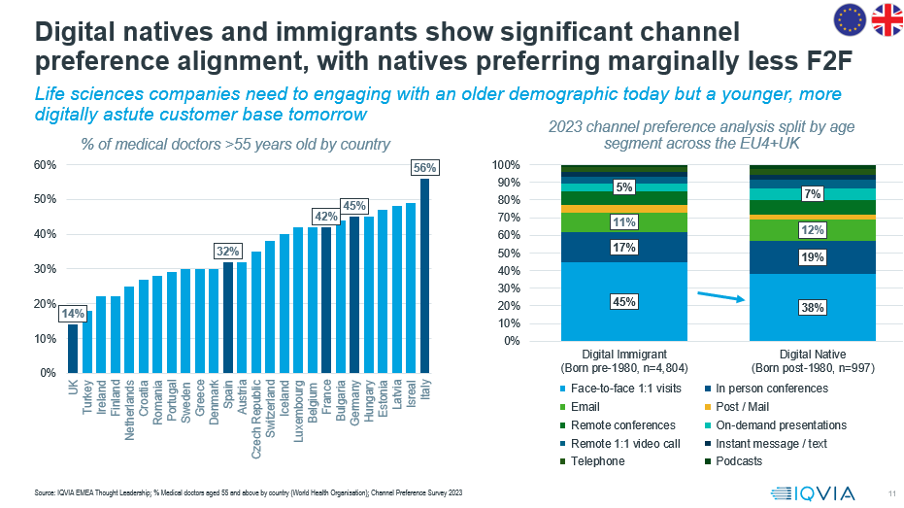

According to a WHO study, the HCP workforce is aging, particularly in Italy where 56% of medical doctors are over the age of fifty-five. This means that pharma and life sciences companies need to balance interactive methods that work for an older audience in certain countries whilst simultaneously providing a suitable channel mix for other countries with a younger HCP demographic.

In the future, as older HCPs retire, it will be increasingly important to understand the needs and preferences that younger cohorts of HCPs have when receiving information from industry. The 2023 Channel Preference Survey shows that digital immigrants (born pre-1980) have a 7% higher preference than digital natives (born post-1980) for 1:1 F2F visits. This is compensated for by increases of 2% for both in-person conferences and on-demand presentations among younger HCPs.

The next article follows on from the country and age analysis featured in the first piece, focusing more closely on trends relating to specialty and gender alongside investigating the relationship between channel preference and the promotional reality.

Related solutions

Measure the performance of your sales force and marketing channels, adapt your commercial strategy and gain real world competitive insights.

Maximize the value of your brand with personalized, precise, and efficient communications.

Take advantage of the latest tools, techniques, and deep healthcare expertise to create scalable resources, precision insights, and actionable ideas.