The biopharmaceutical industry has evolved, and the market access landscape is especially difficult for launch brands. Previously, patient support programs were used primarily to address affordability issues, but they have since expanded into helping patients without coverage to ensure they can receive the therapy they need. The traditional copay card and free trial vouchers are now only two examples of programs in a complex ecosystem of patient support that also includes automatically distributed e-coupons and denial conversion programs, temporary bridge coverage, and debit cards.

Patient access challenges at launch

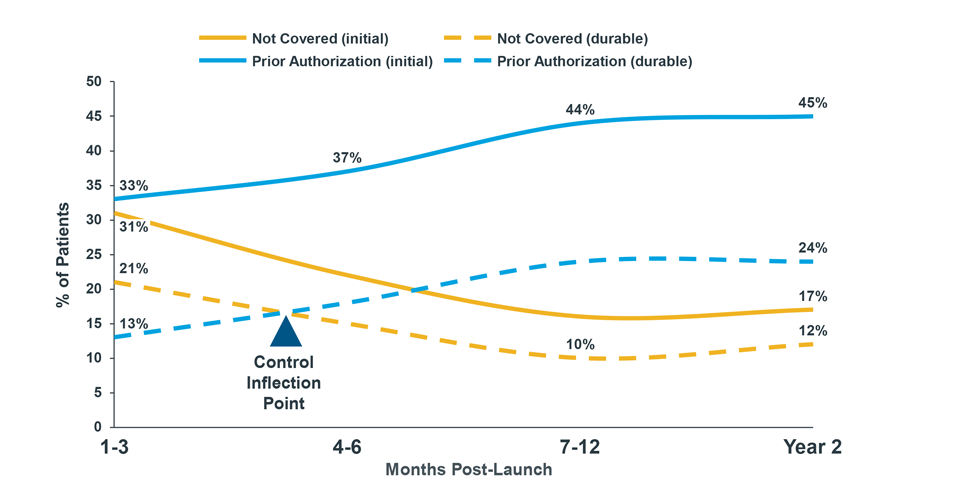

Across all pharmacy products that launched in 2019, only a third of patients who attempted to initiate treatment were able to fill therapy; more than half faced a formulary restriction, and some abandoned due to cost. All too often, launch products must plan for initial formulary exclusion across payers with the expectation that eventually those exclusions will make way for coverage. For launch and mature brands alike, that access increasingly comes with higher patient cost-sharing and utilization restrictions such as prior authorization and step therapy.

Example of New Patient Rejections by Months Post-Launch (Commercial Payers)

Different strategies for launch brands

Because the environment for launching a new pharmaceutical has changed, the definition of a successful launch is also evolving. Today, it is a question of volume vs. value – the delicate tradeoff of margin for early volume gains, with the hope for long-term return. In the short term, a free trial voucher, bridge program, or a denial conversion program can help patients initiate treatment while payers are making coverage determinations. This early support brings assurance to providers that their patients will be able to start on therapy while also relying entirely on the manufacturer to subsidize patient costs outside of a healthcare benefit.

Long term, these programs can erode manufacturer margins in a way that is not sustainable. Recent launch brands have shown support programs investments as large as 60% of their gross-to-net in the first year1. So, as manufacturers make these early margin tradeoffs, they must also consider how all of the patient support offerings can work together in such a way that patients transition off of full manufacturer sponsorship and temporary coverage to their actual healthcare or pharmacy benefit.

Since the margins for launch products are already thin, other challenges, such as accumulator and maximizer programs, can surprise many patient support budgets, where a more established brand may have a better sense of how to absorb and/or mitigate these effects. For these reasons, not having an exit strategy for what are supposed to be temporary fixes is dangerous for a launch.

Elements of a successful launch strategy

Successful support program strategies have a level of agility – or adaptability – that is useful at any stage of a brand’s lifecycle, but is especially useful at launch when patient needs are changing rapidly. For example, unexpected accumulator or maximizer use, poorer coverage than anticipated, and health policy curveballs can combine to upend a launch plan. Of course, evidence and scenario planning are also key characteristics of a good strategy because some of the challenges mentioned before can be anticipated (and modeled) with the right combination of data and analytics of analogue launches.

Lastly, patient support strategies are dependent on payer contracting strategies, and vice versa. Anticipating formulary wins and losses will help manufacturers prepare for access challenges that a support strategy will help overcome. Understanding the geographic footprint of access can even help to target certain support tactics where patients will rely on them most to access a therapy.

If a strategy is designed well, the launch brand will have agreed on a definition of success: What does good look like? Moreover, the strategy will have anticipated margin costs and volume gains based on the various market access strategies working in concert.

1 IQVIA Market Access Copay Card Library