-

Americas

-

Asia & Oceania

-

A-I

J-Z

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

- IQVIA.COM

- Asia Pacific

Regions

-

Americas

-

Asia & Oceania

-

Europe

-

Middle East & Africa

-

Americas

-

Asia & Oceania

-

Europe

Europe

- Adriatic

- Belgium

- Bulgaria

- Czech Republic

- Deutschland

- España

- France

- Greece

- Hungary

- Ireland

- Israel

- Italia

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

Segments

-

Pharmaceutical

-

Consumer Health

-

MedTech

-

Public Health & Government

-

Payer & Provider

Pharmaceutical (Global page)

Bringing data science and human science together to advance human health and support the pharmaceutical industry from clinical trials to commercialization.

Learn More

Consumer Health

Connecting with powerful, evidence-based market insights to drive agile thinking, uncover growth potential, and gain competitive advantage in this fast-moving consumer health market.

LEARN MORE

MedTech

Empowering to orchestrate operations across the entire product lifecycle, from concept-to-market, providing quality control, regulatory, safety and compliance solutions along the way.

Learn more

Public Health & Government

Working across the health system to address key barriers to deliver high-quality, cost-effective care while improving health outcomes using our data-driven and population-centric solutions.

LEARN MORE

Payer & Provider

Delivering a wide range of consulting and technology solutions to support healthcare stakeholders to drive operational efficiency, enhance quality of patient care, and improve systemic outcomes.

learn moreHealthcare Provider Solutions

Solutions

-

Research & Development

-

Real World Evidence

-

Information Insights

-

Market Research

-

Strategy Consulting

-

Contract Sales & Medical Solutions

-

Patient Solutions

-

AI, Digital & Technology Solutions

Research & Development (Global page)

Clinical development enabled by Connected Intelligence™ which combines data and analytics with deep therapeutic and operational expertise to improve efficiency, enhance precision, and bring therapies to patients faster.

Learn More

Real World Evidence

Harness the power of real-world data and insights to demonstrate value-driven evidence and outcomes to meet stakeholder needs across the healthcare ecosystem and to propel healthcare forward.

LEARN MORE

Information Insights

Pharmaceutical market data and information assets that provide actionable data points to help organizations make intelligent connections and drive healthcare forward.

LEARN MORE

Market Research

Primary Intelligence integrates purpose-built and syndicated research solutions with our wide range of data assets, research methodologies, advanced analytics, and deep domain expertise, generating quality insights for our clients.

LEARN MORE

Strategy Consulting

Trusted advisor and partner to global healthcare organisations, solving the most significant business challenges through extensive healthcare expertise.

LEARN MORERelated Solutions

Contract Sales & Medical Solutions (Global page)

Optimize commercial success by leveraging our comprehensive outsourced expertise to accelerate time-to-market.

LEARN MORE

Patient Solutions (Global page)

A single window solution provider to support pharmaco’s design, deploy technology and services that help increase access to medicine and improve treatment adherence.

LEARN MORE

AI, Digital & Technology Solutions

Connected Intelligence™, digital insights, data analytics and advanced technology to power smarter decision-making to enable better patient outcomes and improved business results.

LEARN MOREOur Latest Whitepapers

Get the latest insights on our life sciences, healthcare, and medical technology solutions in Asia Pacific.

Learn MoreBlogs, Case Studies & Podcasts

Explore our library of insights, thought leadership, and the latest topics & trends in healthcare.

Discover Insights

Our Latest White Paper

"Unlocking Pharmaceutical Potential: The Growing Role of Thai Clinics

Read moreCareer Opportunities

Improving human health needs innovative thinkers. Unleash your potential with us.

Search JobsIndustry Analyst Reports

Discover how industry experts recognize IQVIA's impact across the Asia Pacific region.

LEARN MORE- Locations

- Asia Pacific

- Navigating Complex Digital Shifts [Philippines Case Study]

Consumer Health journeys inevitably include digital touchpoints, as consumers are proactive in using the internet to get medical advice and healthcare supplies. With the COVID-19 pandemic limiting access to traditional channels, the consumption of digital pathways has advanced significantly. For Consumer Health companies, developing the right digital strategies is paramount to success.

In a volatile and uncertain environment, IQVIA embarked to understand and validate shifts in behavior across the Consumer Health ecosystem: consumers, healthcare professionals (HCPs), and pharmacists. Using our Southeast Asia WellTrack Study, we were able to gain purchase journey insights in May to June of this year. Below are the highlights of the Philippines study.

Consumers

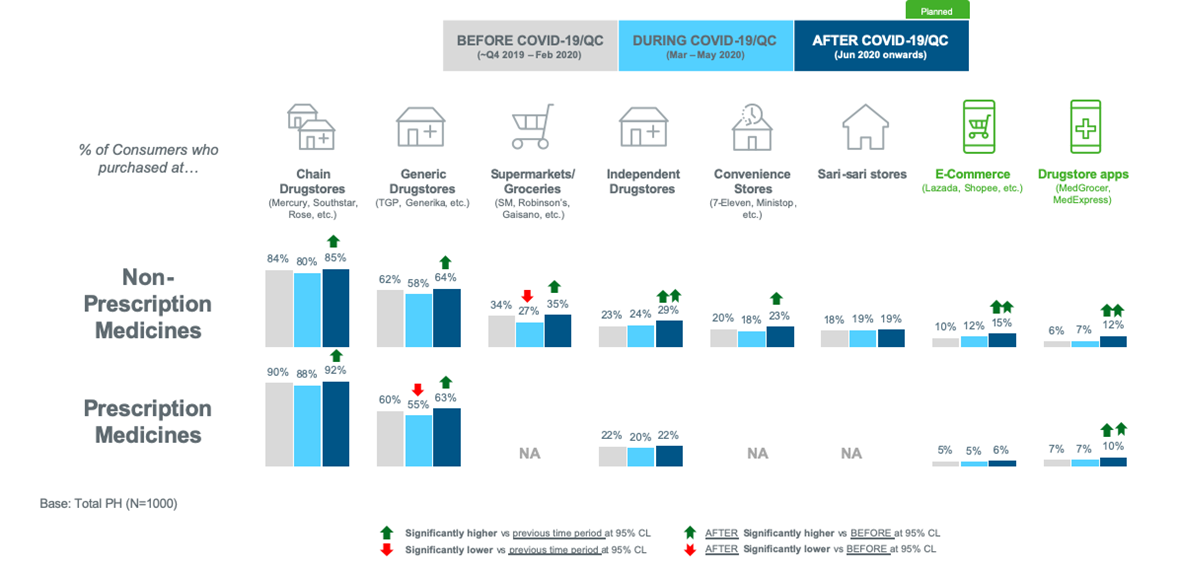

In the Philippines, consumers are buying more frequently, and buying more. During peak pandemic purchasing behavior shifted to alternative independent and online channels, but post-quarantine consumers will continue to look at brick and mortar drugstores. However, new online habits will not disappear and alternative channels – independents, e-commerce, and drugstore apps will continue to also fulfill product demands. For the Consumer Health company, finding a long-term partner to connect physical and online channels is essential.

Healthcare professionals

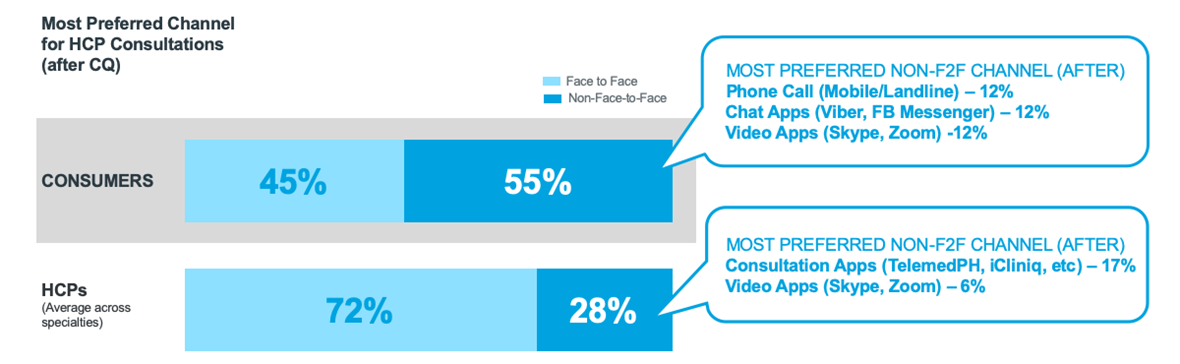

Over a quarter of physicians ‘met’ patients using non-face-to-face channels, such as telephone and apps, but are struggling to meet the increased demand from consumers for non-face-to-face consultations. HCPs are not adapting as quickly as consumers. Furthermore, doctors seek to use more formal consultation apps but there is a disparity with patient awareness for these platforms. There is therefore opportunity for top healthcare brands to devise strategies to connect these stakeholders.

Pharmacists

Pharmacies found an elevated demand for COVID-19 related categories (for example, rubbing alcohol, face masks, Vitamin C, multivitamins) and serviced additional orders through phone and online platforms (owned or partnered with eCommerce/ePharmacy sites).

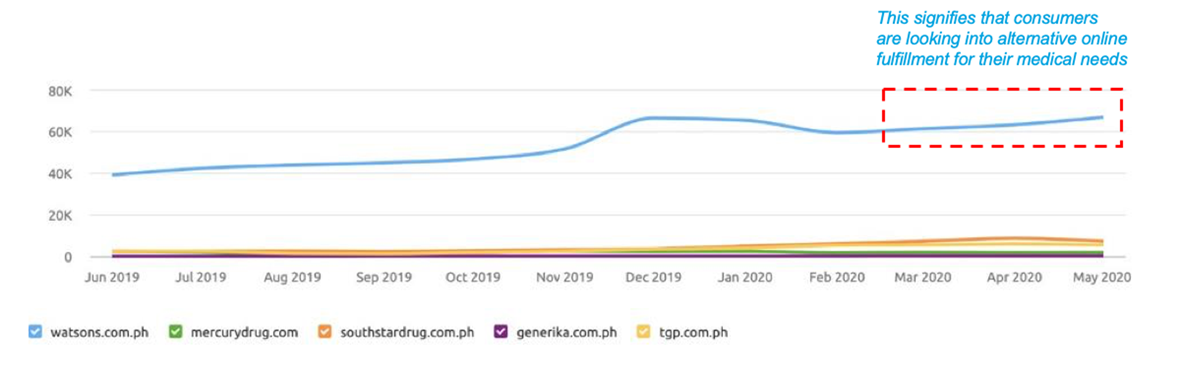

Consumers looked to traditional pharmacy websites over the lockdown period (March 2020 to May 2020) and elevated search trends were observed but only Watsons generated significant search volume. Surprisingly, bigger chain pharmacies who typically generate and service healthcare product demand are yet to establish stronger online presence. Establishing an online end-to-end service moving forward is a basic requirement.

As Consumer Health companies devise their optimal digital strategies, taking a step back to gain understanding and clarity on the complex digital touchpoints across stakeholders is crucial. Our WellTrack findings raise two key questions:

- What digital touchpoints can effectively connect the interface of consumers, doctors and pharmacy channels?

- How can Consumer Health companies enable and support HCPs/ Pharmacists transition to non-face-to-face channels in line with growing consumer demand?

The current environment is volatile and uncertain, but with innovative vision and agile strategies, Consumer Health companies can build a smoother path to fulfill their consumers’ needs.

For more information, please feel free to contact us.