- Blogs

- Growth perspectives for the pharma market

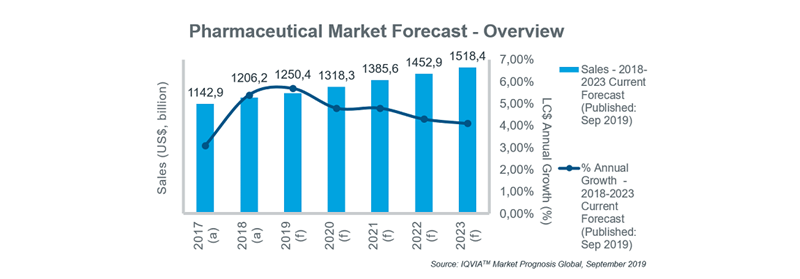

While the global pharmaceutical market is forecast to grow steadily over the next five years, a number of common opportunities and challenges are evident across different markets. Initiatives are being taken to improve access to innovative products, but cost containment remains high on payers’ agendas in all countries, and will contribute to a gradual slowing in annual growth rates over the five-year period.

USA recovery driven by innovative products

The largest pharmaceutical market, the US, recovered substantially in 2018, driven principally by the number of innovative novel products approved over the year. Most of these new product launches benefited from expedited regulatory pathways that recognized innovation and unmet clinical needs. Drug price inflation has cooled, offsetting the boost to growth from new product launches in 2019. Moderation in market growth is expected over the forecast period.

Price pressures will remain high with both the Trump administration’s “Blueprint to Lower Drug Prices and Reduce Out-of-Pocket Costs” and bipartisan support for some policies scrutinizing US drug prices against those in other countries. However, no significant reforms are expected to be implemented until after the 2020 federal elections. Meanwhile, the HHS and the FDA are making concerted efforts to boost market access for generics in a bid to increase competition and achieve lower prices. In addition, support for the generics market, in the form of new LOE opportunities, will be considerably higher from 2022-2023.

Improving access, but strong pricing pressures in China

Demand will remain strong in the second largest market, China, and market access for innovative new drugs there is improving. Reforms to the drug approval process have reduced lengthy registration times, allowing new drugs to reach the market faster and encouraging a rise in the number of innovative new drug submissions and the rate at which these are being processed. Access to reimbursement is also improving, following updates to the National Reimbursement Drug List in 2017 and 2018, and with another update scheduled to come into force in January 2020. More high-cost innovative new drugs are also being selected for listing, subject to successful price negotiations. However, originators are required to make major concessions on the price of innovative new drugs in return for listing, while in parallel the expansion of consolidated, volume-based tendering will drive down procurement prices for patent-expired molecules for which generics that have passed quality consistency evaluations are available.

Macroeconomic and political changes in LATAM underpin growth prospects

The improving economy in Brazil, supported by market-oriented reforms, will boost growth in the pharmaceuticals market in the short-to-medium term. In contrast, short-term growth in Mexican retail sector will be driven by inefficiencies of the public sector caused by the challenging environment under its new president.

Strong demographics, rising employment levels and higher disposable incomes in Brazil are major drivers underpinning the positive outlook for the pharmaceutical makert over the 2019-2023 period. Other factors, such as OTC market deregulation, the fast growth of pharmacy chains, the growing trend by pharmacies to provide value added services to boost margins, as well as the shortcomings of the financially over-burdened SUS, will drive patient demand for medicines in the retail sector. Additionally, generic volume sales will continue to grow robustly, as price-sensitive consumers are increasingly becoming more informed about their safety and quality and are also becoming less loyal to brands. The government’s emphasis on tighter controls to reduce large public deficits and inefficiencies in the healthcare sector will also drive out-of-pocket spending and push further patient migration to the retail sector over the forecast.

In Mexico, inefficiencies in public tenders have created shortages in the institutional sector in the first half of 2019, which will force patients to purchase medicines in the retail sector in the short term. The multiplication of physicians at the point of sale will continue to propel the consumption of medicines due to the ease of access to medical consultations and prescription medicines, and this trend will be reinforced by public sector inefficiencies. However, rampant competition and a degree of consolidation of pharmacy chains over the next five years will place downward pressure on drug prices.

Japan’s growth prospects dampened by drug pricing policy

Pricing reforms and rising generic usage will rule out growth in the overall value of the Japanese pharmaceutical market, which is expected to decline at a CAGR of 0.6% in the five years to 2023. While the government will pursue new measures that encourage innovation, restrictions in access to price maintenance premiums and adoption of cost-effectiveness assessment will curb NHI prices for patented drugs, thereby depressing earnings posted by the industry’s leading innovators.

Enforcement of G1/G2 pricing rule, imposition of ‘one-off’ price cuts to account for consumption tax hike - to be implemented in October 2019 - as well as ‘off-year’ price reviews will ramp up pressure on sales growth of long-listed products and generics; however, in the light of these new rules, price cuts during the regular biennial NHI price revisions are expected to be less severe than what has been seen historically.

Investment plans may be revisited; cost-cutting initiatives – including headcount reductions – will be stepped up; portfolios will be restructured; and a new round of local industry consolidation could be witnessed.

EU5 markets focus on access to innovation

While growth will remain steady in the EU5 markets, key priorities for governments over the forecast period will be price control initiatives and measures to improve patient access. In Germany the launch of new drugs will drive market growth, with at least 30 launches expected in 2019. However, the use of early benefit assessments and unpredictable outcomes of price negotiations remain an issue for manufacturers of innovative drugs. The GSAV law, which came into effect in August 2019, covers a number of different topics, including: provisions for adjusting orphan drug prices; ensuring security of supply in discount contracts between companies and health insurance funds; and measures to increase uptake of biosimilars. France is also introducing measures to improve biosimilar uptake, aiming to achieve 80% penetration rates by 2022. Growing emphasis will be put on disease prevention and the control of chronic diseases under recent and current policy initiatives, including the new health law adopted in July 2019, which targets a transformation of the healthcare system. In Spain, price controls as a means to curb pharmaceutical spend will be ramped up over the forecast period. In Italy, the long-awaited new pharmaceutical governance strategy (published in December 2018) outlines measures to address issues affecting the underfunded healthcare system and is expected to help contain drug costs while improving patient access to new drugs. In the UK steps have also been taken to expedite patient access to new medicines through initiatives such as the Accelerated Access Collaborative, and reforms to the Cancer Drug Fund. The new voluntary pricing system for branded medicines, effective since January 2019, also aims to accelerate and extend the uptake of new medicines.

Moves to improve access to new medicines in all markets will be increasingly linked with pricing/risk-sharing arrangements. With the uncertainty about Brexit continuing, associations representing the European and British Life Science Industry have warned about the challenges across a range of business areas.

Conclusion

Overall, slowing growth over the prognosis period in the majority of countries will be primarily driven by the increasing cost-containment measures adopted by payers. However, improving access to innovative medicines to respond to unmet clinical needs will remain high on the health agenda.

* Market Prognosis Global covers top-level forecasts for over 200 countries. In this release, forecast has been updated for 48 MP countries only. Growth figure excludes Venezuela.

Source: IQVIA Market Prognosis Global, September 2019