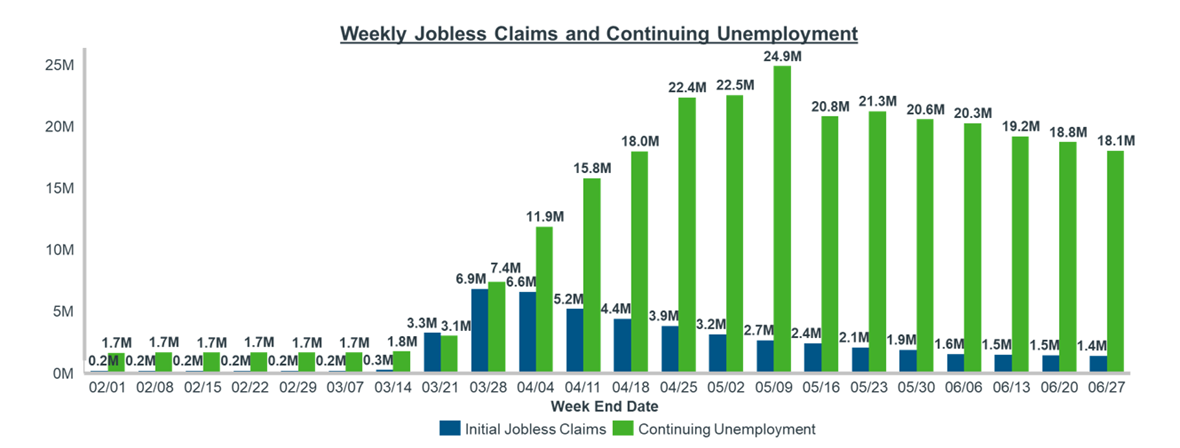

The impacts of COVID-19 are severe and too numerous to address in a single literary examination. While we acknowledge the massive public health and economic impact of the pandemic, this 3-part blog series will focus on a specific ramification of COVID-19’s decimation of the U.S. job market: patient health insurance and how patients are paying for their prescriptions.

As we all know, non-Government (aka Commercial) payers enroll most of their patients via employer-sponsored plans. Employers can choose to subsidize the employee premiums as a benefit of employment, and patients do not need to worry about being excluded from insurance rolls due to pre-existing conditions. While this system is robust and works for millions of Americans, it is ill-equipped to deal with the high levels of mass unemployment that we are currently experiencing.

In the world of pharmaceuticals, the complicated web of stakeholders is enabled by the basic assumption that most patients have a health insurer negotiating costs on their behalf. Any disruption to this model has a substantial impact on patient cost sharing, payer expenses, and manufacturer sales and margin – the latter which we focus on in this blog series.

Coverage Options

A patient who has recently become unemployed has five options:

- Move to a family member’s plan – In the case where the unemployed person’s spouse/parent/family member is still working, they may be able to be added to that person’s coverage.

- Enroll in COBRA Coverage – The Consolidated Omnibus Budget Reconciliation Act (COBRA) provides an explicit healthcare coverage option for a recently unemployed person. Under COBRA, the person has the option of continuing to purchase their old insurance at the unsubsidized rate. This means that they are responsible for both their portion of the premiums as well as the amount originally covered by their employer. While this is great from a continuous care perspective, it can be very expensive, particularly for an individual who has recently lost their job. In fact, the current average COBRA premium for a family of 4 is ~$1,700/month or $20,000 per year1.

- Participate in the ACA Health Exchange – Part of the Affordable Care Act (ACA) was the creation of Health Exchanges (HIX) where a patient could shop for a variety of healthcare coverage without fear of being rejected for a pre-existing condition. In addition, depending on income limits, the patient would be eligible to receive a subsidy from the government to offset the cost of these plans’ premiums. To prevent people from signing up for healthcare right before a big expense is incurred and then cancelling thereafter, one can only enroll in HIX plans during a pre-defined window once per year or after a “life event.” Examples of life events include getting married, having a child or losing your job. This presents a reasonable option for recently unemployed people to pursue coverage that will likely be cheaper than COBRA. The downside is that this will technically be a new plan, meaning that a patient will have to re-accrue against their deductible. They also may find that the specific physicians or pharmaceuticals that they’re accustomed to do not participate in the new plan. In addition, many local markets offer limited plan options as a result of payers exiting the exchanges over recent years, limiting patient choice and making this a less attractive option for the recently unemployed.

- Enroll in a State Medicaid Plan – Government insurance through Medicaid is meant to serve the low-income population, and a recently unemployed person would likely qualify. However, there are a few caveats. The ACA also includes the “Medicaid Expansion,” an option that each state could opt to participate in to expand the pool of patients who are eligible for Medicaid. For states that did expand Medicaid, households that earn less than 138% of the Federal Poverty Limit (FPL) are eligible. For non-expansion states, the limit is much lower (40% of the FPL), and does not include single men regardless of their income. For more on Medicaid eligibility see this article from the KFF.

- Pay Cash / Remain Uninsured – Patients who may need to continue filling prescriptions, but whose medications are not overly expensive, may simply decide not to seek health coverage and instead pay the cash price for a drug. Typically, this will be AWP (or WAC + 20%), so it can get quite expensive for higher WAC therapies. These patients may also attempt to use a discount card in an effort to lower their prescription costs.

Each of these options has a different impact on a manufacturer’s commercial strategy and finances, and it is vital to track these coverage options to minimize disruption of sales and margins.

Because the ratio of patients selecting these coverage options differ by geography and therapeutic area, there is no one-size-fits-all approach when it comes to strategic responses.

This resource is Part 1 of a blog series dedicated to Payer Coverage changes in the time of COVID-19. Our next post will address the two commercial questions manufacturers must answer amid payer coverage changes.

For more guidance on how to track payer coverage, contact Brian Fallica.