- Blogs

- The other Second Wave? The pandemic's impact on EU5 Payers

Before COVID-19, changes were already on the horizon across the EU to address continuing challenges faced by payers. The unprecedented disruption from the pandemic will significantly exacerbate financial pressures for healthcare systems.

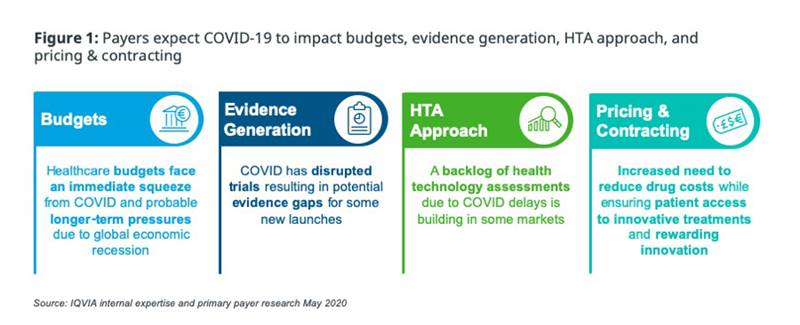

In this blog, we will review how EU5 payers expect to accelerate their plans for change across 4 pillars of Pricing and Market Access decision making (figure 1).

We will answer some key questions on the payer response to COVID-19 in Europe, short- and long-term:

- How will healthcare budgets be impacted over time? What areas of the budget will be high-priority targets for savings?

- How will payers respond to trial data gaps due to COVID-19? Will they accept RWE to fill those gaps?

- Will COVID-19 fundamentally change payer approach to RWE in HTA?

- What is the impact on a) timing, and b) likelihood of positive outcome for HTA due to COVID-19 disruption?

- Will HTA approaches evolve due to COVID-19, including the long-discussed move towards EU harmonisation?

- What measures will payers use to increase pricing stringency after COVID-19?

Healthcare budgets at a macro level are unlikely to be cut short- term, but pressure in the mid-to-longer term will force action

Short-term budget impact

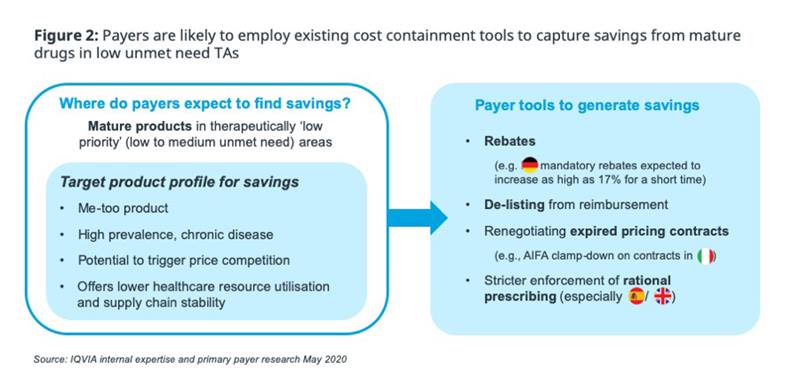

Short-term, the political sensitivity of COVID will have a protective effect on healthcare budgets overall, with some governments are already seizing the opportunity to make symbolic, headline-grabbing pledges of additional funding to capitalise on public sentiment towards healthcare, e.g., UK clearing of hospital debts. But as the healthcare budget focuses towards hospitals and COVID management, there will be a knock-on effect on other areas; Based on past experience, the drugs budget is a likely ‘low-hanging-fruit’ target for short-term savings (figure 2).

Longer-term budget impact

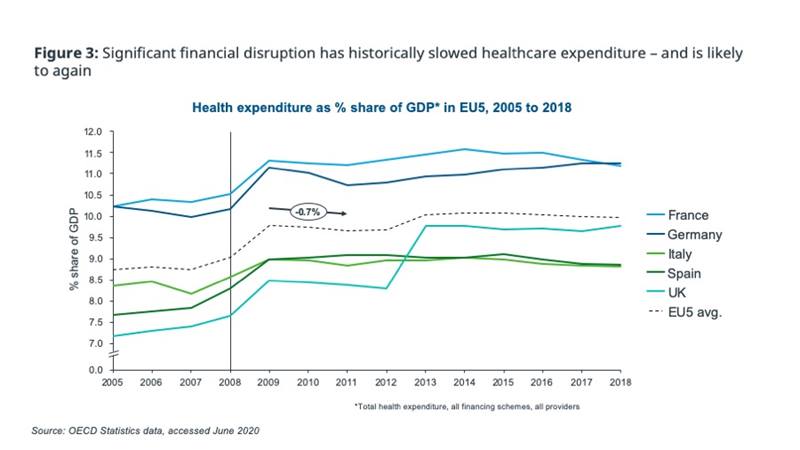

Previous events, e.g. post-2008 financial crisis, indicate that longer-term healthcare spending tends to decline or at least stagnate following economic disruption, after an initial lag (figure 3).

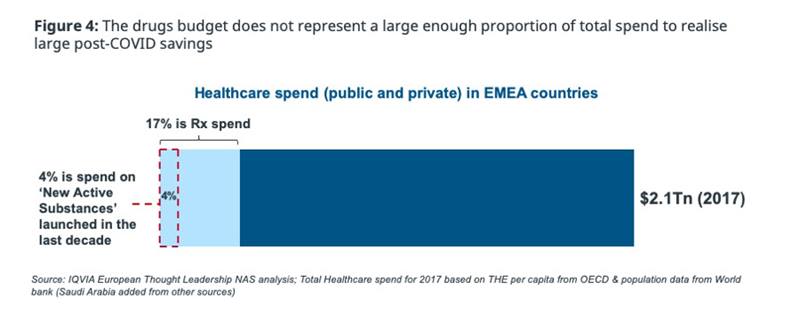

In the longer-term post-COVID world, the fallout from disruption of care pathways during the pandemic, and the scale of the ‘COVID bill’, will drive a rise in payer expenditure. Lower tax receipts during the pandemic already suggest healthcare budgets may need to be cut across the board in the EU – the scope of cuts will be influenced by the proposed central EU COVID fund and the level of country debt permitted. In that scenario, it is unlikely healthcare funding will continue to be protected and the drug budget alone will not deliver the level of post-COVID savings needed, given the small proportion of total healthcare spend it represents (figure 4).

The next EU patent cliff ~2022-24 may offer payers some budget-relief, from brands like Victoza and Januvia, but not to the same extent as past waves (e.g. 2011-12 statin and anti-depressant cliff). Instead, longer-term budget management is more likely to focus on structural healthcare system changes that COVID has exposed as feasible, during this period of rapid change, e.g., closer integration of decision-making bodies, system-wide healthcare delivery (across regions, CCGs etc.), virtual working from home, telemedicine etc. The momentum generated by the pandemic may even be harnessed to address other pain-points that drain healthcare system budgets, e.g., HR / infrastructure costs – bureaucracy and physical overheads reduced during COVID.

Evidence generation may be disrupted by COVID-19, but pharma will still need to provide robust data, or face rerunning trials or accepting price trade-offs

The pandemic has caused significant disruption to both ongoing and new clinical trials, but the payer community is clear that evidence standards will not be lowered: pharma will still be required to provide robust datasets, despite the COVID impact. Payers indicate there will be a case-by-case assessment of any exceptions to be made, likely reserved only for the most disruptive new products in high unmet need indications. Pharma will be faced with the choice of demonstrating that COVID disruption has no impact on trial results, re-running/prolonging ongoing trials, accepting a trade-off on price, or risking non-reimbursement.

This raises the question of whether disrupted trials can be supplemented by RWE, with COVID acting as an opportunity to increase payer acceptance of pre-approval evidence. A recent IQVIA white paper, ‘Excellent launches are winning the evidence battle’ (March 2020), explored how lifecycle RWE planning has become a strategic differentiator for Launch Excellence1, and that Excellent launches generate more published evidence than non-excellent ones pre- and post-approval; COVID may now help to accelerate RWE use in HTA.

Recent years have seen a significant increase in RWE-inclusion in HTA dossiers (45% of EU3/Can submissions by 2017/18), but 90% of that evidence was in support of RCT data – not instead of it – and no clear correlation has been demonstrated, to date, between RWE inclusion and positive HTA outcome. Current uses for supportive RWE in HTA submissions include: population definition; adherence /persistence tracking; identifying appropriate comparator (or acting as an external comparator for single-arm trials); extrapolation of clinical outcomes/validation of surrogate endpoints; economic outcomes, e.g., resource utilisation, utilities.

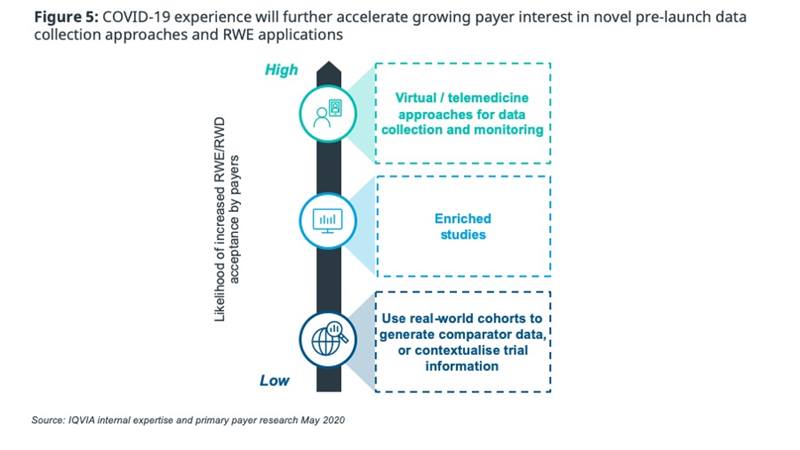

With this background in mind, it is likely that the barrier to increasing payer acceptance of RWE in lieu of RCT data is too high for COVID to overcome in isolation; however, we do expect that COVID will accelerate payer acceptance of novel pre-launch data collection approaches (figure 5). The significant increase in telehealth during the pandemic will increase trust in digital data collection, leading the way for acceptance of virtual clinical trials. Similarly, payers are expected to be more comfortable with studies enriched with digitised healthcare data (e.g. EMR, claims data).

HTAs are already being forced into short-term adaptation and COVID could be a catalyst for longer-term fundamental changes

Mid-pandemic HTA impact

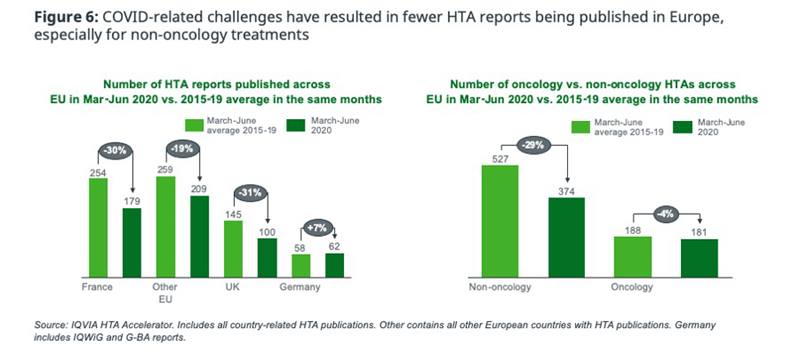

Despite EU5 payer bodies adopting virtual-working, the need to fast track COVID-19-related appraisals whilst under lockdown is resulting in HTA bodies halting, or prioritising assessments based on key product attributes, creating a backlog. Compared to the averages from 2015-2019, the overall number of HTA publications in Europe between Mar-Jun has dropped by 20-30% - but oncology is less significantly impacted than other TAs (figure 6).

This reduced HTA activity in Europe means that pharma will experience delays whilst payers process the backlog, unless the product is prioritised based on a significant unmet need. Assuming pre-COVID HTA publication levels return by September, and an average assessment timeline of 7 months, the backlog may take until Q2 2021 to clear – or longer if there is a significant second wave in Q3/Q4 2020.

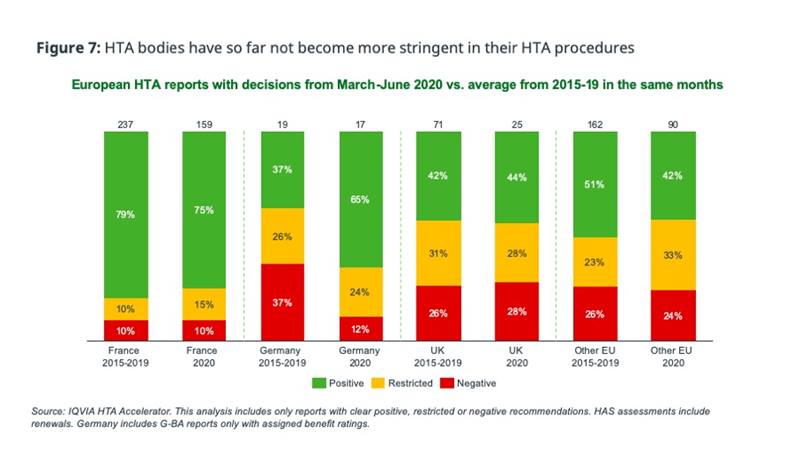

On a positive note, payers have not yet become more stringent in their HTA decision making, based on assessment outcomes published during the pandemic versus the same period in the previous 5 years (figure 7).

Longer-term HTA impact

Major revision of EU HTA is not expected due to COVID-19. Payers believe in current processes and will prioritise rigour vs. changes that have potential to introduce uncertainty; However, the COVID pandemic will act as a catalyst, expediting changes already being discussed – particularly where those planned changes align with a heightened focus on cost-containment post-COVID.

Despite the cross-country impact of COVID, the move towards a harmonised HTA in EU will be delayed by the pandemic and there will be little appetite for discussions on previously-planned EU harmonisation of HTA, as countries look inwards to manage COVID-specific pressures. We do expect harmonisation to remain the long-term goal; In June the rapporteur for EU-level cooperation on HTA in the European Parliament stressed to key figures in the European Commission that COVID has made it clearer than ever that strengthening cooperation in HTA is needed – demonstrated by EUnetHTA’s joint assessment on the role of antibody tests against COVID-19.

COVID-19 is likely to be used as justification for more stringent use of pricing controls and other policies to limit expenditure

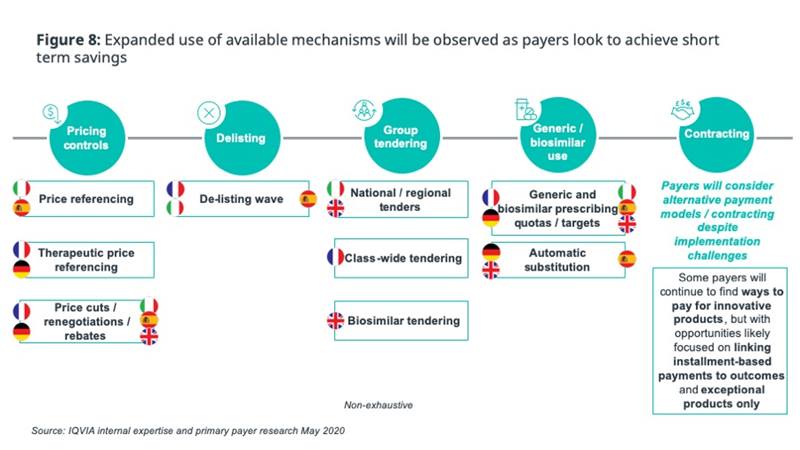

Given the significant healthcare expenditure incurred to manage the pandemic, COVID-19 is likely to be used as justification for more-stringent use of pricing controls and other policies to limit additional spending. We expect payers to leverage the suite of readily-available mechanisms to contain costs, rather than seeing significant changes in overall pricing approach: pricing controls, delisting of non-essential drugs, greater use of tendering, and further incentivisation of generic/biosimilar use (figure 8).

Even in an environment of limited payer capacity and increased pricing stringency, value-based pricing will be needed where drugs truly offer benefit. Payers will continue to have to find ways to pay for innovative products, but only exceptional products are likely to warrant the effort of agreeing on alternative payment contracts or instalment-based payments. Payers’ desire for simple, easy-to-implement options will be intensified by COVID-pressures - simplicity is paramount, and complex deals should only be sought if absolutely needed.

IQVIA recommends a shift towards greater collaboration between pharma and payers to address post-COVID-19 challenges:

- Be prepared for a reopening of price negotiations for mature products

- Monitor P&MA system evolution and revise key stakeholder mapping and engagement approaches

- Carry out scenario planning for trials that are expected to produce incomplete data to inform launch /evidence generation plans

- Conduct a reassessment of product pipeline and upcoming launches in-light of anticipated payer prioritisation

- Prepare for a fundamental shift to demonstrate both clinical and economic value across the healthcare systems

- Expand capabilities to support alternative funding and pricing models, including partnering to overcome implementation challenges

References:

1. IQVIA Institute White Paper ‘Excellent launches are winning the evidence battle’ Mar 2020