Data, AI, and expertise empower Commercial Solutions to optimize strategy, accelerate market access, and maximize brand performance.

- Locations

- United States

- US Blogs

- 2023 Update: Six Years of Deductible Accumulators and Copay Maximizers

Since 2017, IQVIA has tracked and reported on deductible accumulator and copay maximizer plans. While accumulators exclude manufacturer-sponsored copay support from counting towards a patient’s deductible, maximizers are designed to exhaust the annual assistance benefit available from manufacturers. Last year’s report on the topic, Five Years and Counting: Deductible Accumulators and Copay Maximizers in 2022, showed increasing prevalence, the limited impact of state-level accumulator bans, and shifting maximizer designs. New data illustrated below shows that in 2023, accumulator prevalence was slowing, but a growing portion of commercial patients were affected by maximizers. Thus, these programs remain a major concern for patients and the pharmaceutical manufacturers funding their support programs.

Slowed accumulator growth as maximizers pick up

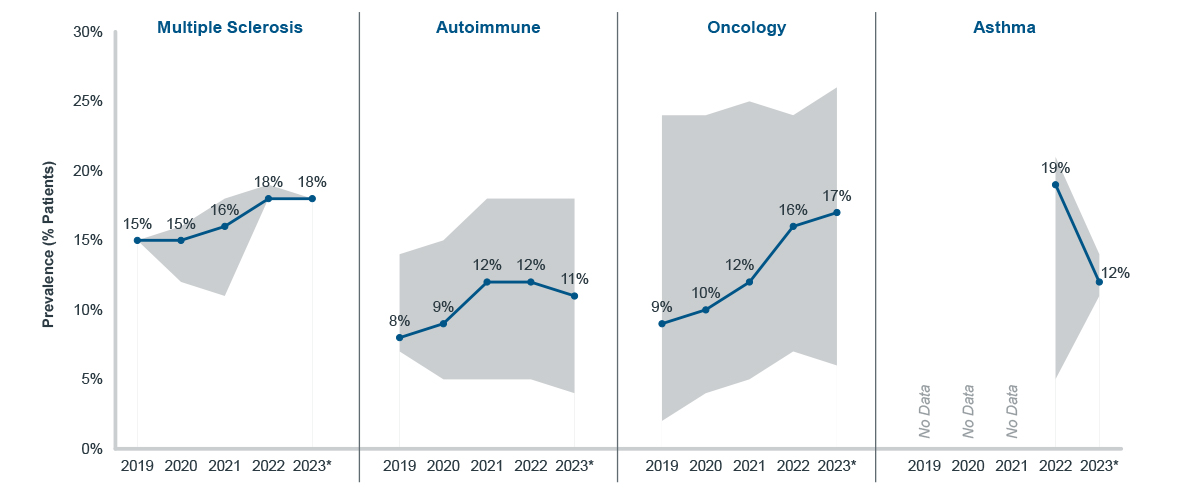

Across four specialty therapeutic areas (multiple sclerosis, autoimmune, oncology, and asthma), accumulator prevalence slowed in 2023 forecasts as compared to previous years. Nevertheless, accumulators continue to represent a sizeable portion of privately insured patients, averaging 11% to 18% depending on the studied market. Within each therapeutic area, accumulators impacted brands across a range. In oncology, where the range of accumulator prevalence is widest, as few as 6% and as many as 26% of commercial patients faced accumulators in 2023. Average accumulator prevalence for autoimmune brands declined slightly from 2022 (12%) to 2023 (11%), however patients continue to experience accumulators at a steady rate despite the various state-level bans on accumulator use. Due to the high costs that accumulator programs exert on co-pay card budgets, they accounted for an estimated $2.1B (9%) of total patient support spend in the U.S. this past year.

Accumulator Prevalence Range and Trend, Commercial, Select Specialty Medicines

*2023 is predicted based on six months of data

Note: Sample is limited to 23 specialty brands and biosimilars; prevalence measured as a proportion of all support-program-using patients

Source: IQVIA, U.S. Market Access Strategy Consulting

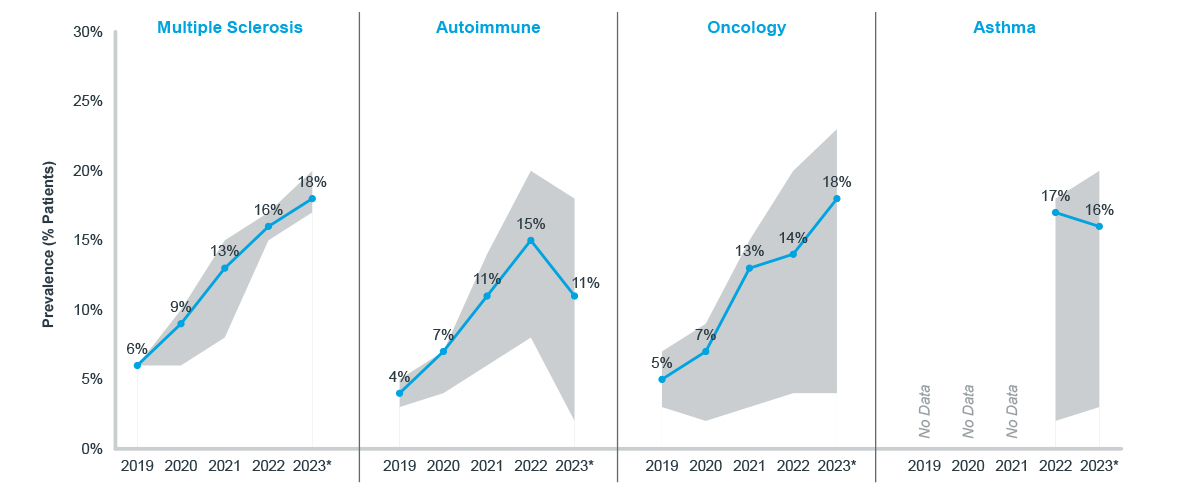

While the prevalence of deductible accumulators slowed, copay maximizers continued to grow at a steady pace across most specialty brands. In multiple sclerosis and oncology, in particular, average maximizer prevalence increased to 18% of patients in 2023. As with accumulators, maximizers can impact brands within the same class differently, resulting in a range of prevalence rates. This range is especially pronounced among oncology brands where maximizer prevalence was as low as 4% and as high as 23% of patients in 2023. Though the average maximizer prevalence declined slightly in autoimmune and asthma brands, at least a tenth of patients were still affected by the program in 2023. Moreover, the average may have declined but accumulator prevalence did increase for some autoimmune brands.

By design, copay maximizers extract the highest amount of money possible for manufacturer-funded patient support programs. Maximizers charge patients a high cost for their drug until the support benefit is exhausted; then patient cost goes to zero. An increasing number of manufacturers have publicized1 that they must modify the designs of their patient assistance programs in response to maximizers. Nevertheless, in 2023, maximizers accounted for an estimated $2.7B (23%) of total patient support spend in the U.S.

Maximizer Prevalence Range and Trend, Commercial, Select Specialty Medicines

*2023 is predicted based on six months of data

Note: Sample is limited to 23 specialty brands and biosimilars; prevalence measured as a proportion of all support-program-using patients

Source: IQVIA, U.S. Market Access Strategy Consulting

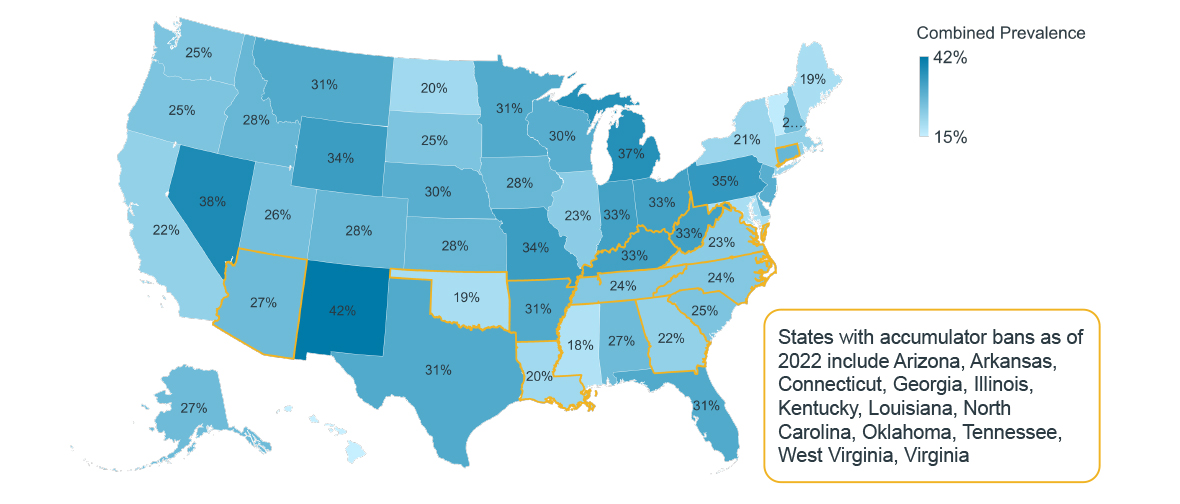

Subnational prevalence

As of March 2024, nineteen states have passed legislation banning accumulators in state-sponsored insurance plans, including plans available through healthcare exchanges (HIX). Twelve of these states had such bans in place by the start of 2022 (highlighted in the figure below). Despite the legislation, accumulator-banning states did not successfully lower accumulator prevalence (Five Years and Counting: Deductible Accumulators in 2022). To date, state legislation has not yet sought to block the use of copay maximizers, only accumulators. State-by-state, accumulators and maximizers combined affect a minimum of 15% (Hawaii) and a maximum of 42% (New Mexico) of patients across the U.S.

Combined Accumulator and Maximizer Prevalence, 2022, Commercial, Select Specialty Medicines

Note: Sample is limited to 23 specialty brands and biosimilars; prevalence measured as a proportion of all support-program-using patients

Source: IQVIA, U.S. Market Access Strategy Consulting

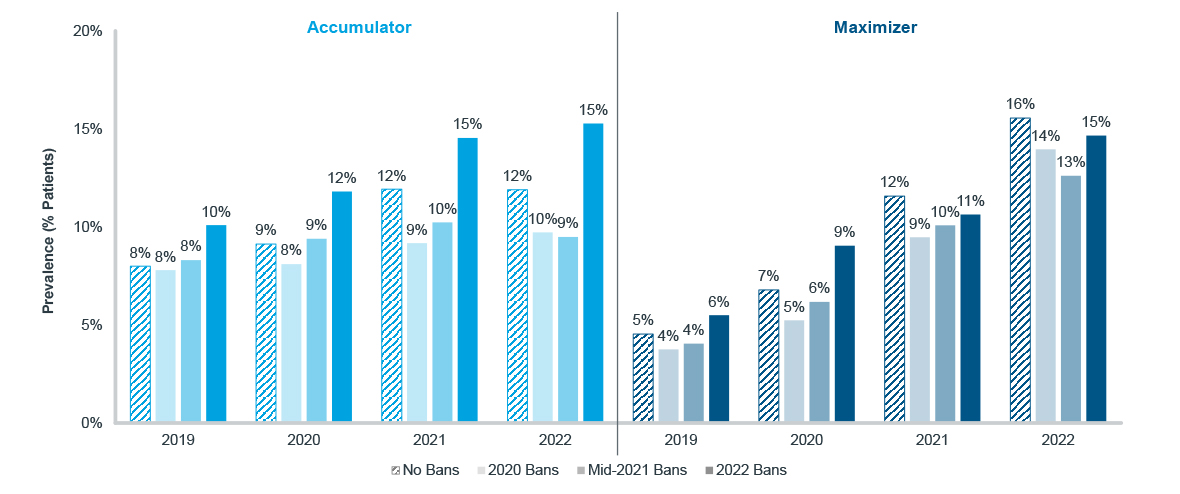

In states that banned deductible accumulators in 2020, such programs were not eradicated but prevalence increased at a slower rate (+25%) than in states without a ban (+49%). States that implemented accumulator bans in 2022 had some of the highest accumulator prevalence – both pre- and post-ban – yet accumulator prevalence did slow by the time the legislation took effect. States with a larger proportion of self-funded benefit enrollees, which are not subject to current bans, appear to have a greater combined accumulator and maximizer prevalence - confirming use as a cost-lowering tactic by PBMs under their national benefit designs.

As observed nationally, maximizer prevalence has been increasing more rapidly than accumulator prevalence. The trend is especially pronounced in states that banned accumulators in 2020 (+272%) compared to states without (+243%), perhaps indicating payers’ use of maximizers to reduce drug spend when accumulators face criticism.

Prevalence Trends by State Accumulator Ban Status, Commercial, Select Autoimmune Medicines

Note: Sample is limited to 23 specialty brands and biosimilars; prevalence measured as a proportion of all support-program-using patients

Source: IQVIA, U.S. Market Access Strategy Consulting

On the political stage, a 2023 decision from a Washington, D.C. federal court ruled against a Trump-era expansion of accumulator use2. While this ruling does not outrightly ban accumulators at a national level, some policymakers seek to do exactly that. The HELP Copays Act was submitted to Congress in 2023 and included a ban against accumulators3. States may have been largely ineffective, but a federal law could more definitively eliminate such a practice. That bill was never voted on, but it does indicate a growing frustration with accumulators. The proposed Notice of Benefit and Payment Parameters for 2025, released by CMS, includes language that would consider any covered drug essential. Currently, “non-essential” drugs tend to be targeted by plans for accumulators and maximizers.

Historically, accumulators and maximizers have been isolated to specialty therapeutic markets. However, manufacturers will need to prepare for the increasing risk and possibility that payers will continue to innovate when it comes to leveraging support programs. The emergence of Specialty Carve-Outs and Alternative Funding Programs4, which enroll patients in high-buydown assistance programs instead of leveraging their prescription benefit, further raises the stakes. Moreover, accumulators and maximizers still have room to expand despite the political efforts against them. Whether it is continued prevalence growth among specialty medicines or the expansion into more markets (retail, medical), determining the extent of these programs will be urgent for the manufacturers that fund copay support and the patients that depend on them.

1Managed Healthcare Executive, Another Dispatch from the Accumulator Maximizer Wars, May 31, 2023

2HIV and Hepatitis Policy Institute vs. United States Department of Health and Human Services, September 29, 2023

3H.R. 830 – HELP Copays Act, February 6, 2023

4Alliance for Patient Access, The High Costs of Alternative Funding Programs, June 2023

IQVIA’S Market Access Center of Excellence

In a time when better access has never mattered more, IQVIA has built the largest and most experienced market access team in the industry. That team of experts drives IQVIA’s Market Access Center of Excellence, powered by intelligent connections between data, analytics, technology, and strategy to help clients navigate today’s challenging access environment.

Related solutions

Gain high value access and increase the profitability of your brands

Rely on market-leading strategists to help you achieve maximum access and profitability