- Locations

- United States

- US Blogs

- Understanding the Impact of Cost Sharing in Pharma: Cost is a Powerful Control of Patient Behavior

If you are just joining our series, let me give you a quick recap of what we have covered so far. Previously, we discussed how pricing pressures, supply and demand factors, and policy uncertainty make up a phenomenon IQVIA calls the “big squeeze.” An earlier post touched on the role of payer controls. In this post, we will tackle another factor impacting demand – patient out-of-pocket costs.

The rule is simple: The more a patient is asked to pay, the less likely they are to do so. Let me say that again – The more a patient is asked to pay, the less likely they are to do so. This is true across therapeutic classes, patient demographics, geographies, income, and more. However, there is wide variation by brand driven by many complex dynamics.

Patient abandonment

Let’s take a couple of hypothetical situations as a case in point:

Consider if your doctor prescribed you an ocular allergy medication. For those of you who suffer from eye allergies, this is no laughing matter as they can be severe and even cause you to miss work or school. You go to the pharmacy and you are asked to pay $100 as your out-of-pocket cost share. Seeing this, the pharmacist may suggest that there are generic alternatives or over-the-counter options that are much less expensive. Given this situation, most of us would consider alternative options to filling that prescription - even if we are very symptomatic.

Now, let’s say you go to the doctor and have a much more troublesome diagnosis (we do not wish anyone ill!), and are prescribed an oral oncologic drug. You go to the pharmacy, and as with your ocular allergy drug, you are asked to pay $100. You are likely thankful that the drug only costs $100 and gladly fill it. Same patient, same price point, but very different responses.

While these two examples may seem to be extremes, they illustrate the initial decision that patients are asked to make when filling their medications. When a patient chooses not to fill an initial prescription, we term that ‘patient abandonment’. This can be studied across populations and products, and presents important insights into how efficient a brand is at capturing patient volume. In fact, when studied broadly, it is one of the top reasons, after payer controls, that demand is lost.

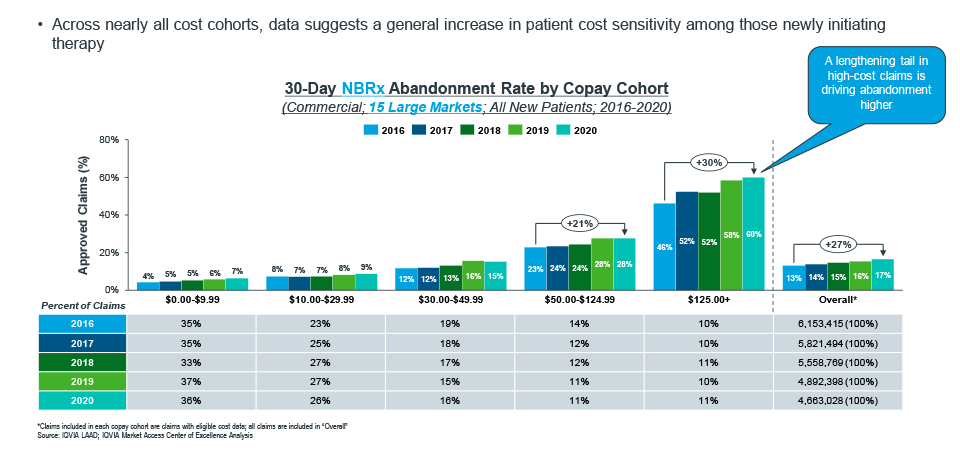

Recently, IQVIA measured the impact of cost sharing over time across 15 major therapeutic categories in the Commercial market. The results demonstrate both the underlying premise that the more a patient is asked to pay, the less likely they are to do so, but also highlights that abandonment is getting worse over time.

Across 15 major therapeutic categories, commercial patient abandonment has increased over the past 5 years

From 2016 to 2020, overall Commercial new-to-brand patient abandonment for these 15 large markets increased by 27% (far right). This has primarily been driven by patients that are being asked to pay more than $50 and can be acutely seen in those that are being asked to pay more than $125. As more patients are exposed to higher cost sharing through co-insurance and deductibles, the likelihood of abandonment increases.

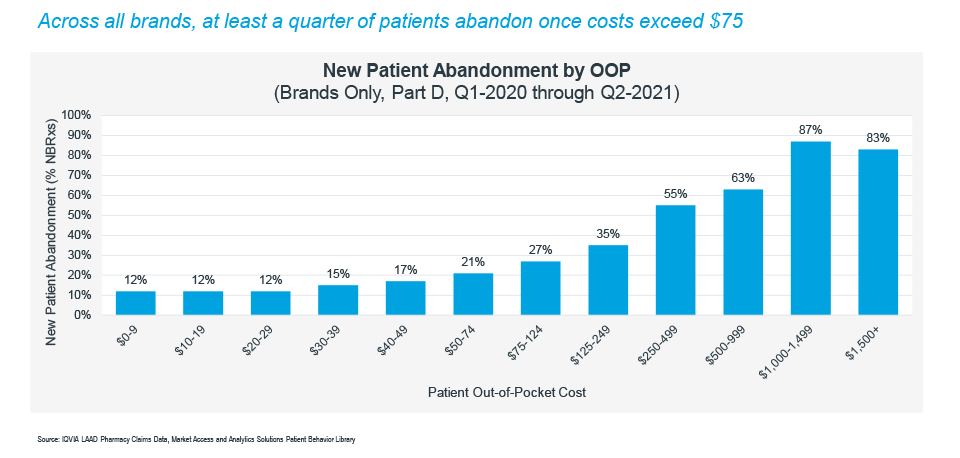

Cost sharing also impacts patient behavior in Medicare Part D, but unlike in Commercial, these patients do not have access to copay programs to offset their cost. Broadly across Medicare, we see patients who are asked to pay more than $75 abandon prescription therapy roughly 25% of the time.

Patients approved to initiate therapy in Part D may still abandon due to cost

Within the Medicare population, there are also three primary sub-populations to consider:

- Low Income Subsidy (LIS) Patients – These are patients who qualify for, amongst other things, reduced out-of-pocket cost sharing based upon income. All of these patients will have cost sharing of under $10, and thus, as a population, have very low patient abandonment.

- Employer Group Waiver Plan (EGWP) Patients – Patients in this population will have employer benefits that, amongst other things, reduce out-of-pocket costs. Many of these patients will have drug benefit designs like Commercial plans and face copays under $50.

- Standard Eligible Patients – These patients are those most often impacted by cost sharing in Medicare Part D. They are not eligible for cost sharing subsidies, and thus, have the highest out-of-pocket exposures.

Patient adherence

The more a patient is asked to pay, the less likely they are to do so. That does not just refer to the initial cost exposure a patient may face, but also includes the continued cost exposure over time. As such, we also see the number of days of therapy a patient has treatment for over a given time period, or what we refer to as patient adherence, impacted by out-of-pocket cost exposure. Like patient abandonment, there is a high level of variation across treatments, therapeutic classes, individual drugs, patient populations, and geographies when examining patient adherence.

Let’s consider an example of a patient being asked to routinely pay more than $75 for their prescription month after month. When looking broadly at Commercial patient adherence, we see that these patients are on therapy for approximately 40% fewer days of therapy over a given year than those paying under $20. That means that the demand efficiency generated from patient populations who are routinely exposed to high out-of-pocket costs generates fewer prescriptions than those who enjoy consistently lower ones.

Pulling it all together

Cost sharing is a very effective means of controlling utilization as demonstrated through patient behavior. As new-to-brand patients are exposed to higher out-of-pocket costs, abandonment increases, thereby directly impacting the efficiency of the demand being generated. This has a compounding impact over time because of the cumulative effect of patient adherence. Lose a patient at the first prescription and they cannot go on to generate subsequent refills.

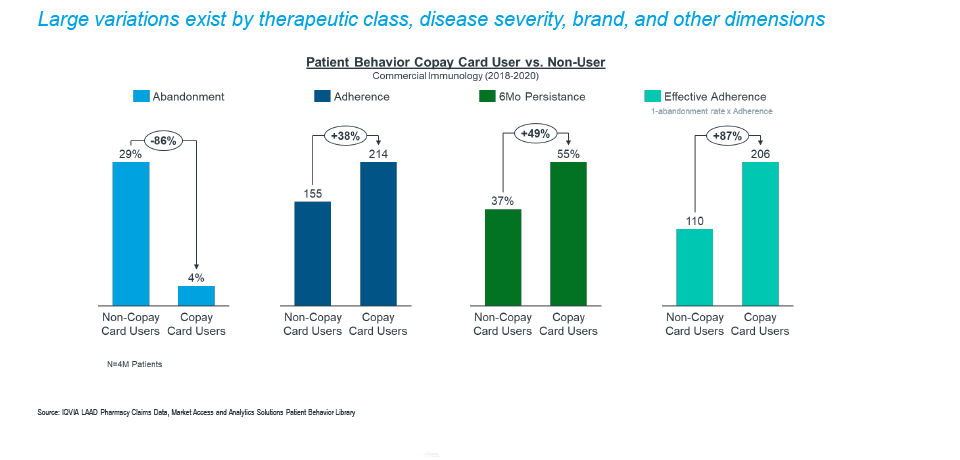

As an example of how patient behavior is impacted by cost sharing, we can look at the use of copay cards over a broad population.

In Immunology, copay cards clearly benefit patients with nearly a doubling of the effective adherence

In Immunology for Commercial patients between 2018-2020, we can observe that lowering a patient’s out of pocket using a copay card improves the effective adherence of the patient population by 87% (far right). Copay card utilization nearly doubles the days of therapy as compared to those who do not use one. These programs are so effective that we now see the emergence of copay Accumulator Adjustment Programs and Copay Maximizers as mechanism by which the large vertically integrated PBMs mitigate the impact (we will save that juicy topic for a later blog!).

In summary, the evidence is clear that patient out-of-pocket clearly drives behavior. The rule that The more a patient is asked to pay, the less likely they are to do so has been proven across brands, therapeutic classes, populations, demographics, geographies, and time. The downstream impact of lost patients and patients not getting the full value of their therapy is significant. Other areas where this is important include the design and operation of Patient Service programs or when considering Health Equity conversations.

Access and affordability go hand in hand when draining demand, and both cause lost opportunity. Demand lost to cost sharing through abandonment and adherence is important to understand and quantify so that the appropriate tactics can be developed.

Please feel free to contact IQVIA with questions or to discuss what this could mean for you.

In our next blog, we will turn towards the margin side of the “big squeeze” as we dive into the complex world of 340B discounts. Stay tuned.