Illuminate a path to consumer health success

- Blogs

- A cold and flu season like no other?

How COVID-19 restrictions could impact on this year’s cough, cold and flu season is a key question for consumer health companies. While it is early in the 2020-2021 season in the northern hemisphere, IQVIA FAN Flu data is showing some weakness in levels of incidence of coughs, colds and flu across Europe, the US, Canada and Mexico. The southern hemisphere’s experience might give us some clues as to what might happen over the next few months.

It would be tempting to say that with COVID-19 cases rising again around Europe and North America that we will see a weak cough, cold and flu season in terms of incidence in those regions, given the almost non-existent season witnessed in some southern hemisphere markets.

However, there are too many variables to say for certain that the 2020-2021 northern hemisphere season will be a bad one for consumer health firms. Responses to COVID-19 have evolved country-by-country, it is not yet clear whether consumers who pantry loaded cough, cold and flu related products in March need to stock up again more than 7 months later, plus we do not know what strain of flu will be prevalent where and what the uptake of available flu vaccines will be.

While we are still in the early stages of the cough, cold and flu season in the northern hemisphere, IQVIA Consumer Health FAN Flu data – which tracks incidence of cough, cold and flu in selected markets – is showing signs of a weak start compared to last year.

What happened in the southern hemisphere?

As COVID-19 struck, sales in categories related the virus’ symptoms – such as pain relief, cough, sore throat - spiked around the world in the March-April period. But, unlike its northern counterpart, the southern hemisphere then headed into the winter and its peak cough, cold and flu season.

The impact was significant, as pantry loading combined with COVID-19 restrictions saw cough, cold and flu cases at levels well below previous years, matched by sales in the related categories stalling. In Brazil, for example, IQVIA data showed sales in the cough, sore throat, cold/flu and decongestant segments all significantly lower than in the same period in 2019i.

Australia’s experience sums up the southern hemisphere season

“Simply put, we’ve had an absent flu season in Australia, with the National Notifiable Disease Surveillance System lab confirmed case load more than 99.5% below the same period last year (see Exhibit 1),” points out Sashindran Anantham, from IQVIA’s Management Consulting & Analytics team in Australia.

Exhibit 1: Lab-confirmed influenza cases in Australia along with sell in and scan units Jan 2019-July 2020 (Source: IQVIA Pharmacy Scan, Australian National Notifiable Disease Surveillance System)

“Naturally the common cold followed this trend and in combination with the pantry stocking of cold and flu products we observed in March,” he adds, “we believe that there is a large surplus of these products on shelves and in homes, which is translating into surplus stock in pharmacy and grocery channels.”

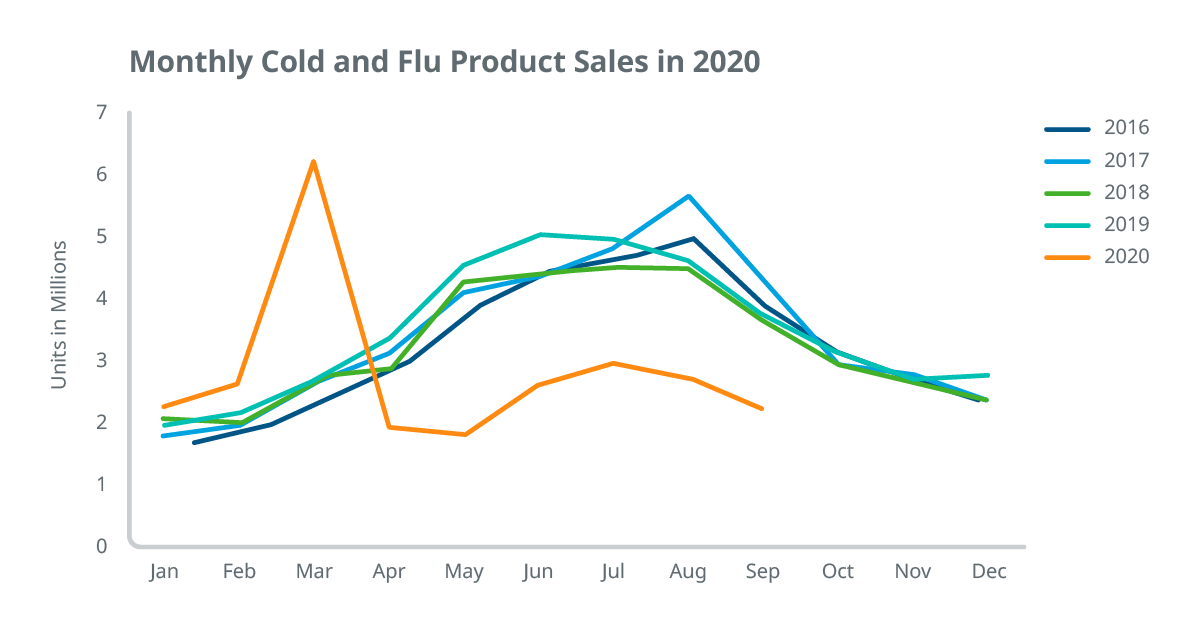

Unit scan sales of cough, cold and flu products in Australia dropped by 17% overall, with unit scan sales falling by 19% in pharmacy and 13% in grocery in the January-September period, but as COVID-19 related restrictions kicked in volume dropped by 40% over the April-September period (see Exhibit 2). This followed a massive spike in unit sales of cold and flu products in March as people stocked up as the pandemic took hold.

Anantham also points out that sales were shifting from pharmacy to grocery, as people limited the amount of shops they went to and stocked-up on essentials as well as healthcare products, he explains, adding that grocery was “also a more consolidated and aggressive discount channel in Australia”.

Exhibit 2: Cough, cold and flu category product unit scan sales in Australia (Source: IQVIA Consumer Health)

Will what we have seen in the southern hemisphere be replicated in the northern hemisphere?

A snapshot across four markets – Canada, Mexico, the UK and the US – show that incidence levels are below that of the previous year, and in some cases well below five-year averages. But there are differences country-to-country.

UK started fast but has dipped

In the UK, weekly incidence of cough, cold and flu in early September – when schools and universities started returning to in-person classes - trended above the previous year and above the five-year average, before dropping below 2019 in mid-October (see Exhibit 3).

Exhibit 3: Affected population in UK to the week ending 16 October (Source: IQVIA FAN UK)

Mexican season has barely got going

By contrast, the cough, cold and flu season in Mexico has barely got started at all. The affected population in the first five weeks of the season is down 44.5% against the 2019-2020 season (see Exhibit 4).

Exhibit 4: Incidence of cough, cold and flu in Mexico by number of affected population (Source: IQVIA FAN Mexico).

Canada illness levels are down dramatically

It is a similar story in Canada, where affected population levels are well below the start of 2019-2020 season, and symptom levels overall are down by 34% compared to the same period of last year’s season (see Exhibit 5). However, it should be noted that while the decline in flu rates can be tied to COVID-19-related restrictions - mask mandates cover about 80% of the population - there has also been a higher uptake of the flu vaccination so far this year.

Exhibit 5: Comparison of incidences of all symptoms between 2019-2020 season and 2020-2021 season so far by population number (Source: IQVIA FAN Canada)

US trending at historic lows

Over the border in the US, IQVIA FAN data is showing a similar trend with affected population levels trending at historic lows, with the current season levels 3.3 million below the previous year (see Exhibit 6).

Exhibit 6: Affected population season comparison US (Source: IQVIA FAN US)

Commenting on the US figures, Chip Schaible, director of IQVIA Consumer Health in the US, points out that specific brands that treat specific symptoms in adults were “doing okay”, despite the lower levels, “especially brands carrying immunity claims”. However, the paediatric segment was taking a “bigger hit”, he revealed.

What to expect going forward

Drawing on the data and trends from Southern Hemisphere, IQVIA Consumer Health has put together some key actions to take when planning for further disruption of the cough, cold and flu season in the northern hemisphere

- Review brand and category investment strategy – conserve resources where possible and focus on building loyalty with consumers and healthcare professionals (HCPs)

- Run Market Mix Modelling to assess which levers will likely provide stronger ROI – digital vs. in-store; traditional TV vs. streaming

- Assess timing for planned launches and line extensions – people are seeking comfort in trusted brands and SKUs through this COVID impacted season

- Maintain engagement with HCPs through remote detailing and digital means – it is challenging to execute F2F in the current environment

- Subscribe to IQVIA Fan Flu offering in your markets and reach out to us for any custom solutions to meet your specific needs

If you would like further information or to talk to an IQVIA Consumer Health expert about how to navigate this year’s cough, cold and flu season please contact consumer.health@iqvia.com.

Click here to learn more about IQVIA Consumer Health.

Contributors:

Amit Shukla, Global Head, Consulting Services and Thought Leadership, IQVIA Consumer Health

Chip Schaible, Director, IQVIA Consumer Health, US

Luiz Alberto Toriz, Client Service, IQVIA Consumer Health, Mexico

Esthela Villavicencio, Offering Manager, IQVIA Consumer Health, Mexico

Sashindran Anantham, Consultant, IQVIA Management Consulting & Analytics, Australia

Ahsan Zaman, Associate Principal, IQVIA Consumer Health, Canada

Diana Burr-Galli, Associate Director, Offering Management, IQVIA Consumer Health, Canada

Greg Curran, Account Manager, IQVIA Consumer Health, UK

i IQVIA Dynamics of the Brazilian Retail Market – July 2020

You May Also Be Interested In

Related solutions

Shape the future of consumer health.

See how we partner with organizations across the healthcare ecosystem, from emerging biotechnology and large pharmaceutical, to medical technology, consumer health, and more, to drive human health forward.