- Locations

- United States

- US Blogs

- Growth of the 340B Program Accelerates in 2020

In August 2020, IQVIA published results of an analysis1 of the size and growth of the 340B Drug Discount Program ("340B Program"), showing it had grown 17.1% year-on-year in 2019 and accounted for $67.4B of pharma sales (dollarized using WAC pricing). A key question emerged from this analysis: Could this growth be sustained in 2020, given the impact of COVID-19? To answer this question, we have refreshed our previous analysis using data through 2020.

Findings

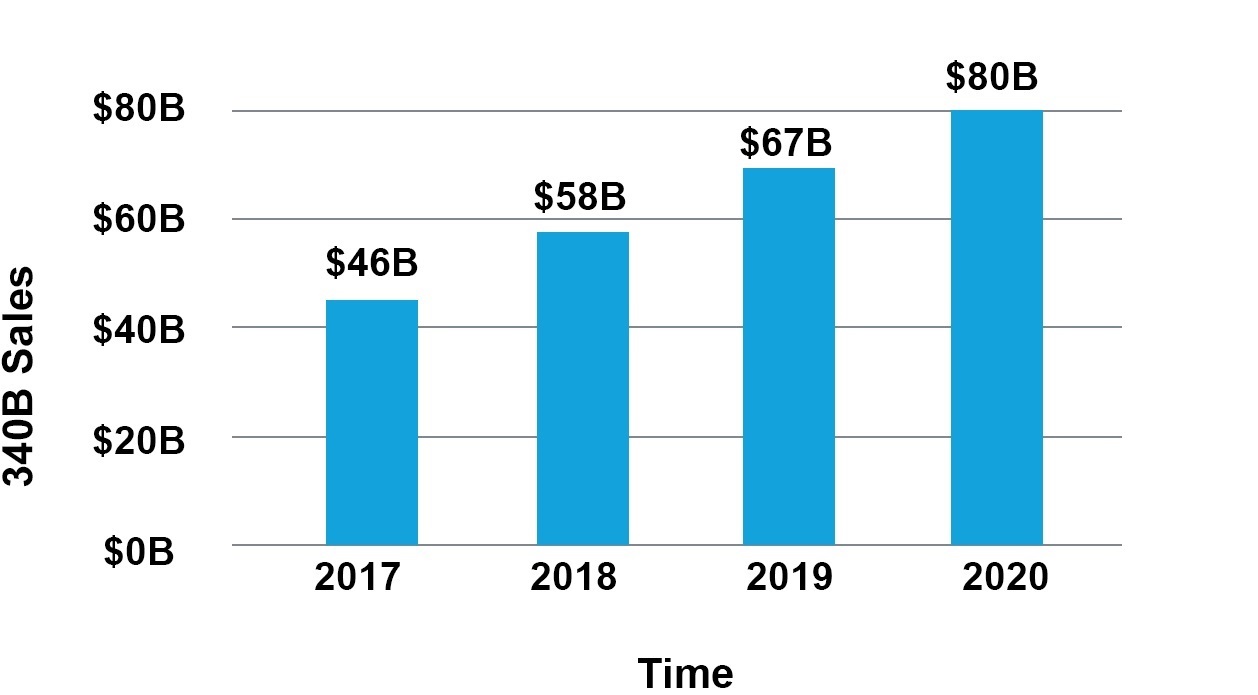

Sales for the 340B Program hit $80.1B (Figure 1) in 2020, an 18.1% year-on-year growth versus 2019, and very close to a forecast made by Nephron Research in October 20202. Astonishingly, this represents an acceleration in 340B growth versus 2019. 340B sales growth was over four and a half times the overall pharma market growth rate of 4.0%. Since 2017, 340B sales have grown 76%.

Fig. 1. Growth of 340B. Sales volume dollarized using WAC using DDD subnational sales data.

Specialty products continued to grow substantially faster than non-specialty products. For 340B sales, specialty products grew at twice the rate of non-specialty products, 21.6% versus 10.8%, respectively. Total sales of specialty products grew 10.1% versus only 2.0% for non-specialty products. There were large differences in 340B growth by route of administration, with IV-administered products growing 12.4%, oral products growing 31.8%, and products administered subcutaneously growing 36.3% year on year in 2020.

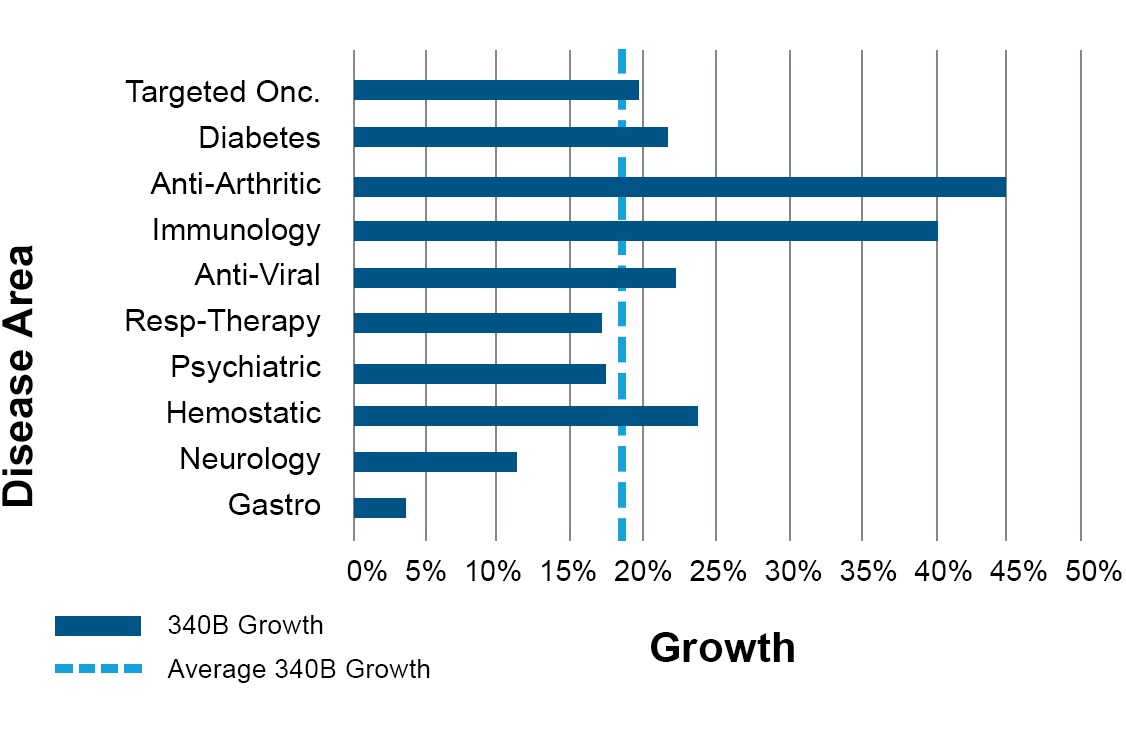

As in 2019, growth of the 340B program was driven by disease areas containing high-priced specialty products including targeted oncology drugs (e.g., growth factor inhibitors, immune checkpoint inhibitors, CDK inhibitors, and tyrosine kinase inhibitors), anti-arthritics (including biologics for Crohn's disease, inflammatory bowel disease, psoriasis, and rheumatoid arthritis), and immunologic agents (e.g., monoclonal antibodies and glutarimide derivatives). See Analysis Methods for additional details. In particular, 340B sales for anti-arthritics and immunologic agents each grew over 40% year-on-year (Figure 2).

Fig. 2. Year-on-year sales growth for the ten largest disease areas based on total sales, 2020 vs 2019.

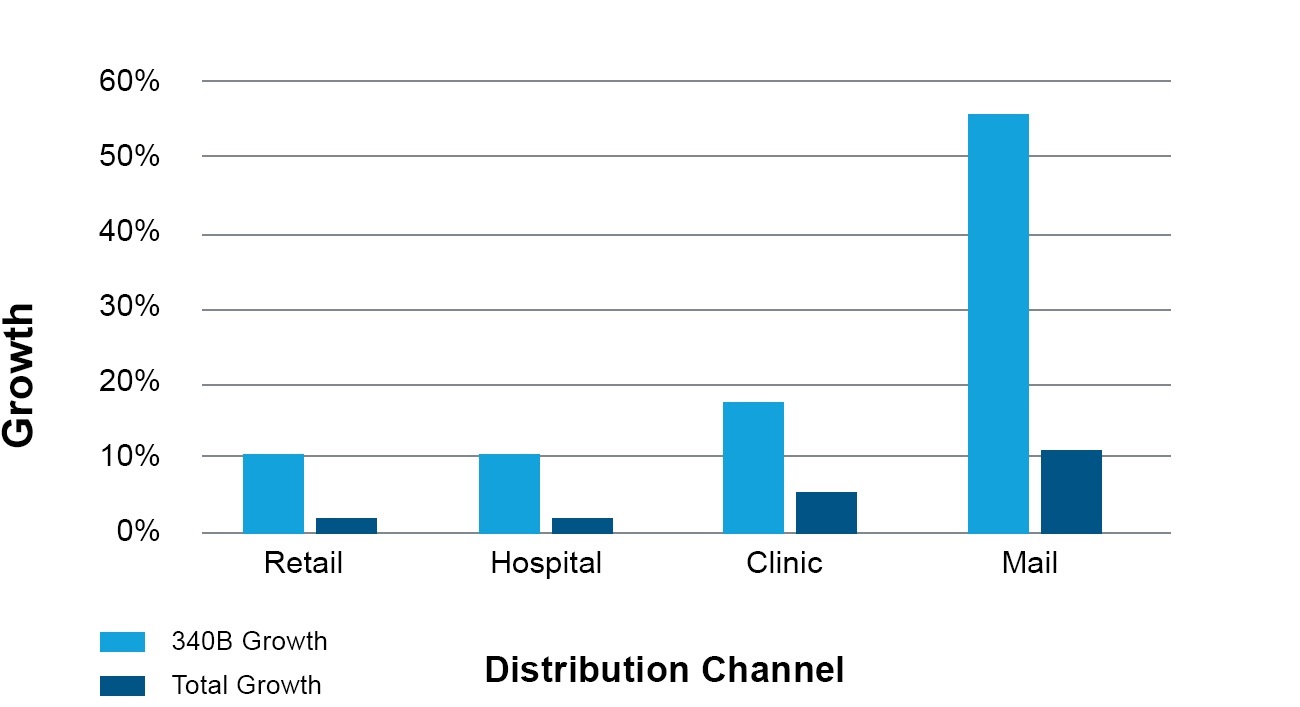

The rise of 340B Mail

In the previously published IQVIA report1, we described the rise of contract pharmacies, and how they're overtaking the traditional 340B model of delivering drugs through hospital outpatient pharmacies and clinics. Total sales (i.e., 340B and non-340B) in the Mail channel grew 11.1% in 2020 versus 2019 , twice as fast as any other channel (Figure 3). But these numbers were dwarfed by sales in 340B Mail contract pharmacies, which grew 56% in 2020 year-on-year, two and a half times the growth rate of 340B Retail contract pharmacies.

COVID-19 has had a substantial impact on the U.S. economy, including driving a widespread change in consumer behavior towards remote shopping. In healthcare, COVID-19 is thought to have caused a shortfall of a billion diagnosis visits in 2020, drove a 3,000% increase in telehealth visits (albeit from a relatively small baseline), and caused treatment to shift from hospitals to offsite facilities3.

To study whether 340B growth was COVID-19-related, IQVIA analyzed publicly available county-level COVID-19 data4 to test whether there was a relationship between the rate of new cases and/or deaths and 340B growth. Although the data did not indicate any such relationship (results not shown), there are several known caveats with available COVID-19 data, including inconsistent testing across geographies, low capture of asymptomatic and mild infections, and incomplete death counts5. COVID-19 is unlikely to be driving the growth observed in 340B Mail because the growth of non-340B Mail was much smaller.

Fig. 3. 340B sales growth by channel, 2020 vs 2019. Low volume channels Nursing Home, Miscellaneous, and Health Care Plan not shown.

Sales in 340B contract pharmacies (Retail and Mail channels) were $22.5B in 2020 and grew 35.6% versus 2019, three times the rate of total sales in these same channels. This is alarming for manufacturers because a substantial proportion of contract pharmacy 340B sales involves payer rebates, a scenario called duplicate discounts. For products subject to 340B penny pricing, a duplicate discount means product sold at a loss.

In an upcoming blog on 340B, we'll explore growth drivers of contract pharmacies to understand how contract pharmacy relationships are growing and the impact this has had on the 340B program.

Analysis methods

The findings from IQVIA’s 2020 report1 that were refreshed in this blog were analyzed using supplier sell-in data from IQVIA's DDD Subnational Sales database. Data spanned 2019 through 2020 and were based on the pharma universe including all disease areas, specialty and non-specialty products, branded drugs and generics, prescription and over-the-counter products, and all distribution channels.

Pharma products were grouped into disease areas following the Uniform System of Classification (USC) system6. The analysis used USC2 level groupings which define approximately 70 therapeutic categories such as vascular agents, diabetes, and antineoplastic agents.

References

1 The 340B Drug Discount Program: Complexity, Challenges, and Change, Martin & Krikorian, IQVIA White Paper, Aug 2020

2 "The 340B Program Reaches a Tipping Point: Sizing Profit Flows & Potential Disruption", Percher, Warburton, & Mach, Nephron Research White Paper, Oct 2020

3 "IQVIA COVID-19 Market Tracking", weekly and monthly reports.

4 https://github.com/nytimes/covid-19-data

5 "Covid-19 Data Remain Mired in Inconsistencies", Wall Street Journal, Jan. 22, 2021

6 "The Uniform System of Classification (USC)", IQVIA Report 2018. USC was created by IQVIA and the Pharmaceutical Marketing Research Group as a standard way of grouping drugs that compete in the same market.

The 340B Drug Discount Program

Learn more about the 340B program, how it's evolving, potential challenges, and possible strategies to mitigate its impact on gross-to-net.