Take advantage of the latest tools, techniques, and deep healthcare expertise to create scalable resources, precision insights, and actionable ideas.

- Insights

- The IQVIA Institute

- Reports and Publications

- Reports

- The Global Use of Medicines 2024: Outlook to 2028

With the World Health Organization’s declaration on May 5, 2023, of the end of the COVID-19 public health emergency, attention has shifted to the prevention and treatment of other communicable diseases as well as non-communicable diseases, and the critical contributions of medicines globally. Breakthrough therapies launched over the past decade for multiple diseases are re-shaping patient care in many areas and the outlook for medicines use – and the related Spending – through 2028 is higher than prior forecasts as more novel drugs become available and despite a significant downward revision of the outlook for COVID-19 vaccines and therapeutics.

The largest driver of medicine spending growth through the next five years is still expected to be the availability and use in developed markets of innovative therapeutics and offset by losses of exclusivity and the lower costs of generics and biosimilars. Traditionally, innovative medicine growth has occurred most in the years immediately following launch, whereas recent years and the forecast outlook show growth driven by older products. This mix of spending growth between volume-driven growth, and mix-driven changes in the cost of therapy are showing most geographies shifting to more expensive therapies, reflecting the broader availability and patient access to medicines with higher clinical value.

In this report, we quantify the impact of these dynamics and examine the spending and usage of medicines in 2023 and the outlook to 2028, globally and for specific therapy areas and countries. We intend for this report to provide an evidence-based foundation for meaningful discussion by all stakeholders about the value, cost, and role of medicines over the next five years in the context of overall healthcare spending.

Key findings:

- Growth outlook is raised by 2 percentage points despite lower expectations for COVID-19 vaccines and therapeutics

- This increase in growth outlook is driven by more patients getting treated with better medicines, especially in immunology, endocrinology, and oncology

- Medicine use in Latin America and Asia will grow faster than other regions over the next five years

- Global use of medicines grew by 14% over the past five years and a further 12% increase is expected through 2028, bringing annual use to 3.8 trillion defined daily doses

- Global spending on medicine using list prices grew by 35% over the past five years and is forecast to increase by 38% through 2028

- The updated outlook for the U.S. market, using estimated net prices, is being raised by 3 percentage points to 2-5% CAGR through 2028, reflecting higher recent growth and expected further increased patient use of higher value therapies

Other findings:

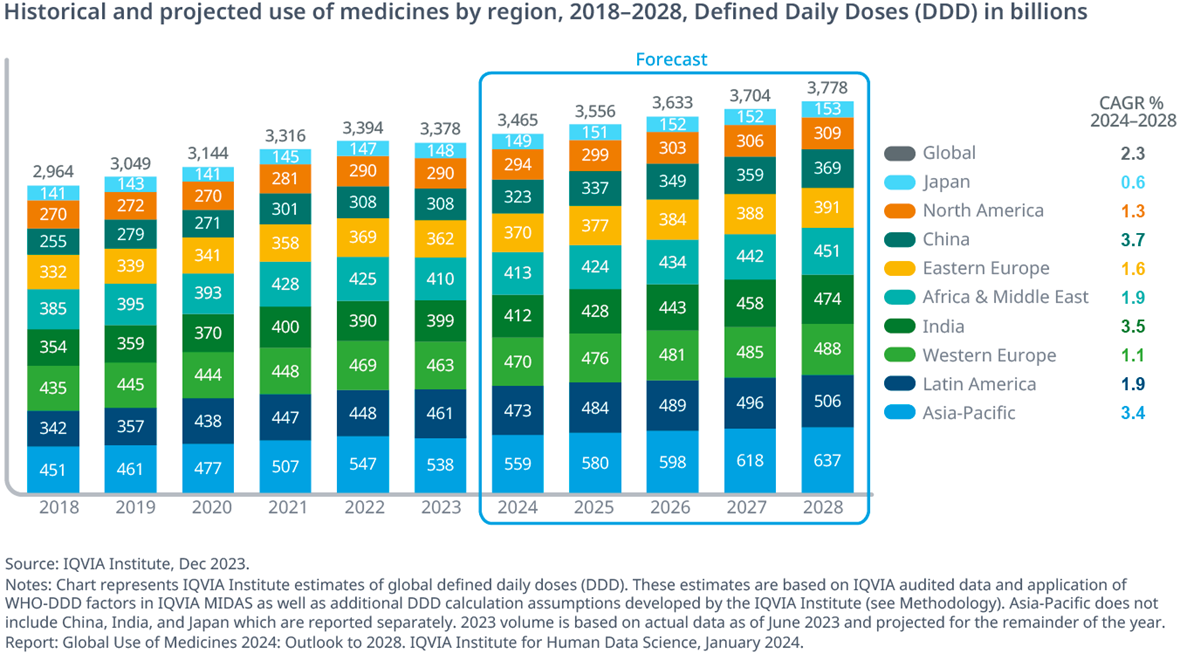

Historical and projected use of medicines by region, 2018-2028, Defined Daily Doses (DDD) in billions

- The global use of medicines — based on modeling medicine volumes shipped according to defined daily dose assumptions — increased by 414 billion defined daily doses over the past five years, and is expected to grow another 400 billion by 2028.

- The highest volume growth over the next five years is expected in China, India and Asia-Pacific, all exceeding 3% compound annual growth.

- Lower volume growth in higher income regions such as North America, Western Europe and Japan are linked to more established health systems and existing access to medicine.

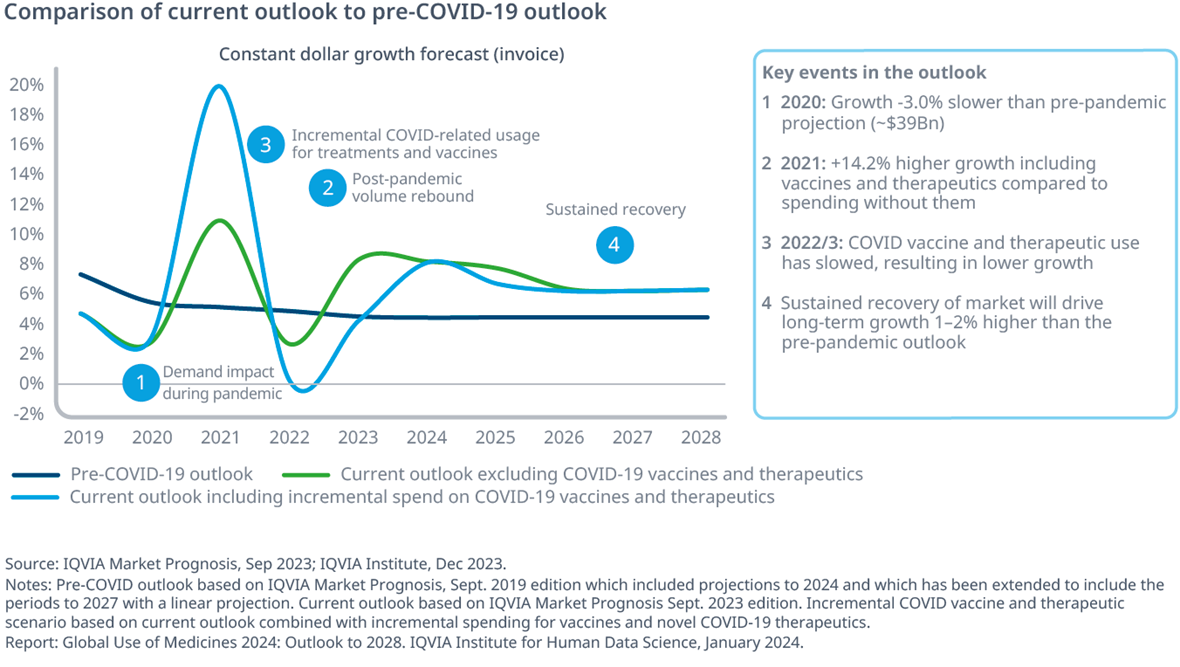

Comparison of current outlook to pre-COVID-19 outlook

- The near-term impact of the COVID-19 pandemic on medicine spending has been the notable short-term disruptions in 2020 and rebound in 2021 and a correction in 2022.

- The higher growth in 2023 driven by non-COVID-19 therapies is expected to continue, raising the five-year outlook by 2%.

- COVID-19 vaccines and therapeutics are seeing declining spending in 2023 and are expected to continue, representing a negative contribution to overall growth through 2026 when the trends stabilize.

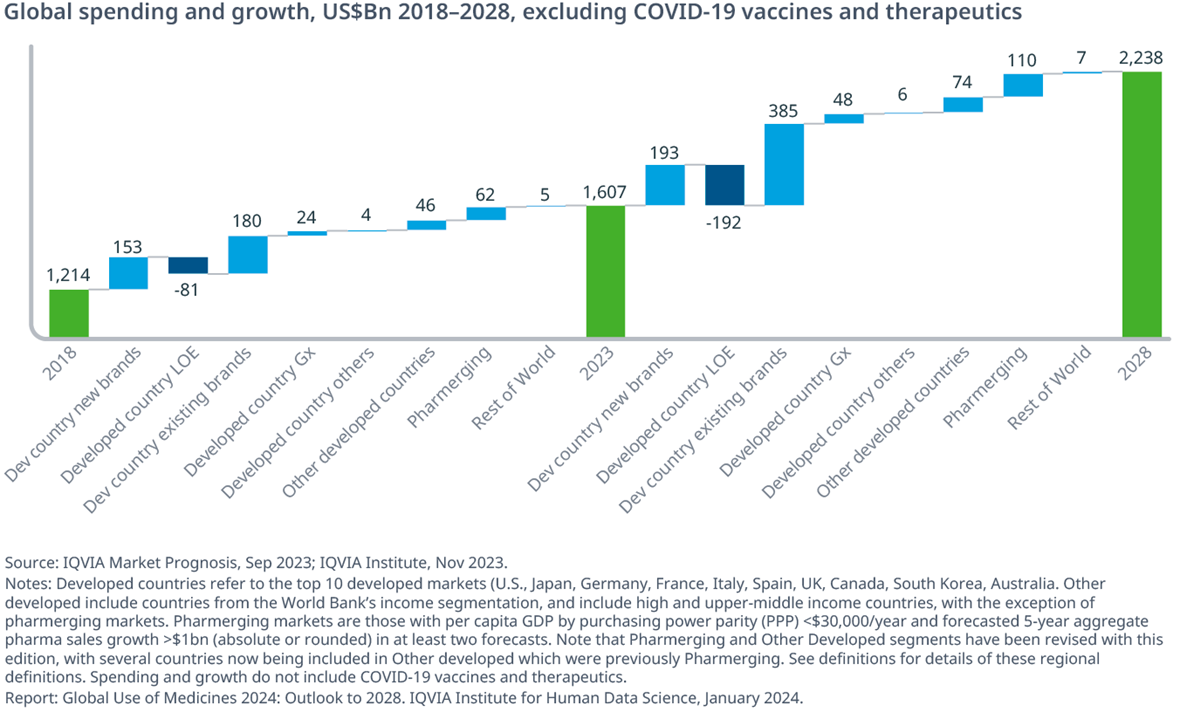

Global spending and growth, US$Bn 2018-2028, excluding COVID-19 vaccines and therapeutics

- Global medicine spending growth is expected to accelerate over the next five years, driven mostly by increased growth contribution from existing branded products even as most growth segments are expected to increase compared to the last five years.

- New brands in the 10 leading developed markets are expected to contribute $193Bn in growth, up $40Bn from the past five years.

- The impact from brands losing exclusivity (LOE) is expected to more than double to $192Bn, although a large part of that increase is from biologics facing biosimilars where the impacts have had more uncertainty.

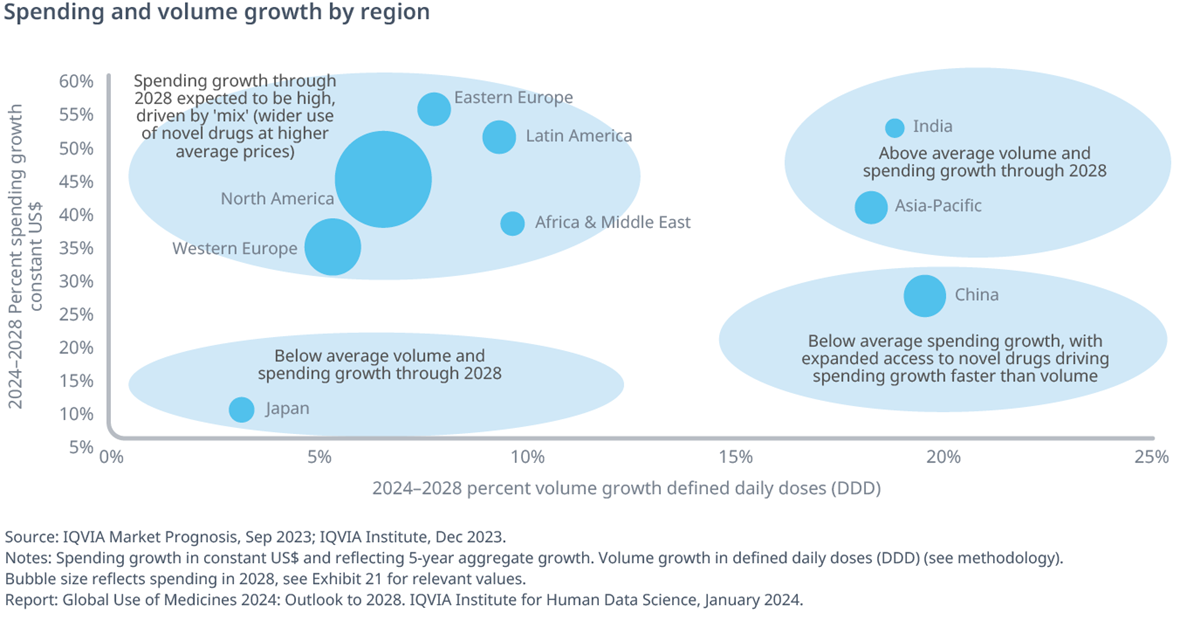

Spending and volume growth by region

- Regions around the world are growing following diverging trends, with some more volume driven while others have a greater contribution from adoption of innovation.

- Countries in North America, Eastern and Western Europe, Latin America, and Africa & Middle East are expected to increase spending growth by more than 30%, indicating both population-driven volume growth and a shift in the mix of products to more expensive products.

- China, the world’s second largest country by pharmaceutical spending, will increase volume by 20% in aggregate over five years, while spending will increase 21%, a more modest rate than in the prior years and still embedding a focus on expanding access to novel drugs via the national reimbursement drug list (NRDL).

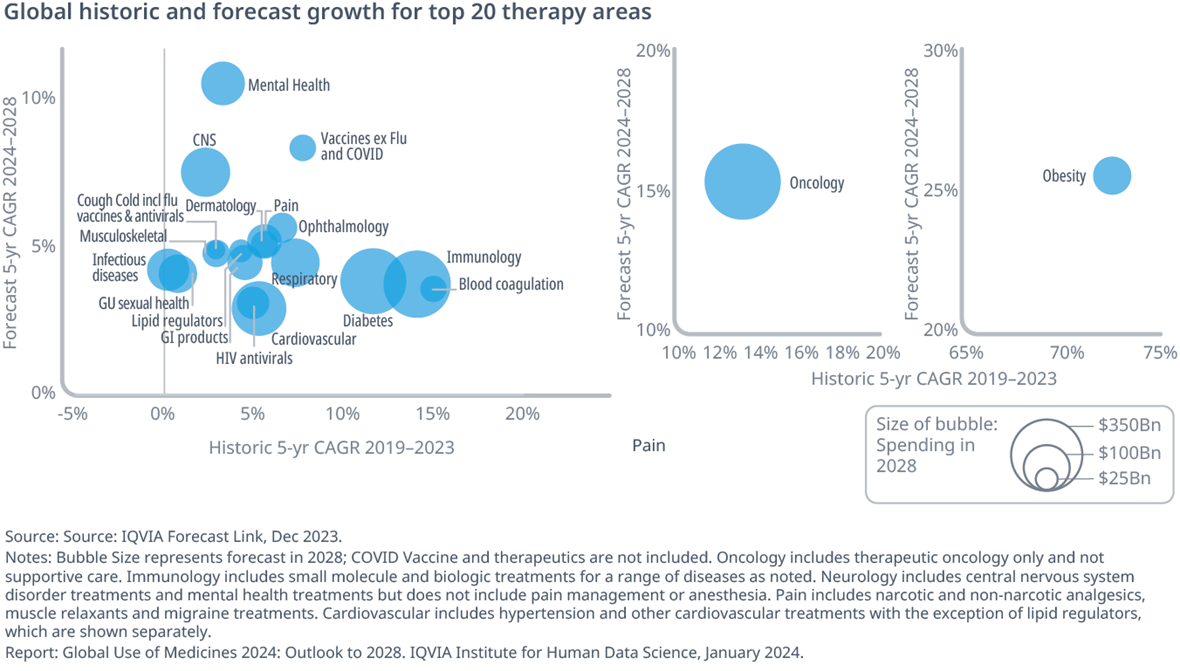

Global historic and forecast growth for top 20 therapy areas

- The biggest contributors to the growth in the next five years are oncology, immunology, diabetes and obesity drugs. The growth is a result of continuous influx of innovative products and offset by exclusivity losses.

- Many therapy areas are expected to grow more slowly in the next five years than in the past five.

- Lipid regulators, which have been declining steadily since leading product expiries a decade ago, are expected to return to growth, with new therapies for some patients.

YOU MAY ALSO BE INTERESTED IN

Related solutions

IQVIA is using vast quantities of data in powerful new ways. See how we can help you tap into information from past trials, patient reported outcomes and other sources to accelerate your research.

Meet the challenge of changing stakeholder demands and increasing cost constraints with IQVIA's integrated technology services and analytics-driven offerings.