Flexible solutions. Responsive teams. Data-driven insights.

- Insights

- The IQVIA Institute

- Reports and Publications

- Reports

- Global Trends in R&D 2022

Summary

As the global COVID-19 pandemic enters its third year, the life sciences innovation system is setting new records in the level of investment, activity, and scientific progress, in addition to the number and range of new medicines reaching patients around the world. Beyond the ground-breaking contributions to COVID-19 in the form of vaccines and therapeutics, this sector has also succeeded in adapting and re-focusing to a remarkable extent, overcoming the many operational and organizational challenges facing those who are leading biopharmaceutical innovation.

This report - Global Trends in R&D: Overview through 2021 – assesses the trends in new drug approvals and launches, overall pipeline activity in terms of actively researched medicines, and the number of initiated clinical trials. It also profiles the state of R&D funding and the activity of companies of different types, and the results of research are compared to the input effort in a Clinical Development Productivity Index. The notable acceleration and adaptability of the innovation ecosystem is examined in terms of several accelerators of the innovation cycle, including dramatic reductions in so-called white space within clinical development timelines that have been achieved for COVID-19 vaccines and other medicines and suggests the kinds of optimization to expect in the future.

Key Findings

NEW DRUG APPROVALS AND LAUNCHES

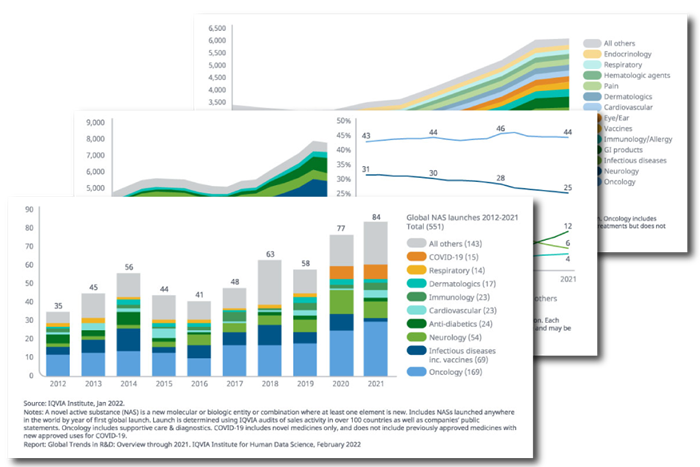

- A record 84 novel active substances (NASs) were initially launched globally in 2021, double the number of five years ago. This brings the total number of launches over the past 20 years to a total of 883.

- The U.S. remains the country with the earliest and highest number of launches and among the 72 NASs launched in 2021, a record 44 (over 60%) were characterized by the FDA as first-in-class, and more than half (40) carried an orphan drug designation indicating their use for patients with rare diseases.

R&D PIPELINE

- The total number of products that are in active development in human trials globally exceeds 6,000, up 68% over the 2016 level, as life sciences companies continue to invest and advance innovative therapeutics and vaccines across a wide range of disease areas, despite the disruptions caused by the COVID-19 pandemic.

- Precision medicine increasingly dominates in oncology where targeted therapies account for almost all of research, and over 40% of the pipeline is for rare cancers where next-generation biotherapeutics — including cell and gene therapies – are increasingly being deployed.

CLINICAL TRIAL ACTIVITY

- Overall clinical trial activity has been sustained through the pandemic as the industry has adapted to the disruption and developed new approaches to enable research to continue. In 2021, 5,500 new planned clinical trial starts were reported, up 14% over 2020 and 19% higher than 2019.

- The aggregate number of study participants in intended new trials exceeded 2 million in 2021 for the first time, double the level seen prior to the trials for both COVID-19 and several very large Ebola virus vaccine trials.

CLINICAL DEVELOPMENT PRODUCTIVITY

- The composite success rate across all development phases and therapy areas declined to 5.0% in 2021, which can be attributed to an appetite for increased scientific risk in clinical development programs as the bar for efficacy and safety rises, as well as increased pauses in product development due to the pandemic.

- Across disease areas, probability of success varies considerably, and 2021’s composite success rate fell below the 10-year trend in all areas except for vaccines and cardiovascular.

R&D FUNDING

- Venture capital deal activity and investment flows in the U.S. accelerated in the past two years as interest in life sciences intensified with more than 2,000 deals and $47 billion of deal value occurring in 2021. In addition, the 15 largest pharmaceutical companies invested a record $133 billion in 2021 in R&D expenditure, an increase of 44% since 2016.

- Life sciences deal transactions – including licensing, collaborative R&D arrangements, and acquisitions – remained at just under 5,000 deals in total in 2021, including over 500 related to COVID-19.

EMERGING BIOPHARMACEUTICAL COMPANIES’ CONTRIBUTION TO INNOVATION

- Emerging biopharma companies (EBPs) – those with an estimated expenditure on R&D of less than $200 million and less than $500 million in revenue annually – are responsible for a record 65% of the molecules in the R&D pipeline, up from less than 50% in 2016 and one-third in 2001.

- EBPs originated – that is, filed the original product patent – for half of the NASs launched in the U.S. in 2021.

ACCELERATORS OF INNOVATION CYCLES

- In addition to actions taken directly in support of COVID-19 vaccine and therapeutic development, intensified efforts are being taken by all stakeholders to accelerate innovation cycles and bring scientific breakthroughs to patients faster. The median time from first patent filing to launch in the U.S. has fallen to its lowest level and in the past two years included 21 drugs that were launched less than five years into their patent terms.

- Most new drugs (72%) received some form of expedited review by FDA including one in four receiving an accelerated approval or an Emergency Use Authorization.

Other Findings

- The record number of NAS launches in 2021 included eight COVID-19 vaccines or therapeutics and excluding those launches each of the past two years still exceed any year in history for new launches.

- Oncology, neurology and infectious diseases have all had a rising share of new launches in the past five years with 197 of the 330 launches (60%), compared to 110 of 221 (49%) from 2012 to 2016.

- The total 169 oncology launches in the past decade include some of the most groundbreaking new treatments in immuno-oncology as well as next- generation biotherapeutics, and many treatments for rare cancers.

- The research and development pipeline plateaued in 2021 with 6,085 products in active development from Phase I to regulatory submission, growing less than 1% from 2020.

- This slowing growth in 2021 is likely due to slowing activity from prolonged uncertainty as a result of impacts of new variants on activity during the ongoing pandemic.

- Oncology remains the focus of the pipeline, comprising 37% or 2,226 products.

- Currently, more than 3,200 companies and more than 200 academic or research groups around the world are involved in the R&D pipeline.

- The U.S. share of the global R&D pipeline has remained relatively stable, at above 40% over the past 15 years.

- Europe’s share has declined from 31% to 25% over the past 15 years, while the absolute number of active programs grew by 32% — from 1,492 to 1,966.

- The composite success rate for the pipeline fell to a 10-year low in 2021, driven by drops in Phase I, II and III success, while slightly offset by an increase in regulatory submission success rates, though still not a return to pre-pandemic levels.

- Phase III success rates saw the greatest drop in 2021, declining to 48%, which is 19% below the 10-year pre-pandemic average.

- Some of this increase in attrition may be due to increasingly risky or aspirational research — both in the mechanism of action with increasing next-generation and first-in-class pipeline penetration.

- COVID-19 vaccine pivotal trial timelines were reduced by 70%, with an estimated 26 months of whitespace and operational time savings compared to earlier vaccine trials.

- These time savings were enabled by regulatory and government investment, which de-risked critical decision-making, innovation, and resourcing.

- Whitespace efficiencies were driven by urgency, execution-partner alignment, and leader engagement, leading to at least two months of savings from accelerated contracting and trial planning alone.

Blog

IQVIA Institute Research Highlights 2022

The Quest for Evidence-Based Research in Healthcare Decision-making.

Related solutions

See how we partner with organizations across the healthcare ecosystem, from emerging biotechnology and large pharmaceutical, to medical technology, consumer health, and more, to drive human health forward.

Explore our end-to-end, full service clinical development capabilities including Therapeutics expertise, Development Planning, Phase I early clinical development, Phase IIb/III and Phase IV Trials, Regulatory Submission and Post-Launch Studies.