Decrease clinical development costs and increase study quality using our global functional resources and flexible services, and get more value from your R&D spend.

- Blogs

- It's Time for Big Data and Real-World Evidence in Portfolio Decision Making

When a company has a portfolio of promising assets in development, there are a set of difficult choices to make. Each asset has the potential to be the next ‘big product’ and has a team of excited people supporting it. How can you pick the likely winners from the losers with so many different and conflicting opinions?

Despite our best attempts at being data-based, sometimes the process can feel like buying a product online based only on a few reviews. Each person in the room presents a preview of how ‘amazing’ their asset is, and the decision is made based on how well they argue.

That approach may work when you’re only committing to a new cooking gadget, but it becomes a real problem when that decision will define your company’s future. Too often the reason for these intuition-based approaches to decision-making – such as deciding based on gut instinct, pet projects, and drawing from limited experiences – comes from a lack of access to good information. Industry information is scattered or hard to interpret, and even relevant company data from past projects is often siloed and managed by isolated teams. That means decision-makers rarely have all the information they need in one place to make the best investment decisions.

Better Data, Better Decisions

To increase your company’s chances of success, you need better data, analogues and analytics tools to draw out the right answers. This is where a lot of pharma portfolio teams fall short, putting heavy weight on instinct rather than digging deeper into the data. All this decision-making based on limited experience adds risk and uncertainty to the drug development process and is part of the reason why drugs are so expensive to develop.

With the average launched drug cost now around $2.6 billion, and an approval rate for new assets of around 12%, it’s more important than ever to get these decisions right.

Today, the best pharmaceutical companies are increasingly using a wealth of rich and nuanced real-world data to inform their critical go/no-go decisions. Taken together, this data can predict with more accuracy how long a specific drug will take to develop, how much the trials will cost, how big the target patient population will be and more. It can also tell you which of your competing projects are likely to be most influential in the market, and which will be most effective at paying back your investments in development.

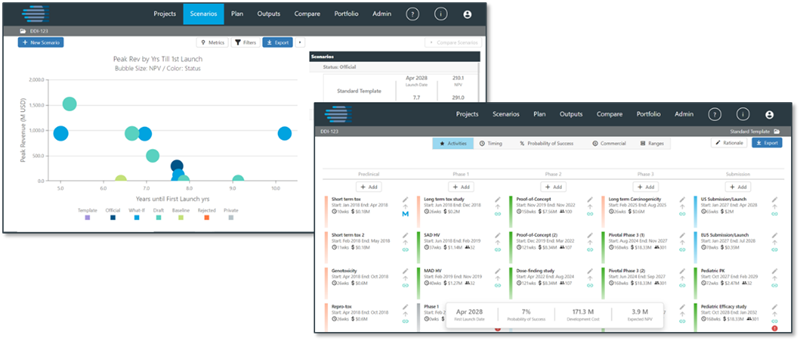

Pharma companies access and analyze this data as part of their decision-making process, they can more accurately predict which drugs in their pipeline offer the most promise with the least risk. These analysis tools allow decision-makers to make ‘apples to apples’ comparisons of one molecule against another, see the impact of different scenarios on timelines, revenue potential, and market uptake, and can even leverage the power of machine learning for deeper insights.

IQVIA’s Pipeline Architect is a tool that pulls healthcare industry data from thousands of trials conducted across hundreds of indications. When users combine this industry data with their own internal data sets, they can forecast outcomes with a much higher degree of accuracy and make better portfolio selections.

COPD Development on a Budget

In many cases, customers use the Pipeline Architect tool to find the best path forward for individual product development plans. Using the data, they can model individual project scenarios and rank various development paths to mitigate risks and maximize results.

Consider a recent project in which the client had a COPD product that had successfully completed Phase 2, but the optimal Phase 3 program budget exceeded their resources. They needed to determine which alternative development option presented the best potential path forward given time and budget constraints.

The client’s internal development team had been asked to rapidly generate alternative lower cost options to be reviewed by the internal governance body. While they were able to generate a set of revised assumptions for alternatives, they were struggling to measure the impact of those changes on the time, cost, and probability of regulatory success in the short turnaround time requested by management.

They turned to IQVIA for help. Using Pipeline Architect, IQVIA’s experts conducted a trial-benchmarking analysis across the desired indication, and within two weeks modeled 20 potential clinical development plan scenarios. They then ranked the scenarios based on expected approval date, probability of regulatory success, total development costs, and risk- adjusted NPV.

This gave the team the insights they needed to rapidly engage in a robust, data-driven discussion with their governance body, and to ultimately select the scenarios that would deliver the best potential market results.

This is just one example of how the right data and analytics transforms the selection process from an educated guess to an evidence-based decision.

So the next time you are pondering which drug candidate to invest in or the best way to move a drug through development to commercialization, move beyond evaluating which PowerPoint is the most compelling. Use the power of big data and machine learning to give you the confidence that you are making the right choice for your business.

To learn more about IQVIA’s Pipeline Architect platform click here or contact us at PipelineArchitect@iqvia.com.

Related solutions

Explore our end-to-end, full service clinical development capabilities including Therapeutics expertise, Development Planning, Phase I early clinical development, Phase IIb/III and Phase IV Trials, Regulatory Submission and Post-Launch Studies.