Shape the future of consumer health.

- Blogs

- Poor cough and cold season restricts OTC growth in 2023

The global over the counter (OTC) healthcare products market in 2023 witnessed intriguing dynamics, marked by shifts in growth trajectories and regional performances, but the headline remains that a poor cough and cold season will always hit overall market growth.

Let’s explore the key takeaways from 2023:

1. Impact of Weak Cough and Cold Season on Overall Growth

The global OTC market underperformed forecasts as a notably weak cough and cold season restricted overall value sales growth to 3.9% for 2023. As the largest market segment, the performance of the cough and cold category strongly influences the overall growth trajectory of the OTC market. With subdued seasonal activity globally, the market faced downward pressure, highlighting the sector’s susceptibility to seasonal variations.

Figure 1: Global OTC market performance 2019-2023 (Source: IQVIA Global OTC Insights plus estimates of e-Commerce & Mass-market - Excluding Venezuela)

2. Regional Variances in Performance

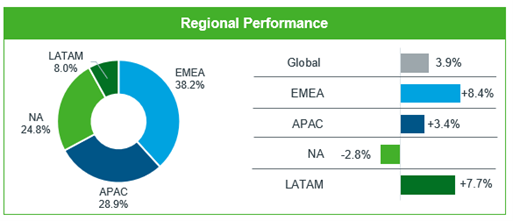

EMEA (Europe, the Middle East, and Africa) emerged as the largest OTC region in 2023 boasting a value sales growth rate of approximately 8%. However, regional disparities were evident, with APAC now positioning itself as the second-largest region. Notably, North America experienced a decline in value by -2.8% for the full year, signaling challenges within the region, including price increases as well as a weak cough and cold season. Conversely, LATAM (Latin America) continued to exhibit resilience with a growth rate of around 7%.

Figure 2: OTC 2023 market performance broken down by regional share and value sales growth (Source: IQVIA Global OTC Insights plus estimates of e-Commerce & Mass-market - Excluding Venezuela)

3. Category Dynamics and Market Resilience

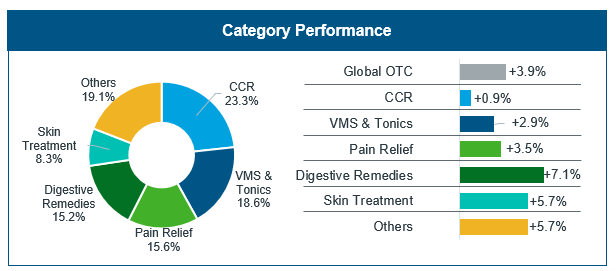

Analyzing performance by category sheds light on the market’s resilience amidst fluctuating conditions. While cough and cold products remain the largest category, the overall market’s pace slows down when this segment underperforms. What is noteworthy however is the steady growth in digestive remedies and skin treatment categories, surpassing the market average (see Figure 3). This underscores the importance of diversification and innovation strategies when navigating evolving consumer preferences and market dynamics.

Figure 3: Global category performance by share and value sales growth in 2023 (Source: IQVIA Global OTC Insights plus estimates of e-Commerce & Mass-market - Excluding Venezuela)

4. Stada’s strategy leads the way

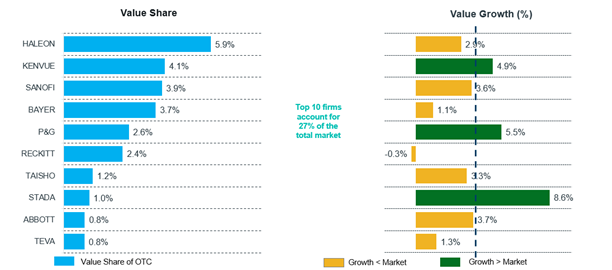

In terms of company performance in 2023, Germany-based Stada was the clear stand out performer in the Top 10. Having posted strong first-half growth (see Holding Steady – Global OTC Market Update Q2 MAT.), the firm secured its place as the fastest growing major player, with OTC sales up by 8.6% for 2023 (see Figure 4).

Figure 4: Top 10 OTC companies globally by share and growth (Source: Source: IQVIA Global OTC Insights plus estimates of e-Commerce & Mass-market - Excluding Venezuela)

Commenting on its performance in its 2023 results release[i], Stada said it success had been built on both establishing market leadership in Germany - through growth from brands such as Grippostad, Silomat, Multilind, Elotrans and Hoggar - and expanding its position in Belgium, France, Italy, and Spain, as recently acquired brands performed strongly. The company expanded its regional reach in July 2023 through the acquisition of a basket of brands such as Antistax, Lomudal, Omnivit and Opticrom from Sanofi, building on an existing successful commercialization partnership in 20 European countries.

5. Projections for 2024: A Tale of Two Halves

We foresee a mixed outlook for 2024. In the first half we are anticipating growth rates ranging from 4% to 6%, reflecting continued challenges and uncertainties, including the closing months of the cough and cold season. However, we believe there are reasons for optimism in the back end of the year, with sales growth expected to rebound to 6% and 8%. This forecast underscores the resilience of the OTC healthcare products market, fueled by anticipated market stabilization and recovery.

For more insights on the state of today’s OTC market contact the team consumer.health@iqvia.com or click the CONTACT US button on this page.

[i] https://www.stada.com/blog/posts/2024/march/stada-continues-with-double-digit-sales-and-profit-growth-in-2023

Learn More

Dynamics of Self-Care Medical Devices in Europe

Consumer Health Capsule

Consumer Health Edge Podcasts

Related solutions

Illuminate a path to consumer health success

Adapt fast, maintain momentum and stay relevant