Take advantage of the latest tools, techniques, and deep healthcare expertise to create scalable resources, precision insights, and actionable ideas.

- Library

- Challenging Market and Economic Conditions Drove Dealmaking Slowdown in Q1 2023

After a somewhat quiet end to 2022, deal activity remained muted in the first quarter of 2023 as macroeconomic uncertainty, rising interest rates and high inflation reduced companies' appetite for deal making.

Despite a flurry of bolt-on acquisitions announced at the start of the year and the first $40+ billion buyout signed since 2019, merger and acquisition (M&A) activity dropped off significantly in Q1 2023, with only 68 deals signed compared to 119 in Q1 2022. Similarly, partnering deal flow was suppressed 40% compared with Q1 2022, as pharma companies were more conservative about the types of assets they invested in. However, despite the slow start to the year, as the market begins to stabilize, there is hope that 2023 will be a far busier year overall for the industry.

M&A DEAL VOLUME ON THE DECLINE

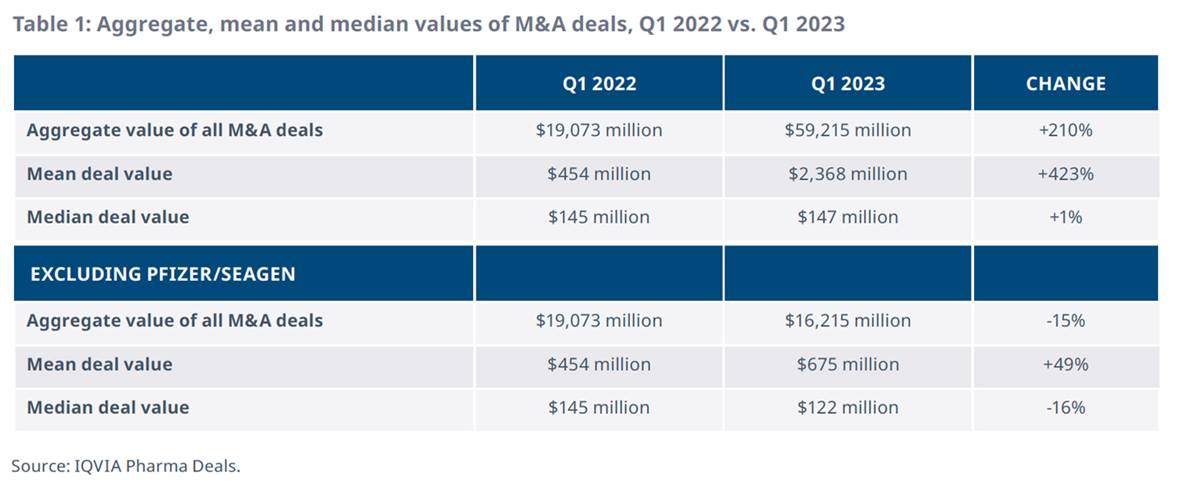

Despite high hopes for an upturn in M&A activity, life sciences companies demonstrated even less of an appetite for M&A in Q1 2023, with the number of deals announced down by 43% in Q1 2023 compared to Q1 2022. This reduction in volume is likely a result of a variety of factors including macroeconomic headwinds, continued market volatility and declining valuations making it a challenging environment for negotiating parties to agree on a price. Interestingly, the aggregate and mean total value of all M&A deals signed in Q1 2023 increased more than three-fold compared with the same period in 2022 (Table 1).

To read more, please fill in your details on the left to download the article.

Related solutions

Be proactive about growing your brand using the latest in data, analytics, and domain expertise.

Go beyond the numbers to analytics-driven insights using artificial intelligence, machine learning and healthcare expertise.