- Blogs

- Novel Drug Delivery Systems Drive Value Growth in the Parkinson's Disease Market to 2029

The global value of the Parkinson’s disease market in 2029 is estimated to be $5.2bn, representing a 43% increase over 2019 and a CAGR of 4%. It is anticipated that this will be driven primarily by changes in the US market, although all regions apart from Japan, are also forecast to achieve positive value growth. Conservative estimates indicate that the prevalence of the disease will double over the next 30 years due to ageing populations and improved survival.1 As a result, global prescription drug volume is expected to grow at a CAGR of 2% between 2019 and 2029. Japan will also experience positive volume growth, albeit at a slower rate of 0.3%. This, combined with the future events discussed below, will result in negative value growth in this market. In most regions, the launch of novel drug delivery systems will take on a prominent role in driving value sales and will offset revenue losses due to loss of protection events.

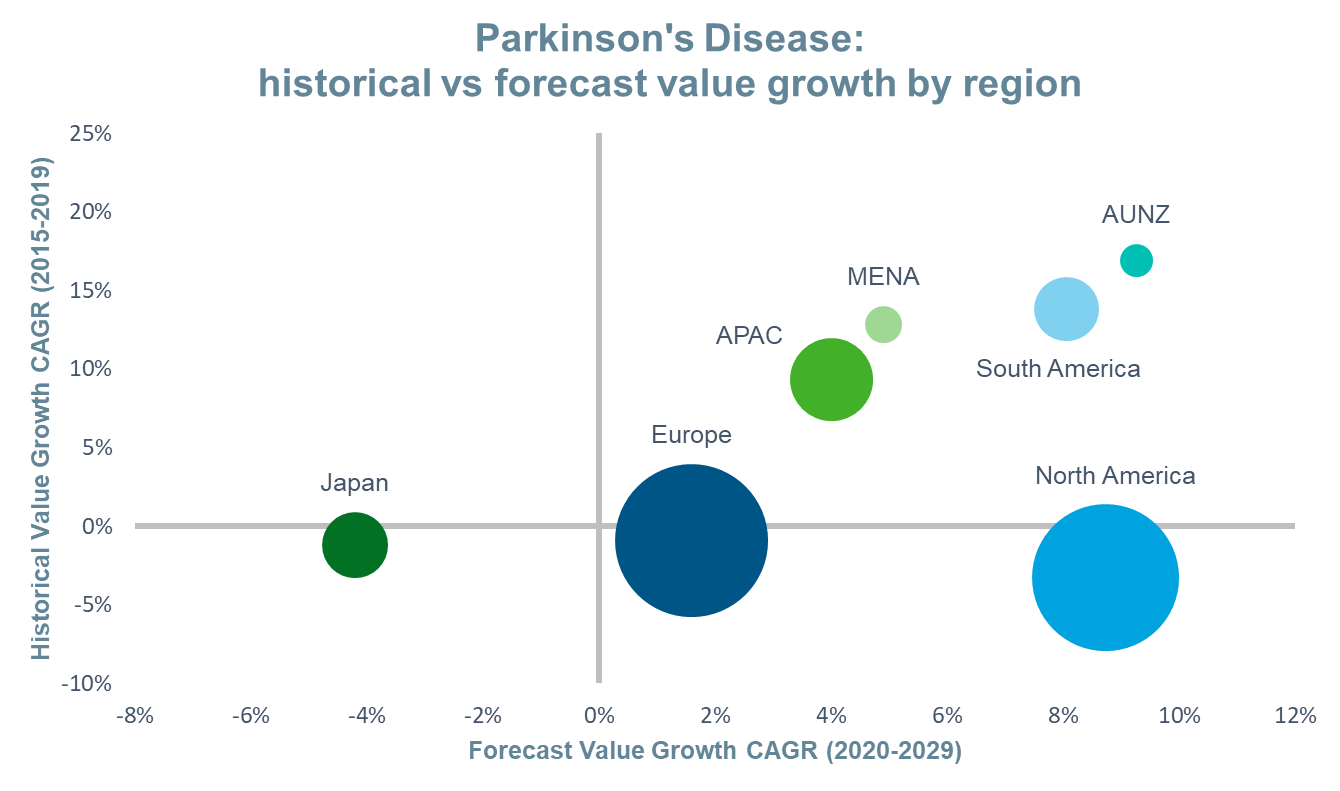

Using IQVIA’s Forecast Link, we compare the historical and forecast growth, and expected market size, of Parkinson’s disease by region in the figure below. A brief examination of the events that will shape these markets in the coming decade follows.

Source: IQVIA Forecast Link, March 2020; Bubble Size=2029 Value Sales

Since the 1960s, levodopa (LD), a pro-drug of dopamine, has been the backbone of treatment for Parkinson’s disease. In most cases it is combined with carbidopa (CD), a DOPA decarboxylase inhibitor, to minimise the breakdown of levodopa in the gut, and increase the concentrations of dopamine reaching the brain. LD has a very short half-life, so extended-release formulations have been developed to decrease the frequency of administration and stabilise serum and brain concentrations. There is also a version which is continuously infused into the jejunum, the region in the gastrointestinal tract where LD is absorbed. This approach has been available in Europe for several years but was only recently launched in the USA in late 2019. Other drugs already added to the armamentarium include dopamine agonists, monoamine oxidase B (MAOB) inhibitors, and catechol-o-methyl transferase (COMT) inhibitors, among others. Quality of life has been improved by these advances, but important unmet needs remain. Foremost among these is the discovery of a disease-modifying neuroprotective therapy. Unfortunately, candidates are only in early-stage development and are unlikely to become available over the next decade.2

The good news, however, is that several late-stage pipeline products which offer hope for improved treatment are expected to launch during the next 10 years, for example:

- inhaled and sublingual film formulations of LD/CD designed to manage “off” periods of the disease;

- continuous subcutaneous infusions of LD that stabilise the serum and brain concentrations of LD;

- adenosine A2A antagonists to enhance the activity of LD; and

- novel COMT inhibitors to decrease the degradation of LD.

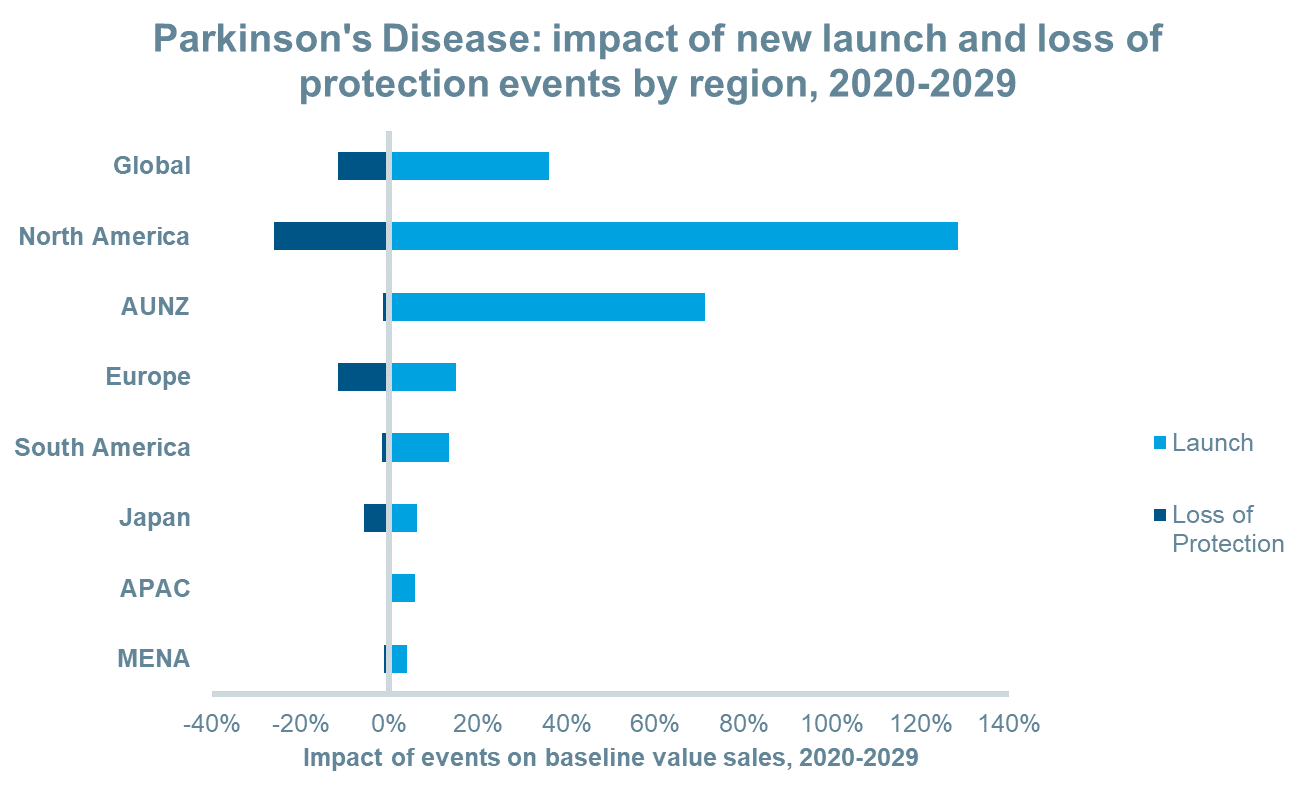

New launch events are expected to add approximately $14.8bn in revenue to the market between 2020 and 2029. Over the same period, several leading therapies will lose patent protection including a transdermal dopamine agonist, an oral long-acting LD/CD combination, an oral LD/CD/COMT inhibitor combination, an MAOB inhibitor among others. Revenues lost between 2020 and 2029 due to loss of protection events will total an estimated $4.7bn leading to a net gain of approximately $10bn. In most regions, the net impact of these events will lead to positive value growth particularly in North America and AUNZ as a greater number of launches are predicted in these regions. On the other hand, Japan will experience a greater number of loss of protection events than other regions which will reduce the impact of new launches thereby leading to negative value growth in that region.

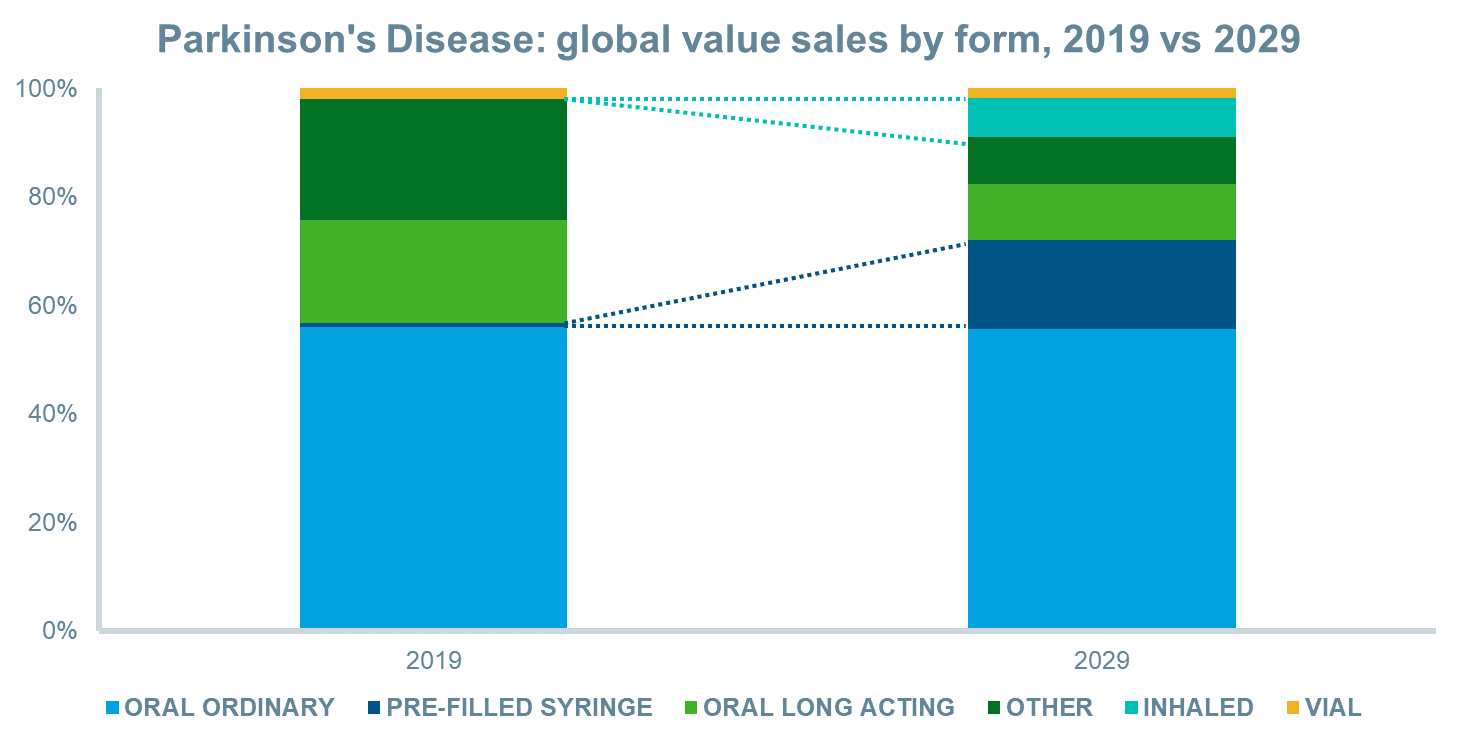

The anticipated launches of novel inhaled and sublingual film formulations for “off” episodes and new continuous subcutaneous infusions will drive value sales over the next decade in most regions and globally. This, combined with patent expiries for existing oral and oral long-acting formulations, will increase the value share of inhaled and pre-filled syringe forms significantly. Between 2019 and 2029, inhalation forms will increase their value share from 0% to 7%, while pre-filled syringes will increase their share from 1% to 16%, globally.

Source: IQVIA Forecast Link, March 2020

Between 2019 and 2029, several novel delivery systems of LD/CD will launch that will enhance the treatment of Parkinson’s disease and drive value sales in the market. Inhalation and sublingual film formulations will assist clinicians and patients to reduce the impact of the “off” cycles of the disease, while continuous subcutaneous infusions of LD/CD carry the potential to overcome the short half-life of LD without the need for a surgically placed tube into the jejunum. These therapies are expected to improve quality of life until the “holy grail” of an effective disease-modifying therapy becomes available.

IQVIA Forecast Link provides regularly updated and fully segmentable sales and volume forecasts across 10,000 products, 600 diseases and 73 countries. Gain insights into current and future market landscapes and power your strategic decision making via this single easy-to-use platform providing unrivalled breadth of coverage. To learn more, please view the Forecast Link video.

References

- Rocca, W.A., The burden of Parkinson’s disease: a worldwide perspective. Lancet 2018; (17): 928-929

- Stocchi, F. Therapy for Parkinson’s Disease: What is in the pipeline? Neurotherapeutics 2014; 11(1):24-33